The Bottom Line: The coronavirus pandemic did not spare green bonds and impacted the green bonds segment of the market in at least three ways.

Introduction: Green bond market also impacted by coronavirus pandemic

The coronavirus pandemic didn’t spare green bonds and it impacted the green bonds segment of the market in at least three ways. First, issuance of green bonds in March tumbled to $2.8 billion or the lowest monthly issuance volume since December 2015[1]. Second, some combination of volatility in bond yields, a steep decline in risk assets and a tightening of market liquidity that led to the significant widening of corporate spreads as well as the effect of foreign currency hedging strategies in some funds, had a negative impact on the performance of green bond mutual funds and ETFs in March and for the entire first quarter 2020. Third, on the plus side, green bond funds benefited from net positive cash flows during the quarter that lifted total net assets to a new high of $648.9 million. The small segment, which is still dominated by institutional investors, consists of eight firms offering eight green bond mutual funds or ETFs as of March 30, 2020.

Green bonds issuance in March reached lowest level since December 2015

Primary green bond activity slowed dramatically in March following the market rout that began on or about February 20th and continuing until governments initiated unprecedented global monetary easing and fiscal actions. According to Climate Bond Initiative (CBI), overall March 2020 green bond issuance dropped to $2.8 billion, or a decrease of 83% relative to March 2019 and down from $15.6 billion in February. A similar amount was issued in January 2020. According to CBI, this is the lowest monthly issuance volume since December 2015 as issuers from sovereigns to corporates shifted attention to address the COVID-19 outbreak. At the same time, issuance of social bonds according to HSBC more than doubled in March to $4.3 billion due to several large pandemic-related bonds from development banks. This development led HSBC to ratchet up its estimate for the issuance of social bonds while at the same time to lower its estimate for green bond issuance in 2020 to $225 billion – $275 billion. Prior to the March downturn, Moody’s Investors had projected that $300 billion in green bonds would be issued this year. The rating agency has not adjusted its projection to-date.

While attention across the globe has for now shifted to addressing the immediate coronavirus pandemic and its various consequences, the intermediate-to-long term outlook for green bond issuance is expected to remain strong if not stronger as governments and other issuers consider how to embed environmental priorities into their post-COVID-19 recovery plans.

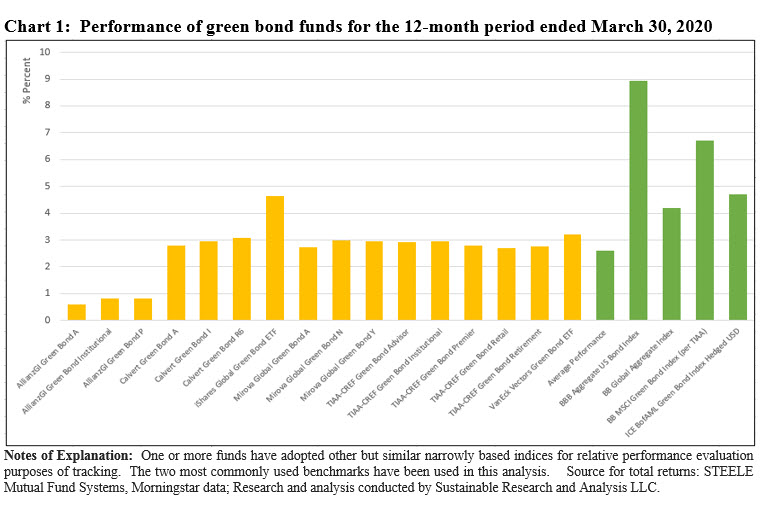

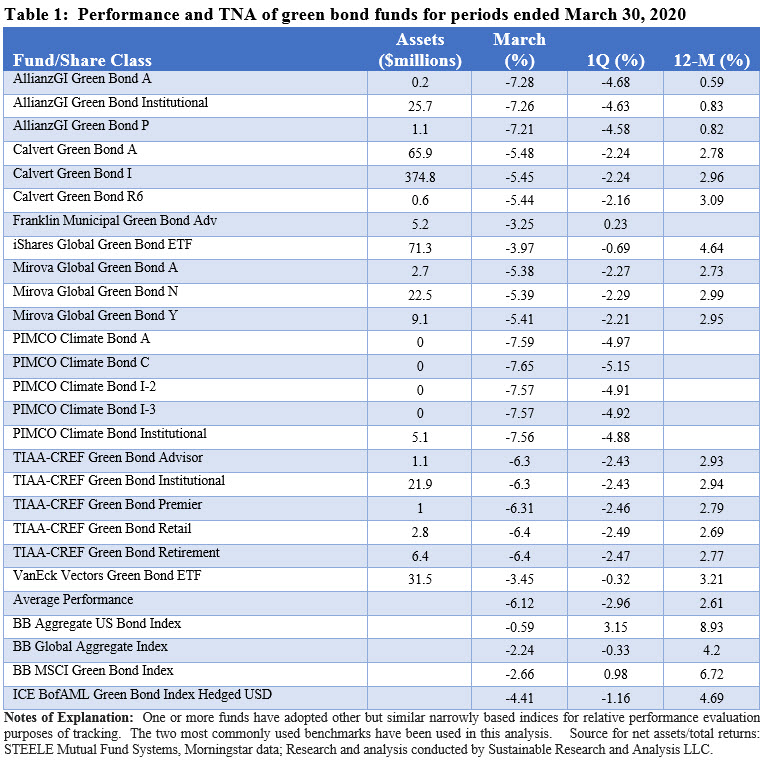

Green bond fund performance lags in March, first quarter and trailing 12-months

A single index for relative performance evaluation purposes does not capture the diverse nature of the eight green bond funds (22 funds/share classes) in operation throughout the entire first quarter 2020. This is due to four key structural differences among funds. Six funds are actively managed while the two ETFs on offer are index tracking. Some funds invest only in dollar denominated green bonds while others invest in US dollar as well as non-dollar denominated green bonds and hedge the currency risk exposure of non-US dollar denominated bonds. A third difference lies in the way each of the fund management firms defines green bonds. Fourth, one of the eight funds, the Franklin Municipal Green Bond Fund, invests only in municipal bonds.

By all accounts, March was a most challenging month and even as investors shrugged off the potential impact of COVID-19 until the last week of February when markets derailed, the quarterly results were severely impacted. Green bond funds posted an average total return of -6.12% in March and an average -2.96% over the first quarter and lagged corresponding indices. Based on performance results compared to their most relevant corresponding taxable green bond benchmark, only one fund beat its benchmark in March as returns ranged from -3.45% to -7.57%. When compared to the performance of non-green bond indices, their results were even worse. The same conclusion holds when performance results are evaluated over the course of the entire first quarter. A reduced number of funds/share classes in existence throughout 2019 recorded an average 2.61% gain over the 12-month period ended in March. The average return lagged both narrowly-based green bond specific indices and the two broader-based conventional benchmarks. With the exception of the iShares Global Green Bond ETF that beat the Bloomberg Barclays Global Aggregate Bond Index by 44 bps but failed to beat the ICE BofAML Green Bond Index Hedged USD, all other funds underperformed both their corresponding narrow or broader conventional indices. The Franklin Municipal Green Bond Fund has been excluded from consideration at this point. Refer to Chart 1 and Table 1.

Net new money: Green bond investors added an estimated $75.8 million in the first quarter

The pandemic dislocations didn’t deter green bond investors who added an estimated $75.8 million in the first quarter, including $10.3 million contributed by two new funds launched by PIMCO and Franklin that likely seeded much of the initial capital. The increase, which was offset in part by market depreciation estimated at $17.5 million, seems like it may have been sourced to flows through financial intermediaries, such as Northern Trust, TD Ameritrade and Charles Schwab, to mention just three of 6 firms, that together account for 71.6% of the assets held by iShares Global Green Bond ETF that ended the quarter with $71.3 million. Also, institutional investors added an estimated $27.8 million to the Calvert Green Bond Fund I that accounts for 85% of the large fund’s total net assets and 58% of the segment’s total net assets.

Reporting and disclosure: At least five firms offer some version of an impact report

In the absence of green bond premiums, investors are less likely to be attracted to green bond funds strictly for outperformance reasons. Rather, they seek to achieve positive environmental outcomes or impacts while also realizing active management or index tracking equivalent returns. Environmental impact reports are the way outcomes can be communicated to fund investors. To this end, at least five investment managers publish impact reports or impact type reports, based on a review of company website disclosures. These are Allianz, iShares/BlackRock, PIMCO, Nuveen (TIAA-CREF) and VanEck. Each firm discloses a variety of metrics, but Nuveen provides the most extensive set of outcomes. Four of these firms calculate and report on at least two of the same intended metrics even though calculation methodologies vary. These include renewable energy generated on an annual basis and CO2 avoided in metric tons. Impact metrics and reporting are still evolving and there are challenges to be resolved on the road toward standardizing these to make them comparable so that investors can actually compare and contrast results. Still, the current reporting on the part of the firms that do so represents a good initial effort.

[1] Source: Climate Bond Initiative.