The Bottom Line: Green bond funds reach $1.0 billion for first time while green bonds pass the cumulative $1.0 trillion level; outlook positive for 2021.

Green bond funds added $87.9 million in assets and exceed $1.0 billion for the first time

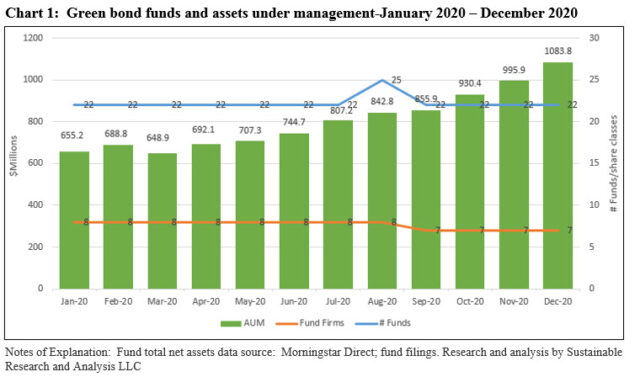

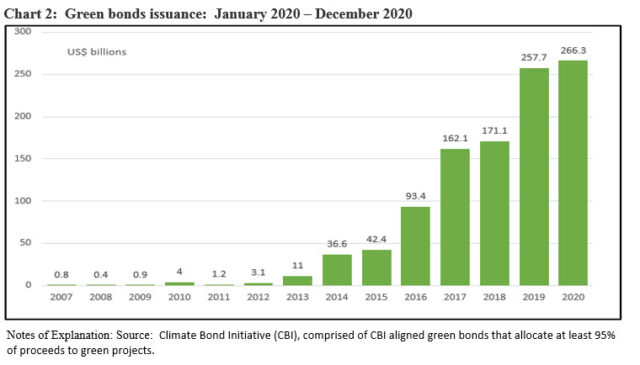

US green bond mutual funds and ETFs, a total of seven funds and 22 funds/share classes, pushed through the $1.0 billion level to end calendar year 2020 above that level for the first time. Adding $87.9 million in net assets in December, the narrow segment, including two ETFs, ended the year with $1,083.8 million in assets. The seven funds, which gained a combined total of $532.6 million during 2020, each experienced positive cash flows in December. The funds posted an average monthly gain of 0.56%, which dropped to 0.52% when the performance of the Franklin Municipal Green Bond Fund is excluded. In either case, the aggregate results exceeded the 14 basis points posted by the Bloomberg Barclays US Aggregate Bond Index as well as the 31 bps registered by the ICE BofAML Green Bond Index Hedged USD. Over the entire calendar year 2020 green bond funds delivered an average return of 7.35%. The achievement by the seven green bond funds occurred at the same time that cumulative green bond issuance since their launch in 2007 surpassed $1.0 trillion. Even as green bond issuance slowed earlier and later in the year, 2020 green bond volume closed at a new high of about $266.3 billion and cumulative green bonds reached $1,051 billion as of December 2020. Various developments unfolding this year point to accelerating momentum that would lead to higher levels of issuance in 2021, likely exceeding about $310 billion.

Green bond assets expanded in December and full calendar year 2020, gaining momentum in Q4

Investors, largely institutional investors, added a net of $87.9 million in December as green bond funds ended 2020 at $1.08 billion, reaching above $1 billion for the first time. For the year, even with the announced liquidation in August 2020 of the Allianz Green Bond Fund for strategic reasons, green bond funds and ETFs in the US gained $493.2 million, or a year-over-year increase of 83.5%. On average, green bond funds added $38.2 million per month in 2020 but momentum accelerated in the fourth quarter when the average monthly net inflows were boosted to $76 million. This culminated with a net increase of $87.9 million in December, the largest monthly net inflow of the year.

The net inflows in December, as in other months, were not evenly distributed. Three funds, including the Calvert Green Bond Fund, (the oldest and largest of the seven funds, launched in late 2013), iShares Global Green Bond ETF and VanEck Vectors Green Bond ETF, in that order, attracted $82.8 million or 94.2% of the net positive cash flows for the month. For the 12-month interval, the seven green bond funds added $93.2 million, or an 84% increase, after accounting for the liquidation of the Allianz Green Bond Fund. The same three funds that led in December also garnered 99% of the segment’s gain in 2020, adding $486.6 million during the twelve-month period. Refer to Chart 1.

Institutional shareholders continue to dominate the investor-based in green bond funds, as $735.1 million, or 67.8% of the assets are sourced to institutional share classes. Of this sum, $672.4 is attributable to the Calvert Green Bond Fund’s institutional share class. This level of institutional sourcing, which declined by 6.4% relative to the level at year-end 2019, is likely higher due to the unaccounted presence of institutional clients in ETFs and investments in mutual funds via non-institutionally oriented share classes.

Green bond funds deliver positive relative performance in December but mixed 12-month results

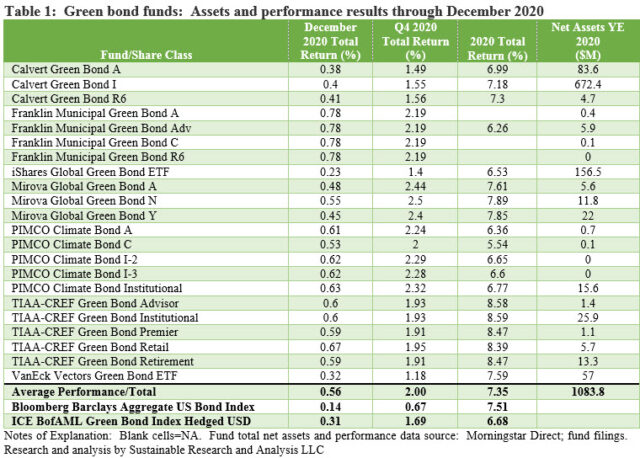

Green bond funds delivered positive relative performance results in December, averaging 0.56% and 0.52% excluding the municipal Franklin Municipal Bond Fund. Each of the seven funds and corresponding 22 share classes exceeded the performance of the Bloomberg Barclays US Aggregate Bond Index, up 0.14%, and all but one fund beat out the ICE BofAML Green Bond Index. Refer to Table 1.

The best performing non-municipal green bond fund in December, at 0.67%, was the TIAA-CREF Green Bond Fund Retail shares. Bringing up the rear was the iShares Global Green Bond ETF. The fund’s 0.23% total return lagged the intermediate investment-grade benchmark as well as the ICE BofAML Green Bond Index. The Franklin Municipal Green Bond Fund was up 0.78% across its four share classes, managing to outperform the two benchmarks along with the Bloomberg Barclays Municipal Bond Index.

For the calendar-year period, performance results are mixed. Green bond funds recorded an average gain of 7.35%, or an even higher 7.41% when the Franklin Municipal Green Bond Fund is excluded. This compares to 7.51% generated by the Bloomberg Barclays US Aggregate Bond Index and 6.68% recorded by the ICE BofAML Green Bond Index. Three funds and their share classes, nine in total or 50% of non-municipal funds, beat the broad benchmark. Returns ranged from a low of 5.54% posted by the PIMCO Climate Bond Fund C to a high of 8.59% attributable to the TIAA-CREF Green Bond Fund Institutional shares. At the same time, more favorable results were recoded relative to the ICE BofAML Green Bond Index as 13 of 18 funds and their corresponding share classes, or 72.2%, outperformed.

The Franklin Municipal Green Bond Fund Adv shares posted a gain of 6.26% in 2020, beating out the Bloomberg Barclays Municipal Bond Index by 1.05%.

Green bonds added around $266.3 to $305.3 billion in 2020 while cumulative issuance exceeded $1.0 trillion

While there is some variation in 2020 green bond issuance by source, with volume for the year ranging from about $266.3 billion to $305.3 billion[1], there is no denying that green bonds achieved an important milestone in 2020 as cumulative issuance reached and exceeded $1.0 trillion even assuming the lower issuance level. This is the first time that cumulative issuance surpassed $1 trillion to reach $1,051 million since the launch of the first green bond in 2007. That said, 2020 issuance volume at the $266.3 level according to the Climate Bond Initiative was only $8.6 million in excess of the prior year’s volume of $257.7 billion, or a gain of 3.3%. This was the lowest year-over-year gain since 2011 when green bond volumes dropped 70% from $4 million in 2010 to $1.2 million. Refer to Chart 2. To some extent, the shortfall in green bond issuances can be attributed to the expansion in the issuance of social bonds and sustainability bonds that benefited from COVID-19 linked developments in 2020. For example, social bonds added $129.7 billion in 2020, or an increase of 720.3% over 2019[2].

That said, momentum is likely to pick up in 2021 and exceed $310 billion which would otherwise be achieved based on the average annual 5-year growth rate, based on the as the following developments are expected to stimulate new issuances, particularly in Europe and the US that together account for about two-thirds of 2020 green bond issuances:

-

- Increasing evidence of climate change and shifting sentiment. Appetite for sustainable investments is high, as asset owners such as asset managers, pension funds and life insurance companies advocate for environmental and social investments in response to client mandates, regulatory initiatives and risk considerations. Individual investors are also stepping up their demands for sustainable investment products, including green bond funds and sustainable funds more generally.

- The publication of the final version of the EU’s Green Bond Standard, part of the European Union’s plan for financing sustainable growth that calls for the creation of standards and labels for green financial products. Once adopted, this should likely stimulate new green bond issuance.

- The EU bloc’s planned green bond issuance debut from Q2 onwards and first-time issuance from several national governments. According to estimates, the EU’s upcoming green bond issuance is expected to be around €225 billon (or around $272 billion), which is equivalent to a third of its COVID-19 recovery package.

- As announced in September of last year, the European Central Bank will accept bonds with coupon structures linked to sustainability criteria, such as green bonds, as collateral for Eurosystem operations starting January 1, 2021. Potential eligibility has also been extended for asset purchases in the ECB’s monetary policy facilities, including the Asset Purchase Programme (APP) and the Pandemic Emergency Purchase Programme (PEPP).

- The new Biden administration in the US is bringing about a rapid and dramatic change in the level of focus directed at climate change and global leadership. The US is expected to rejoin the Paris Climate Agreement on January 20th and overturn the vast majority of the 100 or so climate-related orders that the Trump Administration reversed. Also, Biden has consistently underscored the importance of climate to his economic plans and an infrastructure package is expected to contain climate-friendly proposals.

[1] Climate Bond Initiative at $266.3 billion while Bloomberg NEF is at $305.3 billion.

[2] Source: Bloomberg NEF.