The Bottom Line: December redemptions still place green bond funds at new 2021 high of almost $1.5 billion while absolute total return performance results disappoint.

Summary

Withdrawals by institutional investors led to a net $9.4 million decline in the assets of green bond funds in December, bringing year-end total net assets to $1,480.8 million. While fund assets reached a month-end peak in November, December’s almost $1.5 billion was a new all-time year-end high which was also the case for new green bond issuance that reached $448.2 billion.

Green bond funds, on average, outperformed their benchmarks in December and over calendar 2021 but absolute results were disappointing after green bond funds posted average returns between 7% and almost 9% in the previous two years. Still, 2021 performance results were within the bounds experienced by sustainable fixed income fund investors more generally. The second largest ranking green bond fund, the iShares Global Green Bond ETF, announced in December that it was restricting its universe of eligible securities to US dollar denominated green bonds. Investors will now have two distinct product choices: investing in green bond funds that limit investments to US dollar denominated green bonds and funds that invest in US dollar and non-dollar denominated green bonds.

Withdrawals by institutional investors led to a net $9.4 million decline in assets from green bond fund in December, bringing year-end net assets to a close at $1,480.8 million

Green bond funds experienced net outflows in December as the segment gave up a net of $9.4 million, or 0.6% of assets, to end the year at $1,480.8 million. This was the first month since March of 2020 when green bond funds experienced a drawdown. Over the course of the 2021 calendar year interval, green bond funds added $397 million in net assets, a 37% increase from $1,083.8 million at the end of 2020 to end the year at an all time high. Refer to Chart 1.

Chart 1: Green bond mutual funds and ETFs and assets under management – January 2021 – December 31, 2021

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

The Calvert Green Bond Fund sustained the largest withdrawal. Institutional investors pulled out a net of $26.4 million from the Calvert Green Bond Fund I Shares (GAFX) while an additional $1.2 million was redeemed from the fund’s retail and intermediary-oriented share classes. On a combined basis fund assets declined by $27.6 million. The Van Eck Green Bond ETF (GRNB) experienced a decline of $460, 567 while the PIMCO Climate Bond Fund gave up $216.1.

On the other hand, the biggest winner in December was the iShares Global Green Bond ETF (BGRN) that gained $17.1 million to end December with $273.1 million. The second largest ranking green bond fund announced on December 15, 2021 that it was changing the underlying index and fund name. On or around March 1, 2022, the fund will seek to track a new underlying index, the Bloomberg MSCI USD Green Bond Select Index. This index will supplant the current Bloomberg MSCI Global Green Bond Select (USD Hedged) Index. The fund name will change to iShares USD Green Bond ETF. The fund’s investment objective will also change as a result of this update. This action follows by almost two-and-one half years a similar decision made by the Van Eck Green Bond ETF effective as of September 1, 2019 to restrict portfolio investments to US dollar denominated green bonds.

The shift to a portfolio of securities limited to US dollar denominated green bonds may be an indication that hedging currencies to protect investors against currency fluctuations might have been more challenging and expensive–reflected perhaps in the fund’s recent underperformance. Regardless, green bond fund investors now have two distinct product choices: investing in green bond funds that limit investments to US dollar denominated green bonds and funds that invest in US dollar and non-dollar denominated green bonds.

Two recently registered green bond ETFs, both to be managed by Tuttle Capital Management LLC, including the Green Bond ETF and Green Bond Short-Term ETF, have not yet been listed. Their launch dates have now been deferred several times.

Green bond funds outperform benchmarks in December and in 2021 but post disappointing absolute results

On a combined basis, the seven green bond funds posted an average -0.16% decline in December, but the results were buoyed by the positive performance of the Franklin Municipal Bond Fund and its four share classes. Excluding Franklin, the only green bond fund seeking to maximize income exempt from federal income taxes, green bond funds registered a slightly greater average -0.23% drop. This compares to -0.26% and -0.85% recorded by the Bloomberg US Aggregated Bond Index and broader ICE BofAML Green Bond Hedged US Index, respectively. Refer to Table 1.

Leading the pack in December was the PIMCO Climate Bond Fund I-2 Shares (PEGPX) and I-3 Shares (PEGQX), both recording gains of 29 bps. At the other end of the range, iShares Global Green Bond Fund posted a decline of -1.04%.

The 2021 performance results of fixed income funds generally and green bond funds in particular were disappointing. Green bond funds recorded an average -0.93% total return during calendar year 2021 as investors reacted to concerns about the prospects for inflation. While beating their benchmarks on average, this year’s outcome stood in stark contrast to the average returns posted by the segment in 2020 as well as 2019 when green bond funds posted average returns of 7.35% and 8.87%, respectively. Still, 2021 green bond fund performance results were within the bounds experienced by sustainable fixed income fund investors more generally that experienced an average return of -0.98% (excluding high yield bond funds).

For the year, the Franklin Municipal Green Bond Fund was the only fund to record a positive return, therefore also lifting the average performance of the segment by 42 bps. But even when the Franklin Municipal Bond Fund is excluded, the average performance of green bond funds managed to best the Bloomberg US Aggregate Bond Index and the ICE BofAML Green Bond Hedged US Index. Leading in the rankings over the 12-month interval was the PIMCO Climate Bond Fund I-2 Shares that posted a narrow -0.24% decline. In last place was the Mirova Global Green Bond Fund A Shares that registered a -3.02% drop.

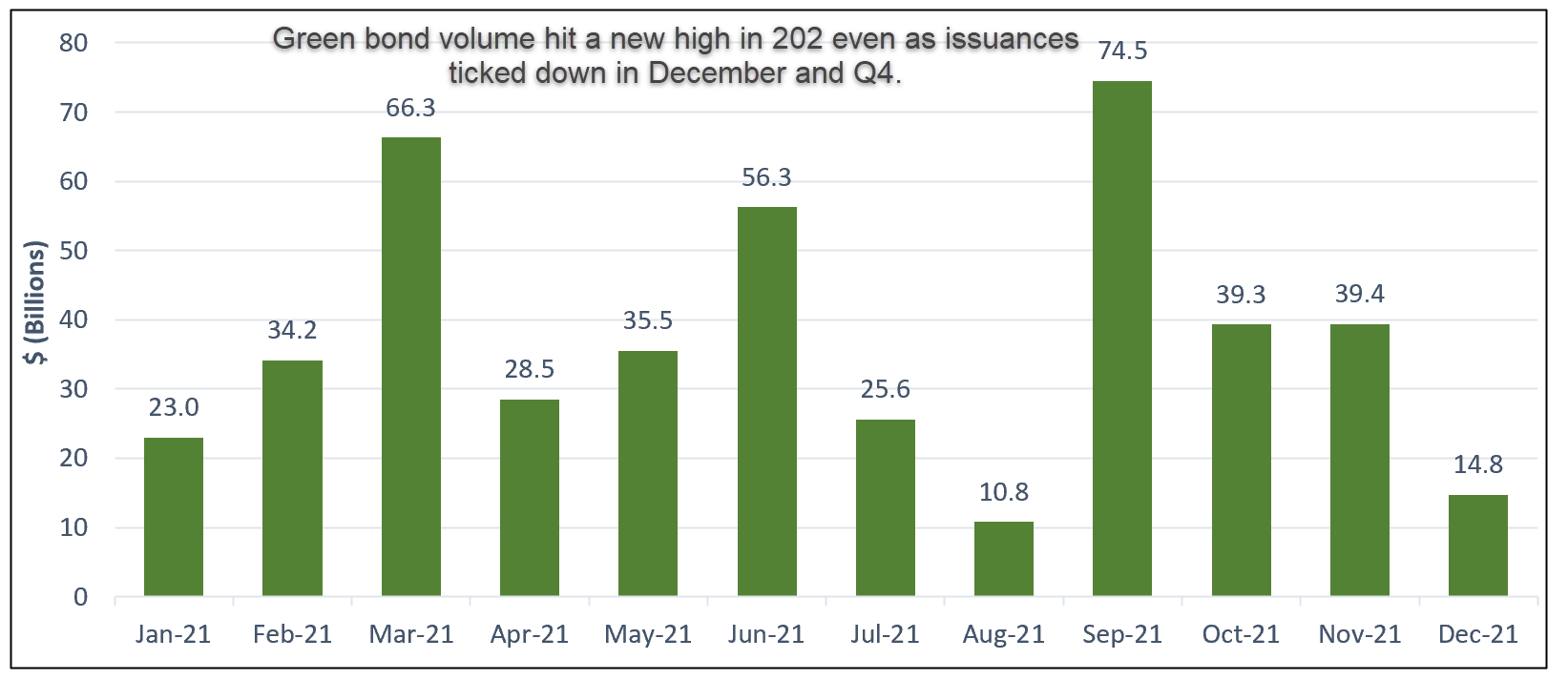

Green bonds volume trended down in December and Q4 2021

Following the conclusion of the two-week COP 26 Glasgow climate summit deliberations, green bonds issuance trended down. In December, $14.8 billion in green bonds came to market. This represented a month-to-month drop of 62% from $39.4 billion in November and ranked as the second lowest monthly issuance volume in 2021. Fourth quarter volume was the lowest of the year, reaching $93.4 billion versus $110.0 billion issued in total during the third quarter and increasingly higher volumes in the first and second quarters. Refer to Chart 2.

Chart 2: Monthly green bonds issuance: January 2021– December 31, 2021

Notes of Explanation: Volume reflects latest available and updated data. Source: Climate Bond Initiative (CBI)

That said, investor interest in green and social bonds continued to grow significantly and more green bonds were issued in 2021 than in any previous year, reaching a new calendar year high of $448.2 billion. The year’s volume eclipsed last year’s $269.5 billion issuance by $178.7 billion, or an increase of 66.3%, and positions 2022 for an even stronger issuance year. The two-week COP 26 climate summit deliberations concluded in November with 200 countries agreeing to the Glasgow Climate Pact that sets out a consensus on accelerating climate action. Also, in early December the EU Taxonomy Regulation became law when its final review period expired. It now sets the criteria for Climate Change Mitigation and Adaptation objectives in more than 60 economic activities, a development that will help mobilize capital for climate action and help meet the EU’s environmental objectives, including an emissions cut of 55% by 2030. Also, it was announced in early December that European Union legislators are seeking to tighten the region’s planned green bond standards and make it harder for issuers of environmentally friendly debt to overstate their promises to investors. Sellers of European green bonds and sustainability-linked bonds should develop a transition plan indicating how they will adhere to a 1.5°C global warming scenario and reach climate neutrality by 2050.

Table 1: Green bond funds: Assets, performance through December 31, 2021, and expense ratios

Fund Name | 1-Month Return (%) | 3-Month Return (%) | 12-Month Return (%) | 3-Yesar Return (%) | AUM ($M) | Expense Ratio (%) |

Calvert Green Bond A* | -0.21 | -0.62 | -1.92 | 4.26 | 89.6 | 0.73 |

Calvert Green Bond I* | -0.19 | -0.56 | -1.67 | 4.52 | 896.2 | 0.48 |

Calvert Green Bond R6* | -0.19 | -0.55 | -1.61 | 9.7 | 0.43 | |

Franklin Municipal Green Bond A** | 0.19 | 0.92 | 0.99 | 1.2 | 0.71 | |

Franklin Municipal Green Bond Adv** | 0.21 | 0.98 | 1.12 | 8.6 | 0.46 | |

Franklin Municipal Green Bond C** | 0.05 | 0.81 | 0.78 | 0.2 | 1.11 | |

Franklin Municipal Green Bond R6** | 0.12 | 0.89 | 1.07 | 0 | 0.44 | |

iShares Global Green Bond ETF*^ | -1.04 | -0.39 | -2.54 | 4.32 | 273.1 | 0.2 |

Mirova Global Green Bond A* | -0.98 | -0.79 | -3.02 | 4.44 | 6.8 | 0.93 |

Mirova Global Green Bond N* | -0.99 | -0.7 | -2.73 | 4.75 | 8.1 | 0.63 |

Mirova Global Green Bond Y* | -1 | -0.71 | -2.69 | 4.71 | 32.1 | 0.68 |

PIMCO Climate Bond A* | 0.27 | -0.78 | -0.56 | 0.8 | 0.94 | |

PIMCO Climate Bond C* | 0.2 | -0.98 | -1.3 | 0 | 1.69 | |

PIMCO Climate Bond I-2* | 0.29 | -0.71 | -0.24 | 1.2 | 0.64 | |

PIMCO Climate Bond I-3* | 0.29 | -0.72 | -0.3 | 0.1 | 0.69 | |

PIMCO Climate Bond Institutional* | 0.3 | -0.68 | -0.15 | 20 | 0.54 | |

TIAA-CREF Green Bond Advisor* | -0.15 | -0.23 | -0.62 | 5.52 | 3.5 | 0.55 |

TIAA-CREF Green Bond Institutional* | -0.15 | -0.23 | -0.6 | 5.54 | 29.7 | 0.45 |

TIAA-CREF Green Bond Premier* | -0.16 | -0.26 | -0.73 | 5.41 | 1.1 | 0.6 |

TIAA-CREF Green Bond Retail* | -0.17 | -0.29 | -0.97 | 5.26 | 7.4 | 0.78 |

TIAA-CREF Green Bond Retirement* | -0.16 | -0.26 | -0.72 | 5.4 | 16.8 | 0.7 |

-0.11 | -0.97 | -2 | 3.62 | 101.5 | 0.2 | |

Average/Total | -0.16 | -0.31 | -0.93 | 4.81 | 1,480.8 | 0.66 |

Bloomberg US Aggregate Bond IX | -0.26 | 0.01 | -1.54 | 4.79 | ||

Bloomberg Municipal Total Return IX | 0.16 | 0.72 | 1.52 | 4.73 | ||

S&P Green Bond US Dollar Select Index | 0.01 | -0.86 | -1.56 | 4.95 | ||

ICE BofAML Green Bond Index Hedged US | -0.85 | -0.29 | -2.19 | 4.73 |

Notes of Explanation: Blank cells=NA. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ^Effective March 1, 2022, fund will shift to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC