Summary

Divestment from fossil fuels and low carbon investing strategies have gained attention and a certain degree of traction among endowments and foundations, sovereign funds, public pension funds and some individual investors. Just in the last two months, both the City of New York’s public pension funds and the New York State Common Retirement Fund (CRF) announced divestment plans even as the largest public pension fund in the US, CalPERS, has decided against doing so. CRF also made known the expansion of its low carbon index investing program first declared at the end of 2015. Divestment is intended to help achieve a reduction in greenhouse gas emissions in line with the Paris Climate Agreement 2°C target by the end of the century. But studies suggest that fossil fuel divesting can also have negative financial consequences. That said, investors interested in fossil fuel divestment and/or low carbon investing can consider a number of options for implementing such strategies either though investments in stocks and bonds directly or through mutual funds as well as exchange-traded funds (ETFs) and exchange-traded notes (ETNs). These options are discussed in this article.

NYS and NYC Pension Funds Announce Fossil Fuel Divestiture Strategies

Last month on January 10, 2018 New York City Mayor Bill de Blasio, Comptroller Scott M. Stringer and the other trustees of the City of New York’s $180 billion pension funds announced plans to pursue a goal of divesting the City’s funds from fossil fuel reserve owners within five years. This followed by just a few short weeks a similar announcement made in December by New York State Governor Andrew M. Cuomo who, as part of a broader commitment to tackle climate change by pledging to reduce statewide greenhouse gas emissions 40% by 2030 and achieve the internationally-recognized target of reducing emissions 80% by 2050, unveiled a plan for divesting the $201.3 billion New York State Common Retirement Fund from significant fossil fuel investment.

These announcements do not mean that the New York State and New York City pension funds are immediately embarking on a process of divesting from fossil fuel holdings in their portfolios. Rather, in both instances, the announcements by two of the largest public pension funds in the US, in contrast to the position staked out by CalPERS, also one of nation’s largest public pension fund, serve to send a strong message to fossil fuel companies, investors, pension fund trustees, the general public as well as others that the funds are committed to a low carbon and clean energy future. At the same time, the state and city are putting into motion the action steps required to reach a final decision on their plans.

In the case of the New York State Common Retirement Fund Governor Cuomo and New York State Comptroller Thomas P. DiNapoli will work together to create an advisory committee of financial, economic, scientific, business and workforce representatives as a resource for the Common Retirement Fund to develop a de-carbonization roadmap to invest in opportunities to combat climate change and support the clean tech economy while assessing financial risks and protecting the fund.

Also, Governor Cuomo called on the CRF to dedicate a meaningful portion of the fund’s portfolio to “investments that directly promote clean energy—which makes economic and environmental sense.” In fact, under the direction of the State Comptroller, who acts as sole trustee of CRF, the fund had already embarked on this strategy by allocating $2.0 billion to a low carbon equity index fund created shortly after the conclusion of the Paris Climate Agreement at the end of 2015. Also under the direction of Comptroller Napoli, it was announced last week that the CRF’s allocation to the low emissions equity index fund will be increased by $2 billion, bringing the total allocation to $4 billion; and it was the same New York State Comptroller who last year spearheaded a proxy proposal for consideration at the May 31, 2017 meeting of Exxon Mobil shareholders requesting that starting in 2018, ExxonMobil publish an annual assessment on the company oil and gas reserves and resources under a scenario in which reduction in demand results from carbon restrictions and related rules or commitments adopted by governments consistent with the Paris Agreement’s globally agreed upon 2°C warming target. For the first time, investors with 62.3% of shares voted in favor of the resolution.

In the case of NYC, the process of implementing this announcement is expected to take some time and may not actually even be implemented. This is because the City’s 5 pension funds are financially independent of the others and each has its own board of trustees and each fund will have to approve the final action after further analysis of the risk and return impacts of such actions on the portfolios along with an enabling fiduciary focused legal opinion.

There is no Universally Accepted Definition of Fossil Fuel Free Investing

The public statements notwithstanding, the scope of the divestments is not entirely clear. For example, fossil fuels are not completely defined, it’s not well defined how this might impact index fund investments that have exposure to fossil fuel companies and the impact on bonds and other asset classes beyond equities was not addressed.

Fossil fuel free investing has gained some currency among investors, especially endowments, foundations and some public pension funds, however, there is no universally accepted definition of fossil fuel free and there can be varying levels of disengagement from fossil fuels. In a more rigorous application of this approach, fossil fuel free investing means the complete elimination of coal, oil and gas companies from a portfolio. This would include investments in any company with proven carbon reserves, investments in any company that explores for, extracts, processes, refines or transmits coal, oil, and gas and it also extends to investments in any utilities that burn fossil fuels to produce electricity.

Divestment Movement: Pros and Cons

There is now an overwhelming consensus among scientists that fossil fuel emissions cause global warming. Observations, theoretical studies and model simulations indicate an overall warming since the mid-20th century and it is at least 95% certain that human activities have caused more than half of the temperature increase since the 1950s. This warming is responsible for climate change effects worldwide, reflected in severe weather, floods, droughts, and wildfires, to mention just a few, the consequences of which are further compounded by population increases and concentrations of people and property in coastal areas. 196 nations agreed in Paris at the end of 2015 to work together to keep the global temperature this century from rising well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase even further to 1.5°C. While various methodologies, scenarios and assumptions can significantly impact outcomes, one estimate provided by the environmental organization 350.org, based on scientist estimates, is that the upper limit of carbon dioxide that the world population can put into the atmosphere and still reasonably expect to stay below the 2°C level is 565 Gigatons. At the same time, the number of proven fossil fuel reserves, which arguably is baked into fossil fuel company valuations, stands at 2,795 Gigatons, or almost 5X the amount that is theoretically allowable within the 2°C limit[1]. This forms the core of the fossil fuel divestment movement spearheaded by 350.org, co-founded by Bill McKibben and a group of university friends in the U.S. The 350.org movement, which opposes new coal, oil and gas projects and favors building 100% clean energy solutions, advocates for divestment as a tactic for keeping fossil fuel reserves in the ground. The organization advances a moral, social and financial argument in favor of this course of action by pressuring institutional investors as well as the fossil fuel companies themselves.

The divestment approach has financial ramifications in that keeping current known reserves in the ground will transform these reserves into “stranded assets” and affect fossil fuel company financial valuations. Advocates also posit that there has been no significant difference in returns for fossil fuel free investments. The arguments against divestment cover the range extending from accusing advocates of misrepresenting the impact that divestment would have on climate change, the mounting evidence of the ineffectiveness of the strategy on fossil fuel companies due to the fact that selling off their shares only results in the transfer of ownership of their shares to some other party who cares much less about the issue than the original seller does, to the financial costs that would be incurred by embracing divestment on the part of investors, such as endowments, foundations, public pension funds as well as the risks to their portfolios due to restricted portfolio optimization. According to one recent study, based on a 50-year sample period, an optimal equity portfolio including fossil fuel stocks outperforms a portfolio of equal risk that is divested of energy stocks by an average of 0.5% per year, or 23% reduction in the value of a divested portfolio over a 50-year period. This leads to the argument that retaining ownership in the stocks avoids the financial consequences while preserving the investor’s ability to engage with the fossil fuel companies to secure improved risk disclosures and get companies to act responsibly by becoming part of the transition to a low-carbon economy. Even as it had divested from thermal-coal companies in response to a state legislative mandate, this was in effect the determination reached in 2017 by the California Public Employees’ Retirement System (CalPERS), concluding that the exercise of its fiduciary obligations “preclude CalPERS from sacrificing investment performance for the purpose of achieving goals that do not directly relate to CalPERS operations or benefits. Divesting appears to almost invariably harm investment performance, such as by causing transaction costs (e.g., the cost of selling assets and reinvesting the proceeds) and compromising investment strategies.”

Fund Investors Interested in Divestment or Low Carbon Strategies Have Options

Investors interested in pursuing a divestment strategy or a low carbon strategy in line with the recent announcements by the New York State Retirement Fund, for example, can do so whether they invest in individual securities or funds. That said, it’s much easier to identify and, if desirable, avoid direct investments in either coal companies, oil and gas firms or fossil-fired utilities, or possibly companies operating in all three sectors, when investing directly in individual stocks or bonds in contrast to doing so through mutual funds, exchange-traded funds or exchange-traded notes. A variation on this when it comes to fixed income is investing in specific project finance or green bond transactions brought to market by firms that might not otherwise meet a sustainable investing threshold except that in these instances the proceeds are explicitly allocated to finance environmentally beneficial projects.

Retail and institutional investors who wish to implement either a fossil fuel free or low carbon strategy through their mutual fund and ETF/ETN investments, applicable to a segment of or across their entire portfolio, can do so by pursuing at least one or more of the four fund-oriented investing strategies discussed below. Another option is to invest in alternative energy funds, however, this approach is not covered in this article. For information on alternative energy funds, investors should refer to a recently published article on www.sustainableinvesting.com entitled Tariffs on Solar Cells and Modules Not Expected to Impact Shift to Renewable Energy.

Investing in Sustainable Funds

Investors may wish to consider investing in the expanding universe of sustainable mutual funds and ETFs/ETNs that take into consideration a company’s sustainability strategies in general and environmental considerations in particular. While almost all of the approximately 785 self-identified diversified sustainable investment funds and share classes as of January 31, 2018 consider environmental issues and should be expected to qualify and restrict to some extent exposure to these sectors, this does not necessarily mean that investments in fossil fuel and related companies is avoided entirely. There could be any number of reasons for this. For example, a fund may consider environmental, social and governance (ESG) factors to inform investment decisions or qualify/disqualify eligible companies and invest in them based on a best-in-class approach or a worst-in-class approach. A fund may also invest in companies within these sectors based on their adoption of robust strategies and programs to manage ESG risks and opportunities and/or in firms that may be moving in this direction. An example of this is Royal Dutch Shell, a company that has been making a bet on lower-carbon with its 2016 purchase of natural gas producer BG Group or purchasing a big stake in American solar producer Silicon Ranch Corp. Or a fund may continue to invest in a company, such as Statoil ASA in the case of Boston Common International Fund in an effort to maintain a dialogue with the issuer and engage to advocate for responsible corporate practices. According to Boston Common Asset Management, this contributed to the sale of Statoil’s oil sands operations in Canada, according to the manager. Given that sustainable funds can have varying exposures to fossil fuel and related companies, investors should review each fund’s investment objectives and strategies to understand the fund’s approach to sustainable investing and supplement this review by further consulting the fund’s periodic reports and holdings as well as any corollary materials that may be published by the fund. Investors can also zero in on a fund’s sustainable strategies, including exclusionary practices referred to in the next paragraph, by consulting the Investment Research/Basics/Sustainable Investment Strategies tab of the www.sustainableinvest.com website.

Funds Employing Exclusionary Strategies

A second approach involves funds within the sustainable universe segment that have adopted exclusionary practices focused on avoiding investing in certain companies, including companies in the fossil fuels sector. For example, the Parnassus Fund and the Parnassus Endeavor Fund avoid investing in companies engaged in the extraction, exploration, production, manufacturing or refining of fossil fuels. Each fund, however, may still invest in companies that use fossil fuel-based energy to power their operations or for other purposes. That said, based on recent holdings, these two funds do not have exposure to the coal industry, oil and gas industry or fossil-fuel fired utilities. Green Century Equity Fund is another example. The fund seeks to replicate the performance of the MSCI KLD 400 Social Index, and also excludes from consideration the stocks of companies that explore for, extract, produce, manufacture or refine coal, oil or gas or produce or transmit electricity derived from fossil fuels or transmit natural gas or have carbon reserves. Based on recent fund holdings information, the fund does not have any exposure to coal companies, oil and gas companies or fossil fuel fired utility companies.

Investing in Low Carbon Funds

Yet another approach involves considering an even smaller subset of funds that specifically targets low carbon investment strategies. While their geographic areas of concentration may differ, these funds are generally designed to address two dimensions of carbon exposure – carbon emissions and fossil fuel reserves expressed as potential emissions. These funds over-weight companies with low carbon emissions and those with low potential carbon emissions so as to reflect a lower carbon exposure than that of the broad market.

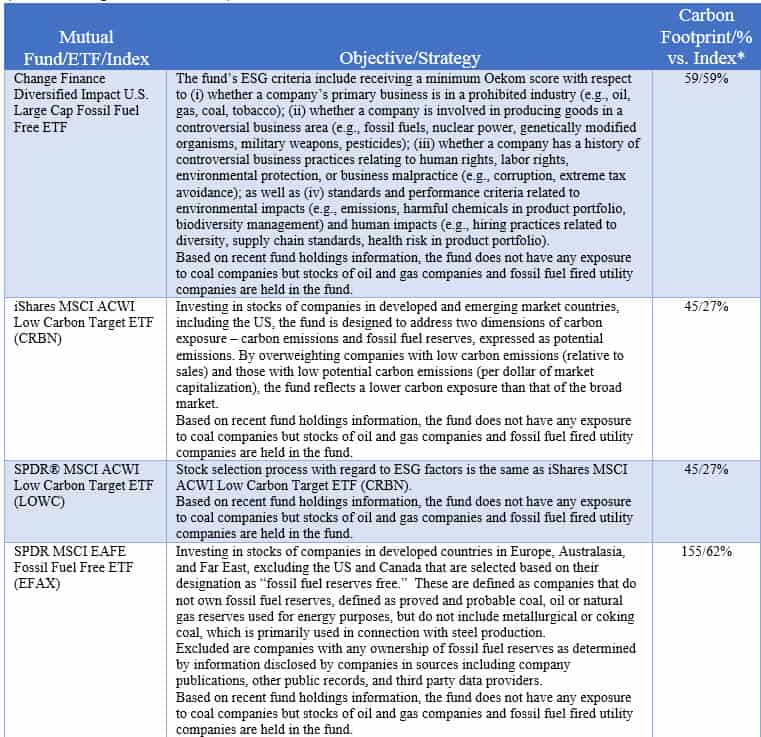

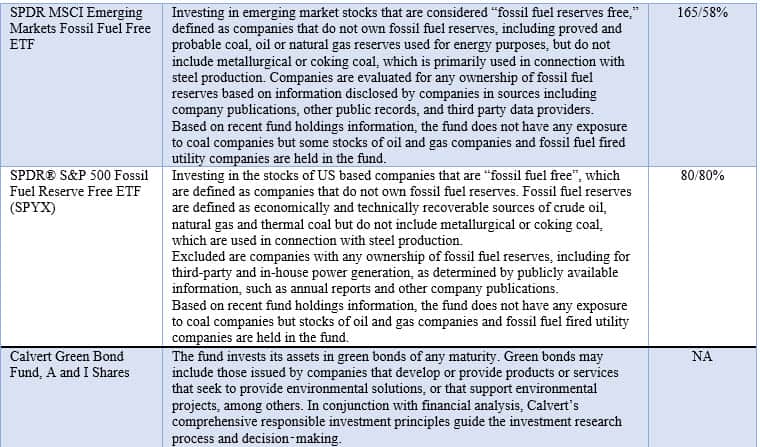

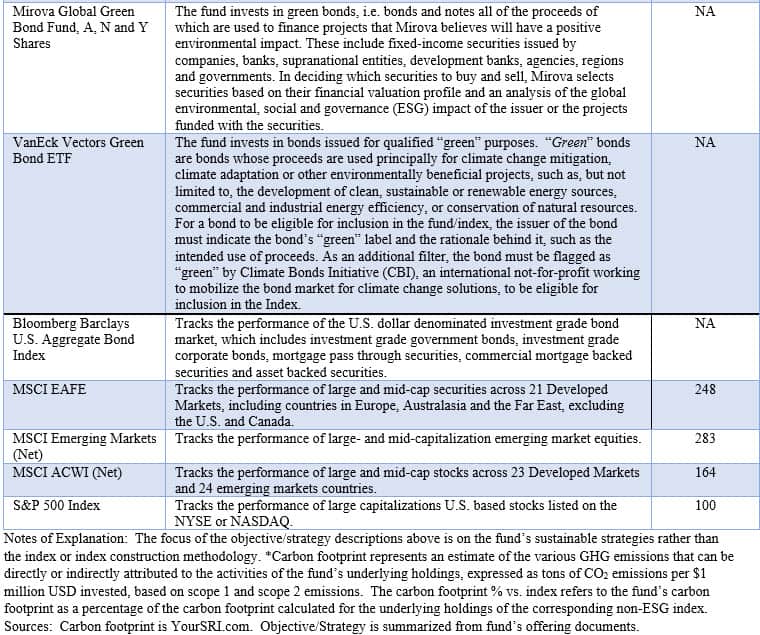

Other than funds employing exclusionary practices (for example, such as the Green Century Equity) mutual funds with low carbon principal investment strategies are not currently available, however, there are 6 ETFs as of December 30, 2017, that fall into this category. These are listed in Table 1 along with an indicator of their carbon footprint, an estimate of the greenhouse gas emissions that can be directly or indirectly attributed to the activities of the fund’s underlying equity holdings, derived from YourSRI.com along with comparisons to the carbon footprint attributed to their corresponding non-ESG securities market indexes.

Investing in Green Bond Funds

A variation on the low carbon theme is investing in green bond funds, or funds that invest entirely or almost entirely in green bonds. These typically include bonds issued by corporations, financial institutions, sovereigns, sub-sovereigns, including municipal entities, or in structured finance transactions, that develop or provide products or services seeking to provide environmental solutions or support various environmental projects intended to contribute toward the transition to a low carbon economy. These could, for example, include green bonds issued by a fossil-fired utility company, as long as the bond proceeds are allocated specifically to finance an environmental project. An example is the Southern Power Company which completed the issuance of $1 billion of green bonds in 2015. The proceeds were specifically allocated to finance renewable energy generation projects in the U.S., such as solar and wind power generation facilities, rather than being used for general corporate purposes.

Two dedicated green bond funds offered via 5 share classes are currently in operation along with one ETF. Two of these funds were launched in 2017. These funds along with brief descriptions of their strategy/objectives may also be found in Table 1.

Table 1: Exchange-Traded Funds (ETFs) and Mutual Funds Pursuing Low Carbon Strategies and Green Bond Funds: Objectives/Strategies and Carbon Footprints (Listed in Alphabetical Order)

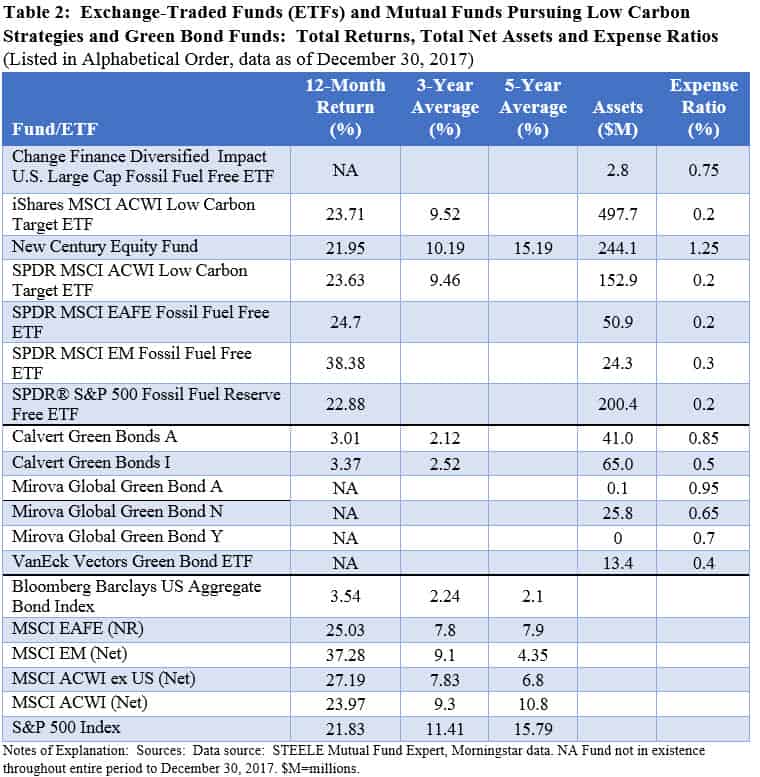

Further, Table 2 provides a summary of the performance results achieved by the group of low carbon funds as well as green bond funds. In addition to total returns posted during the latest 12-month period, also disclosed are the average 3-year and 5-year total returns recorded to December 30, 2017, total net assets as of the same date and expense ratios. While their track record is still somewhat limited, with five of the funds and ETFs having been launched in 2017, the performance track record of the funds in existence throughout 2017 and over the previous 3-years, relative to corresponding non-ESG securities market indexes, has been mixed. To the extent available, 3-year average total return performance results relative to benchmarks eclipses the returns achieved during the calendar year 2017. As for expense ratios, charges levied by the five ETFs offered by BlackRock (iShares), State Street (SPDR) and Van Eck (Vectors) fall into the lowest tier and are attractively priced while the newest entry, offered by Change Finance with an expense ratio of 70 bps, falls above median and is therefore at the higher end of the range. At the same time, the expense ratios covering the green bond funds fall beyond the lowest tier for fixed income funds, with the exception of the Calvert Green Bonds I institutional share class. Finally, 4 of the 12 funds and ETFs are small in that they manage less than $50 million in assets as of December 30, 2017.

[1] Source: Carbon Tracker Initiative. For example, another estimate by Mercator Research Institute on Global Commons and Climate Change based on the latest Assessment Report (AR5) of the IPCC places the upper limit at 720 Gigatons or 3.9X the amount that is theoretically allowable within the 2°C limit.

[2] Source: Fossil Fuel Divestment and Public Pension Funds, Professor Daniel R. Fischel, Christopher R. Fiore and Todd D. Kendall, June 2017.