An article by Vito J. Racanelli entitled “A Setback for ESG in California” that appeared in last week’s November 5, 2018 edition of Barron’s on the subject of the California Public Employees’ Retirement System (CalPERS) election last month that resulted in the ouster of board president Priya Mathur, a 15-year veteran and a strong champion of the public pension fund’s focus on ESG investing and her replacement, Jason Perez, a critic of this focus, perpetuates an increasingly common misunderstanding by conflating ESG integration for the purpose of properly evaluating investment risks with social or ethical investing practices. Even as the elements of what constitute E, S and G are still being debated, the idea of ESG integration, in line with the CFA Institute’s definition, is to take into consideration, in a systematic and consistent manner, any relevant and material environmental, social and governance risks or opportunities. The consideration of ESG issues in investment analysis is intended to complement and not substitute for traditional fundamental analysis that might otherwise ignore or overlook such risks or opportunities. On the other hand, ethical or social investing relies primarily on screening out or excluding companies from investment portfolios for a variety of reasons, including ethical, religious, social as well as other strongly held beliefs, such as environmental concerns or involvement on the part of companies in specific business activities. These may include companies involved in the production or manufacturing of tobacco, firearms, alcohol, or even fossil fuel companies, to mention a few.

The misunderstanding is not surprising as ESG has a definition problem. As reported recently in a joint CFA and PRI publication entitled “ESG Integration in the Americas: Markets, Practices and Data,” a coherent understanding is lacking among asset owners, asset managers, issuers and retail investors of what is meant by ESG…” Further, even when ESG is integrated into the equity and fixed income investing process, challenges remain. Two important ones involve time horizon and materiality. Many ESG issues, particularly environmental issues, are long-term in nature and analysis or investment decisions are often undertaken with a shorter time frame. In the case of long-term bonds or similar financial instruments, confidence in outcomes associated with long-term scenarios diminishes and so there is a tendency to discount the results so that near-term outcomes play a more dominant role in the analysis. Another issue is the lack of a generally accepted definition for materiality which needs to be expressed in terms of its linkage to cash flows and risk.

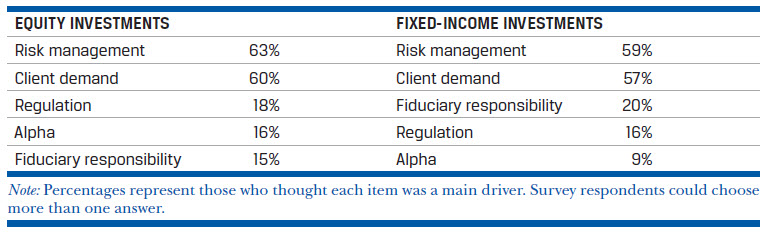

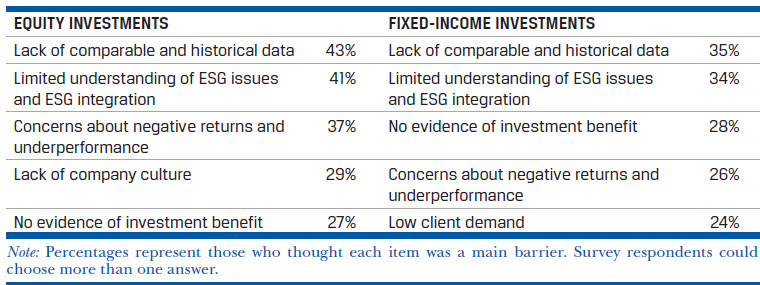

In the same research article, it is noted that investment practitioners may not be able to quantify the precise impact of ESG, but there was agreement that ESG integration can give a more complete understanding of an investment. Indeed, in equity and fixed income investments, risk management was cited as the most important driver of ESG integration in US capital markets while lack of data and a limited understanding of ESG issues and ESG integration were cited as the greatest barriers to ESG integration in US capital markets. Refer to Table 1 and Table 2.

Table 1: Drivers of ESG Integration in US Capital Markets

Source: ESG Integration in the Americas: Markets, Practices and Data, 2018 CFA Institute

Table 2: Barriers to ESG Integration in US Capital Markets

Source: ESG Integration in the Americas: Markets, Practices and Data, 2018 CFA Institute

In the case of the California Public Employees’ Retirement System (CalPERS) with its long-term pension liabilities, ignoring environmental risks due to climate change that are projected to have greater impacts sooner, for example, could potentially further serve to exacerbate the retirement fund’s already underfunded status.