The Bottom Line: Advocating for improved disclosures and renewable energy sources, considering lesser energy consuming cryptocurrencies and purchasing carbon credits are options for sustainable investors.

Summary and options for sustainable cryptocurrency investors

In the 13 or so years since the publication of a white paper by Satoshi Nakamoto¹ that launched the cryptocurrency digital wave with the introduction of Bitcoin, the first cryptocurrency, the market capitalization of all cryptocurrency assets has exploded to over $2.23 trillion². This growth has largely taken place in the last five years, since about July 2017. The number of cryptocurrencies in the market has also expanded dramatically along with the number of investors. While new cryptocurrencies are constantly being created and quite a number have reportedly failed, it is estimated that there are currently more than 13,506 in existence³ The market is highly concentrated with the top ten cryptocurrencies representing 80% of the market cap. Based on a new Pew Research Center survey, the majority of U.S. adults have heard at least a little about cryptocurrencies like Bitcoin or Ethereum, and 16% say they personally have invested in, traded or otherwise used one. In the meantime, increasing focus on climate change has directed attention on the usage of energy by cryptocurrencies in the mining process and the resultant levels of greenhouse gas emissions. This, even as calculating the energy use of cryptocurrencies is exceedingly difficult due to the many parameters at play and spotty data. Bitcoin in particular, due to its dominant market position, high volume of transactions and reliance on a high energy consuming blockchain verification methodology, has been called out for its very high energy usage. This issue may be less problematic for investors generally, but it is concerning for investors that emphasize sustainable investing as well as investors focused on environmental, social and governance (ESG) investing even as some recent data indicates that energy usage may have moderated somewhat. Further, while environmental factors top the list of ESG concerns, cryptocurrencies are exposed to various other ESG-related risks and opportunities that should be considered by sustainable investors. These are noted below, however, this article focuses on environmental considerations and identifies options for consideration by sustainable or ESG investors who may wish to invest in more energy efficient alternatives while keeping in mind the highly speculative nature of cryptocurrency investing. For sustainable investors, options and considerations include advocating for improved disclosures, transparency and a shift to renewable energy sources, considering lesser energy consuming cryptocurrencies and/or offsetting emissions through the purchase of carbon credits.

¹ Bitcoin: A Peer-to-Peer Electronic Cash System, 2008.

² Consisting of all crypto assets, including stablecoins and tokens as of 12/11/2021, according to CoinMarketCap, a cryptocurrency price tracking website that was acquired by Binance in April 2020.

³Source: CoinMarketCap.

Cryptocurrencies have expanded dramatically, however, the market is highly concentrated

Cryptocurrency is a decentralized digital currency that relies on distributed ledger technology to keep ownership records and transfer ownership from one user to another often with little to no information about the identity of the owner over the internet. Unlike the U.S. Dollar or the Euro, for example, there is no central authority that manages and maintains the value of a cryptocurrency. Instead, these tasks are broadly distributed among a cryptocurrency’s users via the internet in the form of governance protocols.

The number of cryptocurrencies in the market has expanded dramatically, however, the market remains highly concentrated. As noted, the top ten cryptocurrencies represent 80% of the segment’s market cap and the top five cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB) Tether (USDT) and Solana (SOL), account for 72.3% of the market cap as of December 11, 2021. With a 40% market cap, Bitcoin remains the market leader, having been created as a concept that was outlined in principle by Satoshi Nakamoto in 2008. Nakamoto described the project as “an electronic payment system based on cryptographic proof instead of trust.” That cryptographic proof comes in the form of transactions that are verified and recorded in a form of technology called a blockchain.

Blockchain–an open, distributed ledger that records transactions in code

A blockchain is an open, distributed ledger that records transactions in code. In practice, it’s a little like a checkbook that’s distributed across countless computers around the world. Transactions are recorded in “blocks” that are then linked together on a “chain” of previous cryptocurrency transactions. With a blockchain, everyone who uses a cryptocurrency has their own copy of this ledger to create a unified transaction record. Software logs each new transaction as it happens, and every copy of the blockchain is updated simultaneously with the new information, keeping all records identical and accurate. To prevent fraud, each transaction is checked using one of two main validation techniques: Proof of Work (PoW) or Proof of Stake (PoS).

Of the two validation techniques, PoW requires an intense amount of computer power and electricity

Proof of Work (PoW). This validation method, used by a substantial percentage of all cryptocurrencies, including Bitcoin and Ethereum, employs a consensus mechanism that requires computers to solve complex mathematical problems. Each participating computer, often referred to as a “miner,” races to solve the mathematical problem that helps verify a group of transactions—referred to as a block—then adds them to the blockchain leger. The first computer to do so successfully is rewarded with a small amount of cryptocurrency for its efforts. This race to solve blockchain problem can require an intense amount of computer power and electricity. According to the Bitcoin Energy Consumption Index, it is estimated that Bitcoin’s annualized electrical energy consumption is 201.32 TWh, comparable to the power consumption of Thailand and slightly below Vietnam. Its carbon footprint per single transaction is 958.68 Kg of CO2, equivalent to the carbon footprint of 2.1 million Visa transactions. By way of comparison, Ethereum’s annualized electrical energy consumption is 97.19 TWh, or 11X lower than Bitcoin4. Its carbon footprint per single transaction is 100.91 Kg of CO2, equivalent to 223,651 Visa transactions. That said, the numbers should be viewed as rough estimates.

Proof of Stake (PoS). The Proof of Stake method, which was introduced in 2012, reduces the amount of power necessary to check transactions. With proof of stake, the number of transactions each person can verify is limited by the amount of cryptocurrency they’re willing to “stake,” or temporarily lock up in a communal safe, for the chance to participate in the process.

Because proof of stake removes energy-intensive equation solving, it’s much more efficient than proof of work, allowing for faster verification/confirmation times for transactions. If a stake owner (sometimes called a validator) is chosen to validate a new group of transactions, they’ll be rewarded with cryptocurrency, potentially in the amount of aggregate transaction fees from the block of transactions. To discourage fraud, if you are chosen and verify invalid transactions, you forfeit a part of what you staked.

New validation techniques are reported to consume far less energy and/or rely on renewable energy sources

In addition to cryptocurrencies that rely on PoS, there are also new cryptocurrencies that have been introduced, with an emphasis on limiting the energy-related impact of transactions. Chia and IOTA are examples of this. Chia, which describes itself as green money for a digital world, explains that it is an attempt to improve on Proof of Work-based blockchains with a new consensus algorithm that is referred to a Proof of Space and Time. Instead of consuming massive amounts of electricity and wasteful single-purpose ASIC hardware to validate transactions, Proof of Space leverages the over-provisioned exabytes of disk space that already exist in the world today.

The farming process for Chia doesn’t rely on the heavy processing power of mining and thus consumes less energy than other popular currencies. Similarly, IOTA uses an alternative to blockchain called the ‘Tangle’ which essentially removes the need for miners. Instead, the network is maintained by smaller devices and uses calculations that require less power and thus consume less energy per transaction.

Another example is Ripple (XRP), a $39.4 billion cryptocurrency that last December became subject to a Securities and Exchange Commission action for allegedly raising over $1.3 billion through an unregistered, ongoing digital asset securities offering. The platform doesn’t rely on the Proof of Work validation method but rather it uses a protocol that polls its network to validate account balances and transactions. If the majority agrees on the transaction’s integrity, it gets the green light.

Environmental impacts can vary significantly across cryptocurrencies, but these are difficult to estimate

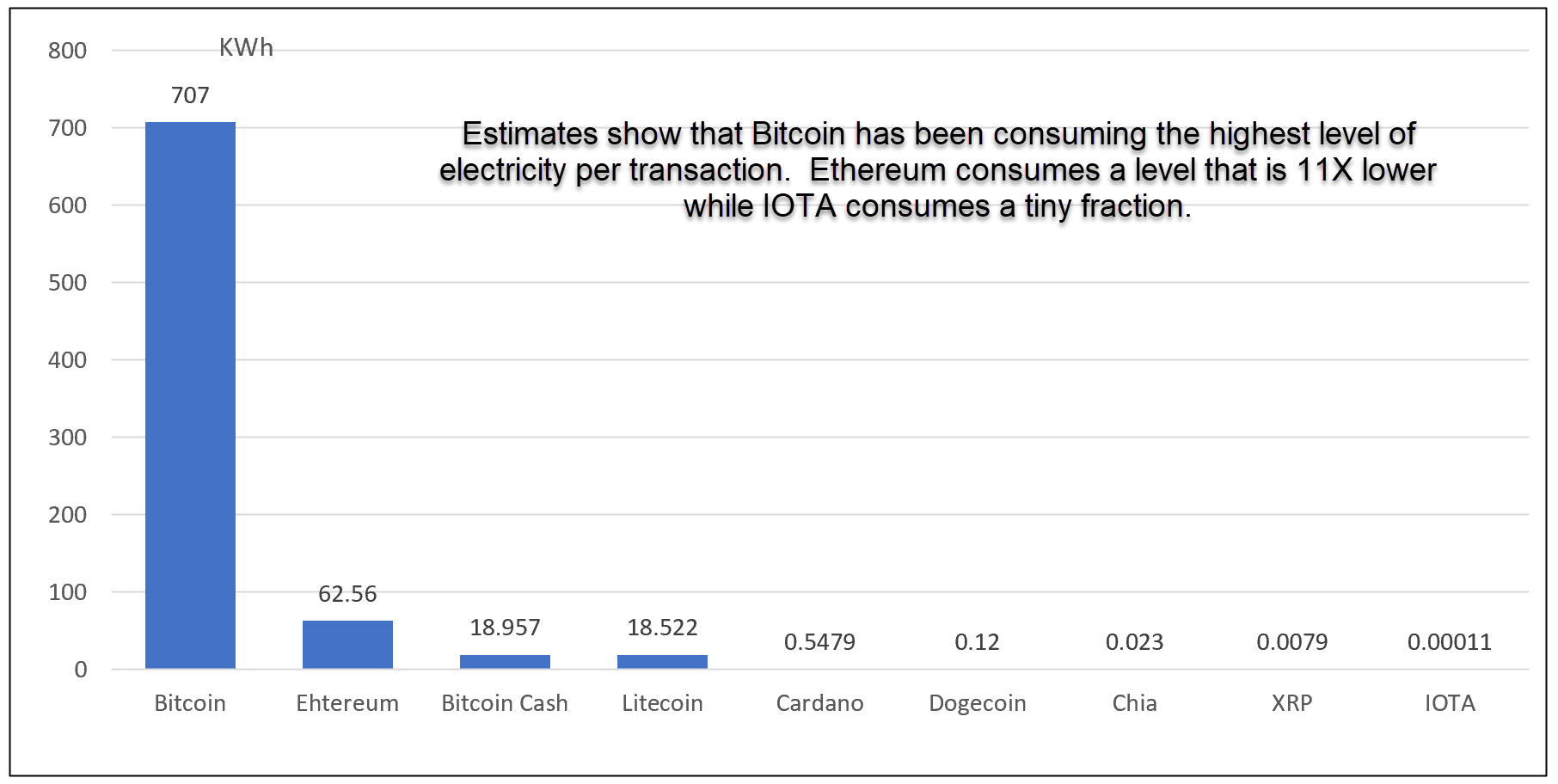

While some of the energy use and greenhouse gas emissions attributable to cryptocurrencies is sourced to the level of efficiency of the mining devices and the electronic wastes created due to replacements of the high intensity computers used in the mining process, most of the energy expenditure of cryptocurrencies is attributed to the energy intensive mining process by which coins are made available. The machines performing the work consume huge amounts of energy and the energy used, which is challenging to quantify, has been reported to be primarily linked to fossil fuels. Referencing another data source based on what may be less current approximate energy consumption data for some popular cryptocurrencies compiled by DRG Datacenters, a Houston-based datacenter management company, Bitcoin consumed 707 Kilowatt hour (KWh) of electricity per transaction as compared to 62.6 KWh of electricity per transaction or 11.30 times lower than Bitcoin. This compares to currencies at the other end of the range that have a far lower impact, such as IOTA, XRO and Chia that consumed from 0.00011 to 0.023 KWh of electricity per transaction. Refer to Chart 1. That said, according to the Bitcoin Mining Council (BMC) based on survey data as of Q3 2021, Bitcoin mining electricity mix has increased to 57.7% sustainable as of Q3 2021. According to BMC, there has been an improvement in Bitcoin mining energy efficiency and sustainability due to advances in semiconductor technology, the exodus earlier this year from China of cryptocurrency miners that had been relying on coal-dominated energy sources and the rapid expansion in North American mining, the worldwide rotation toward sustainable energy and modern mining techniques.

Chart 1: Estimated energy consumption per transaction, in KWh

Source: DRG Datacenters, using approximate figures taken from external sources. According to DRG, some smaller currencies do not have as much information published around them, so the consumption per transaction was calculated using the data available (e.g. yearly consumption per transaction x and transaction number per day).

In the end, the lack of transparency and data make it exceedingly difficult to point to any one currency being ‘greener’ than others. There are many parameters at play, there is no central register with all active machines, their location and exact power consumption. Most miners are small private firms that do not yet disclose this information. This degree of difficulty means that many of the much smaller cryptocurrencies naturally have a far lower energy footprint because they involve far fewer daily transactions as compared to Bitcoin and other larger scale PoW validation technique users. For this reason, the recently announced formation of the Crypto Climate Accord (CCA) is a welcome development for sustainable investors and other stakeholders. The Accord represents a private sector collaborate effort to decarbonize the crypto and blockchain industry. According to the organization’s website, more than 200 companies and individuals spanning the crypto and finance, technology and NGO, energy and climate sectors have joined the Crypto Climate Accord as supporters that are involved with helping advise, develop and scale solutions in support of the CCA. Signatories “make a public commitment to achieve net zero emissions from electricity consumption associated with all their respective crypo-related operations by 2030 and to report progress toward this net zero emissions target using the best industry practices5”. That said, further details have not yet been made available.

4Ethereum is reportedly moving to the PoS consensus mechanism

5 Refer to Crypto Climate Accord at cryptoclimate.org.

Cryptocurrency investors are exposed to additional ESG risks and opportunities

While the focus of this research article was limited to environmental impacts, cryptocurrency investors should be aware of potential social and governance risks and opportunities sourced to cryptocurrencies. These considerations are listed in Table 1 but it should also be noted that the same issues are not limited to direct investing in the currencies. According to research recently published by MSCI, there are at least 52 public companies covered by MSCI research that have exposure to cryptocurrencies 6

Table 1: Cryptocurrency ESG risks and opportunities

ESG Factor | Considerations |

Governance | Evaluation challenges due to the decentralized nature of cryptocurrencies. Oversight and risk management policies and practices may apply, but its challenging to evaluate at this point. Reporting and disclosure, which is not standardized, is limited, especially with regard to smaller and privately held firms. |

Environmental | Energy usage and greenhouse gas emissions. |

Social | Cryptocurrencies have been associated with ransomware and fraud. The location of some mining companies, such a Xinjiang Province in China, has been associated with human rights abuses. Such allegations have been denied by China. It has also been reported that there is a lack of gender diversity in the cryptocurrency and blockchain space. At the same time, cryptocurrencies and the underlying blockchain technology can facilitate greater levels of inclusion by the expansion of financial and banking services to the estimated 1.7 billion people who don’t have access to banking services. |

6Creeping Crypto: Cryptocurrency Risk and ESG, MSCI, October 13, 2021

Considerations and options for sustainable investors

Investors drawn to cryptocurrency should keep in mind that it is a new, unregulated, highly speculative investment opportunity with limited transparency. Bitcoin, which traded at $66,971.83 as recently as November 8, 2021 dropped to $46,581.05 as of December 4, 2021, registering a 30.4% decline. The cryptocurrency has since settled at a price of $48,777.75, recovering some 4.7%. Still, interested sustainable investors can take into account the following considerations and options:- Advocate for the disclosure and tracking of energy use and renewable energy sources in a standardized format directly from the cryptocurrencies and to the extent possible, engage with these entities to encourage emphasis on renewable energy sources. The Bitcoin Mining Council7 was recently formed to standardize energy reporting in an effort to correctly track how much bitcoin utilizes renewable energy sources. This voluntary organization still has a limited number of members.

- Consider a shift in part on in whole away from cryptocurrencies that are significant consumers of energy and focus on lower energy consuming alternatives, including cryptocurrencies that rely on Proof of Task verification methods as well as newer lower-to-low energy consuming cryptocurrencies that seek to limit the impact of transactions, such as Chia, XRP or IOTA, to mention just a few.

- Purchase carbon offsets to counterbalance the CO2 emissions sourced to cryptocurrency investments. Carbon offset programs let individuals and businesses offset their environmental footprint by paying to reduce greenhouse gas emissions elsewhere. Projects that help support carbon reduction may include landfill gas capture facilities, renewable energy development in communities, wind farms and reforestation projects, to mention just a few.