The Bottom Line: Slides presented at Crane Data’s Bond Fund Symposium, March 28, 2022, on the topic of ESG Issues in the Bond Fund Space.

Key takeaways from Crane’s Bond Fund Symposium presentation:

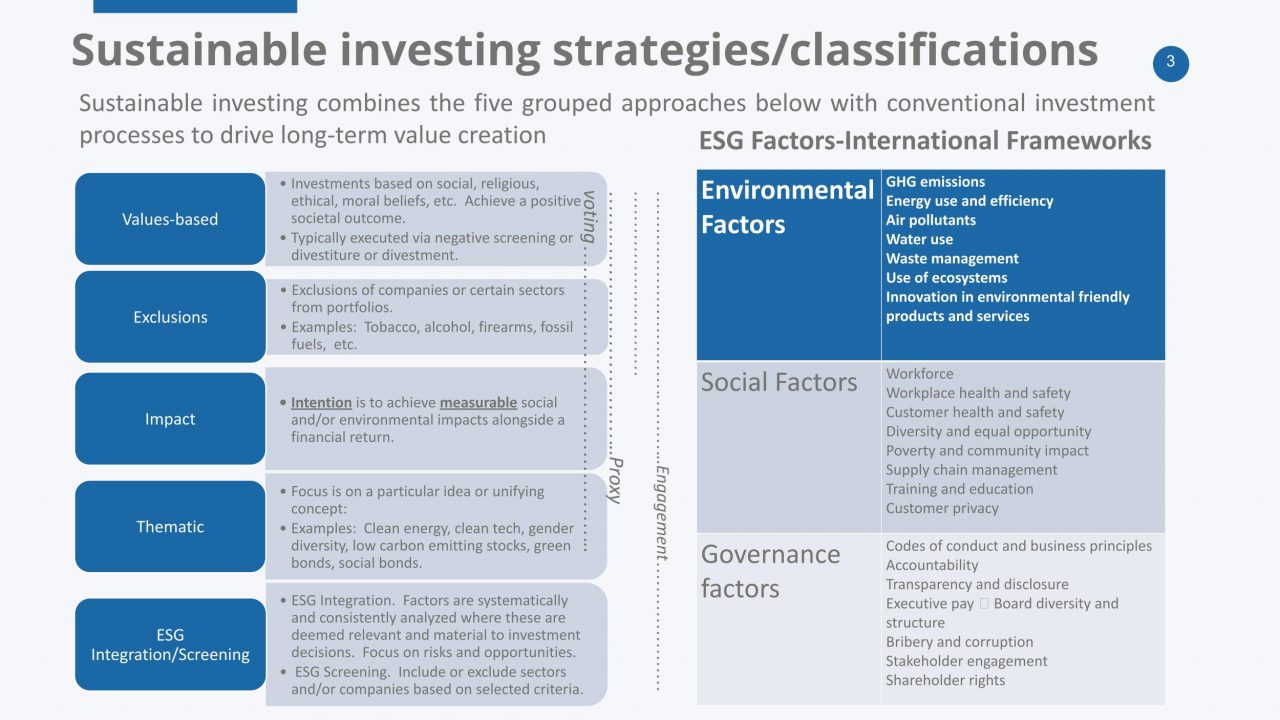

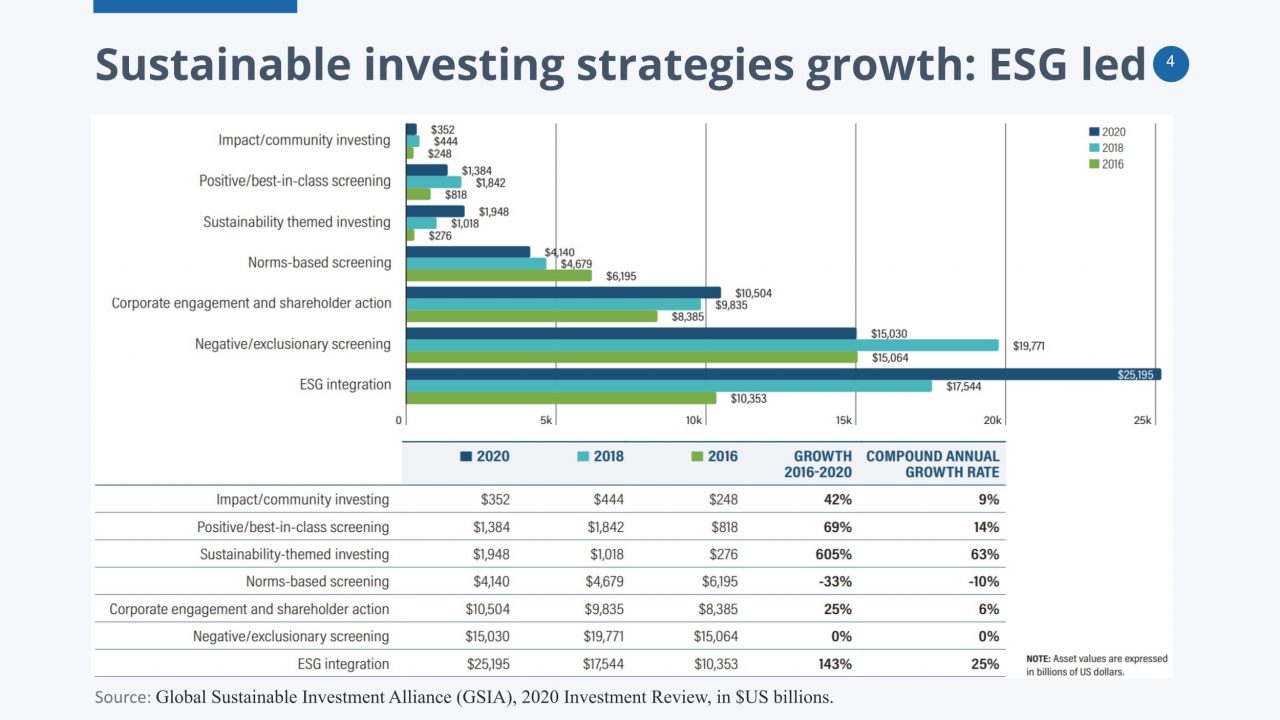

- ESG and sustainable investing are terms that are used interchangeably, leading to confusion and misunderstanding. Terms should be defined, and standards established for sustainable funds, otherwise segment growth will be impeded.

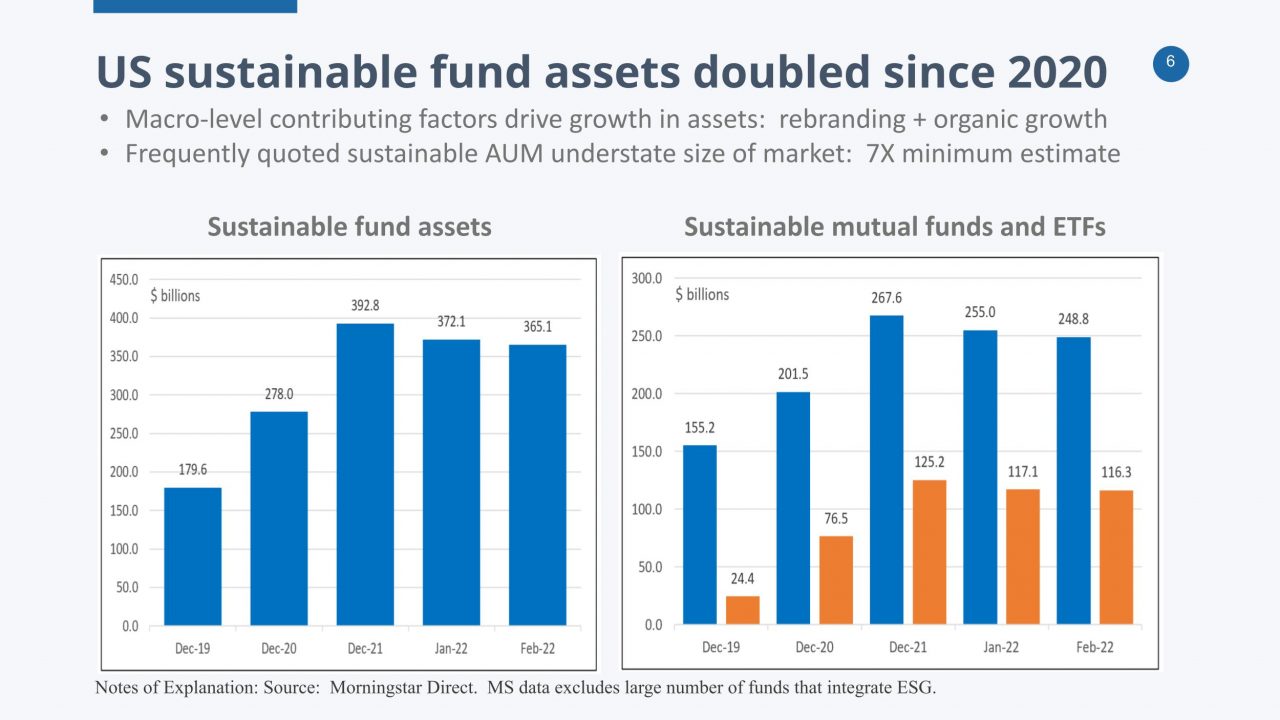

- Macro-level factors have contributed to significant growth in US sustainable fund assets under management, either organically or due to the rebranding of existing products, but frequently quoted AUM either overstate or understate the size of funds market which is likely in the $2.5 trillion level.

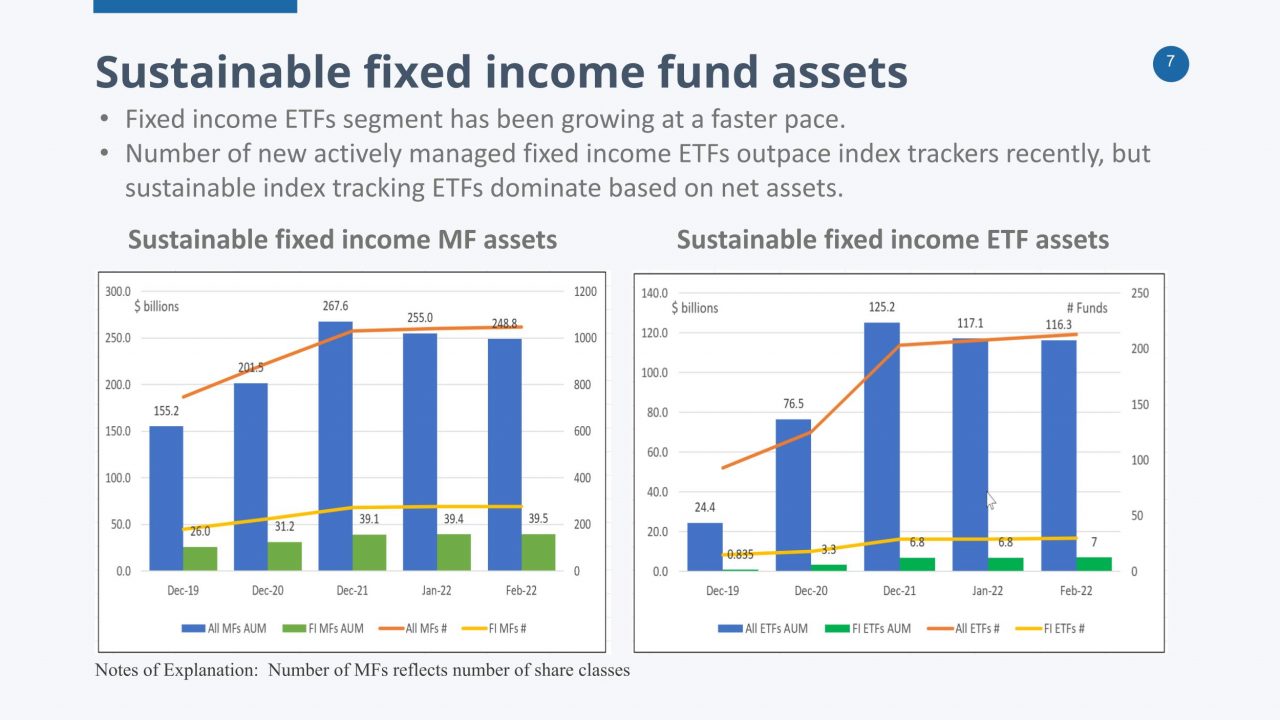

- The fixed income ETF segment has been expanding at a faster pace relative to sustainable fixed income mutual funds. The number of new actively managed fixed income ETFs outpaced index trackers recently, but sustainable index tracking ETFs dominate based on net assets.

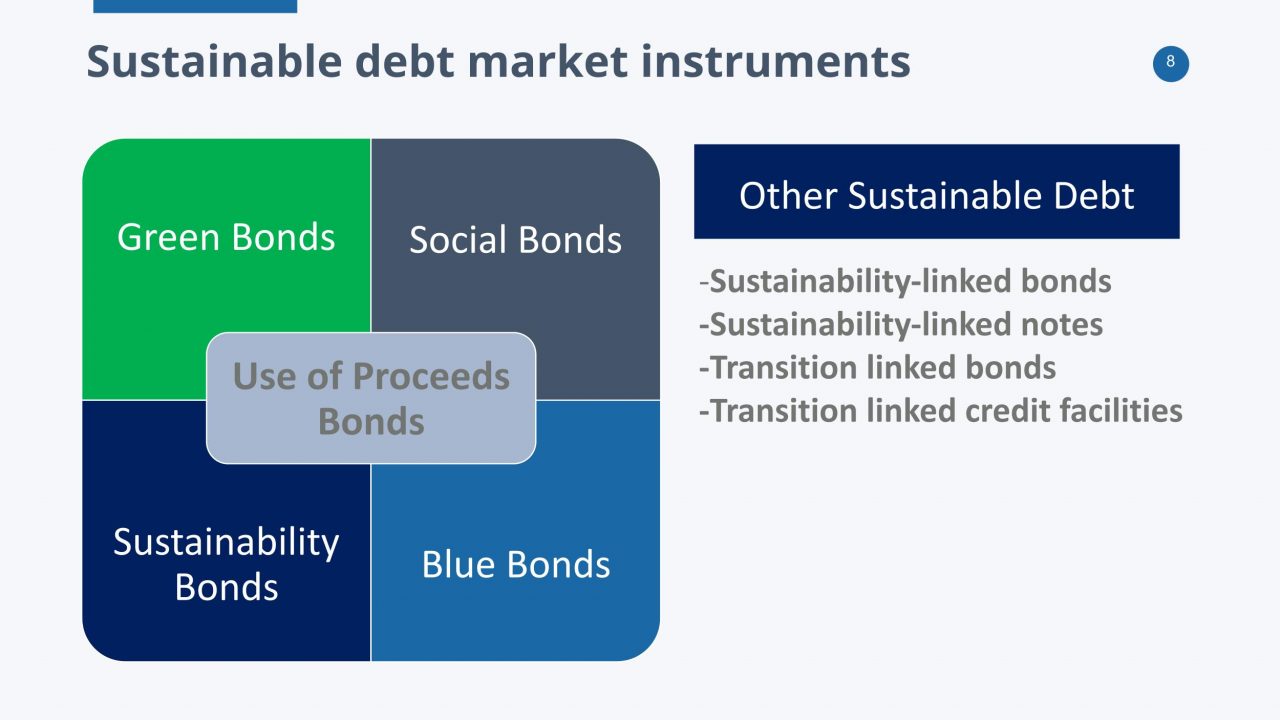

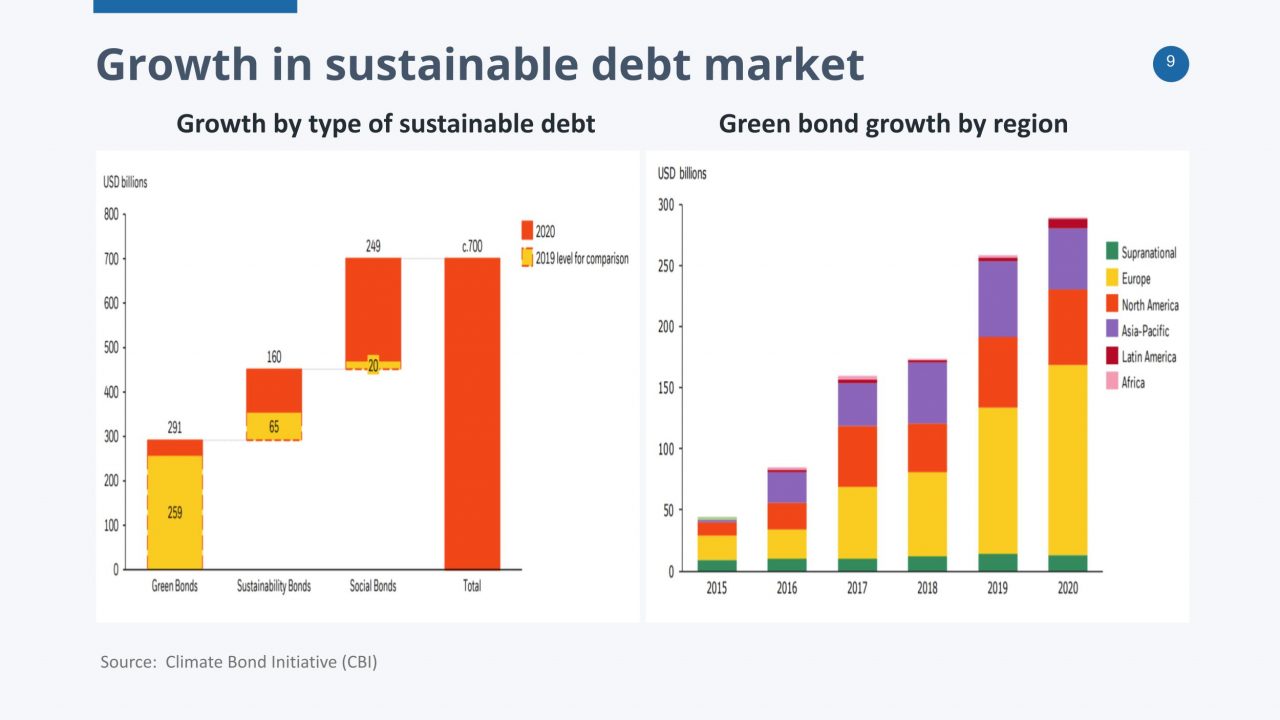

- Issuance of sustainable debt market instruments, including green and social bonds, reached $1.6 trillion in 2021.

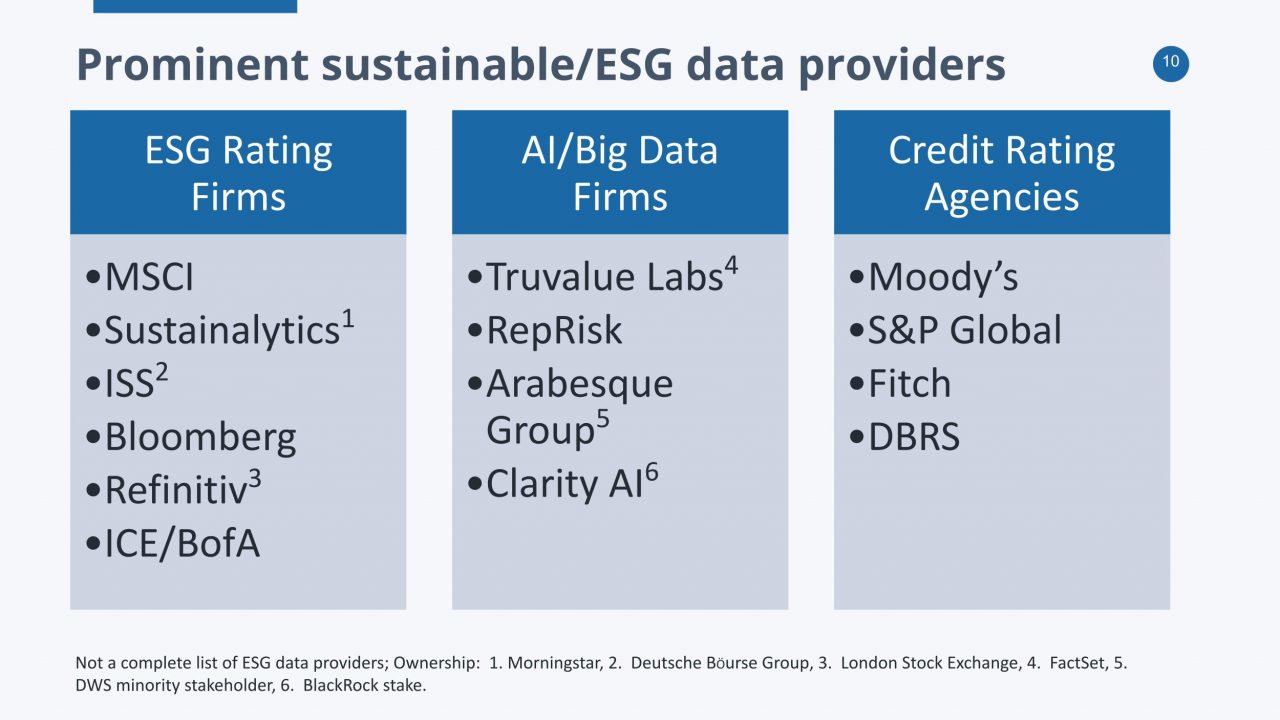

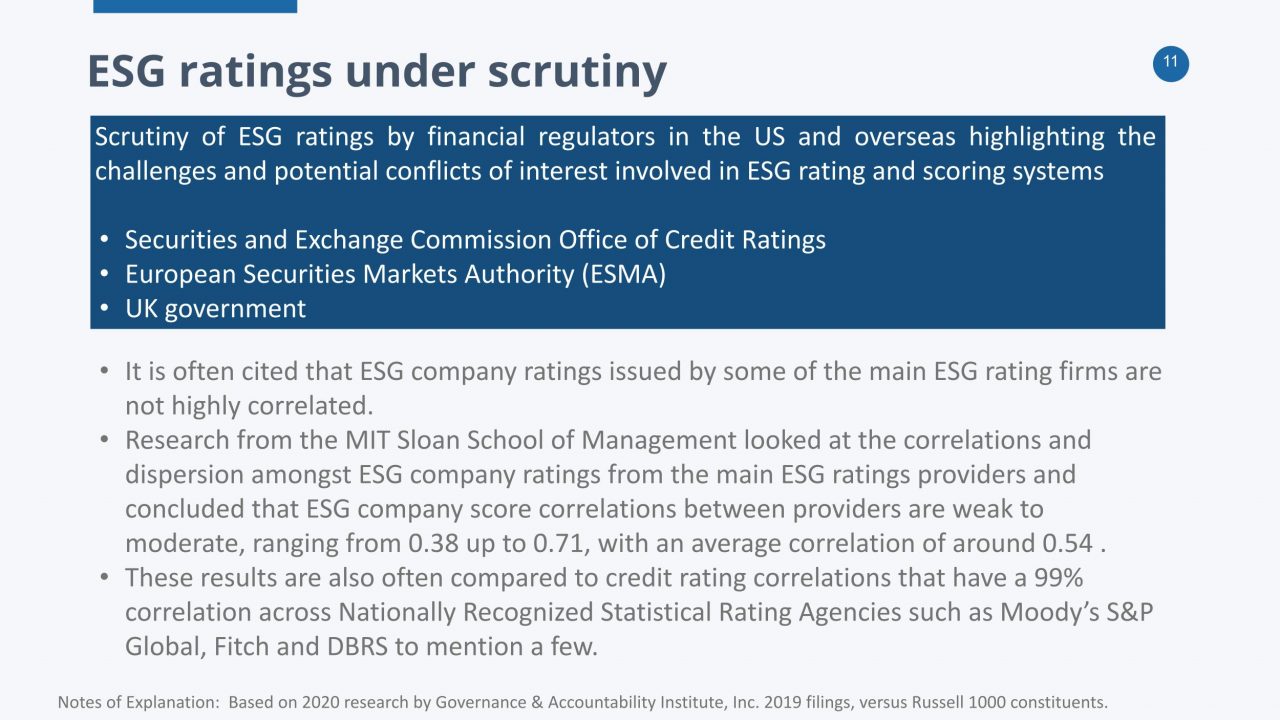

- It is often sited that ESG company ratings issued by some of the main ESG rating firms are not highly correlated, and, in particular, when compared to the high 99% or so correlations associated with credit ratings. Yet, there is value to diversity of opinions in the sustainable investing sphere and varying opinions should be encouraged and valued by market participants.