The Bottom Line: Two of three Sustainable (SUSTAIN) fund indices outperformed conventional benchmarks by 36 bps and 32 bps; third index trailed by 125 bps.

Stock and bond prices rose in July: S&P 500 gained 5.6% while the Bloomberg Barclays US Aggregate Index added 1.5%

Stock prices rose in July as investors seemed to exhibit a higher level of tolerance for the coronavirus pandemic in light of further evidence that economic activity had improved since the COVID-19 lockdowns were lifted and Q2 corporate earnings were coming in a little stronger than previously lowered analyst expectations. Of course, these sentiments continue to be underpinned by historic levels of Federal Reserve policies intended to minimize the losses stemming from the global pandemic and unprecedented massive fiscal stimulus. Yet as the month of July wore on, high-frequency data pointed to a pause in the recovery, particularly in the US. The pace of increase in new infections in the US began to rise again from mid-June and this trend continued throughout most of July. This led many states to shift gears and to partly reverse or pause their reopening plans. GDP in the second quarter suffered the largest decline since World War II and the outlook for the third quarter was stalling. Against this backdrop, the stock market as measured by the S&P 500 added 5.6%, the second best monthly gain so far this year following April’s 12.82% increase. The S&P 500 is now in the black on a year-to-date basis, up 2.4%. The Nasdaq Composite was up 6.9% and stands 20.4% higher since the start of the year. Growth stocks outperformed value stocks by as much as 3.4% across mid-cap stocks while small cap stocks posted positive results but lagged with a total return gain of 2.8%. At the same time, intermediate investment-grade bonds gained 1.5% while below investment-grade corporates (Caa-rated) registered an increase of 4.8%.

Europe and Asia also saw gains in July, with the MSCI ACWI ex USA up 4.5%

Although reversals have been observed there too, Europe and Asia appeared to manage the virus more effectively and sustained lower GDP declines relative to the US. The MSCI ACWI ex USA Index was up 4.5% in July but remains -6.7% year-to-date. The MSCI EAFE Index was up 2.3% and emerging markets registered a 9% gain. Across developed and developing individual countries, Taiwan led with a 126.6% gain while Japan posted a decline of -1.6%.

Sustainable indices: Domestic and foreign ESG equity indices outperformed conventional securities benchmarks but fixed income ESG lagged

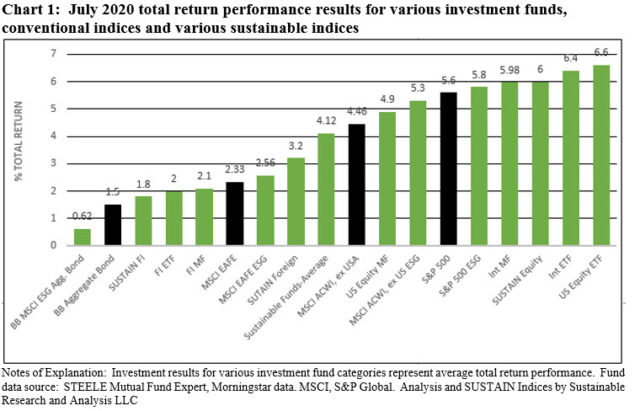

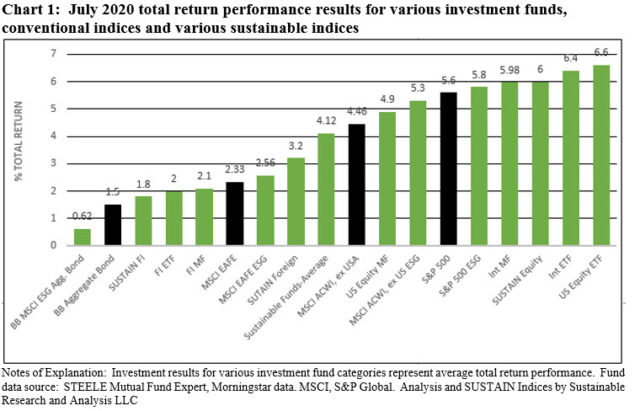

Sustainable mutual funds and ETFs[1] across all fund categories recorded an average total return increase of 4.11%. Average returns by investment category ranged from a low of 2.0% and 2.1% posted by fixed income ETFs and mutual funds, respectively, to highs of 6.6% and 4.9% registered by US equity ETFs and US equity mutual funds, in that order. International mutual funds and ETFs delivered average returns of 5.8% and 6.4%. Domestic and international equity ESG-oriented securities market indices outperformed their conventional counterparts while non-ESG intermediate investment-grade bonds trailed ESG bonds by 88 bps, based on the Bloomberg Barclays US Aggregate Index. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index and the Sustainable (SUSTAIN) Bond Fund Index outperformed their conventional securities market indices but the Sustainable (SUSTAIN) Foreign Fund Index dropped behind by 1.3%. Refer to Chart 1.

Sustainable (SUSTAIN) Large Cap Equity Fund Index gains 5.99% and exceeded the S&P 500 by 36 bps

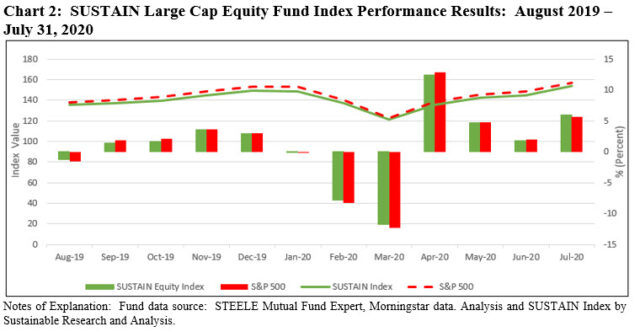

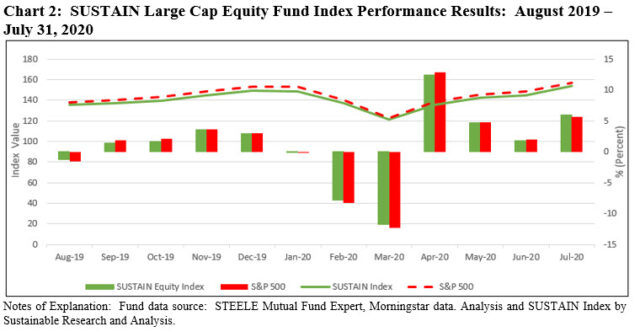

The Sustainable (SUSTAIN) Large Cap Equity Fund Index recorded a gain of 5.99%, registering a fourth consecutive monthly gain and a cumulative four-month return of 27.1%. The SUSTAIN benchmark beat the S&P 500 by 36 bps after lagging the conventional benchmark for three consecutive months. Refer to Chart 2.

Six of the ten constituent funds lifted the index by outperforming the S&P 500 with returns ranging from 6.95% recorded by the Hartford Capital Appreciation Fund A to 7.22% posted by the Nationwide Institutional Service Shares. The same fund was up 6.08% year-to-date.

Sustainable (SUSTAIN) Bond Fund Index gained 1.81% and beat the conventional index by 32 bps

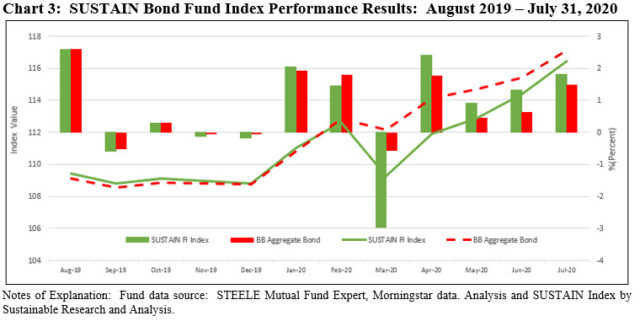

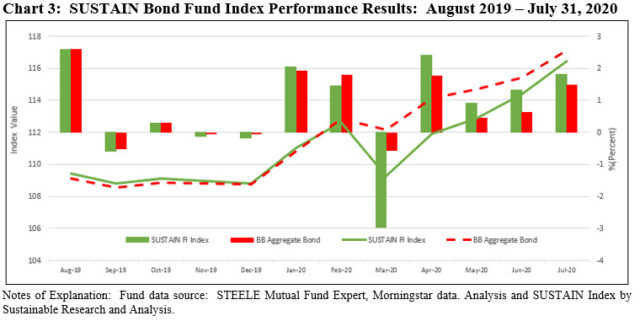

The Sustainable (SUSTAIN) Bond Fund Index gained 1.81% in July and outperformed the Bloomberg Barclays US Aggregate Index by 32 bps. The SUSTAIN Index has now beaten the conventional benchmark for four consecutive months during which both indices registered positive results and this has contributed to the SUSTAIN’s 1.47% trailing three-month outperformance. That said, sustainable bond funds are lagging based on year-to-date and trailing 12-month results. Refer to Chart 3.

The SUSTAIN Index benefited from the outperformance achieved by six of the ten funds that comprise the index, ranging from the 1.86% total return achieved by the Calvert Bond Fund I to the 2.21% delivered by the BMO Core Bond Fund I. These funds along with the eight other index members posted conventional index beating results covering the trailing 3-months, but results lag for the year-to-date interval and previous 12-months.

Sustainable (SUSTAIN) Foreign Equity Fund Index gained 3.21%% but failed to overtake the MSCI ACWI ex USA Index by 125 bps

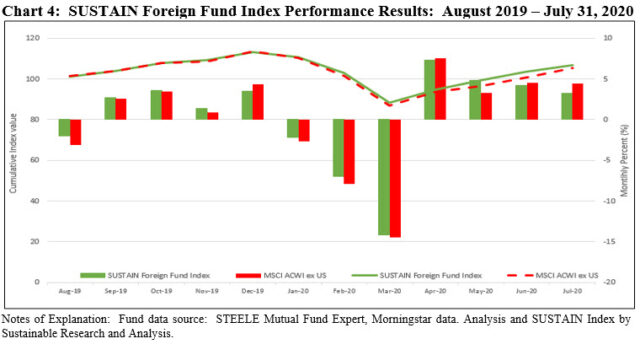

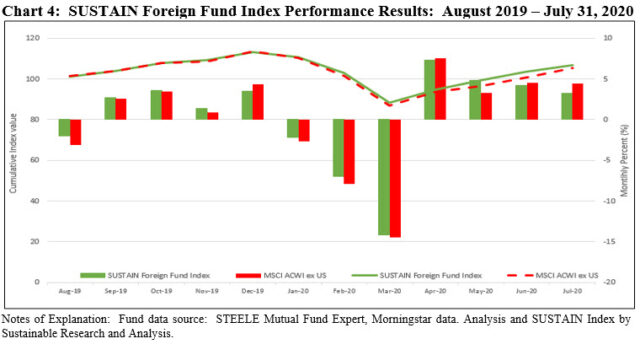

The SUSTAIN Foreign Equity Fund Index posted a gain of 3.21% but failed to keep up with the MSCI ACWI ex USA Index that gained 4.46%. The SUSTAIN Index lagged by 125 bps, the widest negative spread since launch in June 2019, as eight of ten index members underperformed. The exceptions included the Aberdeen Select International Equity Fund A, up 5.83%, and the Hartford International Opportunities Fund Y, up 6.4%.

July’s performance drag was offset by May’s strong performance, which allowed the SUSTAIN Index to stay ahead of the MSCI ACWI ex USA Index over the trailing 3-months, year-to-date and 12-month intervals with returns of 12.83%, -5.43% and 3.43%, respectively. Refer to Chart 4.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

SUSTAIN US equity and bond fund indices excelled in July 2020

The Bottom Line: Two of three Sustainable (SUSTAIN) fund indices outperformed conventional benchmarks by 36 bps and 32 bps; third index trailed by 125 bps.

Share This Article:

The Bottom Line: Two of three Sustainable (SUSTAIN) fund indices outperformed conventional benchmarks by 36 bps and 32 bps; third index trailed by 125 bps.

Stock and bond prices rose in July: S&P 500 gained 5.6% while the Bloomberg Barclays US Aggregate Index added 1.5%

Stock prices rose in July as investors seemed to exhibit a higher level of tolerance for the coronavirus pandemic in light of further evidence that economic activity had improved since the COVID-19 lockdowns were lifted and Q2 corporate earnings were coming in a little stronger than previously lowered analyst expectations. Of course, these sentiments continue to be underpinned by historic levels of Federal Reserve policies intended to minimize the losses stemming from the global pandemic and unprecedented massive fiscal stimulus. Yet as the month of July wore on, high-frequency data pointed to a pause in the recovery, particularly in the US. The pace of increase in new infections in the US began to rise again from mid-June and this trend continued throughout most of July. This led many states to shift gears and to partly reverse or pause their reopening plans. GDP in the second quarter suffered the largest decline since World War II and the outlook for the third quarter was stalling. Against this backdrop, the stock market as measured by the S&P 500 added 5.6%, the second best monthly gain so far this year following April’s 12.82% increase. The S&P 500 is now in the black on a year-to-date basis, up 2.4%. The Nasdaq Composite was up 6.9% and stands 20.4% higher since the start of the year. Growth stocks outperformed value stocks by as much as 3.4% across mid-cap stocks while small cap stocks posted positive results but lagged with a total return gain of 2.8%. At the same time, intermediate investment-grade bonds gained 1.5% while below investment-grade corporates (Caa-rated) registered an increase of 4.8%.

Europe and Asia also saw gains in July, with the MSCI ACWI ex USA up 4.5%

Although reversals have been observed there too, Europe and Asia appeared to manage the virus more effectively and sustained lower GDP declines relative to the US. The MSCI ACWI ex USA Index was up 4.5% in July but remains -6.7% year-to-date. The MSCI EAFE Index was up 2.3% and emerging markets registered a 9% gain. Across developed and developing individual countries, Taiwan led with a 126.6% gain while Japan posted a decline of -1.6%.

Sustainable indices: Domestic and foreign ESG equity indices outperformed conventional securities benchmarks but fixed income ESG lagged

Sustainable mutual funds and ETFs[1] across all fund categories recorded an average total return increase of 4.11%. Average returns by investment category ranged from a low of 2.0% and 2.1% posted by fixed income ETFs and mutual funds, respectively, to highs of 6.6% and 4.9% registered by US equity ETFs and US equity mutual funds, in that order. International mutual funds and ETFs delivered average returns of 5.8% and 6.4%. Domestic and international equity ESG-oriented securities market indices outperformed their conventional counterparts while non-ESG intermediate investment-grade bonds trailed ESG bonds by 88 bps, based on the Bloomberg Barclays US Aggregate Index. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index and the Sustainable (SUSTAIN) Bond Fund Index outperformed their conventional securities market indices but the Sustainable (SUSTAIN) Foreign Fund Index dropped behind by 1.3%. Refer to Chart 1.

Sustainable (SUSTAIN) Large Cap Equity Fund Index gains 5.99% and exceeded the S&P 500 by 36 bps

The Sustainable (SUSTAIN) Large Cap Equity Fund Index recorded a gain of 5.99%, registering a fourth consecutive monthly gain and a cumulative four-month return of 27.1%. The SUSTAIN benchmark beat the S&P 500 by 36 bps after lagging the conventional benchmark for three consecutive months. Refer to Chart 2.

Six of the ten constituent funds lifted the index by outperforming the S&P 500 with returns ranging from 6.95% recorded by the Hartford Capital Appreciation Fund A to 7.22% posted by the Nationwide Institutional Service Shares. The same fund was up 6.08% year-to-date.

Sustainable (SUSTAIN) Bond Fund Index gained 1.81% and beat the conventional index by 32 bps

The Sustainable (SUSTAIN) Bond Fund Index gained 1.81% in July and outperformed the Bloomberg Barclays US Aggregate Index by 32 bps. The SUSTAIN Index has now beaten the conventional benchmark for four consecutive months during which both indices registered positive results and this has contributed to the SUSTAIN’s 1.47% trailing three-month outperformance. That said, sustainable bond funds are lagging based on year-to-date and trailing 12-month results. Refer to Chart 3.

The SUSTAIN Index benefited from the outperformance achieved by six of the ten funds that comprise the index, ranging from the 1.86% total return achieved by the Calvert Bond Fund I to the 2.21% delivered by the BMO Core Bond Fund I. These funds along with the eight other index members posted conventional index beating results covering the trailing 3-months, but results lag for the year-to-date interval and previous 12-months.

Sustainable (SUSTAIN) Foreign Equity Fund Index gained 3.21%% but failed to overtake the MSCI ACWI ex USA Index by 125 bps

The SUSTAIN Foreign Equity Fund Index posted a gain of 3.21% but failed to keep up with the MSCI ACWI ex USA Index that gained 4.46%. The SUSTAIN Index lagged by 125 bps, the widest negative spread since launch in June 2019, as eight of ten index members underperformed. The exceptions included the Aberdeen Select International Equity Fund A, up 5.83%, and the Hartford International Opportunities Fund Y, up 6.4%.

July’s performance drag was offset by May’s strong performance, which allowed the SUSTAIN Index to stay ahead of the MSCI ACWI ex USA Index over the trailing 3-months, year-to-date and 12-month intervals with returns of 12.83%, -5.43% and 3.43%, respectively. Refer to Chart 4.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact