Exchange-Traded Fund Investors Legal Action Rebuffed

This week on September 25, 2017 the Wall Street Journal (WSJ) reported that exchange-traded fund (ETF) investors were rebuffed in their legal action against BlackRock Inc. for omitting certain warnings in fund documents about what could go wrong with ETFs. The complaint against BlackRock was initiated by a group of investors who suffered losses due to price discrepancies that arose during the August 24, 2015 Flash Crash. Barring a reversal upon appeal, if one should be filed, this decision could limit investors’ ability in the future to bring action again ETF providers for leaving out or misrepresenting risks in fund registration statements. But the WSJ article also serves as a reminder to investors of the potential volatility and illiquidity that ETFs may experience during periods of market stress. It also suggests that investors should be cautious about their aggregate levels of exposure to ETFs and therefore, avoid investing their entire portfolio exclusively in these investment vehicles. Instead, diversified investors should consider allocating their investments across ETFs as well as low cost index mutual funds to avoid the prospect of having to liquidate under pressure at distressed prices. This approach also applies to sustainable investors and their investment portfolios aimed at achieving a positive societal outcome.

The Legal Complaint Against BlackRock

The complaint alleged that BlackRock and its affiliates represented to investors that ETFs “offer the same” trading liquidity as stocks while BlackRock knew from prior experiences in 2008 and 2010, according to the complaint, that ETF trading liquidity presented additional and different material risks from that of traditional stocks or mutual funds. As a result, the complaint noted that investors who sold ETF shares pursuant to market or stop-loss orders sold at prices far below the underlying NAV of their ETF portfolio. On Monday, August 24, 2015, investors in BlackRock’s iShares ETFs who placed market or protective stop-loss orders prior to or at the opening of the markets suffered disproportionate losses when 19.2% of all ETFs experienced price declines of more than 20%, compared to an average decline of only 4.7% in underlying corporate securities. Investors in Blackrock’s iShares ETFs suffered significant losses as a result. While not involved in the suit, early morning sellers also sustained losses.

August 24, 2015 Flash Crash

A significant advantage associated with ETFs over mutual funds, the ability to buy or sell ETF shares at any time during the trading day, especially under volatile conditions when markets can experience significant intraday movements, was tested on August 24th when a number of popular ETFs experienced outsized price declines during the first minutes of trading. In the opening minutes of trading, the S&P 500 index fell as much as 5.3% while some stock ETFs slid as much as 37%, according to published reports. Some market practitioners attributed this to overlapping and conflicting market rules and circuit breakers.

According to published reports, “at least dozens of stock ETFs saw their prices plunge far below the values of the indexes they’re designed to track, sowing confusion and potentially handing big losses to investors that attempted to unload positions into the falling market[1].” For example, the Vanguard Dividend Appreciation ETF (VIG) traded down by as much as 37% while at the same time the net asset value of the stocks in its index only fell as much as 7.2%, according to FactSet. The $66 billion iShares Core S&P 500 ETF (IVV) was down about 26% before bouncing back to close within fractions of a percentage point away from the underlying benchmark.

There isn’t any evidence to suggest that equally large divergences in the prices and NAVs were experienced by some of the largest sustainable ETFs. Still, extreme volatility events could be repeated again in the future, even in the light of procedural rule improvements that have been implemented by the exchanges since then, and as a consequence, some ETFs should not necessarily be relied upon for liquidity during times of market distress. It further supports the thesis that longer-term investors, especially diversified sustainable investors who are likely to be intermediate-to-long-term oriented, may wish to avoid relying exclusively on ETFs. Rather, they may wish to adopt a strategy of combining investments in ETFs along with mutual funds, provided there are available effectively priced index mutual fund direct equivalents or a sufficiently close approximation in terms of its investment strategy, i.e. underlying index, or theme.

Sustainable ETFs

There are 1,775 ETFs with net assets of $3,029.1 billion as of July 31, 2017[2]. Of these, just 53 are classified as sustainable ETFs on the basis of their objectives and strategies. These include U.S. and foreign developed and emerging market-oriented funds, or some combination, that invest in equities and fixed income securities that employ exclusionary practices, impact and thematic approaches, ESG integration and shareholder advocacy, or some combination of these strategies. Almost $6 billion is invested in these ETFs, which range in size from the smallest, the recently launched $2.6 million SerenityShares Impact ETF (ICAN) to the largest, the $865.8 million iShares MSCI KLD 400 Social ETF (DSI). The average ETF stands at $112.7 million in assets with a median value of $20.4 million[3]. In fact, 34 ETFs have less than $50 million in assets–generally considered to have achieved scale, adequate diversification and liquidity. All but four recently launched sustainable bond ETFs, or 49 funds, invest in equities.

Just focusing on the remaining top 19 ETFs with assets equal to or greater than $50 million, a segment that accounts for $5.5 billion or 92% of the sustainable universe, these funds fall into three broad equity investing categories: U.S. oriented funds that employ exclusionary practices, ESG integration and shareholder advocacy, similarly structured European oriented and emerging market funds as well as equity-oriented thematic investments including for example water, wind, solar, low carbon and gender diversity. When these offerings are juxtaposed against currently available and effectively priced index mutual fund counterparts, direct equivalents are not readily available. Refer to Table 1.

Implementing a Core and Satellite Portfolio Approach

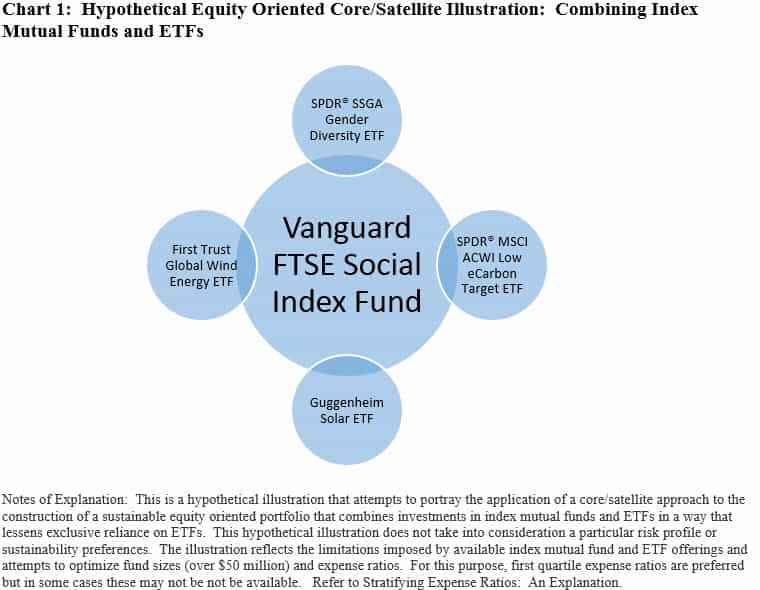

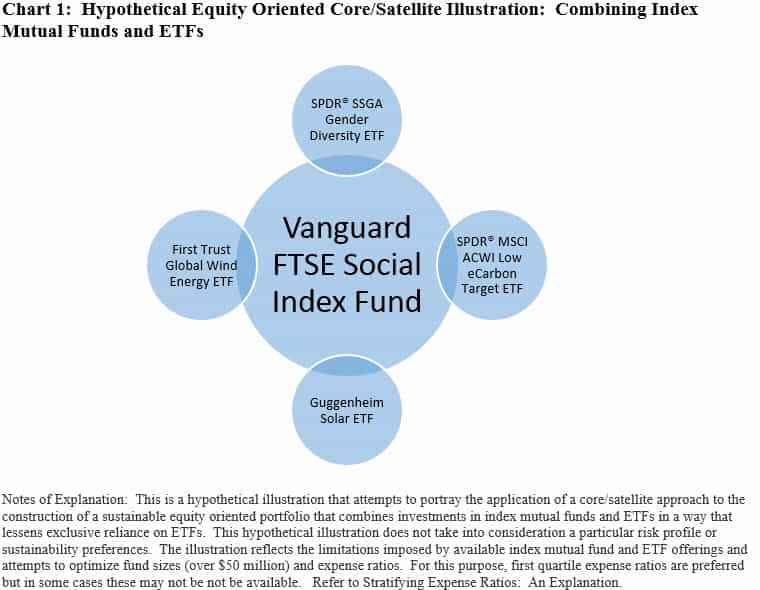

For diversified equity oriented investors interested in structuring a sustainable investment portfolio that lessens their exclusive reliance on ETFs and instead combines both index mutual funds as well as ETFs, a core and satellite portfolio approach could be implemented, provided there is a willingness to substitute underlying indexes that can vary in substantive but more likely in a nuanced fashion. Under this approach, assuming a U.S. oriented investment strategy, the core holding would consist of a diversified ESG focused U.S. directed index mutual fund portfolio along with satellite funds, comprised of ETFs focused on the desired sustainability themes and/or foreign sustainable investing strategies.

To illustrate one such approach (Refer to Chart 1), a sustainable portfolio could be structured around the Vanguard FTSE Social Index Fund, an effectively priced mutual fund, serving as a core holding with various ETFs serving in satellite positions. These could include thematic investments and also provide exposures, if desired, to developed markets outside the U.S. as well as emerging markets. The Vanguard FTSE Social Index Fund tracks the FTSE4Good US Select Index that relies on a top-down approach to screen for large and mid-cap stocks of US companies based on environmental, social and governance criteria developed by FTSE Russell, a unit of the London Stock Exchange. Companies involved in the manufacturing and production of tobacco, weapons, coal as well as nuclear power generation and infant formula, based on an evaluation of specific indicators, are excluded.

This represents a hypothetical illustration that attempts to portray the application of a core/satellite approach to the construction of a sustainable equity-oriented portfolio that combines investments in index mutual funds and ETFs in a way that lessens exclusive reliance on ETFs. This hypothetical illustration does not take into consideration a particular risk profile or sustainability preferences. The illustration reflects the limitations imposed by available index mutual fund and ETF offerings and attempts to optimize fund sizes (over $50 million) and expense ratios. For this purpose, first quartile expense ratios are preferred but in some cases, these may not be available. Refer to Stratifying Expense Ratios: An Explanation.

[1] Source: Barron’s

[2] Source: Investment Company Institute

[3] Source: STEELE Mutual Fund Expert, Morningstar data as of August 31, 2017.

Research Note: ETFs Exposure to Vulnerabilities During Periods of Market Stress

This week on September 25, 2017 the Wall Street Journal (WSJ) reported that exchange-traded fund (ETF) investors were rebuffed in their legal action against BlackRock Inc. for omitting certain warnings in fund documents about what could go wrong with ETFs. The complaint against BlackRock was initiated by a group of investors who suffered losses due…

Share This Article:

Exchange-Traded Fund Investors Legal Action Rebuffed

This week on September 25, 2017 the Wall Street Journal (WSJ) reported that exchange-traded fund (ETF) investors were rebuffed in their legal action against BlackRock Inc. for omitting certain warnings in fund documents about what could go wrong with ETFs. The complaint against BlackRock was initiated by a group of investors who suffered losses due to price discrepancies that arose during the August 24, 2015 Flash Crash. Barring a reversal upon appeal, if one should be filed, this decision could limit investors’ ability in the future to bring action again ETF providers for leaving out or misrepresenting risks in fund registration statements. But the WSJ article also serves as a reminder to investors of the potential volatility and illiquidity that ETFs may experience during periods of market stress. It also suggests that investors should be cautious about their aggregate levels of exposure to ETFs and therefore, avoid investing their entire portfolio exclusively in these investment vehicles. Instead, diversified investors should consider allocating their investments across ETFs as well as low cost index mutual funds to avoid the prospect of having to liquidate under pressure at distressed prices. This approach also applies to sustainable investors and their investment portfolios aimed at achieving a positive societal outcome.

The Legal Complaint Against BlackRock

The complaint alleged that BlackRock and its affiliates represented to investors that ETFs “offer the same” trading liquidity as stocks while BlackRock knew from prior experiences in 2008 and 2010, according to the complaint, that ETF trading liquidity presented additional and different material risks from that of traditional stocks or mutual funds. As a result, the complaint noted that investors who sold ETF shares pursuant to market or stop-loss orders sold at prices far below the underlying NAV of their ETF portfolio. On Monday, August 24, 2015, investors in BlackRock’s iShares ETFs who placed market or protective stop-loss orders prior to or at the opening of the markets suffered disproportionate losses when 19.2% of all ETFs experienced price declines of more than 20%, compared to an average decline of only 4.7% in underlying corporate securities. Investors in Blackrock’s iShares ETFs suffered significant losses as a result. While not involved in the suit, early morning sellers also sustained losses.

August 24, 2015 Flash Crash

A significant advantage associated with ETFs over mutual funds, the ability to buy or sell ETF shares at any time during the trading day, especially under volatile conditions when markets can experience significant intraday movements, was tested on August 24th when a number of popular ETFs experienced outsized price declines during the first minutes of trading. In the opening minutes of trading, the S&P 500 index fell as much as 5.3% while some stock ETFs slid as much as 37%, according to published reports. Some market practitioners attributed this to overlapping and conflicting market rules and circuit breakers.

According to published reports, “at least dozens of stock ETFs saw their prices plunge far below the values of the indexes they’re designed to track, sowing confusion and potentially handing big losses to investors that attempted to unload positions into the falling market[1].” For example, the Vanguard Dividend Appreciation ETF (VIG) traded down by as much as 37% while at the same time the net asset value of the stocks in its index only fell as much as 7.2%, according to FactSet. The $66 billion iShares Core S&P 500 ETF (IVV) was down about 26% before bouncing back to close within fractions of a percentage point away from the underlying benchmark.

There isn’t any evidence to suggest that equally large divergences in the prices and NAVs were experienced by some of the largest sustainable ETFs. Still, extreme volatility events could be repeated again in the future, even in the light of procedural rule improvements that have been implemented by the exchanges since then, and as a consequence, some ETFs should not necessarily be relied upon for liquidity during times of market distress. It further supports the thesis that longer-term investors, especially diversified sustainable investors who are likely to be intermediate-to-long-term oriented, may wish to avoid relying exclusively on ETFs. Rather, they may wish to adopt a strategy of combining investments in ETFs along with mutual funds, provided there are available effectively priced index mutual fund direct equivalents or a sufficiently close approximation in terms of its investment strategy, i.e. underlying index, or theme.

Sustainable ETFs

There are 1,775 ETFs with net assets of $3,029.1 billion as of July 31, 2017[2]. Of these, just 53 are classified as sustainable ETFs on the basis of their objectives and strategies. These include U.S. and foreign developed and emerging market-oriented funds, or some combination, that invest in equities and fixed income securities that employ exclusionary practices, impact and thematic approaches, ESG integration and shareholder advocacy, or some combination of these strategies. Almost $6 billion is invested in these ETFs, which range in size from the smallest, the recently launched $2.6 million SerenityShares Impact ETF (ICAN) to the largest, the $865.8 million iShares MSCI KLD 400 Social ETF (DSI). The average ETF stands at $112.7 million in assets with a median value of $20.4 million[3]. In fact, 34 ETFs have less than $50 million in assets–generally considered to have achieved scale, adequate diversification and liquidity. All but four recently launched sustainable bond ETFs, or 49 funds, invest in equities.

Just focusing on the remaining top 19 ETFs with assets equal to or greater than $50 million, a segment that accounts for $5.5 billion or 92% of the sustainable universe, these funds fall into three broad equity investing categories: U.S. oriented funds that employ exclusionary practices, ESG integration and shareholder advocacy, similarly structured European oriented and emerging market funds as well as equity-oriented thematic investments including for example water, wind, solar, low carbon and gender diversity. When these offerings are juxtaposed against currently available and effectively priced index mutual fund counterparts, direct equivalents are not readily available. Refer to Table 1.

Implementing a Core and Satellite Portfolio Approach

For diversified equity oriented investors interested in structuring a sustainable investment portfolio that lessens their exclusive reliance on ETFs and instead combines both index mutual funds as well as ETFs, a core and satellite portfolio approach could be implemented, provided there is a willingness to substitute underlying indexes that can vary in substantive but more likely in a nuanced fashion. Under this approach, assuming a U.S. oriented investment strategy, the core holding would consist of a diversified ESG focused U.S. directed index mutual fund portfolio along with satellite funds, comprised of ETFs focused on the desired sustainability themes and/or foreign sustainable investing strategies.

To illustrate one such approach (Refer to Chart 1), a sustainable portfolio could be structured around the Vanguard FTSE Social Index Fund, an effectively priced mutual fund, serving as a core holding with various ETFs serving in satellite positions. These could include thematic investments and also provide exposures, if desired, to developed markets outside the U.S. as well as emerging markets. The Vanguard FTSE Social Index Fund tracks the FTSE4Good US Select Index that relies on a top-down approach to screen for large and mid-cap stocks of US companies based on environmental, social and governance criteria developed by FTSE Russell, a unit of the London Stock Exchange. Companies involved in the manufacturing and production of tobacco, weapons, coal as well as nuclear power generation and infant formula, based on an evaluation of specific indicators, are excluded.

This represents a hypothetical illustration that attempts to portray the application of a core/satellite approach to the construction of a sustainable equity-oriented portfolio that combines investments in index mutual funds and ETFs in a way that lessens exclusive reliance on ETFs. This hypothetical illustration does not take into consideration a particular risk profile or sustainability preferences. The illustration reflects the limitations imposed by available index mutual fund and ETF offerings and attempts to optimize fund sizes (over $50 million) and expense ratios. For this purpose, first quartile expense ratios are preferred but in some cases, these may not be available. Refer to Stratifying Expense Ratios: An Explanation.

[1] Source: Barron’s

[2] Source: Investment Company Institute

[3] Source: STEELE Mutual Fund Expert, Morningstar data as of August 31, 2017.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact