EU Green Bond Standard, if implemented, will raise the bar on standards and may increase cost of issuance

On June 18, 2019, the Technical Expert Group on Sustainable Finance (TEG) of the European Commission published its Report on EU Green Bond Standard. The report proposes that the Commission create a voluntary, non-legislative EU Green Bond Standard (EU-GBS) to enhance the effectiveness, transparency, comparability and credibility of the green bond market and to encourage market participants to issue and invest in European Union green bonds. The proposal, according to the EU, builds on best market practices and includes four elements that cover alignment with an EU-taxonomy that covers the allocation of bond proceeds, including compliance with minimum social safeguards, publication of a green bond framework, mandatory reporting and mandatory verification by an external reviewer that the EU recommends be formally accredited and supervised. The EU report was issued a few weeks prior to the end of the second quarter 2019 following which it was also disclosed that green bond issuance surpassed the $100 billion mark for 2019. At the same time green bond investment company offerings in the US are approaching $400 million. The EU proposal, if implemented, seems likely to increase the cost of issuance and also raise the bar for European firms as well as any US based firms issuing in Europe. This may further serve to limit green bond issuance globally and impede the achievement of scale required to transition to a low carbon economy. This article summarizes the Report on the EU Green Bond Standard and provides an update on US-based green bond investment company offerings.

Report on EU Green Bond Standard

This report builds on the interim report that was published on March 6. 2019. More than 100 organizations provided feedback on the interim report and the feedback received was generally positive, according to the EU. It is further noted that a large majority of the respondents supported the creation of a voluntary EU-GBS. The TEG has carefully studied the detailed feedback received from participating stakeholders and has created an improved version of the EU-GBS. This report is now presented in an updated form.

The TEG mandate has been extended until the end of this year. In terms of green bonds, during this extension period, the group will inter alia advise the Commission on the proposed link between the EU-GBS and the EU taxonomy , should any changes be needed due to the negotiations or the taxonomy call for feedback. The group will also work further on the design and suggested set-up of the proposed temporary, voluntary registration system of approved verifiers.

According to the TEG, it does not plan to organize an additional public call for feedback on the June EU Green Bond Standard report, as it is not proposing substantial changes compared to the interim report. The Commission will now study the report carefully. The next Commission will ultimately be in charge of deciding on how to take this proposal from the TEG forward.

Proposal for an EU Green Bond Standard

According to the TEG documentation, the EU Green Bond Standard, which builds on best market practices, would comprise four critical elements:

1. Alignment with EU-taxonomy: proceeds from EU Green Bonds should go to finance or refinance projects/activities that (a) contribute substantially to at least one of the six taxonomy Environmental Objectives, (b) do not significantly harm any of the other objectives and (c) comply with the minimum social safeguards. Where (d) technical screening criteria have been developed, financed projects or activities shall meet these criteria, allowing however for specific cases where these may not be directly applicable.

2. Publication of a Green Bond Framework, which confirms the voluntary alignment of green bonds issued with the EU GBS, explains how the issuer’s strategy aligns with the environmental objectives, and provides details on all key aspects of the proposed use-of-proceeds, processes and reporting of the green bonds.

3. Mandatory reporting on use of proceeds (allocation report) and on environmental impact (impact report).

4. Mandatory verification of the Green Bond Framework and final allocation report by an external reviewer.

Further, the TEG recommends that external verifiers be subjected to formal accreditation and supervision. The TEG believes that the most suitable European authority to design and operate such an accreditation regime for verifiers would be the European Securities and Markets Authority (ESMA). As this will take time, they recommend to set-up an interim registration process for external verifiers of green bonds, for a transition period of up to three years, in close cooperation with the EC.

The TEG is proposing six additional preliminary recommendations suggesting how the EC, EU Member State governments and market participants can support the uptake of the EU GBS through both demand and supply-side measures.

The standard would solve several barriers in the current market, including reducing uncertainty on what is green by linking it with taxonomy, standardizing verification and reporting processes, and having an official standard to which incentives could be attached.

Green Bonds Issuance Reaches $100 billion at June 2019

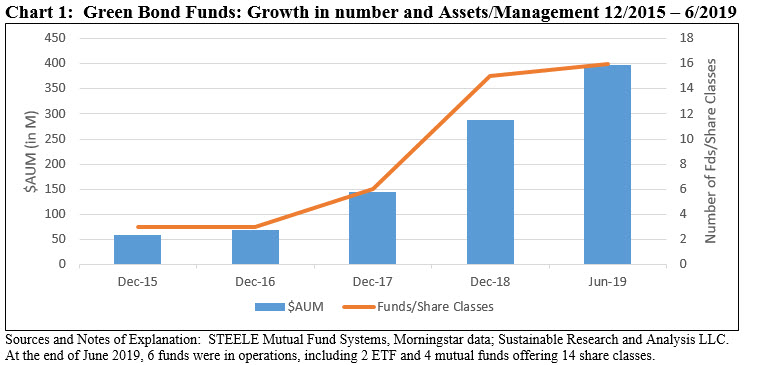

The EU report was issued about two weeks prior to the end of the second quarter 2019 following which it was also disclosed that green bond issuance surpassed the $100 billion mark for 2019, according to the Climate Bonds Initiative. This brought total issuance since inception to an estimated $624 billion with roughly one-half that number outstanding at this time. At the same time, green bond investment company offerings in the US are approaching $400 million. This rather small segment grew substantially in 2018 when assets ticked up by $142.5 million and also over the last six months due primarily to sourcing of institutional assets by the Calvert Green Bond Fund as well as new green bond offerings. Refer to Chart 1.

Update on US Green Bond Fund Investment Options

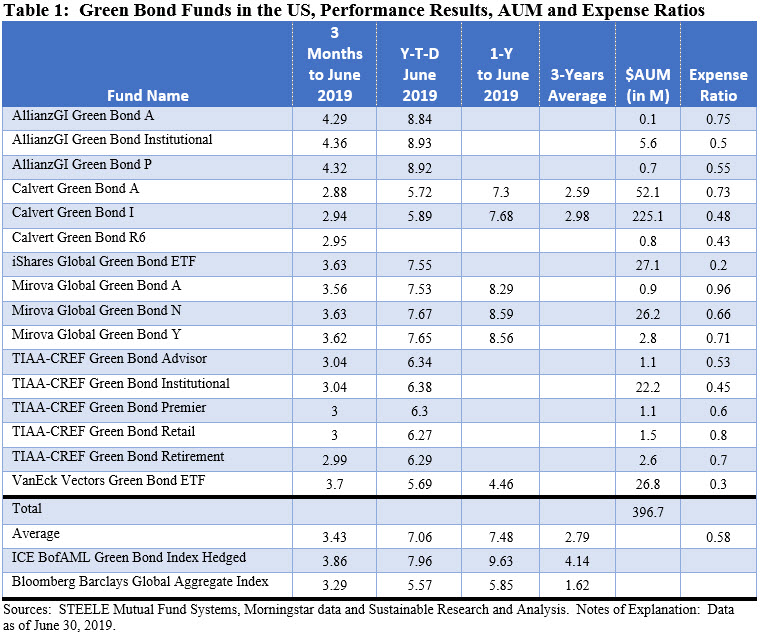

As previously reported in an article entitled New Green Bond Fund Investment Options Double in Number, investors interested in targeted green bond investing can invest directly in green bonds or broad-based sustainable investment funds, mutual funds as well as ETFs that invest in green bonds along with other securities. Investors in the US can also choose from one of six green bond funds, four bonds mutual funds offering 14 share classes and two ETFs. These are listed in Table 1 below along with their assets, most recent performance and expense ratios.

Observations:

• Investment mandate: While specific green bond selection criteria vary, each fund generally invests in bonds issued by both domestic and foreign issuers. These may include investment opportunities within and beyond the green bond universe that can also be subject to broader sustainable investing guidelines maintained by the investment management firm. For example, this is the case with the Calvert Green Bond Fund that also qualifies green bonds pursuant to Calvert’s Principles for Responsible Investment covering investment decisions and engagement efforts and also TIAA-CREF’s proprietary impact framework.

• Calvert’s Green Bond Fund, now consisting of three share classes, is the largest and oldest fund, launched in 2013. The other five currently available funds have been in operation only since 2017. At $278 million, the Calvert fund accounts for 70% of the combined assets of the six funds as of June 2019.

• Institutional investors represent at least $283.4 million, or 71.4% of green bond mutual funds net assets.

• Performance results. Except for the Calvert funds, the evaluation time intervals are limited as the funds have only been recently launched. The only funds/share classes with a 3-year track record are the Calvert Green Bond A shares and I shares. Each has consistently trailed the ICE BofAML Green Bond Index (Hedged) across 3-year and in time intervals. At the same time, each has consistently exceeded the performance of the conventional broad-based Bloomberg Barclays Global Aggregate Bond Index. Excepting the VanEck Vectors Green Bond ETF which has lagged, the same observation applies over the trailing 12-months and year-to-date to June 2019 time intervals with respect to the Mirova funds, iShares Global Green Bond ETF and TIAA-CREF Green Bond Fund, including all share classes.

• The average expense ratio for green mutual funds and ETFs is 0.58% (0.50% on an asset weighted basis) and 0.25%, respectively. The average expense ratio for green bond mutual funds is lower than the average expense ratio for fixed income sustainable long-term fixed income mutual funds that is 0.88% (average) and 0.67% on an asset weighted basis.

• Disclosure practices. As noted in previous research on this topic, unlike the underlying green bond issuers that may offer varying levels of disclosure as to environmental outcomes and impacts, portfolio level disclosures as to outcomes and impact across the six green bond funds is lacking. Based on disclosures made in annual and semi-annual reports, none of the existing green bond funds offer such information for the benefit of investors seeking to understand the impact of their investments. Corollary literature offered by these firms on their websites offer limited supplemental impact disclosures. Literature accompanying the Calvert Green Bond offers an impact scorecard that describes the allocation of portfolio assets but falls short of actually providing impacts data.