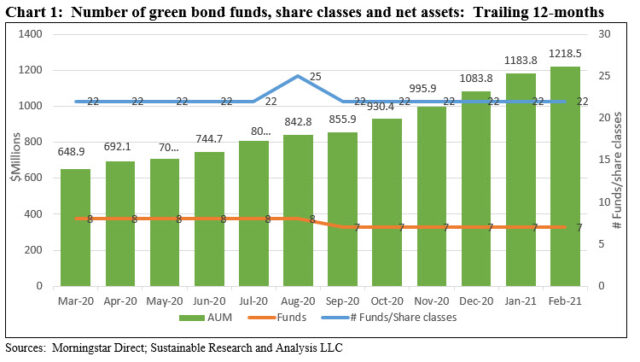

The Bottom Line: Green bond funds recorded another gain in assets under management to reach $1.2 billion on the back of negative returns in February.

Green bond fund assets post gains even as total return performance in February drops an average -1.30%

Green bond funds, including mutual funds and ETFs, recorded another gain in assets under management in February to reach $1.2 billion. Adding $34.6 million in net assets, green bond funds experienced a narrower gain in assets of 3% on the back of negative total returns in February. Green bond funds gave up an average -1.47% or -1.30% if the municipal bond-oriented Franklin Municipal Green Bond Fund is excluded from the computation. Intermediate investment-grade bonds got slammed in February, dropping -1.44%, as measured by the Bloomberg Barclays US Aggregate Bond Index. Green bonds, based on the ICE BofAML Green Bond Index (Hedged USD), posted an even lower -1.86% total return. According to preliminary data, about $87.6 billion in sustainable bonds, including green bonds, were issued in February worldwide, bringing the year-to-date totals to $172 billion. February was also marked by notable issuances of sustainable bonds in the US by Goldman Sachs and JP Morgan Chase & Co. as well as announcements of soon to be issued green sovereign bonds by the UK and Spain.

Green bond funds added $34.6 million and reached $1.2 billion at the end of February

For the eleventh consecutive month, green bond funds, including five mutual funds and two ETFs, gained assets to reach $1.2 billion at the end of February 2021. Refer to Chart 1. Adding $34.6 million in net assets, green bond funds experienced a narrow 3% gain, relative to last month’s $100 million increase or a 9% gain. All but one of the seven funds registered flat to positive net flows. The exception was the $188.5 million iShares Global Green Bond Fund that suffered a net withdrawal of $3.5 million. This was the ETF’s first month-over-month drawdown since it was launched in October 2018 (the fund has since recovered to reach $201.9 million by March 9). The Calvert Green Bond Fund led yet again, adding a net of $30.6 million that was largely attributable to institutional investors. VanEck Vectors Green Bond ETF followed with a net gain of $5.8 million.

On a combined basis, institutional shareholders continue to dominate the segment. Institutional investors, participating through institutional share classes and/or share classes that require a minimum investment of $1.0 million, account for a minimum of $811.7 million or 66.6% of green bond fund assets under management.

Green bond funds gave up an average -1.47% in February but 12-month return at 2.15%

The anticipation of strong economic growth on the back of stepped up vaccination efforts along with unprecedented fiscal and monetary stimulus fueled concerns about higher inflation that, in turn, led to rising yields. The 10-year Treasury gained 33 bps to end February at 1.44%–a level not observed since February of 2020. Against this backdrop, Green bond funds gave up an average -1.47% or -1.30% if the municipal bond-oriented Franklin Municipal Green Bond Fund is excluded from the computation[1]. At the same time, intermediate investment-grade bonds dropped -1.44%, as measured by the Bloomberg Barclays US Aggregate Bond Index. The benchmark experienced the worst monthly decline since November 2016. Green bonds, based on the ICE BofAML Green Bond Index (Hedged USD), posted an even lower -1.86% return in February. Refer to Table 1.

Individual green bond fund returns ranged from a high of -0.85% achieved by the PIMCO Climate Bond I-2 and Institutional share classes to a low of -1.85% registered by the globally- oriented iShares Global Green Bond ETF. The performance of municipal bonds, which ended the month behind corporates and government securities, pushed the Franklin Municipal Green Bond Fund C even lower to -2.28% versus a decline of -1.59% posted by the Bloomberg Barclays Municipal Total Return Bond Index.

The performance of green bond funds over the trailing three-months remains negative but exceeds benchmark performance both with and without the inclusion of the Franklin Municipal Green Bond Fund. The segment posted an average decline of -1.30% or -1.05% over the 3-month interval to February 28th and outperformed both the Bloomberg Barclays US Aggregate Bond Index and the ICE BofAML Green Bond Index (Hedged USD) with their returns of -2.02% and -20.1%, respectively.

Green bond funds turned in positive results over the trailing twelve months, with average total returns for the segment ranging from 2.15% to 2.24% and exceeding benchmark results in each case. For the three year interval, a limited number of three funds were continuously available.

Sustainable and green bond issuance reached a preliminary $87.6 billion

Based on preliminary data, about $87.6 billion in sustainable bonds, including green bonds, were issued in February worldwide. Sustainable bonds volume exceeded January’s $84.4 billion, including an uptick in green bonds that reached an estimated $32.5 billion as compared to $31.5 billion in January 2021 and $19.7 billion in February 2020 for a two-month total of $37.2 billion.

Two notable transactions in the US in February illustrates the expanding dimension of sustainable bonds. The first transaction, which settled on February 12th, was an $800 million sustainability bond issued by Goldman Sachs to accelerate climate transition and advance inclusive growth across nine core thematic areas that represent Goldman’s sustainable finance commitment: clean energy, sustainable transport, sustainable food and agriculture, waste and materials, ecosystem services, accessible and innovative healthcare, accessible and affordable education, financial inclusion, and communities.

The second was a $1 billion February 16th inaugural social bond issuance by JPMorgan Chase & Co. According to its announcement, JPMorgan may allocate an amount equal to the net proceeds of this issuance to activities that promote economic development by financing small businesses in low- and moderate-income geographies, affordable housing and projects that promote access to education and health care in low-and moderate-income geographies. JP Morgan expects the proceeds of this social bond issuance to be allocated to fund affordable housing projects.

Also in February, a number of sovereigns announced plans to issued green bonds. The UK Debt Management Office, the agency responsible for issuing UK sovereign debt, said it would sell at least £15bn (about $US17.94 billion) of green bonds this calendar year. The Debt Management Office said it would issue two inaugural “green gilts” in 2021, with the first to be issued in the summer. Also, the UK Treasury announced that it would launch its first sovereign green savings bonds, offering retail investors the chance to buy green debt through National Savings & Investments, the government-backed savings scheme.

The Spanish Treasury also announced plans to issue green bonds in the second half of 2021; and in a transaction that hit the market in early March, the Italian government made a splash by issuing a green bond and raising some €8.5bn (about $US10.2 billion) to be used to fund environmental projects.

[1] The Franklin Municipal Bond Fund invests in municipal securities whose interest is free from regular federal income taxes whereas the other six green bonds funds in the peer group invest in taxable securities.