The Bottom Line: Green bond fund investors experienced disappointing near-term returns, but intermediate-term outcomes continue to flash green, especially if accompanied by positive environmental outcomes.

Summary

Green bond funds invest in “green” bonds whose proceeds are used principally for climate mitigation, climate adaptation or other environmentally beneficial projects, such as, but not limited to, the development of clean, sustainable or renewable energy sources, commercial and industrial energy efficiency, or conservation of natural resources. The small universe of seven dedicated green bond funds, including green bond mutual funds and green bond ETFs, eked out a slight gain in net assets during the month of February. The universe of green bond funds will shortly drop to six funds due to the announced liquidation of the only Federal tax-exempt Franklin Municipal Green Bond Fund. Against a difficult investment backdrop in February, green bond funds posted an average decline of 1.61%. But results to-date continue to support the case for lower priced green bond funds over the intermediate-term, especially if accompanied by some evidence of positive environmental outcomes.

Green bond funds managed to eke out a slight gain in net assets even as six of seven funds experience net outflows

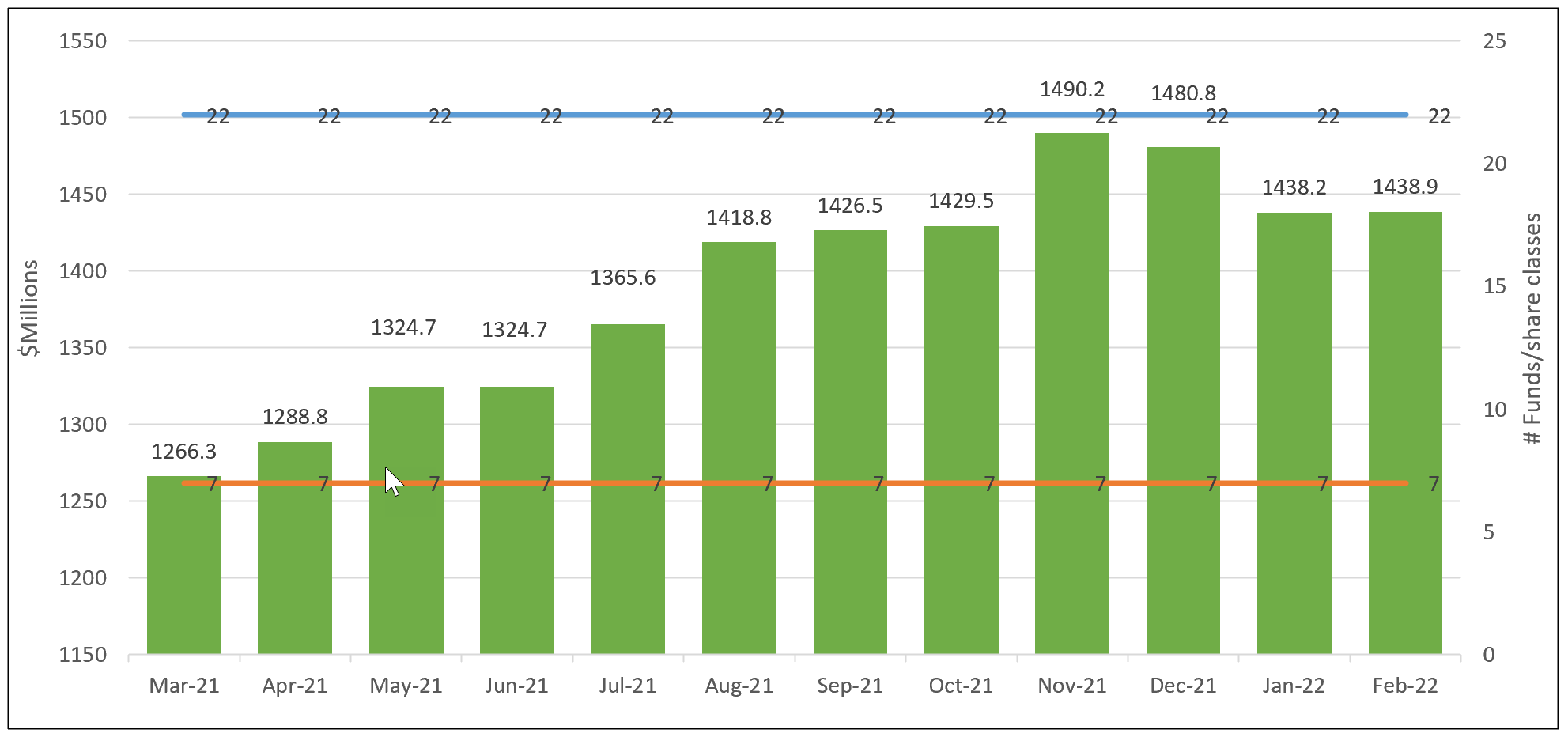

Green bond funds, including green mutual funds and green bond ETFs, managed to eke out a slight gain in net assets, adding $618,994 to end the second month of 2022 with $1,438,863,530. All but one fund reported a gain in net assets. This was the TIAA-CREF Green Bond Fund that recorded a sizable $19.6 million net gain. The fund benefited from a $19.5 million dollar net gain into its TIAA-CREF Green Bond Fund Institutional Share Class (TGRNX). Refer to Chart 1.

Otherwise, the remaining six funds in the segment sustained net outflows ranging from $10,384 attributable to the Franklin Municipal Green Bond Fund to $9.0 million sustained by the Calvert Green Bond Fund.

Since the start of the year, the net assets of green bond funds have declined by almost $42 million.

On February 28, 2022, Franklin Advisers announced that the Franklin Municipal Green Bond Fund will be liquidated on or about May 6, 2022, and that effective at the close of market on April 1, 2022, the fund will be closed to all new investors and new investments. Shareholders of the fund on the will have their shares redeemed in full and the proceeds will be delivered to them. At $10.5 million by the end of February, the fund, which was launched on October 1, 2019, did not gain much traction.

Chart 1: Green bond mutual funds and ETFs and assets under management – March 2021 – February 28, 2022

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Green bond funds experienced a third consecutive monthly decline, giving up an average of 1.61% in February

Equity and bond markets experienced a difficult month in February as concerns surrounding Russia’s invasion of Ukraine and its fallout eclipsed expectations regarding inflation, interest rate hikes and growth outlook. Against this backdrop, green bond funds posted an average decline of 1.61%, including the Franklin Municipal Green Bond Fund that invests in green bonds exempt from Federal income taxes. The average result for green bond funds is even lower in February, at -1.83%, if the Franklin Municipal Green Bond Fund and its various share classes are excluded. This compares to the Bloomberg US Aggregate Bond Index, gave up 1.12% and the Bloomberg Global Aggregate Bond Index that dropped 1.19%. At the same time, the ICE BofAML Green Bond Hedged US Index sustained a decline of 2.44%. Refer to Table 1.

For green bond fund investors seeking to at least match the results of domestic or global investment grade intermediate bonds, the results were disappointing. Green bond funds posted total returns that ranged from -0.52% registered by the Franklin Municipal Green Bond A (FGBKX) to -2.81% recorded by the Mirova Global Green Bond Y (MGGYX). Excluding Franklin, the top results by taxable funds were delivered by the TIAA-CREF Green Bond Fund Advisor (TGRKX) and Institutional (TGRNX), each posting a return of -1.34%. Three-month returns were also generally disappointing.

With one exception due to a higher-than-average expense ratio, one-year trailing results to February were more comforting for green bonds investors. Posting an average return of -3.05%, green bond funds invested in global bonds denominated in US dollars outperformed the Bloomberg Global Aggregate Bond Index. This also applies over the trailing 3-year and 5-year time horizons for share classes with lower expense ratios. These results continue to support the case for lower priced green bond funds over the intermediate term, especially if accompanied by some evidence of positive environmental outcomes.

Table 1: Green bond funds: Expense ratios, assets and performance results to February 28, 2022

Fund Name | Symbol | February 2022 TR (%) | 3- Months TR (%) | 12-Months TR (%) | 3-Years TR (%) | 5-Years TR (%) | Expense Ratio (%) | AUM ($ millions) |

Calvert Green Bond A* | CGAFX | -1.74 | -3.81 | -4.05 | 2.63 | 2.24 | 0.73 | 85.1 |

Calvert Green Bond I* | CGBIX | -1.72 | -3.75 | -3.8 | 2.86 | 2.54 | 0.48 | 827.3 |

Calvert Green Bond R6* | CBGRX | -1.71 | -3.74 | -3.75 | 2.94 | 0.43 | 12.8 | |

Franklin Municipal Green Bond A** | FGBGX | -0.52 | -3.21 | -0.55 | 0.71 | 1.5 | ||

Franklin Municipal Green Bond Adv** | FGBKX | -0.6 | -3.15 | -0.38 | 0.46 | 8.8 | ||

Franklin Municipal Green Bond C** | FGBHX | -0.65 | -3.4 | -0.82 | 1.11 | 0.2 | ||

Franklin Municipal Green Bond R6** | FGBJX | -0.6 | -3.15 | -0.34 | 0.44 | 0 | ||

Mirova Global Green Bond A* | MGGAX | -2.34 | -5.04 | -4.27 | 2.35 | 0.2 | 262 | |

Mirova Global Green Bond N* | MGGNX | -2.81 | -5.57 | -5.41 | 2.21 | 2.1 | 0.93 | 6.5 |

Mirova Global Green Bond Y* | MGGYX | -2.71 | -5.47 | -5.11 | 2.51 | 2.42 | 0.63 | 7.3 |

PIMCO Climate Bond A* | PCEBX | -2.81 | -5.58 | -5.26 | 2.47 | 2.35 | 0.68 | 31 |

PIMCO Climate Bond C* | PCECX | -1.77 | -3.53 | -3.35 | 0.94 | 0.9 | ||

PIMCO Climate Bond I-2* | PCEPX | -1.83 | -3.71 | -4.08 | 1.69 | 0 | ||

PIMCO Climate Bond I-3* | PCEWX | -1.75 | -3.46 | -3.06 | 0.64 | 0.6 | ||

PIMCO Climate Bond Institutional* | PCEIX | -1.75 | -3.47 | -3.11 | 0.69 | 0.1 | ||

TIAA-CREF Green Bond Advisor* | TGRKX | -1.74 | -3.44 | -2.97 | 0.54 | 17.3 | ||

TIAA-CREF Green Bond Institutional* | TGRNX | -1.34 | -3.53 | -2.41 | 3.79 | 0.55 | 3.5 | |

TIAA-CREF Green Bond Premier* | TGRLX | -1.34 | -3.52 | -2.39 | 3.81 | 0.45 | 48.6 | |

TIAA-CREF Green Bond Retail* | TGROX | -1.35 | -3.56 | -2.52 | 3.67 | 0.6 | 1 | |

TIAA-CREF Green Bond Retirement* | TGRMX | -1.37 | -3.59 | -2.66 | 3.53 | 0.78 | 7.3 | |

iShares Global Green Bond ETF*^ | BGRN | -1.35 | -3.56 | -2.52 | 3.67 | 0.7 | 15.8 | |

GRNB | -1.57 | -3.93 | -4.25 | 1.95 | 0.2 | 101.3 | ||

Average/Total | -1.61 | -3.87 | -3.05 | 2.95 | 2.33 |

| 1,438.9 | |

Bloomberg US Aggregate Bond Index | -1.12 | -3.49 | -2.64 | 3.3 | 2.71 | |||

Bloomberg Global Aggregate Bond Index | -1.19 | -3.35 | -5.32 | 2.15 | 2.36 | |||

Bloomberg Municipal Total Return Index | -0.36 | -2.93 | -0.66 | 3.19 | 3.24 | |||

S&P Green Bond US Dollar Select IX | -2.44 | -4.99 | -4.06 | 2.67 | 2.92 | |||

ICE BofAML Green Bond Index Hedged US Index | -0.36 | -2.93 | -0.66 | 3.19 | 3.24 |

Notes of Explanation: Blank cells=NA. 3-year annualized average performance results to January 2022. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ^Effective March 1, 2022 fund will shift to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC