Sustainable Bottom Line: Focused sustainable mutual funds and ETFs remain a niche segment, constrained by limited scale, the lack of standardization and uneven investor adoption.

By most measures, the focused sustainable funds market segment qualifies as a niche product offering

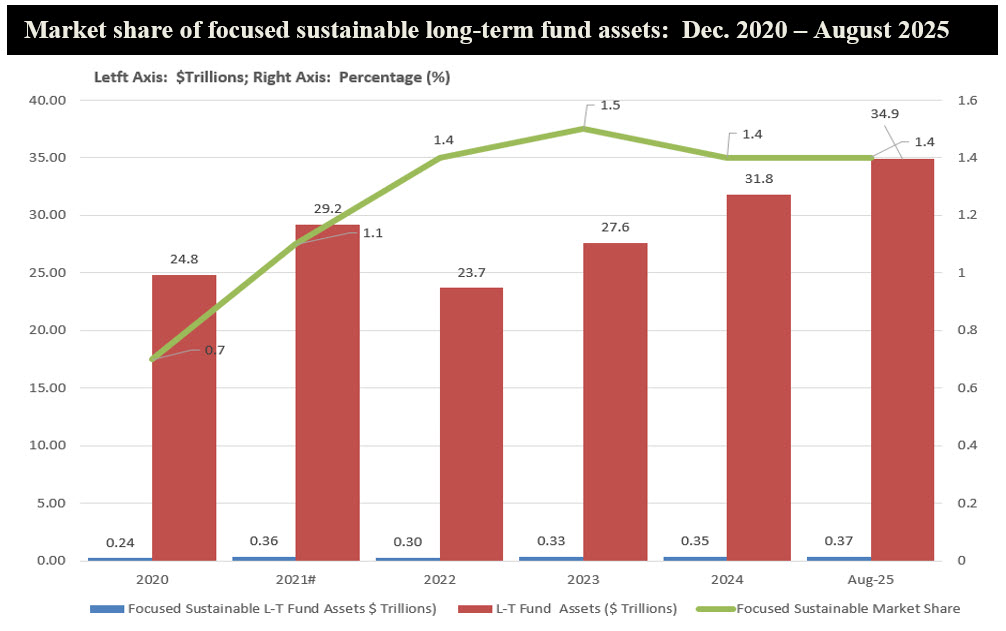

As of August 31, 2025, focused sustainable long-term mutual funds and ETFs—those that explicitly incorporate ESG factors pursuant to a sustainable investing approach (1)—held $367.7 billion, or about 1 percent of the $34.9 trillion invested in U.S. long-term funds and ETFs. By most measures, that places the segment firmly within niche territory, but this isn’t the only deciding factor.

Surveys suggest the sustainable investing market will continue to grow. Yet this expansion may not significantly lift mutual fund and ETF assets, especially without the benefit of standardized terminology, classifications and disclosure rules. Meanwhile, sustainable investing practices, particularly ESG integration linked to financially material considerations, have gained traction among asset owners and investment managers across their investing platforms and separate account management, now extending to an estimated $6.5 trillion in U.S. assets under management (2).

Notes of Explanation: Funds reflect combined assets of mutual funds and ETFs. #Data for 2021 is as of November 30, 2021, otherwise as of year-end, except for data as of August 2025. Sources: ICI.org, Morningstar and Sustainable Research and Analysis LLC.

Focused sustainable funds have not achieved mainstream penetration

Focused sustainable funds have not achieved mainstream penetration despite high public awareness and extensive product launches, especially until mid-2023, but there have been reversals following the 2022 markets drop and intensification of political pushback against ESG. Long-term assets under management, as measured by Morningstar (3), ranged between almost $300 billion at the beginning of 2023 to nearly $368 billion as of August 2025, largely reflecting market appreciation after recovering from declines in 2022 (4). The number of fund/share class offerings has dropped by over 100, or about 8%, since the end of 2022. At the same time, the number of managers offering focused sustainable funds shrank from 154 to 121 firms by September 2025.

Assets are highly concentrated, with the top ten firms, including BlackRock, Vanguard, Calvert, Parnassus, Nuveen and five others, controlling roughly 70% of the market. Product breadth remains uneven, with offerings clustered in U.S. large-cap growth equity, intermediate core bonds and global large-cap stock categories while the small-cap sector and high yield bonds, for example, remain thinly represented. Average fund size, at about $573 million, is well below the industry’s $2.2 billion average, or almost 4X as large, and net flows have been flat to negative after several years of expansion.

Uptake has been constrained due to several factors

This structural concentration is mirrored in investor behavior. Sustainable funds are most often employed by values-driven institutions, younger retail investors, and mission-aligned advisors, while broad retirement and brokerage channels have been slower to adopt them. Regulatory uncertainty and ongoing debates over ESG terminology, fund classifications and disclosure rules have further constrained uptake. It may also be the case that instead of constructing a diversified portfolio consisting entirely of sustainable funds, investors are choosing to express their sustainability preferences by integrating into conventional portfolios one or a limited number of focused sustainable mutual funds and ETFs. In the end, a portfolio fully aligned with an investor’s sustainability preferences may require the acceptance of trade-offs—such as narrower diversification or tracking-error risks—that could detract from achieving market-based rates of return. While investors may be ready to seek positive environmental and social outcomes with their investments, subject to stepped up disclosures, they may not be prepared to do so at the expense of sacrificing market-based financial outcomes.

Even so, the sustainable investing category continues to evolve. While some funds are still liquidating or merging, innovations around climate-transition, autonomous-vehicle, and impact-oriented themes are broadening the universe. Widespread acceptance of terminology, standardized classifications and disclosure rules may eventually increase confidence and comparability. For now, sustainable funds remain a distinct and specialized corner of the U.S. investment landscape—large enough to be visible, yet small enough to qualify as a niche.

Sustainable investing approaches have been incorporated into investment strategies by a growing number of asset owners and investors in the U.S.

That said, various sustainable investing approaches have been incorporated into investment strategies by a growing number of asset owners and investors in the U.S. Approaches, such as ESG integration, screening and exclusions, impact investing, engagement, and proxy voting are applied in separate account portfolios, allowing asset owners to align investments with more targeted sustainability preferences. Even more importantly, investment managers, according to an increasing number of published stewardship reports, now consider, as a base line, financially relevant environmental, social, and governance assessments in their evaluation of risk exposures and in the process of identifying potential investment opportunities related to climate transition and social considerations.

When viewed through a wider lens that includes separate accounts and institutional strategies, sustainable investing spans roughly $6.5 trillion, or about 12 percent of the U.S. professionally managed market—approximately $52.5 trillion in total.

Endnotes:

(1) In the U.S., there is no single formal definition, regulatory or otherwise of “sustainable investing” that all firms use. However, among practitioners, a widely accepted definition refers to sustainable investing as an investment approach that considers environmental, social and governance (ESG) factors alongside financial returns in investment decision making. Investment approaches can vary widely and include: (a) Values-based investing. Also referred to as faith-based investing, socially responsible investing, responsible investing, ethical investing or investing based on a set of morals, the guiding principle is that investments are based on a set of beliefs with a view to achieving a positive societal outcome. Typically, this approach is implemented via negative ESG screening or exclusions. (b) ESG screening or exclusionary strategies. This involves an emphasis on positive or negative scoring pursuant to which stocks or bonds may be overweighted or underweighted in portfolios based on their ESG scores or excluded in their entirety. In such cases, companies or certain sectors or industries are excluded as eligible securities from portfolios based on specific ethical, religious, social or environmental guidelines or preferences. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling and sex related activities, the production or manufacturing of alcohol, tobacco or firearms, or even atomic energy. These exclusionary categories have been extended in recent years to incorporate additional considerations, for example, firms that are the subject of serious labor-related actions or penalties by regulatory agencies or demonstrate a pattern of employing forced, compulsory or child labor, or firms that exhibit a pattern and practice of human rights violations or are directly complicit in human rights violations committed by governments or security forces, including those that are under US or international sanctions for grave human rights abuses, such as genocide and forced labor. Closely related is the strategy of divestiture or divestment. (c) Impact investing. Still a relatively small but growing slice of the sustainable investing segment, impact investments are incremental (additional) moneys directed to companies, organizations, and funds with the intention to achieve measurable social and environmental impacts alongside a financial return. Impact investments can be implemented in both emerging and developed markets and made across asset classes, such as equities, fixed income, venture capital, and private equity. In each instance, the objective is to direct capital to address challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services, including housing, healthcare, and education. Historically, impact investments have targeted a range of returns from below market to market rate, depending on the investors’ strategic goals. But increasingly, impact investing strategies are expected to at least achieve risk-adjusted market rates of return. (d) Thematic investing. An investment approach with a focus on a particular idea or unifying concept, for example securities or funds that invest in solar energy, wind energy, clean energy, clean tech and even gender diversity, to mention just a few of the leading sustainable investing fund themes. Investing in low carbon emitting stocks and bonds or green bonds or funds also fall into the thematic investing category. (e) ESG integration. This is a widely practiced investment strategy by which environmental, social and governance factors and risks are systematically analyzed and, when these are deemed relevant and financially material to an entity’s performance, they will influence decisions on whether to buy or hold a security, and to what extent. Such considerations may lead to the liquidation of security from the portfolio but at the same time, these factors may also identify investment opportunities. (f) Shareholder advocacy, issuer engagement and proxy voting. These strategies, which leverage the power of stock ownership in publicly listed companies and, regarding engagement, the power of bond investments, are action-oriented approaches that rely on learning about each company’s ESG practices and related risks and opportunities. These strategies may also extend to influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting.

(2) Source: US SIF 2024 edition of US Sustainable Investing Trends Report, December 2024.

(3) Morningstar’s universe of sustainable funds consists of funds whose official documents indicate a focus on sustainability, impact investing, or environmental, social, and governance (ESG) factors, and it uses binding ESG criteria for investment selection. Funds that only use limited exclusions or non-binding ESG considerations are not categorized as sustainable by Morningstar. It should be noted that Morningstar’s definition of a sustainable fund may be widely used but is not universally embraced. That said, the definition is transparent and its adaptation in the context of SRA Fund Quality Ratings facilitates the assignment of such ratings based on Morningstar’s investment categorization.

(4) ICI.org, which has adopted a broader definition of funds that invest according to ESG criteria that classifies funds into four categories, including Broad ESG Focus, Environmental Focus, Religious Value Focus and Other Focus, reports that combined long-term assets of mutual funds and ETFs as of August 2025 stood at $605.2 billion. According to ICI.org, assets ranged between $462 billion at the end of 2022 to $570 billion at the end of 2024. During that interval, funds experienced net outflows in 2023 and 2024.