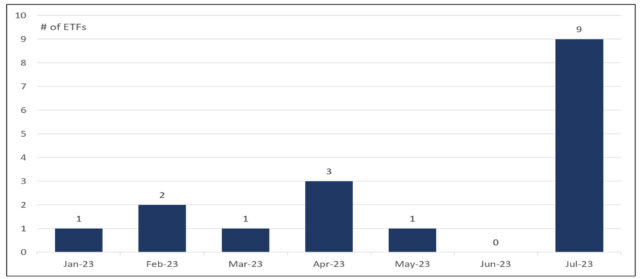

The bottom line: ETF closures spiked in July, serving as a reminder that small-sized funds can potentially expose investors to the risk of untimely liquidation.

Monthly sustainable ETF closures: January 2023 – July 2023 Sources: Morningstar Direct and Sustainable Research and Analysis.

Sources: Morningstar Direct and Sustainable Research and Analysis.

Observations:

- Sustainable ETF closures spiked up in July, reaching nine ETF closures versusan average of 1.3 closures in each of the previous six months in 2023. By way of further comparison, there were nine sustainable ETF fund closures in all of 2022.

- The July spike is, in part, due to the closure of five actively managed equity-oriented sustainable ETFs managed by Emerge Capital Management Inc., a small Buffalo, NY-based advisory and consulting firm, and sub-advised by Catherine Avery Investment Management LLC. The five funds, launched September 8, 2022 and offered at 95 basis points, didn’t manage to gain traction beyond their likely seed capital and closed within a year of launch. The funds ranged in size from about $519,000 to $536,000 prior to closing and were far from reaching break-even, which can usually be achieved at levels of around $30 to $35 million in assets under management based on a rough estimate.

- Most of the other ETF closures in 2023 involved funds averaging between $2.1 million in assets under management to a high of $6.3 million. Exceptions occurred in April when three State Street Global Advisors’ Bloomberg SASB tracking index funds were liquidated. Net assets prior to the liquidation of these three funds ranged from about $13 million to $23 million.

- There were 110 listed sustainable ETFs with less than $30 million in assets under management, or 44% of the 249 sustainable ETFs listed at the end of July.

- July’s spike in fund closures serves as a reminder to investors in smaller-sized funds that such investments should be monitored even more closely to avoid, if possible, having their shares liquidated at potentially disadvantageous prices due to fund closures.