The Bottom Line: Green bond fund investors largely stay the course through July of this year, earning an average 3.1% year-to-date and 0.49% in July.

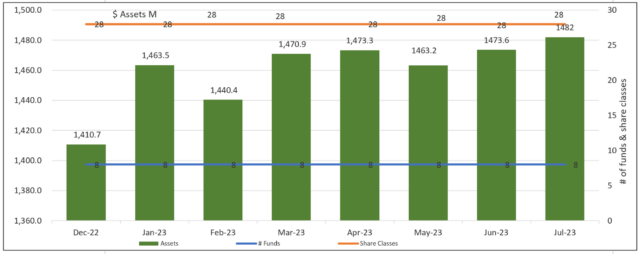

Green bond funds total net assets: December 2022 – July 2023 Notes of Explanation:

Notes of Explanation:

Sources: Morningstar and Sustainable Research and Analysis LLC

Observations:

- Following the pause in June, the Fed voted to raise the federal funds rate by 25 bps at the July FOMC meeting, pushing the top end of the target range to 5.50%. 10yr Treasury yields rose 16 bps to 3.97% in July and 2yr yields fell 2 bps, steepening the curve. The Bloomberg US Aggregate Bond Index declined by a modest 0.07% in July while single A corporate bonds achieved a gain of 27 basis points.

- Against this backdrop, green bond mutual funds and ETFs posted an average gain of 0.49%, benefiting from their shorter average five-year maturity and single A to BBB credit quality profile. Returns in July ranged from a high of 85 basis points recorded by the PIMCO Climate Bond Fund Institutional shares to a low of 1 basis point posted by the TIAA-CREF Green Bond Fund Advisor shares.

- Year-to-date results were a positive 3.1%, not yet erasing their average 13% decline in 2022.

- Still, investors have largely stayed the course. The universe of eight green bond funds/28 share classes added $8.4 million in net assets during July and $71.3 million year-to-date. While declines were experienced in February and May of this year, net assets expanded, supported by a large $52.8 million gain in January, reaching a new 2023 month end high of $1.5 billion in July.

- The three largest funds, accounting for $1.3 billion of the segment’s net assts, or 87%, provided the 92% of the assets gains in July. Gains were recorded by the iShares USD Green Bond ETF and TIAA-CREF Green Bond Fund, adding $7 million and $1.2 million, respectively, while the Calvert Green Bond Fund gave up $0.5 million.

![COW-8-14-2023[1] Energy export, energy prices increase concept with energy prices graphs, high voltage towers and finance and economy graph](https://sustainableinvest.com/wp-content/uploads/elementor/thumbs/COW-8-14-20231-qyx7jl9wh9xdak8q4bgh4rdjkj9rb0czyp5sai3iy4.jpg)