The Bottom Line: Favorable green bond fund results tend to converge around selected funds that are managed effectively and are offered at low-to-lower expense ratios.

October Summary

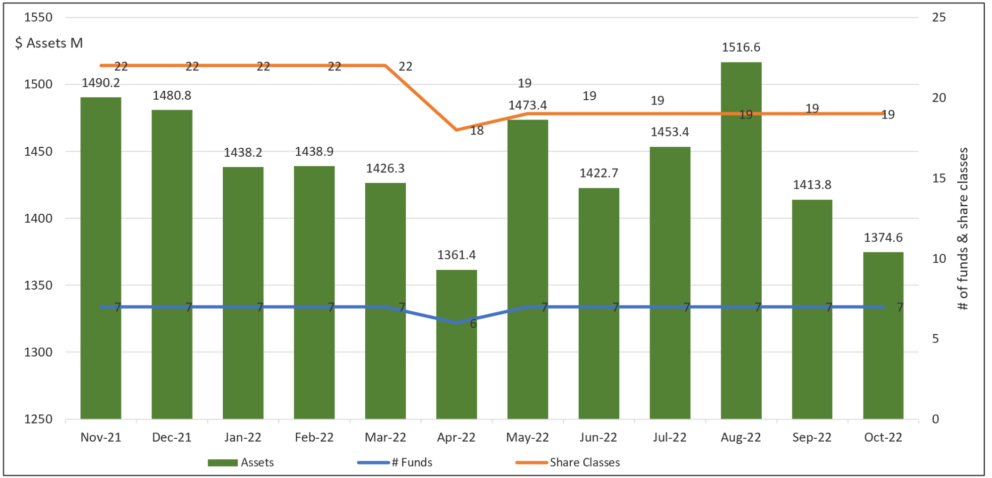

- The small segment of thematic green bond funds, consisting of four mutual funds and three ETFs that offer investors exposure to environmental projects and investments while seeking market-based returns, was subjected to net withdrawals for the second consecutive month as assets under management declined by $39.2 million to end October 31, 2022 with $1,374.6 million in net assets. This left the segment with the lowest level of assets under management since April 2022 when assets dropped to $1,361.4 million. Refer to Chart 1. Net outflows are estimated at $10 million.

- Much of the decline in October is attributable to the Calvert Green Bond Fund I shares (CGBIX) that sustained a net drop of $35.7 million in assets. The same fund also gave up $77 million in September, almost entirely linked to the institutional oriented Calvert Green Bond I shares.

- Further reinforcement that the Fed’s tighter interest rate policy remains a priority for as long as inflation persists at unacceptably high levels translated into an extension of the bond market’s historic downward slide through the end of October. Unlike equities that gained 8.1% in October, according to the S&P 500 Index, intermediate-term investment grade bonds gave up 1.3% per the Bloomberg US Aggregate Bond Index. The same benchmark is down 15.7% on a year-to-date basis. Against this backdrop, taxable green bond funds managed to narrow their declines in October, giving up an average 0.51% versus a drop of 4.05% in September, computed on a comparable basis. Including the municipal Franklin Green Municipal Bond Fund (FLMB), -1.05% in October, shifts the average results slightly lower to -0.53%. Returns ranged from a low of -1.2% posted by the iShares USD Green Bond ETF (BGRN) to a positive 0.37% recorded by the Mirova Global Green Bond Fund A, N and Y shares (MGGAX, MGGNX, MGGYX). Average 3-month, year-to-date and trailing 12-month results were -7.32%, -15.63% and -15.64%. Refer to Table 1.

- Both short and intermediate-term favorable green bond fund results converge around selected funds that are offered at low-to-lower expense ratios, funds that avoid currency exposure or have exhibited effective management skills, including currency hedging in cases where foreign currency exposure is taken. Fund size may also be a factor.

- While clear results covering sustainable and green bonds issuance in October are not yet available, based on September’s volume it was established that year-to-date issuance of green bonds reached as high as an estimated $395.8 billion according to Bloomberg. This represents a drop of 11% drop compared to last year over the same period. At the same time, global sales of social, sustainability and sustainability-linked debt also declined in September. It is therefore not surprising that with only three months remaining, both Moody’s Investors and S&P Global Ratings lowered their forecasts for 2022 global issuance of green, social, sustainability and sustainability-linked bonds. Influencing the results are deteriorating credit conditions and weaker issuance trends for the global bond markets. Moody’s had projected 2022 bond volumes to hit $1.35 trillion but lowered its full-year forecast for global sustainable bond issuance in October to around $900 billion. S&P took a similar action, lowering its forecast from $1.5 trillion to $865 billion. Based on S&P reporting, this would represent a 16% decrease from actual 2021 issuance of $1.0 trillion in 2021.

- A more upbeat assessment regarding green bonds was offered by a Climate Bond Initiative investor survey conducted on October 28th in London. According to the survey, investors expect global green bond investment to double and reach $1 trillion for the first time in a single year by the end of 2022. COP 27 may produce a bump in green bond issuance, but it remains to be seen whether $1+ trillion will be reached this year.

- A noteworthy transaction-oriented development in October was the Republic of Uruguay issuance of a $1.5 billion 5.75% sustainability-linked bond due 2034. The bond includes a first-time coupon step-down feature in the event that Uruguay overperforms its pre-defined environmental targets by a certain threshold. The targets contemplated by Uruguay’s bonds include achieving a reduction in aggregate greenhouse gas emissions, expressed in CO2 equivalent per real GDP unit, by 2025 compared to 1990 and maintaining or increasing the native forest area covering Uruguay’s territory by 2025 as compared to 2012. Closed on October 28, 2022, the offering was the first sustainability-linked bond issued by Uruguay and the second ever by a sovereign. The first was a $2 billion sustainability-bond issued by Chile in March of this year.

Chart 1: Green bond mutual funds and ETFs and assets under management – November 2021 – October 31, 2022 Notes of Explanation: Franklin Municipal Green Blond Fund and tis four share classes with total net assets of $9.7 million included in the data. At the same time, the rebranded Franklin Liberty Federal Tax-Free Bond ETF renamed the Franklin Municipal Green Bond ETF is excluded as of April 29, 2022. Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Franklin Municipal Green Blond Fund and tis four share classes with total net assets of $9.7 million included in the data. At the same time, the rebranded Franklin Liberty Federal Tax-Free Bond ETF renamed the Franklin Municipal Green Bond ETF is excluded as of April 29, 2022. Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Table 1: Green bond funds: Performance results, expense ratios and AUM-Oct. 31, 2022

Name |

Symbol | 1-Month Return (%) | 3-Month Return (%) | 12-Month Return (%) | 3-Year Average Return (%) | 5-Year Average Return (%) | Expense Ratio (%) | Net Assets ($M) |

Calvert Green Bond A* | CGAFX | -0.48 | -6.71 | -14.7 | -3.71 | -0.55 | 0.73 | 69 |

Calvert Green Bond I* | CGBIX | -0.46 | -6.58 | -14.46 | -3.46 | -0.27 | 0.48 | 624.6 |

Calvert Green Bond R6* | CBGRX | -0.46 | -6.56 | -14.41 | -3.41 | 0.43 | 37.4 | |

Franklin Municipal Green Bond ETF@ | FLMB | -1.05 | -8.58 | 0.3 | 100.6 | |||

iShares USD Green Bond ETF^ | BGRN | -1.2 | -7.06 | -15.69 | -4.6 | 0.2 | 279.9 | |

Mirova Global Green Bond A* | MGGAX | 0.37 | -8.39 | -18.19 | -5.35 | -1.29 | 0.94 | 5.5 |

Mirova Global Green Bond N* | MGGNX | 0.37 | -8.35 | -17.99 | -5.07 | -1 | 0.64 | 4.9 |

Mirova Global Green Bond Y* | MGGYX | 0.37 | -8.36 | -17.94 | -5.11 | -1.03 | 0.69 | 28.3 |

PIMCO Climate Bond A* | PCEBX | -0.28 | -7.4 | -15.23 | 0.91 | 0.8 | ||

PIMCO Climate Bond C* | PCECX | -0.34 | -7.59 | -15.87 | 1.66 | 0 | ||

PIMCO Climate Bond I-2* | PCEPX | -0.26 | -7.33 | -14.97 | 0.61 | 0.5 | ||

PIMCO Climate Bond I-3* | PCEWX | -0.26 | -7.35 | -15.01 | 0.66 | 0.1 | ||

PIMCO Climate Bond Institutional* | PCEIX | -0.25 | -7.31 | -14.88 | 0.51 | 10.8 | ||

TIAA-CREF Green Bond Advisor* | TGRKX | -1.05 | -6.99 | -15.27 | -3.01 | 0.6 | 43.4 | |

TIAA-CREF Green Bond Institutional* | TGRNX | -1.04 | -6.97 | -15.23 | -2.99 | 0.45 | 69.7 | |

TIAA-CREF Green Bond Premier* | TGRLX | -1.06 | -7.01 | -15.36 | -3.11 | 0.6 | 0.9 | |

T TIAA-CREF Green Bond retail* | TGROX | -1.07 | -7.04 | -15.48 | -3.26 | 0.8 | 6.8 | |

TIAA-CREF Green Bond Retirement* | TGRMX | -1.06 | -7.01 | -15.37 | -3.12 | 0.7 | 13.3 | |

GRNB | -0.95 | -6.56 | -15.06 | -3.65 | -1.64 | 0.2 | 78.1 | |

Average/Total+ | -0.51 | -7.25 | -15.62 | -3.83 | -0.96 | 0.64 | 1374.6 | |

Bloomberg US Aggregate Bond Index | -1.3 | -8.23 | -15.68 | -3.77 | -0.54 | |||

Bloomberg Global Aggregate Bond Index | -0.69 | -10.13 | -16.45 | -2.18 | 1.83 | |||

Bloomberg Municipal Total Return Index | -0.83 | -6.73 | -11.98 | -2.18 | 0.37 | |||

S&P Green Bond US Dollar Select IX | -1.03 | -6.64 | -15.28 | -3.43 | -0.4 | |||

ICE BofAML Green Bond Index Hedged US Index | -0.11 | -8.70 | -17.47 | -5.11 | -0.69 |

Notes of Explanation: Blank cells=NA. 3 and 5-year returns are average annual total returns. +Average returns apply to taxable funds only and excludes Franklin Municipal Green Bond ETF. If Franklin is included, results are -0.53% in October and -7.32% over the trailing 3-months. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. @Fund rebranded as of May 3, 2022. ^Effective March 1, 2022, fund shifted to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC