The Bottom Line: Green bond funds posted a negative -0.38% average total return in August but added $35.6 million to end August at $842.8 million.

August green bond funds summary

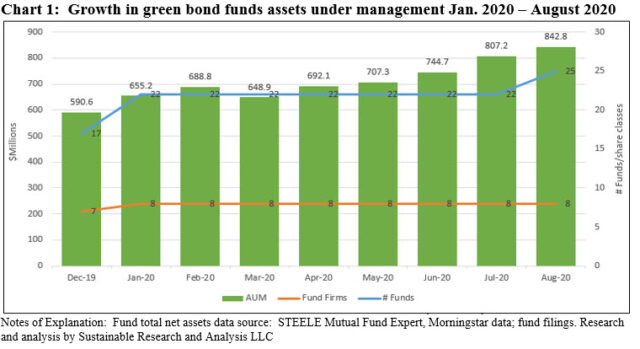

Against a backdrop of rising long-term Treasury yields throughout August, green bond funds, including mutual funds and ETFs, posted a negative -0.38% average total rate of return and beat out the -0.81% recorded by the Bloomberg Barclays US Aggregate Bond Index and -0.49% registered by a narrower-based green bond index. At the same time, the eight corporate and municipal green bond funds ended August at $842.8 million, benefiting from positive cash inflows that added $35.6 million in net assets. Refer to Chart 1. Up from $807.2 million last month, the funds continue on track to equal or exceed $1 billion on or prior to year-end even in the light of the announced liquidation and dissolution of the $29.9 million Allianz Green Bond Fund. Green bond issuance reached $13.2 billion in August[1], down from $20 billion the prior month. That said, there is a strong pipeline of green bond issuance going into September 2020, including several sovereign issuers.

Green bond funds experienced positive inflows in the amount of $38.6 million

Green bond funds attracted an estimated $38.6 million in positive flows that were largely directed to three green bond funds. The Calvert Green Bond Fund added a net of $25.7 million in assets sourced almost entirely to institutional investors. The iShares Global Green Bond ETF and the VanEck Vectors Green Bond ETF added $4.9 million and $2.5 million, respectively.

The eight funds are inching closer to reaching $1.0 billion in net assets, however, the announced liquidation and dissolution of the AllianzGI Green Bond Fund on or about September 28, 2020 will drain $29.9 from the segment. The fund, likely seeded by Allianz Global Investors, has not been able to gain traction and the move seems linked to a strategic partnership between Allianz and Virtus Investment Partners, Inc. intended to enhance the business opportunities of both firms in the US retail market.

Green bond fund investors continue to be dominated by institutional investors who account for a minimum of $604.9 million in assets or almost 72% of the segment’s combined assets under management[2].

August performance: Five funds outperformed both indices while three trailed

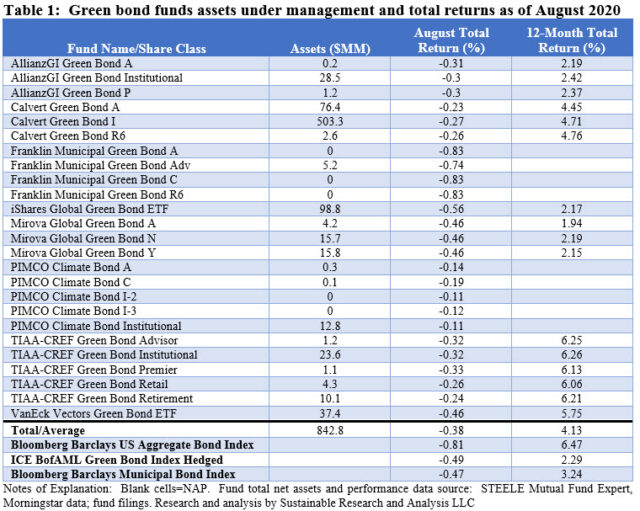

The eight green bond funds and the corresponding 25 funds/share classes posted an average total return of -0.38% in August, beating the Bloomberg Barclays US Aggregate Bond Index by 43 basis points and the ICE BofAML Green Bond Index Hedged by 11 basis points. August returns ranged from a low of -0.83% attributed to the Franklin Municipal Green Bond A[3] to a high of -0.11% recorded by PIMCO Climate Bond I-2. Five funds outperformed both indices while three trailed, including the recently launched Franklin Municipal Green Bond Fund. Refer to Table 1.

Viewing results over the trailing twelve months, the segment registered an average total return of 4.1% as compared to the 2.29% achieved by the ICE BofAML Green Bond Index Hedged and 6.5% posted by the conventional intermediate investment grade Bloomberg Barclays US Aggregate Bond Index. 11 out of 16 funds/share classes outperformed the narrower green bond index but the broader bond index beat all green bond funds/share classes. Refer to Table 1.

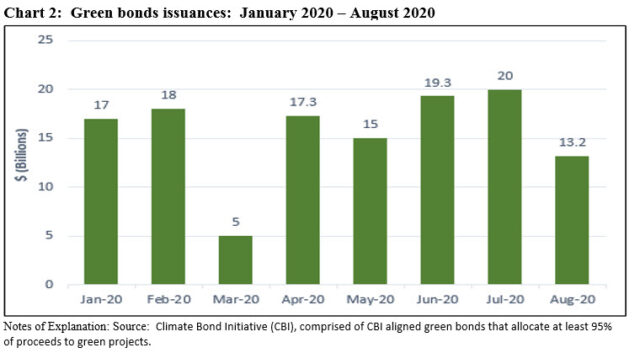

Green bonds volume in August reached $13.2 billion

52 issuers launched green bond transactions that reached a total of $13.2 billion in August, including 15 issuers in the US that accounted for almost $4.0 billion of monthly volume, or 30%. Refer to Chart 2. These are largely but not entirely sourced to municipal issuers, led by Los Angeles County MTA that issued about $1.35 billion in tax-free revenue debt to refinance loans covering improvements and extensions to its rail system. In order of size of issuances, the LA County MTA transaction was followed by San Francisco BART and Tucson Electric Power.

Other developed market issuers included entities in Germany and Hong Kong, offering $2.4 billion and $1.3 billion, respectively. Development banks lead in terms of volume, with Germany’s Kfw issuing $2.0 billion while China Development Bank added $2.6 billion.

Year-to-date through the end of August, green bond volume stood at $124.8 billion.

[1] Source: Climate Bond Initiative (CBI), comprised of CBI aligned green bonds that allocate at least 95% of proceeds to green projects.

[2] Excludes institutional investors in ETFs.

[3] Franklin Municipal Green Bond Fund compares its performance to the Bloomberg Barclays Municipal Bond Index. The index registered -0.47% in August.