The Bottom Line: Beaten down prices of clean energy stocks and related securities may be approaching a buying opportunity for intermediate and long-term fund investors.

Stocks and bonds continued to register declines in October

Stocks fell for the third consecutive month in October, with large cap stocks giving up 2.1%, and lowering year-to-date and trailing 12-month gains to 10.7% and 10.1%, respectively. The S&P 500 Index continued to decline throughout the month and reached correction territory on October 27, only to pull back modestly during the last two trading days. Concerns in October centered on corporate earnings and projected earnings, interest rates and the state of the economy. All but one of 11 large cap stock sectors, namely utilities, posted negative returns in October. Returns ranged from a low of 0.07% recorded by Information Technology to a drop of 6.1% posted by the energy sector.

The results in foreign markets were even worse in October. The MSCI ACWI ex USA Index was down 4.13%, but year-to-date and trailing 12-monht results were positive 1.0% and 12.1%, respectively.

Short-dated government instruments aside, the bond market gave up almost 1.6% in October, based on the Bloomberg US Aggregate Bond Index total return results, as 10-year treasury yields briefly touched 5% mid-month before settling at 4.88% on October 31st. This was the benchmark’s sixth consecutive monthly drop, which is down 2.8% year-to-date.

Against this backdrop, sustainable mutual funds and ETFs, a combined total of 1,596 active and passively managed funds/share classes accounting for $304.9 billion in net assets under management, gave up an average of 3.0% in October, 0.39% year-to-date and 3.5% during the trailing 12-months. Returns in October ranged from a high of 3.62% to a low of -40.2%. Sustainable actively managed US equity funds recorded an average decline of 3.4% while sustainable actively managed taxable fixed income funds experienced an average 1.1% decline. A limited performance comparison of sustainable funds versus conventional funds indicates that actively managed sustainable US equity funds outperformed their conventional counterparts over the last year while actively managed sustainable bond funds underperformed¹.

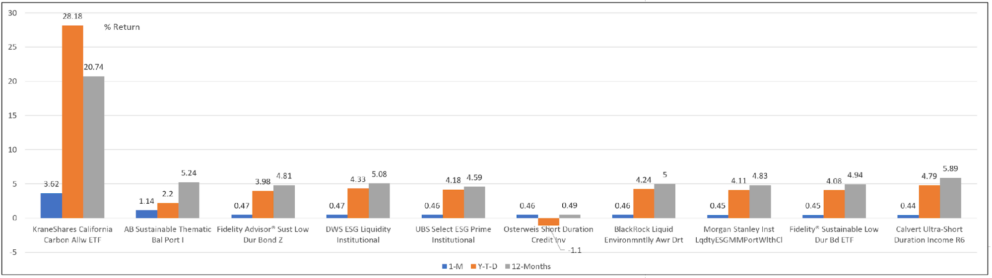

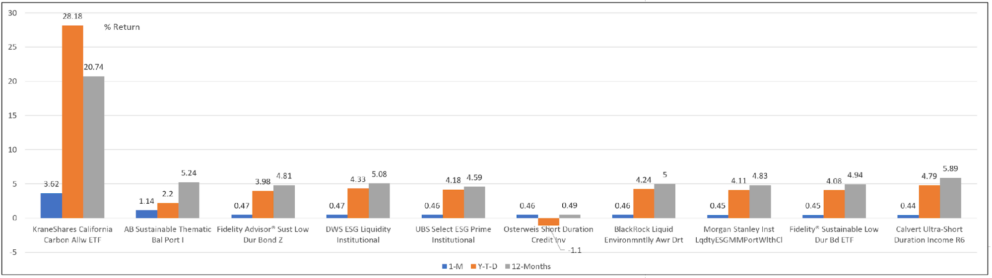

Top 10 performing funds dominated by money market and short duration bond funds

The top 10 performing funds/share classes posted an average gain of 0.84% in October, and year-to-date as well as trailing 12-month gains of 5.9% and 6.2%, respectively. Except for the two top performing funds, the segment dominated by money market funds as well as short duration bond funds.

The top performing fund was the $270.7 million KraneShares California Carbon Allowance ETF (KCCA), up 3.62% during the latest calendar month and a very impressive 28.18% year-to-date. The fund seeks to provide a total return that tracks the performance of the IHS Markit Carbon CCA Index, an index comprised of futures contracts on emission allowances issued by a “cap and trade” regulatory regime that seeks to reduce greenhouse gas emissions over time to curb climate change. The index is designed to measure the performance of a portfolio of futures contracts on carbon credits issued under the California Carbon Allowance “cap and trade” regime. The fund’s performance has likely been receiving a boost from the California Legislature’s two climate-related bills that were debated and passed in late September, the Voluntary Carbon Market Disclosures Act (VCMDA) and the Voluntary Carbon Offsets Business Regulation Act (VCOBRA). The first entails far-reaching disclosure obligations for companies making climate-related claims while the second bill would have made it unlawful for a person to certify or issue a voluntary carbon offset if the person knows or should know that the greenhouse gas reductions or greenhouse gas removal enhancements of the offset project related to the voluntary carbon offset are unlikely to be quantifiable, real, additional, and permanent. Only the VCMDA was signed into law by Governor Gavin Newsom.

The second-best performing fund, the $98.8 million AB Sustainable Thematic Balanced Portfolio I, invests in a diversified portfolio of equity and fixed-income securities that meet the fund’s sustainability criteria. Most recently, the fund maintained a 42% exposure to high quality fixed income securities with heavy weightings in technology and healthcare issues.

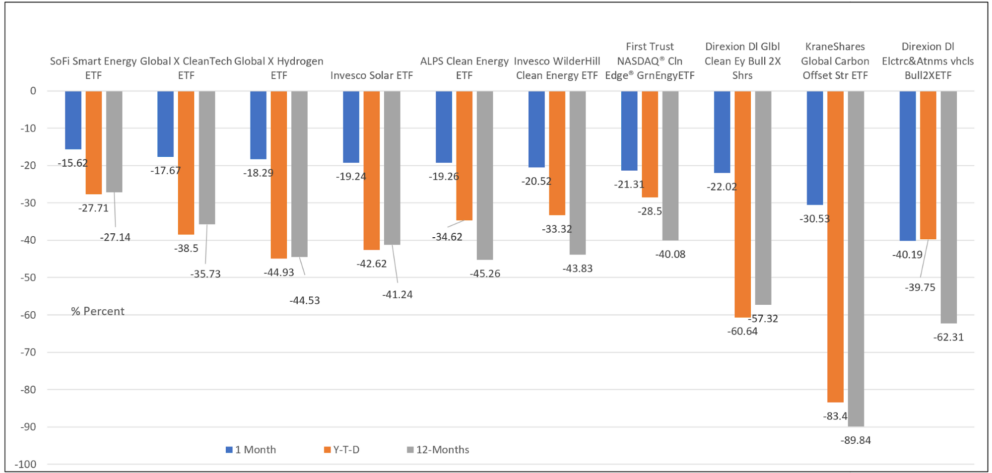

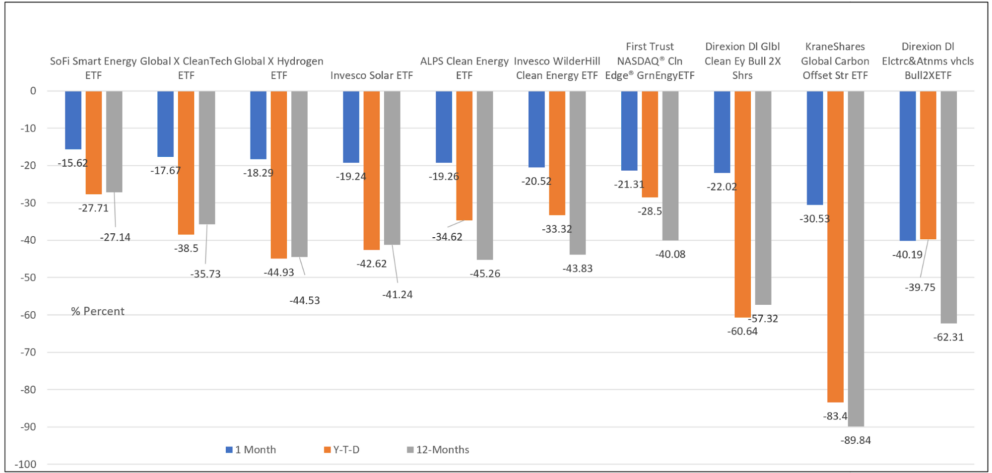

Performance laggards in October focused on the hard hit clean and renewable energy sector

At the other end of the range, the worst performing funds in October were all thematic ETF funds, including leveraged funds, focused on clean and renewable energy. These concentrated thematic portfolios, along with other sustainable energy funds and their stock holdings, have suffered due to higher interest rates, inflation, supply-chain issues, inadequate electric transmission infrastructure and competition from China. The 10 lagging funds posted an average decline of 22.5% in October and registered even wider average drops of 43.4% year-to-date and 48.7% over the trailing twelve months.

Thematic funds generally and the identified 10 funds in particular tend to be riskier, especially when they are concentrated or exposed to leverage. They will exhibit higher levels of volatility over time—reaching higher highs and lower lows over a market cycle. For example, the four funds in existence throughout 2020 recorded returns ranging from 140% to 233%. The average annualized 3-year volatility of the six funds in operation during the previous three years was 44, almost 2.5 times the 3-year volatility of the S&P 500.

While caution is advised, beaten down prices of clean energy stocks and related securities may be approaching a buying opportunity for intermediate and long-term fund investors. It’s tough to know a trough has been reached. That said, the energy transition is advancing and it will continue to move forward. Collective efforts to curb climate change to head off frequent and severe weather events by increasing our reliance on renewable energy and making advances in new technologies to reduce greenhouse gas emissions are not likely to diminish. To the contrary, they are likely to get a lift at the forthcoming COP 28 climate change conference in the United Arab Emirates. Clean energy stocks and related securities should benefit from these developments.

Top 10 performing funds in October 2023: 1-month, Y-T-D and 12-month performance results Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of top 10 funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of top 10 funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Worst 10 performing funds in October 2023: 1-month, Y-T-D and 12-month performance results Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of performance laggards. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of performance laggards. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

¹ Several factors other than sustainability practices will influence the performance of sustainable fund groupings when compared to conventional funds, which is why comparisons are difficult to make. For example, the number and composition of funds by type can have a material impact on the composite results of each group over the evaluation period. In this instance, the comparisons were restricted to actively managed US equity funds and actively managed taxable bond funds.

Have renewable energy funds reached bottom?

Stocks fell for the third consecutive month in October, with large cap stocks giving up 2.1%, and lowering year-to-date and trailing 12-month gains to 10.7% and 10.1%, respectively. The S&P 500 Index continued to decline throughout the month and reached correction territory on October 27, only to pull back modestly during the last two trading…

Share This Article:

The Bottom Line: Beaten down prices of clean energy stocks and related securities may be approaching a buying opportunity for intermediate and long-term fund investors.

Stocks and bonds continued to register declines in October

Stocks fell for the third consecutive month in October, with large cap stocks giving up 2.1%, and lowering year-to-date and trailing 12-month gains to 10.7% and 10.1%, respectively. The S&P 500 Index continued to decline throughout the month and reached correction territory on October 27, only to pull back modestly during the last two trading days. Concerns in October centered on corporate earnings and projected earnings, interest rates and the state of the economy. All but one of 11 large cap stock sectors, namely utilities, posted negative returns in October. Returns ranged from a low of 0.07% recorded by Information Technology to a drop of 6.1% posted by the energy sector.

The results in foreign markets were even worse in October. The MSCI ACWI ex USA Index was down 4.13%, but year-to-date and trailing 12-monht results were positive 1.0% and 12.1%, respectively.

Short-dated government instruments aside, the bond market gave up almost 1.6% in October, based on the Bloomberg US Aggregate Bond Index total return results, as 10-year treasury yields briefly touched 5% mid-month before settling at 4.88% on October 31st. This was the benchmark’s sixth consecutive monthly drop, which is down 2.8% year-to-date.

Against this backdrop, sustainable mutual funds and ETFs, a combined total of 1,596 active and passively managed funds/share classes accounting for $304.9 billion in net assets under management, gave up an average of 3.0% in October, 0.39% year-to-date and 3.5% during the trailing 12-months. Returns in October ranged from a high of 3.62% to a low of -40.2%. Sustainable actively managed US equity funds recorded an average decline of 3.4% while sustainable actively managed taxable fixed income funds experienced an average 1.1% decline. A limited performance comparison of sustainable funds versus conventional funds indicates that actively managed sustainable US equity funds outperformed their conventional counterparts over the last year while actively managed sustainable bond funds underperformed¹.

Top 10 performing funds dominated by money market and short duration bond funds

The top 10 performing funds/share classes posted an average gain of 0.84% in October, and year-to-date as well as trailing 12-month gains of 5.9% and 6.2%, respectively. Except for the two top performing funds, the segment dominated by money market funds as well as short duration bond funds.

The top performing fund was the $270.7 million KraneShares California Carbon Allowance ETF (KCCA), up 3.62% during the latest calendar month and a very impressive 28.18% year-to-date. The fund seeks to provide a total return that tracks the performance of the IHS Markit Carbon CCA Index, an index comprised of futures contracts on emission allowances issued by a “cap and trade” regulatory regime that seeks to reduce greenhouse gas emissions over time to curb climate change. The index is designed to measure the performance of a portfolio of futures contracts on carbon credits issued under the California Carbon Allowance “cap and trade” regime. The fund’s performance has likely been receiving a boost from the California Legislature’s two climate-related bills that were debated and passed in late September, the Voluntary Carbon Market Disclosures Act (VCMDA) and the Voluntary Carbon Offsets Business Regulation Act (VCOBRA). The first entails far-reaching disclosure obligations for companies making climate-related claims while the second bill would have made it unlawful for a person to certify or issue a voluntary carbon offset if the person knows or should know that the greenhouse gas reductions or greenhouse gas removal enhancements of the offset project related to the voluntary carbon offset are unlikely to be quantifiable, real, additional, and permanent. Only the VCMDA was signed into law by Governor Gavin Newsom.

The second-best performing fund, the $98.8 million AB Sustainable Thematic Balanced Portfolio I, invests in a diversified portfolio of equity and fixed-income securities that meet the fund’s sustainability criteria. Most recently, the fund maintained a 42% exposure to high quality fixed income securities with heavy weightings in technology and healthcare issues.

Performance laggards in October focused on the hard hit clean and renewable energy sector

At the other end of the range, the worst performing funds in October were all thematic ETF funds, including leveraged funds, focused on clean and renewable energy. These concentrated thematic portfolios, along with other sustainable energy funds and their stock holdings, have suffered due to higher interest rates, inflation, supply-chain issues, inadequate electric transmission infrastructure and competition from China. The 10 lagging funds posted an average decline of 22.5% in October and registered even wider average drops of 43.4% year-to-date and 48.7% over the trailing twelve months.

Thematic funds generally and the identified 10 funds in particular tend to be riskier, especially when they are concentrated or exposed to leverage. They will exhibit higher levels of volatility over time—reaching higher highs and lower lows over a market cycle. For example, the four funds in existence throughout 2020 recorded returns ranging from 140% to 233%. The average annualized 3-year volatility of the six funds in operation during the previous three years was 44, almost 2.5 times the 3-year volatility of the S&P 500.

While caution is advised, beaten down prices of clean energy stocks and related securities may be approaching a buying opportunity for intermediate and long-term fund investors. It’s tough to know a trough has been reached. That said, the energy transition is advancing and it will continue to move forward. Collective efforts to curb climate change to head off frequent and severe weather events by increasing our reliance on renewable energy and making advances in new technologies to reduce greenhouse gas emissions are not likely to diminish. To the contrary, they are likely to get a lift at the forthcoming COP 28 climate change conference in the United Arab Emirates. Clean energy stocks and related securities should benefit from these developments.

Top 10 performing funds in October 2023: 1-month, Y-T-D and 12-month performance results Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of top 10 funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of top 10 funds. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Worst 10 performing funds in October 2023: 1-month, Y-T-D and 12-month performance results Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of performance laggards. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Notes of Explanation: In the event of multiple share classes, only the best performing share class is included in the listing of performance laggards. Sources: Morningstar Direct and Sustainable Research and Analysis LLC.

¹ Several factors other than sustainability practices will influence the performance of sustainable fund groupings when compared to conventional funds, which is why comparisons are difficult to make. For example, the number and composition of funds by type can have a material impact on the composite results of each group over the evaluation period. In this instance, the comparisons were restricted to actively managed US equity funds and actively managed taxable bond funds.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact