Sustainable Bottom Line: Family offices represent an important slice of the estimated $3.7 to $30 trillion in AUM linked to the sustainable investing market segment.

What the major recurring surveys reveal

Family offices, which are private companies that manage the wealth, investments, and entire financial life for a single ultra-high-net-worth family (or a few families in a multi-family office), offering holistic, integrated services like investment management, tax, estate planning, philanthropy, and even concierge tasks such as bill pay and travel to preserve and grow wealth across generations, are increasingly relevant stakeholders in sustainable and impact investing. These entities, which are now estimated to number more than 8,000 globally with roughly $5.5 trillion in assets according to the Wall Street Journal,* represent an important slice of the estimated $3.7 trillion to $30 trillion in assets under management (AUM) linked to the sustainable investing market segment**. While this segment does not report with the same transparency as institutional asset owners, several large, recurring family-office studies provide consistent insight into both adoption rates and implementation approaches.

Adoption: meaningful, but uneven and regionally skewed

Across surveys, sustainable investing adoption among family offices is best described as material but heterogeneous. The latest UBS Global Family Office Report published in 2025, which surveyed 317 family offices across regions, finds that nearly half (mid-40% range) of respondents report taking sustainability considerations into account in their investments or operating businesses. Importantly, UBS notes a shift in framing: sustainability is increasingly viewed as a source of long-term opportunity, not solely a risk-management overlay.

Other studies apply a more stringent definition. Campden Wealth’s North America Family Office Report 2025, produced with RBC, reports that approximately one-quarter of North American family offices are “engaged in responsible investing,” compared with closer to one-third globally and materially higher rates in Europe and Asia-Pacific. These regional gaps are persistent and reflect differences in regulatory context, cultural norms, and attitudes toward ESG terminology.

Morgan Stanley’s private wealth surveys sit between these definitions, reporting that roughly four in ten family offices show some level of ESG influence, though allocations tend to be modest as a share of total portfolios. Taken together, the surveys suggest that headline adoption rates vary meaningfully depending on how sustainability is defined, but that a sizeable and growing minority of family offices are active participants.

How sustainability mandates are implemented in practice

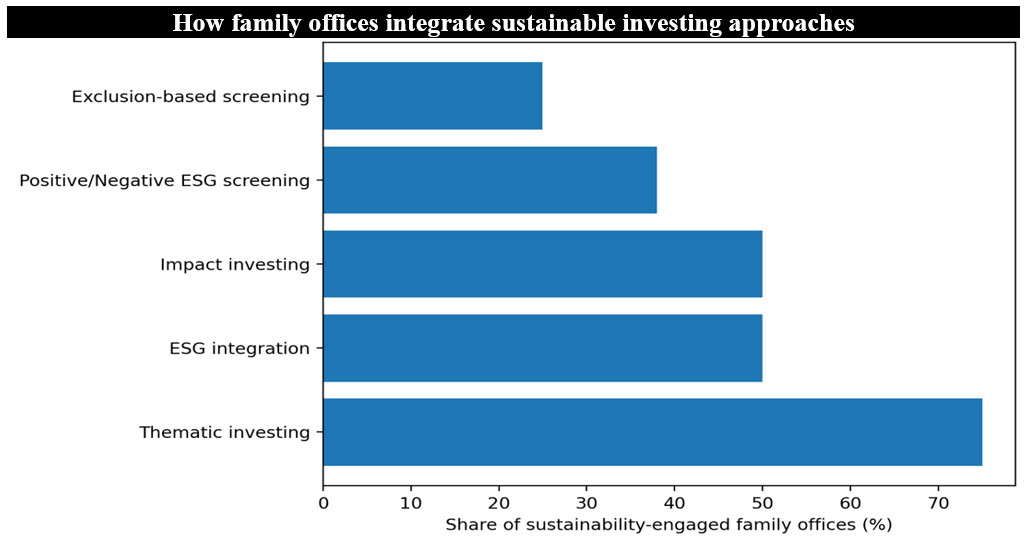

Where family offices differ from traditional institutional investors is not only whether they adopt sustainability, but how they express it. Survey evidence points to five dominant implementation pathways:

1. Values-based investing and exclusions. Many family offices begin with explicit values embedded in investment policy statements or family constitutions. These often translate into exclusion lists, such as tobacco, certain weapons, or fossil fuels, reflecting legacy values rather than portfolio-wide ESG optimization. This approach is especially common among first-generation sustainable adopters.

2. ESG screening and best-in-class selection. Beyond exclusions, some family offices apply positive or negative ESG screens, minimum score thresholds, or controversy filters when selecting managers or securities. These screens are often applied selectively rather than across the full portfolio, reflecting customization and governance preferences.

3. ESG integration into investment decisions. Roughly half of sustainability-engaged family offices report integrating ESG considerations into manager due diligence, security selection, and monitoring. In practice, this typically means assessing financially material ESG risks, sector-specific exposures, governance quality, and transition readiness, rather than targeting explicit impact outcomes. This approach aligns closely with risk-adjusted return objectives.

4. Thematic investing as a core expression. Thematic investing, such as climate solutions, renewable energy, healthcare innovation, education, or water infrastructure, is the most widely used sustainability approach among family offices. It fits naturally with their preference for private markets, co-investments, and long holding periods. Thematic exposure allows families to align capital with long-term secular trends without fully re-engineering public-market allocations.

5. Impact investing and blended strategies. Approximately half of sustainability-engaged family offices report some form of impact investing, typically in private equity, venture capital, private credit, or real assets. Impact strategies often sit alongside philanthropic activity and may target measurable social or environmental outcomes with concessionary or market-rate returns. Family offices frequently view impact capital and philanthropy as complementary rather than distinct silos.

What distinguishes family offices from institutions

Three characteristics consistently emerge across studies. First, implementation is selective rather than comprehensive, as few family offices apply sustainability uniformly across all assets. Second, private markets dominate, enabling customization and direct influence. Third, values and legacy considerations often matter as much as formal ESG metrics.

*Source: Wall Street Journal, December 26, 2025.

** Estimates for global AUM linked to sustainable investing vary widely primarily because different sources are measuring different universes, such as sustainable mutual funds and ETFs (excluding, in some cases, money market funds that employ a "structural sustainability" approach vs all assets managed with some ESG process vs assets managed by organizations that have signed a responsible-investment commitment, as is the case with PRI data. The result is a very wide range in assets under management. For example, Morningstar reported global sustainable mutual fund and ETF assets of $3.7 trillion as of September 2025, based on funds that explicitly incorporate sustainable/ESG language in offering documents. Global Sustainable Investment Review 2024 reports a scaled back $16.7 trillion in sustainable fund assets constrained by the recently adopted Morningstar’s funds approach. On the other hand, Bloomberg Intelligence has stated that global ESG assets surpassed $30 trillion in 2022. At the other end of the range, the UN-supported Principles for Responsible Investment (PRI) reports total signatory AUM of about $139.6 trillion as of its 2025 reporting. This is the broadest and perhaps most misinterpreted number as it represents the total AUM of organizations that have signed the UN-supported Principles for Responsible Investment (PRI). It is not a measure of “assets managed sustainably” but rather it is a measure of the asset base of signatory organizations.

Notes of Explanation: Chart shows the percentage of sustainability-engaged family offices using each approach, based on Campden Wealth’s North America Family Office Report 2025, produced with RBC. Sources: Campden Wealth North America Family Office Report 2025.

Notes of Explanation: Chart shows the percentage of sustainability-engaged family offices using each approach, based on Campden Wealth’s North America Family Office Report 2025, produced with RBC. Sources: Campden Wealth North America Family Office Report 2025.