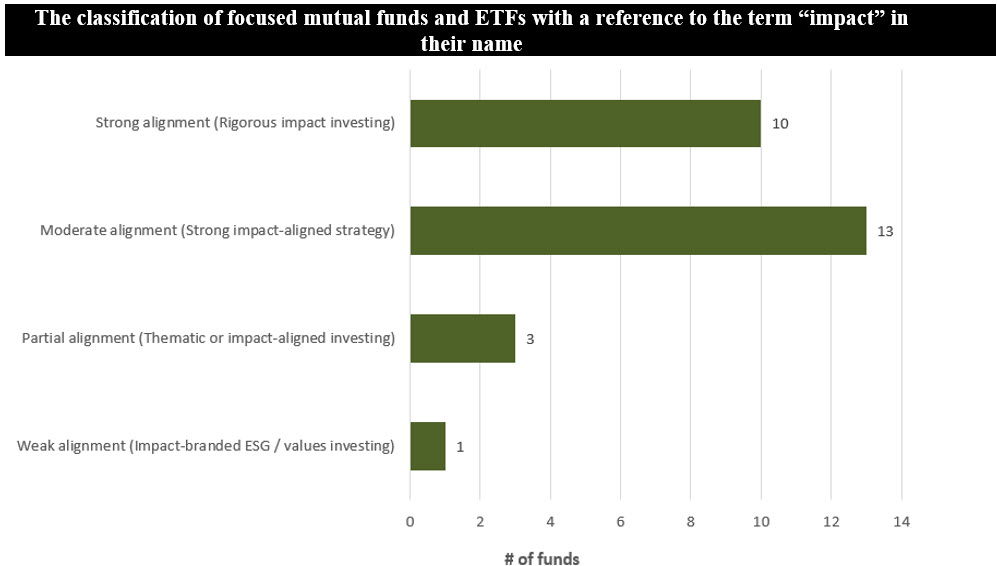

Sustainable Bottom Line: A small number of 27 funds include “impact” in their names to indicate a sustainable investing impact-oriented approach, but variations are significant.

Notes of Explanation: The universe of 27 funds have been scored based on four key characteristics that are considered within the widely accepted and de facto industry standard of “impact” and “impact investing” developed by the Global Impact Investing Network (GIIN). Source: Sustainable Research and Analysis LLC.

Summary

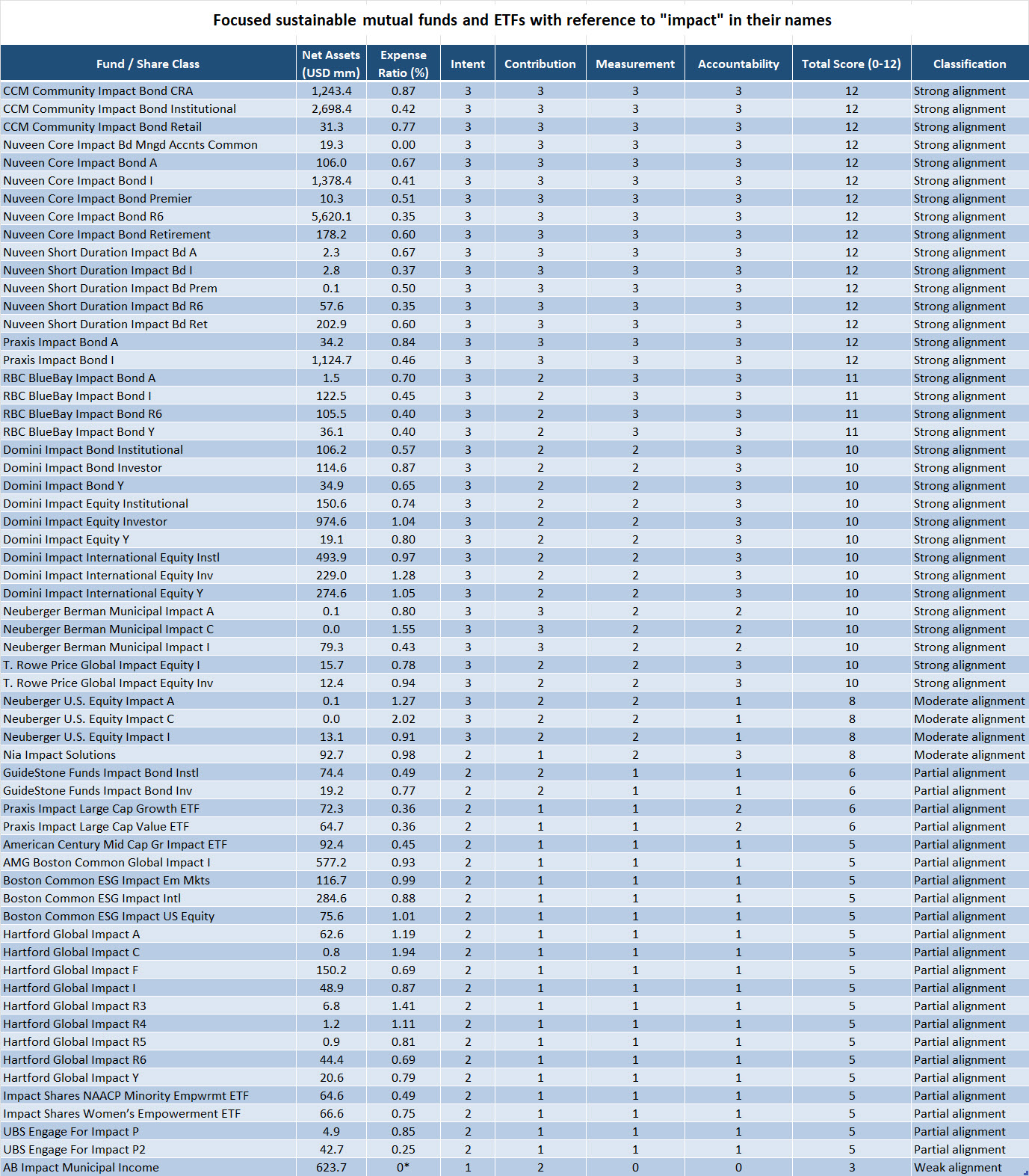

A small number of 27 funds with $18.1 billion in assets include “impact” in their names to indicate a sustainable investing impact-oriented approach. That said, the approach that characterizes these funds with the term “impact” in their names can vary significantly. Because these variations exist, sustainable investors and financial intermediaries seeking exposure to impact-oriented public investments in the form of mutual funds and ETFs should reflect on these variations when considering their impact investing options. To assist investors and financial intermediaries in their evaluation of these variations, a scoring framework was crafted for classifying funds across four independent dimensions that reflect the globally accepted definition of impact investing, including intentionality, contribution, measurement as well as accounting and reporting. A list of funds, including share classes in the case of mutual funds, and their scores is provided at the end of the article.

Focused sustainable mutual funds and ETFs that reference “impact” in their name represent a small segment of total sustainable funds universe

Out of about 320 focused sustainable long-term mutual funds and ETFs totaling $381.9 billion in assets as of January 31, 2026, only 27, or less than 1%, with $18.1 billion in assets include “impact” in their names to indicate a sustainable investing impact-oriented approach. This small segment of funds is dominated by taxable and municipal bond funds, a total of nine funds/29 share classes, with almost $14 billion in net assts. The rest consist of US and international equity funds. In total, 16 fund firms offer these funds, but the group is dominated by Nuveen, Community Capital, Domini and Praxis Investment Management, which together account for 84% of assets.

Across academia, asset owners, regulators, and industry bodies, a widely accepted and de facto industry standard of “impact” and “impact investing” comes from the Global Impact Investing Network (GIIN). According to GIIN, impact investments are investments made with the intention to generate positive, measurable social and/or environmental impact alongside a financial return. This definition has three required elements: (1) Intentionality–impact is an explicit investment objective, (2) Measurability–impact outcomes are identified and assessed and (3) Financial return–investments are expected to generate a return (not philanthropy).

Significant variations found in approaches characterizing funds with the term “impact” in their names

That said, the approach that characterizes the 27 funds with the term “impact” in their names can vary significantly. These approaches can be classified into one of four categories that span from impact investing aligned with GIIN’s rigorous definition that integrates intent plus measurement as well as reporting, to a strong impact-aligned strategy, to a thematic or impact-aligned investing, to an impact-branded ESG/values investing that focuses on values alignment but with limited accountability.

Since these variations exist, sustainable investors and financial intermediaries seeking exposure to impact-oriented public investments in the form of mutual funds and ETFs should reflect on these variations when considering their impact investing options.

The following framework for classifying funds across four independent dimensions that reflect the globally accepted definition of impact investing, including intentionality, contribution, measurement as well as accounting and reporting, is intended to assist investors and financial intermediaries in their evaluation of these variations.

A practical scoring framework for evaluating impact-related funds

The framework below translates the core principles of impact investing into a practical, investor-ready score.

Framework overview

The scoring system evaluates funds across four independent dimensions derived from globally accepted definitions of impact investing (e.g., intentionality, measurability, and accountability):

1. Intentionality

2. Contribution

3. Measurement

4. Accountability and Reporting

Each dimension is scored on a 0–3 scale, producing a maximum total score of 12. This structure allows consistent comparison across asset classes (equity vs. fixed income), investment styles (active vs. index), and firms.

The four dimensions

1. Intentionality (0–3)

This dimension assesses whether impact is an explicit investment objective and attempts to answer the key question of whether impact is central to the mandate, or merely descriptive branding.

0 – No stated impact objective; financial return only

1 – General sustainability or values language; impact implied

2 – Explicit impact themes (e.g., SDG alignment)

3 – Impact is a primary stated investment objective

2. Contribution (0–3)

This dimension evaluates whether invested capital plausibly contributes to the stated impact. It attempts to answer the key question of whether the impact would plausibly occur without this capital allocation. Contribution tends to be strongest in use-of-proceeds fixed income strategies and more indirect in public equity strategies.

0 – No identifiable link between capital and outcomes

1 – Indirect exposure (e.g., owning companies with positive products)

2 – Capital allocated to issuers or themes aligned with outcomes

3 – Clear use-of-proceeds or project-level financing linkage

3. Measurement (0–3)

This dimension assesses whether impact outcomes are defined and tracked.

0 – No impact metrics disclosed

1 – Portfolio alignment or thematic exposure only

2 – Defined metrics at portfolio or issuer level

3 – Quantified outcomes tied to investments or projects

Importantly, ESG scores or thematic alignment alone do not constitute impact measurement.

4. Accountability and Reporting (0–3)

This dimension evaluates transparency and stewardship.

0 – No impact disclosure beyond marketing

1 – Limited disclosure (e.g., website summaries)

2 – Periodic disclosures or case studies

3 – Regular, structured impact reports with methodology

Regular reporting is often the clearest differentiator between impact-branded strategies and a rigorous impact investing definition.

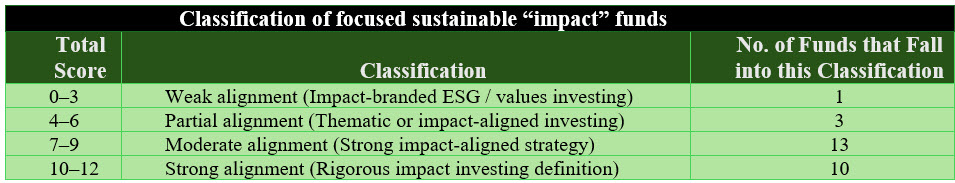

Interpreting total scores

The total score (0–12) places the identifies 27 funds with the term “impact” in their names along an impact spectrum, relative to the GIIN definition of impact or impact investing, as follows:

Source: Sustainable Research and Analysis LLC

This system is diagnostic rather than normative. A lower score does not imply inferior investment quality; rather, it clarifies the degree to which a strategy aligns with the core principles of intentional, measurable impact.

Illustrative application

Applying this framework to a range of U.S. mutual funds and ETFs reveals meaningful differentiation:

• Use-of-proceeds impact bond funds often score 10–12, reflecting strong intentionality, measurable outcomes, and structured reporting.

• Moderately aligned funds, with scores between 7-9, tend to reflect lower measurement and accountability scores.

• In addition to lower measurement and accountability scores, funds with scores between 4-6, classified as partially aligned, also reflect lower contribution scores.

• Funds with scores between 0-3 reflect the lowest alignment with the GIIN definition and may reflect the absence of or limited clarity around one or more of the four dimensions, such as measurement as well as accountability and reporting.

Notes of Explanation: The universe of 27 funds have been scored based on four key characteristics that are considered within the widely accepted and de facto industry standard of “impact” and “impact investing” developed by the Global Impact Investing Network (GIIN), including (1) Intentionality-impact is a stated objective, (2) Contribution-capital plausibly enables the outcome, (3) Measurement-outcomes are tracked and disclosed, and (4) Accountability and Reporting-impact reporting and stewardship. Each dimension has been scored on a 0–3 scale, for a maximum total score of 12. Funds achieving a score between 10-12 are considered to reflect a strong alignment with the GIIN definition, funds achieving a score between 7-9 are considered to reflect a moderate alignment, funds achieving a score between 4-6 are considered to reflect a partial alignment and funds achieving a score between 0-3 are considered to reflect a weak alignment with the GIIN definition. *Shares of the fund only available through various fee based programs. Source: Sustainable Research and Analysis LLC.

Notes of Explanation: The universe of 27 funds have been scored based on four key characteristics that are considered within the widely accepted and de facto industry standard of “impact” and “impact investing” developed by the Global Impact Investing Network (GIIN), including (1) Intentionality-impact is a stated objective, (2) Contribution-capital plausibly enables the outcome, (3) Measurement-outcomes are tracked and disclosed, and (4) Accountability and Reporting-impact reporting and stewardship. Each dimension has been scored on a 0–3 scale, for a maximum total score of 12. Funds achieving a score between 10-12 are considered to reflect a strong alignment with the GIIN definition, funds achieving a score between 7-9 are considered to reflect a moderate alignment, funds achieving a score between 4-6 are considered to reflect a partial alignment and funds achieving a score between 0-3 are considered to reflect a weak alignment with the GIIN definition. *Shares of the fund only available through various fee based programs. Source: Sustainable Research and Analysis LLC.