The Bottom Line: The campaign against ESG considerations by investment managers and investors shows no evidence so far that interest in sustainable investing is diminishing.

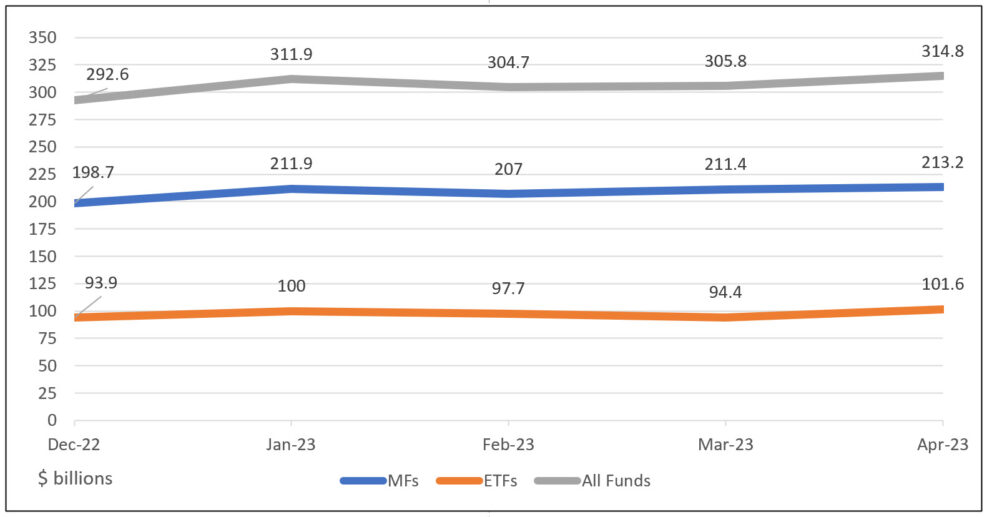

Sustainable mutual funds and ETFs net assets: December 2022 – April 30, 2023

Sources: Morningstar Direct and Sustainable Research and Analysis LLC

Observations:

- The continuing campaign against the use of ESG considerations by managers, investors, corporations and financial institutions, with the latest salvo being directed by a group of 17 Republican US state attorneys general against BlackRock, does not appear to be impacting the sentiments of current sustainable investors in US mutual funds and ETFs or their investment managers. This conclusion is supported by fund flows since the start of the year as well as new fund formations.

- According to Reuters, the Republican state attorneys general asked federal energy regulators to review BlackRock’s ownership of utilities, citing the top fund manager’s involvement in industry efforts to limit climate change. In their motion on Wednesday of this week the attorneys general asked the four-member body known as FERC to audit whether BlackRock has complied with a 2022 order that gave it permission to own more than 10% of U.S. utility company shares. This, as well as various other Republican led initiatives are detrimental to their own constituents in that they promote a disregard for the consideration of ESG risks and opportunities in financial and investment decisions that are likely in the best interests of stakeholders when such factors mitigate short and long-term financial losses and potentially take advantage of investment opportunities.

- So far this year, the combined assets of sustainable mutual funds and ETFs expanded by $19.2 billion, for a gain of 7%. Based on a simplified evaluation, the gain in net assets is exceeding the 5.3% average aggregate rate of return achieved by the universe of 1,478 funds/share classes that make up the Morningstar universe of sustainable funds. Separately, mutual funds recorded a gain of $14.5 million while the assets attributable to sustainable ETFs added a net of $7.7 million in assets.

- Sustainable mutual funds, which account for 67.7% of sustainable fund assets as of April 30, 2023, experienced successive monthly gains in assets since the start of the year. February was the only exception with funds experiencing a sharp 2.74% decline due to market factors. Otherwise, sustainable mutual funds reached a four-month high of $213.2 billion.

- Sustainable ETFs also reached a four-month high at the end of April, ending the four-month interval with $101.6 billion. ETFs, however, experienced two monthly declines in net assets before gaining $7.2 million in April.

- At the same time, investment management firms have continued to launch new products, but at a slightly reduced pace. So far this year, 26 new mutual funds and ETFs were launched versus 30 during the first four months of 2022, excluding a one-off strategic positioning by Fidelity that added 21 sustainable funds in April 2022. While this represents a slight lag, it is more likely attributable to the banking scare in March that disrupted the new issue calendar. During March, there were three mutual fund launches but no new ETF introductions.