The Bottom Line: Investment Company Institute (ICI) endorsement of a first-time ESG Roadmap represents another step forward in a process of clarifying sustainable investment strategies.

Board of Governors of the Investment Company Institute (ICI) endorsed a first-time ESG Roadmap

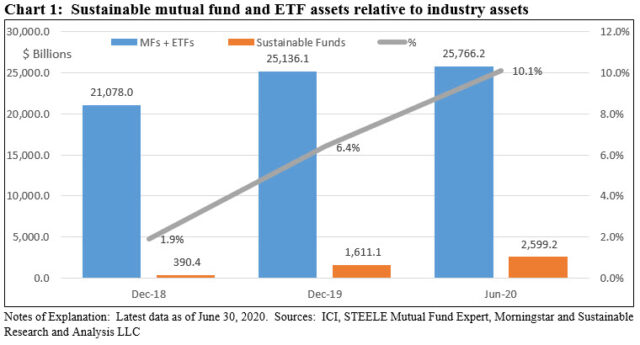

Last week, the Board of Governors of the Investment Company Institute (ICI), the US regulated funds trade association, issued a white paper that encourages the fund industry to use consistent ESG terminology in public communications and offers a framework for classifying common sustainable investment strategies in funds management. In issuing this ESG Roadmap document entitled “Funds’ Use of ESG Integration and Sustainable Investing Strategies: An Introduction” the ICI is acknowledging that sustainable investing has gained significant traction as mutual fund and ETF assets sourced to sustainable investing expanded dramatically. In fact, sustainable fund assets reached a milestone as of June 2020 when assets sourced to sustainable investing strategies surpassed for the first time 10% of combined industry assets. Refer to Chart 1. Also, the ICI and its industry member firms are recognizing that there exists a level of confusion and misunderstanding regarding sustainable investing among fund shareholders, policymakers, regulators, as well as other practitioners that is best addressed by adopting a consistent terminology to describe the various terms and techniques associated with sustainable investing. In addition to describing and defining sustainable investing strategies, the ICI strongly encourages member firms to “incorporate the agreed-upon common terminology into their own public communications describing ESG integration and sustainable investing strategies.” The ESG roadmap published by the ICI aligns in its sentiments with three key proposed standard setting recommendations advanced by Michael Cosack and Henry Shilling in a research paper published in May that called for the adoption of standardized sustainable investing strategy definitions, creation of an accepted mutual fund/ETF product classification framework and stepped up fund disclosures[1]. The ICI ESG roadmap represents another step forward in a process that will require additional consideration and further refinements.

Sustainable fund assets reached $2.6 trillion and for the first time now represent just over 10% of fund industry assets

The growth in the number of investment management firms offering sustainable mutual funds and ETFs and the rapid expansion in the number of funds as well as assets under management has been documented by Sustainable Research and Analysis for some time. As noted in previous research on this topic, 182 separate firms now offer a total of 4,534 sustainable funds/share classes and ETFs with combined assets that reached $2.6 trillion at the end of June 30, 2020, up from $390 billion at the end of 2018. Refer to Chart 1. This 6X growth has largely been achieved via fund re-brandings, or the process of taking an existing fund and formally amending its prospectus to explicitly reflect the adoption of a sustainable investing strategy. While definitions continue to evolve, most practitioners today agree that sustainable investing refers to a range of five overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one or more of these strategies that are not mutually exclusive. Since the start of 2019, our research indicates that 90% of the growth in assets is sourced to re-branded funds, followed by market movement and net cash flows, in that order.

Another way to illustrate the magnitude of the impact that the combination of fund re-brandings, market movement and positive fund flows have had on the sustainable funds segment of the investment company industry is to compare the level of sustainable fund assets relative to aggregate mutual fund and ETF assets. In just a short 18-month period, sustainable mutual funds and ETFs jumped from 1.9% of industry assets at the end of 2018 to 6.41% at the end of 2019 and to 10.1% as of June 30, 2020. This is the first time sustainable fund assets exceeded 10% or more of fund industry assets.

Sustainable fund assets at the end of June include sustainable money market funds that stood at $703.8 billion and accounted for 27.1% of sustainable fund assets. Excluding money market funds, the percentage declines to 9% of industry assets.

Growth in segment seems to correlate with elevated level of confusion and an increasingly common misunderstanding regarding sustainable investing

The evolving nature and expansion of the sustainable funds segment without a common set of definitions applicable to the various sustainable investing terms and portfolio management approaches seem to correlate with growing confusion and an increasingly common misunderstanding on the part of stakeholders between values-based investing, reflecting social or ethical investing considerations, and environmental, social and governance (ESG) integration, pursuant to which relevant and material risks and opportunities are taken into account in the process of evaluating securities. To ensure continued growth and development in the sustainable investing sector and to allow it to reach its full potential, Cosack and Shilling proposed three key standard setting recommendations for consideration and debate. These recommendations include the adoption of standardized sustainable investing strategy definitions, creation of a generally accepted mutual fund/ETF product classification framework and stepped up fund disclosures practices.

The ICI ESG Roadmap embraces two principles: Use of a consistent framework for classifying and describing funds and the adoption of these in public communications

The ICI ESG Roadmap embraces two principles. First, is the introduction of a consistent framework to cover the various ESG and sustainable investing approaches, using the following three nonexclusive approaches as set forth in the ESG Roadmap:

-

- ESG exclusionary investing: Funds using an ESG exclusionary investing approach may exclude companies or sectors that do not meet certain sustainability criteria or do not align with investors’ objectives. For example, a fund may not invest in companies that have significant business related to weapons manufacturing or distribution, gambling, tobacco, alcohol, or nuclear energy.

- ESG inclusionary investing: Funds using an ESG inclusionary investing approach generally seek positive sustainability-related outcomes by pursuing and focusing on portfolios that fundamentally or systematically tilt a portfolio based on ESG factors alongside financial return. For example, a fund may invest in equity securities of companies that contribute to and benefit from clean energy generation, sustainable infrastructure, waste management, and other environmentally friendly approaches.

- Impact investing: Funds using an impact investing approach seek to generate positive, measurable, and reportable social and environmental impact alongside a financial return. Measurement, management, and reporting of impact is a defining feature of impact investing. For example, a fund may invest the majority of its assets in securities whose use of proceeds, in the fund manager’s opinion, provide measurable positive social or environmental benefits.

The second principle is to incorporate the agreed up common terminology into public communications describing ESG integration and sustainable investment strategies.

Conclusion

The ICI’s ESG Roadmap represents a good first step forward in a process that will require additional consideration and further refinements to achieve greater clarity regarding terminology and practices across the growing universe of sustainable investment funds. For example, the ICI’s ESG Roadmap does not address the adoption of standardized sustainable investing definitions, and related to this, the financial and non-financial expectations or outcomes associated with funds that pursue such strategies. Also, the ICI’s investing approaches do not fully differentiate between various types of funds and their sustainable strategies, such as thematic or values-based funds. Addressing these considerations would serve to further support financial intermediaries and investors in their efforts to more effectively align funds with sustainable goals, objectives or values. Also, the ESG Roadmap does not offer any guidance regarding stepped up disclosure practices that help investors understand the relationship between the adoption of sustainable strategies, how such strategies may be impacting investment decisions as well as financial and, as relevant and appropriate, non-financial outcomes. At the present time, disclosure and transparency practices vary considerably.

[1] Rapid Growth in Sustainable Funds Calls for Adoption of Standards, Michael Cosack and Henry Shilling, May 2020. https://sustainableinvest.com/rapid-growth-in-esg-funds-calls-for-adoption-of-standards/