Summary

The Sustainable Investor Profile Evaluator (SUSTAIN Evaluator) is a Microsoft Excel-based application that relies on an easy to use questionnaire approach by which answers are analyzed methodically and systematically to arrive at a profile of an investor’s sustainable investing goals and objectives. The analysis and resulting profile, in turn, allows financial intermediaries to reflect translate an investor’s individual sustainable preferences into a tailor-made investment program through the selection of an appropriate and corresponding mix of investment products that fit into a broader recommended asset allocation strategy. The Microsoft Excel-based application does so by combining a proprietary questionnaire and a statistical Analytic Hierarchy Process (AHP) methodology to automatically evaluate and synthesize an investor’s questionnaire results, eliminate inconsistencies, and generate a rank ordering of each respondent’s sustainable investing preferences. The end result is a series of charts and graphs to assist investors and their financial intermediaries to understand, modify and finalize each individual investor’s sustainable investing preferences. The SUSTAIN Evaluator, which can be found by clicking on the Questionnaire & Research tab, is available at no cost to financial intermediaries as well as interested investors who have registered at for the Sustainableinvest Premium option.

Rising Demand

Sustainable investing has been gaining footing among individual, high net worth as well as a wide range of mainstream institutional investors. These range from public pension funds, endowments, and foundations, to mention just a few, as well as traditional investment management firms. Historically, much of the focus of sustainable investing has been on equity-oriented strategies. As more investors seek to apply a sustainable approach to a percentage of their portfolios or to their entire portfolio of securities, attention has begun to shift to other asset classes, including fixed income and real estate. This approach in one form or another has also found its way into alternative investments, such as hedge funds and private equity portfolios.

The Forum for Sustainable and Responsible Investment (USSIF) released its 2018 Biennial Foundation’s “Report On US Sustainable, Responsible and Impact Investing Trends.” The Report, based on data collected and analyzed through the beginning of 2018, disclosed that assets linked to sustainable, responsible and impact investing (SRI) strategies have reached $12.0 trillion, up 38% percent from $8.7 trillion in 2016. According to USSIF, this represents one in four dollars out of the $46.6 trillion in total assets under professional management in the United States. The report notes that “asset management firms and institutional investors are addressing a diverse set of environmental, social and governance concerns across a broader span of assets than in 2016. Many of these money managers and institutions, concerned about racial and gender discrimination, gun violence and the federal government’s rollbacks of environmental protections, are using portfolio selection and shareowner engagement to address these important issues.”

Much of this growth, per the report, is driven by asset managers, who now consider environmental, social or corporate governance (ESG) criteria across $11.6 trillion in assets, up 44% from $8.1 trillion in 2016. The top three issues for asset managers and their institutional investor clients are climate change/carbon, tobacco and conflict risk. While it is challenging to fully comprehend the absolute numbers, especially when juxtaposed against mutual funds and ETFs that are classified as sustainable investments which stand at only $312.6 billion as of September 30, 2018 and account for a small 1.5% fraction of combined long-term mutual fund and ETF assets, the overall increase reported by USSIF is consistent with the growing attention directed at SRI investing linked to a range of strategies and practices encapsulated in SRI, from values/faith-based and social investment strategies, exclusionary practices, ESG integration, impact/thematic investing, to shareholder engagement and proxy voting. Regardless of the top line numbers, however, perhaps as much as 50% of the assets, by some estimates, are sourced to SRI strategies are likely linked to exclusionary practices, such as tobacco, weapons, and alcohol, to mention just a few.

Sustainable Investing

Sustainable investing is not new. Its origins in the US can be traced to religious considerations practiced by the Methodist movement in the 18th century. Historically, the Methodist church opposed investments in companies involved with liquor or tobacco products or promoting gambling, which was expressed in the form of positive and negative screening. As for investment products, the first public offering of a screened investment fund is reported to have occurred in 1928 when an ecclesiastical group in Boston established the Pioneer Fund. The simple screening approach has been expanded to include divestiture, social impact analysis well as shareholder activism, practices that were encapsulated under the label of sustainable and responsible investing or SRI. More recently, this term has begun to fade somewhat from contemporary usage—being supplanted by the idea, referred to as ESG integration, that the performance of companies on sustainability issues such as social, environmental and governance factors, is linked to the financial performance of these same companies. This had also translated into the belief that investing in sustainable companies permits investors to attain long-term competitive financial returns while at the same time achieving a positive societal impact.

Sustainable investing is the idea that investing in sustainable companies permits investors to achieve long-term competitive financial returns while at the same time attaining a positive societal impact. Achieving a positive societal impact can be broadly encapsulated into goals that are focused on ending poverty, protect the planet and ensure that all people enjoy peace and prosperity. These can also be disaggregated to include the following 16 remediation goals that are in line with the United Nations Sustainable Development Goals that include: (1) poverty, (2) hunger, (3) good health and well-being, (4) education, (5) gender equality, (6) cleaner water and sanitation, (7) affordable and clean energy, (8) decent work and economic growth, (9) industry, innovation and infrastructure, (10) inequalities, (11) sustainable cities and communities, (12) consumption and production, (13) climate, (14) life below water, (15) life on land, (16) peace, justice and strong institutions.

Sustainable investing permits investors to focus on the above goals via investment strategies that can be executed individually or in a combination of one or more strategies. These strategies extend from a values-based approach that largely relies on excluding certain objectionable industries and/or companies from portfolios, to thematic investing, including green bond investing, to environmental, social and governance integration (ESG integration) to shareholder/bondholder engagement and proxy voting. The desired strategies can be executed via mutual funds, exchange-traded funds (ETFs), managed funds and individual securities, or some combination of these.

Plethora of Options

For investors, the alternative approaches to sustainable investing has become very challenging. Not only is the terminology around sustainable investing evolving, but investors are faced with a plethora of strategy options and investment vehicles from which to choose. On top of that, people’s values are as unique as their fingerprints as these tend to vary from one person to the next. For example, one person may be most concerned about environmental issues while another may be entirely focused on gender diversity. Even for one individual or organization, it may be quite difficult to identify specific areas of focus and to prioritize across varying objectives.

The Sustainable Investor Profile Evaluator (SUSTAIN Evaluator)

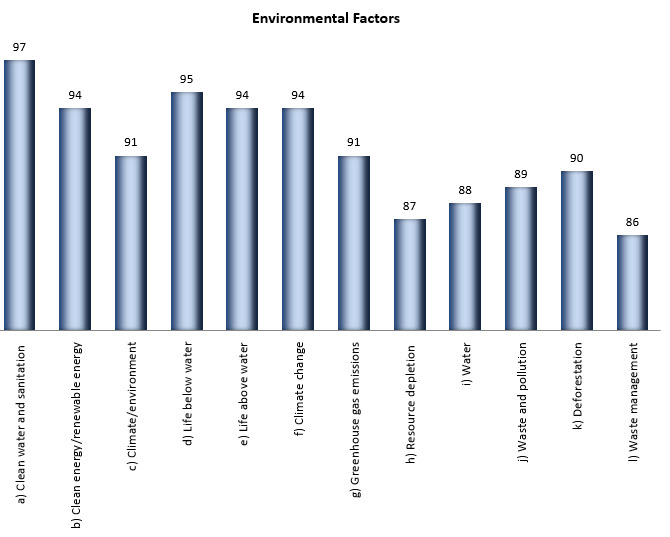

The SUSTAIN Evaluator facilitates the process of developing an individualized sustainable investing profile for investors who wish to invest in a way that is intended to achieve a positive societal outcome while at the same time realizing market-based rates of return—either across an entire portfolio or for a segment of a larger portfolio. The SUSTAIN Evaluator is intended for use as a companion to and in conjunction with an investor’s financial risk assessment. The combination of the two assessments can be used to craft a portfolio or a segment of one that is aligned with an investor’s financial as well as sustainability goals and objectives. The questionnaire which may be modified over time, currently consists of multiple choice questions and possible answers that reflect potential preferences for one or more of several possible sustainable investing strategies. In addition to an introduction, the SUSTAIN Evaluator consists of six sections, as follows: Section I seeks to identify an investors’ overall sustainable investing preferences. Section II focuses on social factors. Section III focuses on environmental factors, Section IV focuses on broad societal factors, Section V focuses on governance factors. Finally, Section VI, which is automatically calculated, displays the investor’s sustainable investing profile. Refer to Chart 1 below for an illustration of a single investor’s environmental preferences, based on responses to Section III of the application.

Registered users to the www.sustainableinvest.com website can download the SUSTAIN Evaluator as many times as they wish by clicking on the Questionnaire & Research tab at Sustainableinvest Premium. Any feedback and suggestions to improve this application are welcome.

Analytic Hierarchy Process (AHP)

The SUSTAIN Evaluator combines a proprietary sustainable Investing questionnaire with a statistical methodology used to reach decisions when multiple options are available and these have to be sorted out—known as the Analytic Hierarchy Process (AHP).

Introduced by Thomas Saaty (1980), the Analytic Hierarchy Process (AHP) is a statistical tool for dealing with complex decision making and is designed to aid the decision maker to set priorities and make the best decision. By reducing complex decisions to a series of pairwise comparisons, and then synthesizing the results, the AHP helps to capture both subjective and objective aspects of a decision. In addition, the AHP incorporates a useful technique for checking the consistency of the decision maker’s evaluations, thus reducing the bias in the decision making process.

The AHP considers a set of evaluation criteria and a set of alternative options among which the best decision is to be made. It is important to note that, since some of the criteria could be contrasting, it is not true in general that the best option is the one which optimizes each single criterion, rather the one which achieves the most suitable trade-off among the different criteria.

The AHP generates a weight for each evaluation criterion according to the decision maker’s pairwise comparisons of the criteria. The higher the weight, the more important the corresponding criterion. Next, for a fixed criterion, the AHP assigns a score to each option according to the decision maker’s pairwise comparisons of the options based on that criterion. The higher the score, the better the performance of the option with respect to the considered criterion. Finally, the AHP combines the criteria weights and the options scores, thus determining a global score for each option, and a consequent ranking. The global score for a given option is a weighted sum of the scores it obtained with respect to all the criteria.