Receive a free compilation highlighting and summarizing each month’s key research articles published by Sustainable Research and Analysis.

Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

January 2019 Sustainable Investment Funds Performance Scorecard

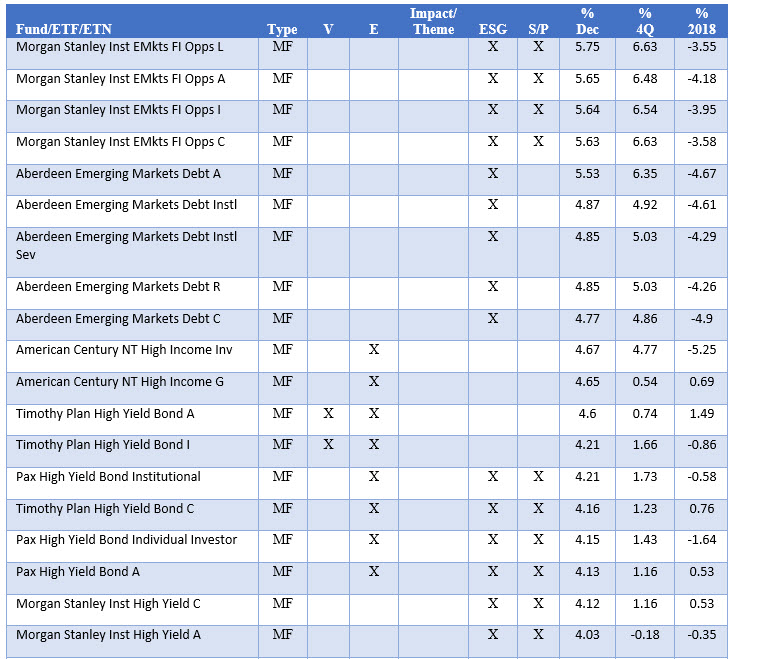

Fixed Income Mutual Funds, ETFs and ETNs 10 Top Performing Funds—January 2019

Share This Article:

Fixed Income Mutual Funds, ETFs and ETNs

10 Top Performing Funds—January 2019

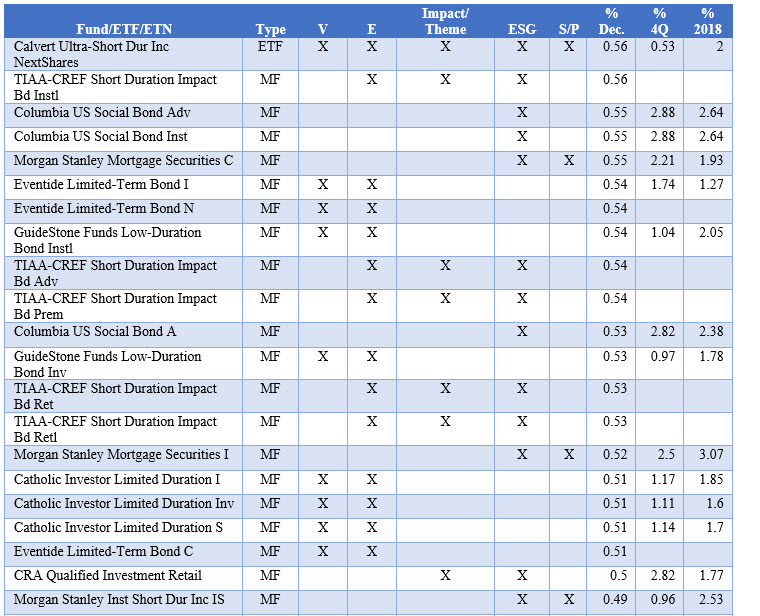

Fixed Income Mutual Funds, ETFs and ETNs

10 Bottom Performing Funds—January 2019

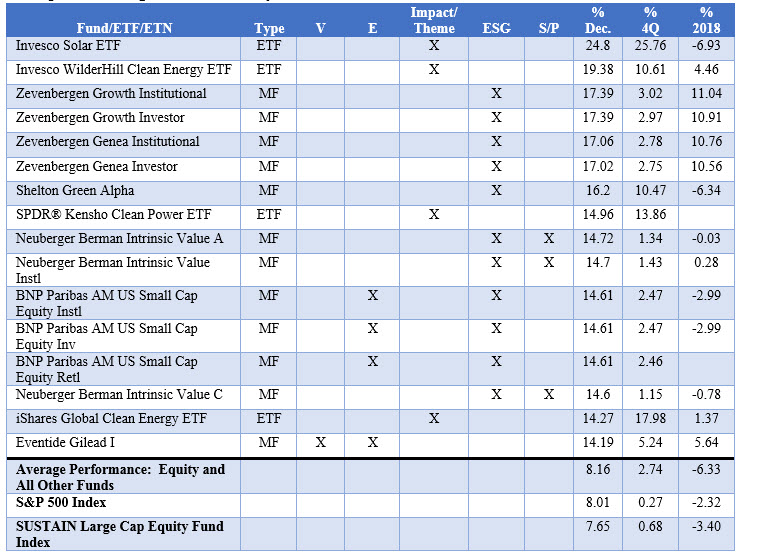

Equity and all Other Mutual Funds, ETFs and ETNs

10 Top Performing Funds—January 2019

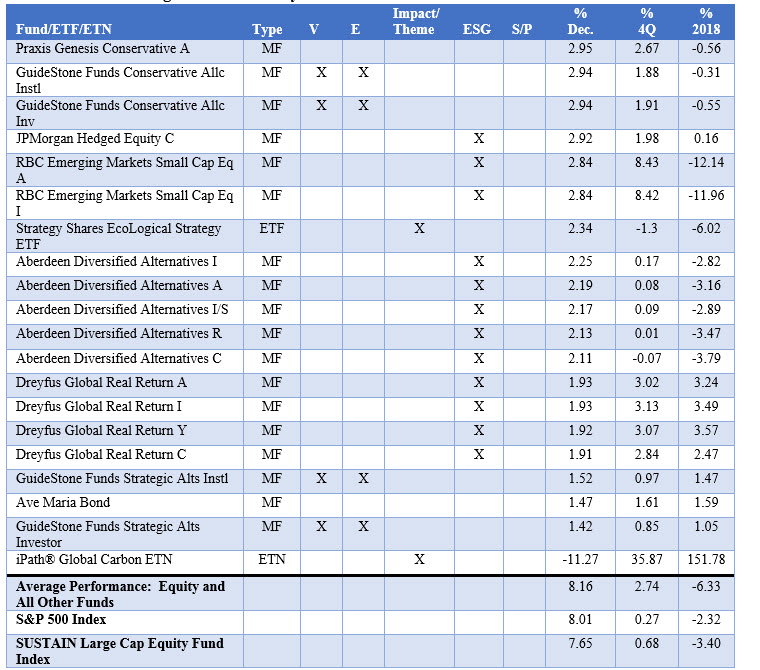

Equity and All Other Mutual Funds, ETFs and ETNs

10 Bottom Performing Funds—January 2019

Notes of Explanation

Notes of Explanation covering long-term fixed income funds: Results are total returns. Fixed income funds include long-term taxable and tax exempt bond funds and ETFs (excluding money market funds), a total of 241 funds/share classes, ETFs, ETNs with performance for the full month of January. Top 10 defined as top 10 funds which may include a larger number due to more than one share class. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Notes of Explanation covering equity and all other funds: Results are total returns. Equity funds include all US and international equity as well as all other funds, except for fixed income funds, a total of 1,073 funds/share classes, ETFs, ETNs with performance for the full month of December. Top 10 defined as top 10 funds which may include a larger number due to more than one share class. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact