Summary

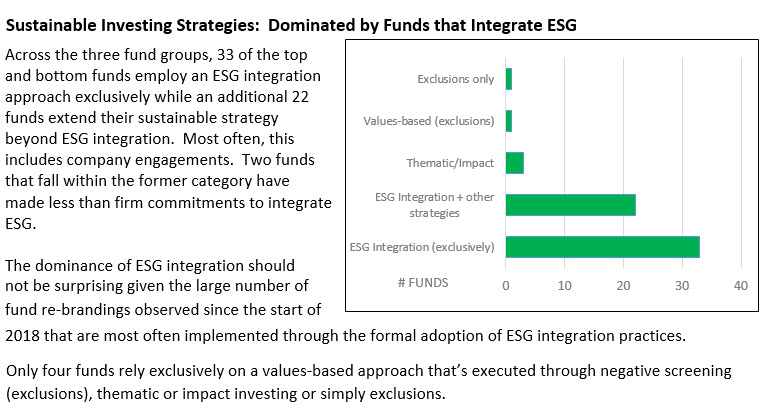

Markets in January reversed course starting at the end of the third week of the new month in response to news of the coronavirus outbreak in China. January produced divergent results, ranging from a high of 6.99% recorded by 20+ year US Treasury securities to a low of -11.88% for Brent Crude. The S&P 500 ended slightly in the red, finishing the month at -0.04% after a strong start that fizzled out while the Bloomberg Barclays US Aggregate Index gained 1.92%–its best performance in five months. The yield on 10-year US Treasury bonds declined 41 basis points during the month with slightly over 80% of that decline registered following news of the coronavirus outbreak. Overseas, the MSCI ACWI, ex USA Index (net) finished at -1.94%, while Europe, emerging markets and China posted even lower results at -2.09%, -4.66% and -4.8%, in that order. Small company stocks straddled the performance of overseas markets, giving up -3.21% while growth stocks across the market capitalization continuum turned in much stronger results relative to their value-oriented counterparts. Sustainable investing funds,[1] including mutual funds and ETFs, posted an average decline of -0.46%, but variations across fund types and sectors ranged from an average of 1.11% for fixed income funds to an average of -1.08% and -2.45%, respectively, for US equity and related funds and international funds. Top and bottom performing funds in the three sectors dimensioned below based on January’s total return performance, a total of 60 funds, were dominated by 33 funds/share classes that integrate ESG factors as part of their investment process with another 22 that extend their sustainable strategies beyond ESG integration, most often to include company engagements.

US Equity, Sector Equity and Equity Related Funds/Share Classes: Average -1.08% in January

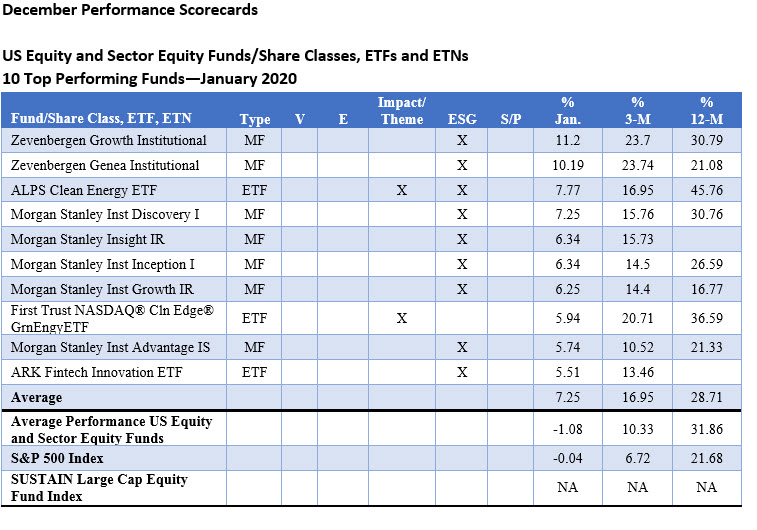

US Equity and equity related mutual funds and ETFs registered an average decline of -1.08% in January, but the top ten funds in the category, all but two ESG integrators, posted an average increase of 7.25%. The top 3 funds, including a thematic clean energy fund, recorded gains in excess of 7.25%. These results were bolstered by investments in Tesla that ranged from 5.75% of portfolio assets to a high of 9.32% in the case of ALPS Clean Energy ETF. Tesla gained 55.5% in January in the lead up to the announcement at the end of the month of the company’s first-ever quarterly profit that left short-sellers with heavy losses and scrambling to cover their positions.

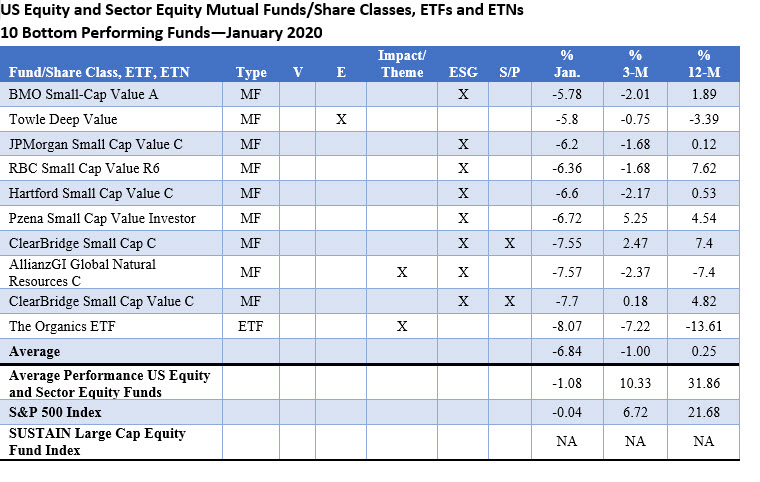

The 10 bottom performing equity and equity related funds, eight of which integrate ESG factors either exclusively or in combination with other sustainable strategies, ended the month of January with an average decline of -6.84%. Four funds posted even lower results. The Organics ETF was the worst performing fund, recording a decline of -8.07%. This impact/thematic fund managed by Janus Capital Management LLC seeks exposure to companies globally that can capitalize on our increasing desire for naturally-derived food and personal care items, including companies that service, produce, distribute, market or sell organic food, beverage, cosmetics, supplements, or packaging.

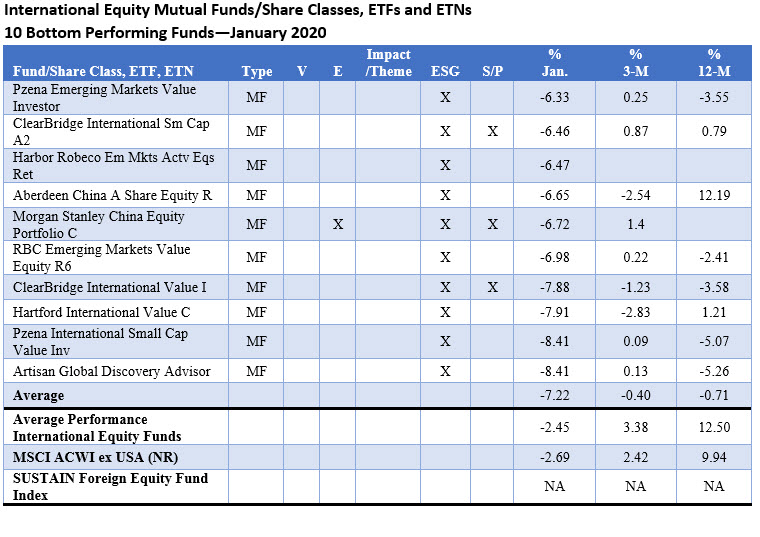

International Equity Funds: Average -2.45% in January

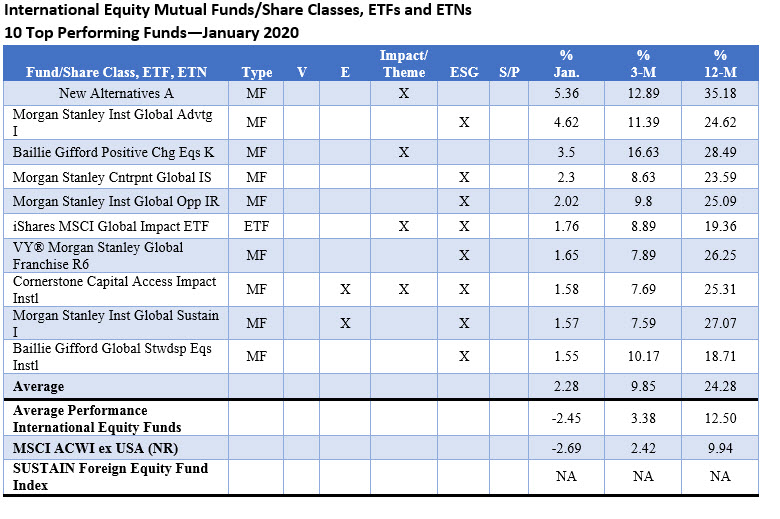

Sustainable international equity funds posted an average return of -2.45% in January whereas the top 10 funds, which turned in an average return of 2.28%, exceeded this level by margins ranging from 4.0% to 7.81%. Like their US counterparts, at least one of the leading funds had exposure to Tesla that boosted performance results in January. The best performing fund, New Alternatives, registered a gain of +5.36%. New Alternatives, which previously held a small position in Tesla as of September 30, 2019 but not through January of 2020, invests in equity securities of companies in the alternative energy industry. Baillie Gifford Positive Change Equities K, the third best performing fund that takes into account corporate governance and stewardship alongside investment considerations when selecting securities, had a 6.1% position in Tesla, based on reporting as of December 31, 2019. The fund manager, Baillie Gifford Overseas Limited, an Edinburgh-based fund-management company, reportedly holds one of the largest stakes Tesla. Also making it to the top 10 is the $5.6 million Cornerstone Capital Access Impact Fund Institutional Shares. This is a fossil fuel free fund that was launched in November of last year.

At the other end of the range, the 10 bottom performing international funds were dominated by ESG integrators with exposure, in particular, to emerging markets, China and small cap stocks. This cohort posted an average return of -7.22%. The laggard in the group, the Artisan Global Discovery Fund-Advisor Shares managed by Artisan Partners, was rebranded in January by adopting prospectus language to indicate that the fund’s portfolio management team overlays its investment process with environmental, social and governance considerations and broad knowledge of the global economy.

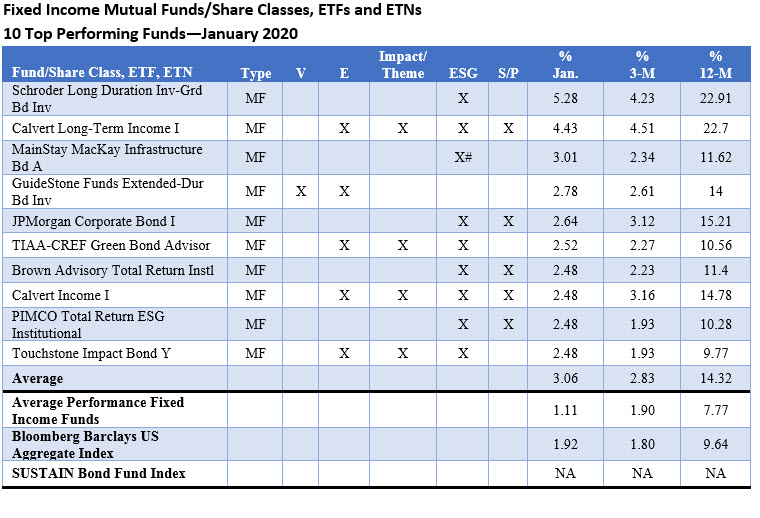

Fixed Income Funds: Average 1.11% in January

Sustainable fixed income funds and, in particular, longer-dated portfolios, posted strong results in January. The top 10 performing funds generated a total return of 3.06%, led by the Schroder Long-Duration Investment Grade Bond Fund-Investor Shares. This ESG integrator was up 5.28%. Also making the cut is the TIAA-CREF Green Bond Fund Advisor Shares, having gained 2.52%. This thematic green bond fund invests in securities issued by various entities that have committed to earmark bond proceeds toward projects or uses aimed to achieve environmentally beneficial purposes.

Unlike any of the other categories of top or bottom performing sustainable funds, the cohort of top performing fixed income funds are the most diverse in terms of their approach to sustainable investing, with four of the ten funds adopting at least three to four sustainable investing approaches beyond strictly ESG integration.

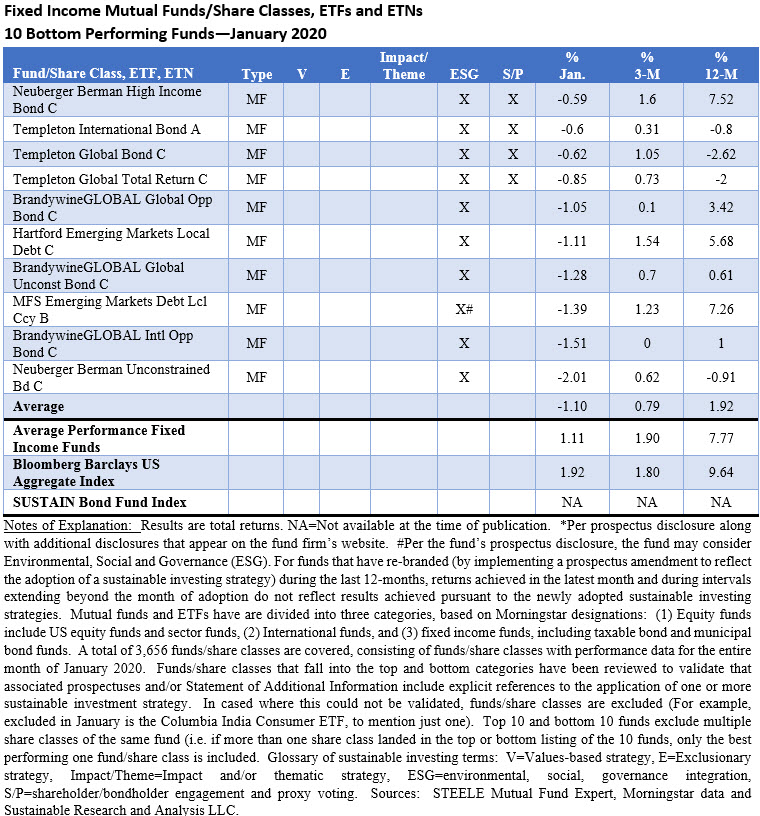

The bottom 10 performing sustainable fixed income funds are dominated by emerging market and high yield fund exposures employing a more narrowly defined set of sustainable investing strategies consisting of ESG integration and, in some cases, combined with company engagements.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainable Investment Funds Performance Scorecard: January 2020

Summary Markets in January reversed course starting at the end of the third week of the new month in response to news of the coronavirus outbreak in China. January produced divergent results, ranging from a high of 6.99% recorded by 20+ year US Treasury securities to a low of -11.88% for Brent Crude. The S&P…

Share This Article:

Summary

Markets in January reversed course starting at the end of the third week of the new month in response to news of the coronavirus outbreak in China. January produced divergent results, ranging from a high of 6.99% recorded by 20+ year US Treasury securities to a low of -11.88% for Brent Crude. The S&P 500 ended slightly in the red, finishing the month at -0.04% after a strong start that fizzled out while the Bloomberg Barclays US Aggregate Index gained 1.92%–its best performance in five months. The yield on 10-year US Treasury bonds declined 41 basis points during the month with slightly over 80% of that decline registered following news of the coronavirus outbreak. Overseas, the MSCI ACWI, ex USA Index (net) finished at -1.94%, while Europe, emerging markets and China posted even lower results at -2.09%, -4.66% and -4.8%, in that order. Small company stocks straddled the performance of overseas markets, giving up -3.21% while growth stocks across the market capitalization continuum turned in much stronger results relative to their value-oriented counterparts. Sustainable investing funds,[1] including mutual funds and ETFs, posted an average decline of -0.46%, but variations across fund types and sectors ranged from an average of 1.11% for fixed income funds to an average of -1.08% and -2.45%, respectively, for US equity and related funds and international funds. Top and bottom performing funds in the three sectors dimensioned below based on January’s total return performance, a total of 60 funds, were dominated by 33 funds/share classes that integrate ESG factors as part of their investment process with another 22 that extend their sustainable strategies beyond ESG integration, most often to include company engagements.

US Equity, Sector Equity and Equity Related Funds/Share Classes: Average -1.08% in January

US Equity and equity related mutual funds and ETFs registered an average decline of -1.08% in January, but the top ten funds in the category, all but two ESG integrators, posted an average increase of 7.25%. The top 3 funds, including a thematic clean energy fund, recorded gains in excess of 7.25%. These results were bolstered by investments in Tesla that ranged from 5.75% of portfolio assets to a high of 9.32% in the case of ALPS Clean Energy ETF. Tesla gained 55.5% in January in the lead up to the announcement at the end of the month of the company’s first-ever quarterly profit that left short-sellers with heavy losses and scrambling to cover their positions.

The 10 bottom performing equity and equity related funds, eight of which integrate ESG factors either exclusively or in combination with other sustainable strategies, ended the month of January with an average decline of -6.84%. Four funds posted even lower results. The Organics ETF was the worst performing fund, recording a decline of -8.07%. This impact/thematic fund managed by Janus Capital Management LLC seeks exposure to companies globally that can capitalize on our increasing desire for naturally-derived food and personal care items, including companies that service, produce, distribute, market or sell organic food, beverage, cosmetics, supplements, or packaging.

International Equity Funds: Average -2.45% in January

Sustainable international equity funds posted an average return of -2.45% in January whereas the top 10 funds, which turned in an average return of 2.28%, exceeded this level by margins ranging from 4.0% to 7.81%. Like their US counterparts, at least one of the leading funds had exposure to Tesla that boosted performance results in January. The best performing fund, New Alternatives, registered a gain of +5.36%. New Alternatives, which previously held a small position in Tesla as of September 30, 2019 but not through January of 2020, invests in equity securities of companies in the alternative energy industry. Baillie Gifford Positive Change Equities K, the third best performing fund that takes into account corporate governance and stewardship alongside investment considerations when selecting securities, had a 6.1% position in Tesla, based on reporting as of December 31, 2019. The fund manager, Baillie Gifford Overseas Limited, an Edinburgh-based fund-management company, reportedly holds one of the largest stakes Tesla. Also making it to the top 10 is the $5.6 million Cornerstone Capital Access Impact Fund Institutional Shares. This is a fossil fuel free fund that was launched in November of last year.

At the other end of the range, the 10 bottom performing international funds were dominated by ESG integrators with exposure, in particular, to emerging markets, China and small cap stocks. This cohort posted an average return of -7.22%. The laggard in the group, the Artisan Global Discovery Fund-Advisor Shares managed by Artisan Partners, was rebranded in January by adopting prospectus language to indicate that the fund’s portfolio management team overlays its investment process with environmental, social and governance considerations and broad knowledge of the global economy.

Fixed Income Funds: Average 1.11% in January

Sustainable fixed income funds and, in particular, longer-dated portfolios, posted strong results in January. The top 10 performing funds generated a total return of 3.06%, led by the Schroder Long-Duration Investment Grade Bond Fund-Investor Shares. This ESG integrator was up 5.28%. Also making the cut is the TIAA-CREF Green Bond Fund Advisor Shares, having gained 2.52%. This thematic green bond fund invests in securities issued by various entities that have committed to earmark bond proceeds toward projects or uses aimed to achieve environmentally beneficial purposes.

Unlike any of the other categories of top or bottom performing sustainable funds, the cohort of top performing fixed income funds are the most diverse in terms of their approach to sustainable investing, with four of the ten funds adopting at least three to four sustainable investing approaches beyond strictly ESG integration.

The bottom 10 performing sustainable fixed income funds are dominated by emerging market and high yield fund exposures employing a more narrowly defined set of sustainable investing strategies consisting of ESG integration and, in some cases, combined with company engagements.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact