As of February 28, 2017, the date of the fund’s updated prospectus, it was noted that this municipal bond fund now invests the majority of its assets in securities whose proceeds provide positive social or environmental benefits, including investments in green bonds. This was not previously the fund’s main investment strategy. That said, the fund’s prospectus does not elaborate on the fund adviser’s methodology for evaluating the eligibility of securities based on use of proceeds beyond the enumeration of qualifying bond categories, as noted below.

This municipal ESG bond fund is a welcome addition to a category that, as of the date of this writing, consists of only three funds, but the cost of entry for retail investors, in particular, remains high. While it declines to 0.0% for purchases of $1.0 million, the JPMorgan Municipal Income Fund imposes on new retail investors a 3.75% up-front sales charge (Class A shares) and 1.0% up-front charge for Class C shares, on top expense ratios of 0.73% and 1.28%, respectively, that place the fund in the second quartile and third-quartile of expense ratios within a universe of municipal bond funds. Institutional investors benefit from a more favorable 0.48% expense ratio but this still places the fund in the second quartile across a universe of institutional municipal funds.

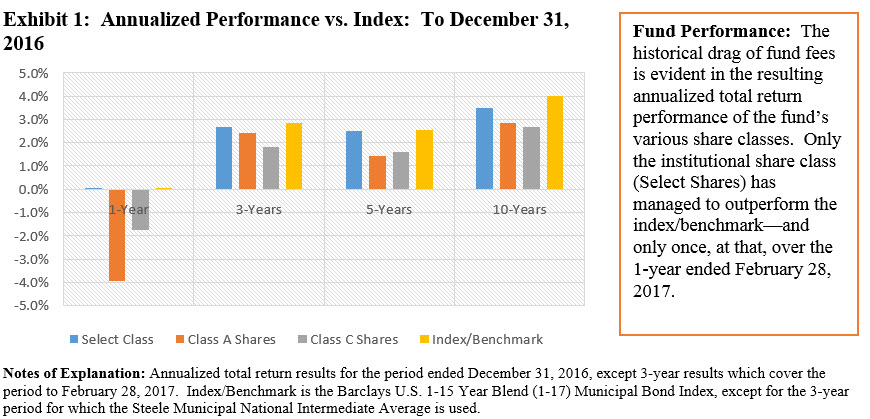

While it’s premature to evaluate the fund’s performance based on its newly adopted ESG oriented strategy, the potential drag of fund fees can be gleaned from the results achieved by the fund’s historical annualized total return performance across the fund’s various share classes. Only the institutional share class (Select Shares) has managed to outperform the index/benchmark—and only once at that over the 1-year ended February 28, 2017.

On the positive side, the fund’s asset base, provided its current investors stay put, means no start-up risks provided a smooth transition is executed to the new strategy.

Analysis

This $271.1 million fund (as of February 28, 2017) with 3 share classes (A, C and Select) and an original launch date in 1993 is managed by J.P. Morgan Investment Management Inc., one of the top 10 asset managers worldwide, under the guidance of two portfolio managers who have managed the fund since 2006. The fund invests in a portfolio of municipal bonds, including municipal mortgage-backed and asset-backed securities. While current income is the fund’s primary focus, it seeks to produce income in a manner consistent with the preservation of principal. Under normal circumstances, the fund invests at least 80% of its assets in municipal bonds, the income from which is exempt from federal income tax.

The fund’s current average weighted credit quality, at single A, is upper medium grade. Its average maturity can range from three to 15 years, but the fund’s average weighted maturity is currently at 5.13

years while its average duration is 4.75. The fund’s turnover rate was 22%, 12-month yield stood at 2.74% while total return performance, net of expenses, largely lagged the fund’s designated benchmark. See Exhibit 1.

The fund invests the majority of its assets in securities whose use of proceeds provide positive social or environmental benefits. In order to identify and invest in bonds that provide positive social or environmental benefits, the adviser determines and assesses each bond’s intended use of proceeds. J.P. Morgan will generally view bonds that finance affordable housing, healthcare, municipal water & sewer, education, mass transit, not for profits and issuer designated green bonds as promoting positive social or environmental benefits. In addition to the uses of proceeds, the adviser may identify additional uses of bond proceeds that it believes will provide positive social or environmental benefits and may invest in such bonds as part of the fund’s investment strategy. The use of proceeds determination for securities purchased by the fund will be made at the time of purchase. If the use of proceeds of a security changes after the time of purchase so as to no longer provide positive social and/or environmental benefits, the fund may continue to hold the security.

As for the fund’s fees, the up-front sales charges noted above are high enough. On top of these, retail investors are subject to expense ratios that fall outside the lowest end of the range and rank in the second and third quartiles within a universe of national municipal bond funds and share classes. Institutional investors purchasing Select shares, on the other hand, are not exposed to any up-front sales charges, however the fund’s expense ratio falls into second quartile, but still lower than the median expense ratio, within a universe of institutional national municipal funds.[1].

While first quartile expense ratios are preferred, the fund’s placement in the second quartile should not be the basis for rejecting the fund out of hand. Yet when combined with the additional considerations outlined above, including transparency and track record, it’s difficult to advocate for this fund at this time either as a stand-alone investment or in combination with other funds that make up an ESG portfolio.

Bottom Line

Low Conviction. The fund was recently rebranded and it now invests the majority of its assets in securities whose use of proceeds is intended to provide positive social or environmental benefits. That said, the fund’s prospectus does not elaborate on the adviser’s methodology for evaluating the eligibility of securities based on use of proceeds beyond the enumeration of qualifying bond categories. The fund’s historical total return performance, which does not as yet extend to the fund’s newly adopted strategy, has generally failed to exceed the selected securities benchmark over the last 1, 3, 5 and 10 year time intervals. At the same time, fund expenses for retail shares, combining both up-front sales charges and expense ratios applicable to Class A and C shares are high. Expenses are more tolerable for the institutional Select shares were it not for the transparency and historical performance issues that’s don’t as yet reflect the adoption of the fund’s ESG oriented strategy.

[1] The analysis is based on a universe of 621 retail oriented ESG and non-ESG municipal bond funds/share classes, including investment grade and non-investment grade and 131institutional funds/share classes as of February 28, 2017.