The Bottom Line: Green bond fund investors tested by sharp 12-month performance declines in a difficult environment as markets priced in higher interest rate increases.

June Commentary

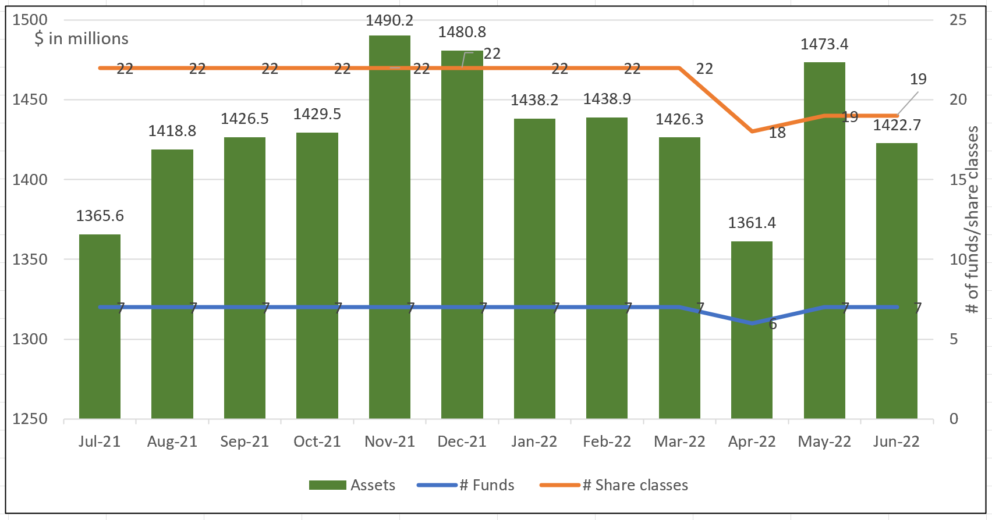

- The assets of dedicated green bond funds, a segment consisting of seven active and passively managed mutual funds as well as ETFs, declined by $50.7 million in June, a month-over-month drop of 3.4%, to end the first six months of the year at $1.4 billion in assets. Refer to Chart 1. This was the fourth monthly decline in the six months since the start of the year. Capital depreciation in June combined with net outflows accounted for the decline, with outflows registering about $17 million. This was almost entirely attributable to institutional redemptions from the Calvert Green Bond Fund I (CGBIX) in the amount of about $21.2 million while the recently rebranded Franklin Municipal Green Bond ETF (FLMB) added $5.7 million¹.

- Against a backdrop of declines in government and corporate bond values as markets moved to price in significant further increases in interest rates on top of what has already been announced, green bond funds posted an average drop of 2.49% versus -1.57% recorded by the Bloomberg US Aggregate Bond Index². Returns ranged from -1.85% registered by the TIAA-CREF Green Bond Fund Institutional Shares (TGRNX) to a low of -3.82% attributable to the Mirova Global Green Bond Fund A (MGGAX) that was likely impacted by the rising value of the US dollar. Year-to-date and trailing twelve-month results also suffered significant declines, with green bond fund averages dropping 11.60% and 11.96%, respectively. Refer to Table 1.

- Green bond issuance in June ticked up to $47 billion but trailed the $56.3 billion recorded in June 2021, according to preliminary data from the Climate Bond Initiative. Year-to-date, preliminary issuance stood at $218.1 billion versus $243.8 billion during the first six months of the prior year. Refer to Chart 2.

- At the end of June, the International Capital Markets Association (ICMA) announced new and updated publications and resources to help stakeholders and capital market participants navigate the framework of sustainable finance, including new definitions for green securitization, an updated registry of key performance indicators for sustainability-linked bonds, a new registry containing methodologies for climate transition finance, new metrics for reporting of both green and social projects to assess the impact on the environment and natural resources and the impact on certain social indicators and target populations, respectively, and enable improved disclosures regarding such projects, updated guidelines for external reviews of bonds issued under the Green Bond Principles (GBP), guidance for providers of green, social and sustainability bond index services, and updated mapping to the United Nations’ Sustainable Development Goals, tying the GBP to global ESG goals.

¹Franklin Templeton rebranded the Franklin Liberty Federal Tax-Free ETF as of May 3rd and shifted $101.9 million into the renamed Franklin Municipal Green Bond ETF (FMLB) as well as the green bonds segment.

²Results are the same whether the Franklin Municipal Green Bond ETF is included or excluded.

Chart 1: Green bond mutual funds and ETFs and assets under management: July 2021 – June 30, 2022 Notes of Explanation: Franklin Municipal Green Bond Fund and its four share classes with total net assets of $9.7 million included in the data as of April 2022. At the same time, the rebranded Franklin Liberty Federal Tax-Free Bond ETF renamed the Franklin Municipal Green Bond ETF is excluded as of April 29, 2022. Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Notes of Explanation: Franklin Municipal Green Bond Fund and its four share classes with total net assets of $9.7 million included in the data as of April 2022. At the same time, the rebranded Franklin Liberty Federal Tax-Free Bond ETF renamed the Franklin Municipal Green Bond ETF is excluded as of April 29, 2022. Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

Chart 2: Issuance of green bonds: January 1, 2021 – June 30, 2022 Notes of Explanation: Volumes data varies by data source and may be preliminary. Source: Climate Bond Initiative (CBI)

Notes of Explanation: Volumes data varies by data source and may be preliminary. Source: Climate Bond Initiative (CBI)

Table 1: Green bond funds: Performance results, expense ratios and AUM-June 30, 2022

Name |

Symbol | 1-Month Return (%) | 3-Month Return (%) | 12-Month Return (%) | 3-Year Average Return (%) | 5-Year Average Return (%) |

$Assets (millions) |

Expense Ratio (%) |

Calvert Green Bond A* | CGAFX | -2.43 | -5.63 | -11.57 | -1.55 | 0.39 | 0.73 | 74.6 |

Calvert Green Bond I* | CGBIX | -2.4 | -5.56 | -11.33 | -1.32 | 0.68 | 0.48 | 695.8 |

Calvert Green Bond R6* | CBGRX | -2.4 | -5.48 | -11.28 | -1.25 | 0.43 | 40.1 | |

Franklin Municipal Green Bond ETF*** | FLMB | -2.49 | -4.91 | -11.75 | -0.82 | 0.3 | 111 | |

iShares USD Green Bond ETF* | BGRN | -1.8 | -4.86 | -11.49 | -2.14 | 0.2 | 269.1 | |

Mirova Global Green Bond A* | MGGAX | -3.82 | -8.84 | -15.22 | -3.17 | -0.12 | 0.94 | 6.3 |

Mirova Global Green Bond N* | MGGNX | -3.81 | -8.81 | -14.98 | -2.89 | 0.15 | 0.64 | 4.5 |

Mirova Global Green Bond Y* | MGGYX | -3.81 | -8.82 | -15.03 | -2.93 | 0.12 | 0.69 | 28.1 |

PIMCO Climate Bond A* | PCEBX | -2.57 | -5.95 | -11.66 | 0.94 | 0.8 | ||

PIMCO Climate Bond C* | PCECX | -2.63 | -6.13 | -12.33 | 1.69 | 0 | ||

PIMCO Climate Bond I-2* | PCEPX | -2.55 | -5.88 | -11.4 | 0.64 | 0.5 | ||

PIMCO Climate Bond I-3* | PCEWX | -2.55 | -5.89 | -11.44 | 0.69 | 0.1 | ||

PIMCO Climate Bond Institutional* | PCEIX | -2.54 | -5.85 | -11.31 | 0.54 | 11 | ||

TIAA-CREF Green Bond Advisor* | TGRKX | -1.86 | -5.35 | -10.83 | -0.49 | 0.55 | 3.1 | |

TIAA-CREF Green Bond Institutional* | TGRNX | -1.85 | -5.35 | -10.81 | -0.47 | 0.45 | 72.7 | |

TIAA-CREF Green Bond Premier* | TGRLX | -1.87 | -5.38 | -10.93 | -0.6 | 0.6 | 0.9 | |

TIAA-CREF Green Bond Retail* | TGROX | -1.88 | -5.42 | -11.14 | -0.75 | 0.78 | 7.1 | |

TIAA-CREF Green Bond Retirement* | TGRMX | -1.87 | -5.38 | -10.94 | -0.6 | 0.7 | 14.4 | |

GRNB | -2.14 | -5.09 | -11.88 | -2.08 | -0.2 | 0.2 | 82.6 | |

Average/Total | -2.49 | -6.03 | -11.96 | -1.50 | 0.17 | 0.64 | 1,422.7 | |

Bloomberg US Aggregate Bond Index | -1.57 | -4.69 | -10.29 | -0.93 | 0.88

| |||

Bloomberg Global Aggregate Bond Index | -3.21 | -8.26 | -15.25 | -3.22 | -0.55 | |||

Bloomberg Municipal Total Return Index | -1.64 | -2.94 | -8.57 | -0.18 | 1.51 | |||

S&P Green Bond US Dollar Select IX | -2.23 | -5.07 | -11.84 | -1.06 | 0.82 | |||

ICE BofAML Green Bond Index Hedged US Index | -2.81 | -7.58 | -13.78 | -2.78 | 0.62 |

Notes of Explanation: Blank cells=NA. 3 and 5-year returns are average annual total returns. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. ***Performance should be compared to the Bloomberg Municipal Total Return Index. ^Effective March 1, 2022, fund shifted to US dollar green bonds. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC