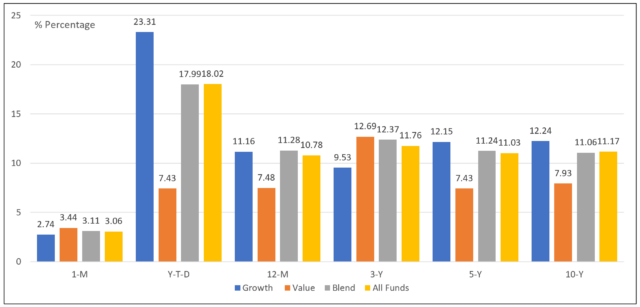

The Bottom Line: Large cap growth-oriented sustainable mutual funds as well as ETFs have largely outperformed their value-oriented counterparts over the short to long-term intervals.

Average performance of large cap sustainable mutual funds and ETFs to July 31, 2023 Notes of Explanation: Performance over 3, 5 and 10-years is annualized. Sustainable funds based on Morningstar classificaaitons. Sources: Morningstar and Sustainable Research and Analysis LLC

Notes of Explanation: Performance over 3, 5 and 10-years is annualized. Sustainable funds based on Morningstar classificaaitons. Sources: Morningstar and Sustainable Research and Analysis LLC

Observations:

- Large cap sustainable mutual funds and ETFs were up almost 3.1% in July versus a gain of 3.2% recorded by the S&P 500. Large cap value-oriented sustainable funds outperformed growth funds, adding an average of 3.4% in July as compared to 2.7%, or a differential of 70 basis points.

- That said, the outperformance of large cap value-oriented sustainable funds in July does not overcome the wide gap that has developed over the short, intermediate, and long-term relative to the performance of large cap growth-oriented sustainable funds. So far this year and over the trailing twelve months through July, the average performance of large cap growth-oriented sustainable funds has exceeded their value-oriented counterparts by 15.9% and 3.7%, respectively.

- Large cap growth-oriented sustainable funds have benefited from a heavy weighting in technology stocks, with leading funds in the category based on their trailing 12-month total return results, such as the Invesco ESG Nasdaq 100 ETF (24.9%), Clearbridge Large Cap Growth ESG ETF (22.9%), Nuveen ESG Large Cap Growth ETF (19.5%), Clearbridge All Cap Growth ESG ETF (18.8%) and Nuveen Winslow Large-Cap Growth ESG Fund R6 (17.6%), reflecting an average 46.3% exposure to the technology sector as of the latest reporting periods. During the same interval, the Nasdaq 100 Index was one of the best performing benchmarks, up 22.8%.

- Average annual returns realized by large cap growth-oriented sustainable funds retain their performance advantage over the intermediate and long-term, producing an annualized advantage over five and ten years of 3.81% and 3.1%. The only exception is the 3-year interval during which large cap value-oriented funds outperformed by 3.2%.

- Investors have the option of allocating capital to individual growth and value funds, or they can straddle both growth and value oriented large-cap sustainable funds by investing in funds that combine both factors. Blended funds mitigate the periodic variations in returns between growth and value and these funds have delivered respectable outcomes by exceeding the average performance of growth and value sustainable funds over periods ranging from 12-months to 10 years. In either case, investors should be aware that the long-term records attributed to some sustainable mutual funds, in particular, may have been achieved, in part, when the funds employed different investment strategies, and these should be examined closely. Examples include the Putnam Sustainable Leaders Fund and the Nuveen Winslow Large-Cap Growth ESG Fund.