The Bottom Line: A number of the largest ten sustainable investment funds can each serve as a sustainable investment portfolio’s anchor equity or bond position.

Notes of Explanation: Total net assets combine all share classes. For mutual funds, trailing 12-month returns apply to the largest share class. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.

Notes of Explanation: Total net assets combine all share classes. For mutual funds, trailing 12-month returns apply to the largest share class. Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Largest sustainable mutual funds and ETFs going into 2024 can serve in anchor positions

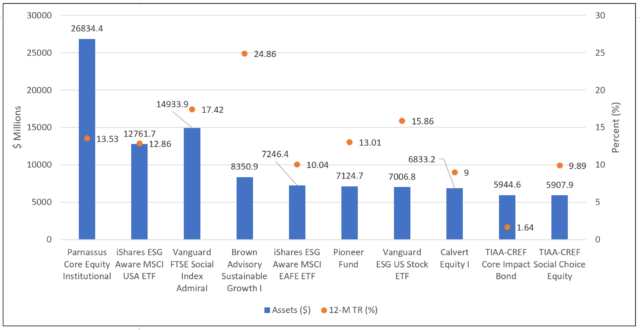

The largest sustainable mutual funds and ETFs going into 2024, based on total net assets as of November 30, 2023, include a diverse group of funds that, with one exception, can each serve as a sustainable investment portfolio’s anchor equity position or, in one other case, a fixed income investment option.

The top 10 funds manage $102.9 billion in assets, accounting for some 31% of the $326.9 billion in sustainable fund assets at the end of November 2023. They are managed by seven different firms and include domestic equity, one international fund and one fixed income fund. These funds also consist of index funds and actively managed funds as well as funds that pursue varying fundamental investing and sustainable investing approaches. Most funds have integrated a sustainable investing approach since their inception, while one fund adopted its ESG investing strategy in the last four or so years.

Largest funds are here to stay

Given their history and size, these funds are here to stay. They range from the smallest, the $5.9 billion actively managed TIAA-CREF Social Choice Equity Fund, to the largest, the $26.8 billion actively managed Parnassus Core Equity Fund. These funds posted an average gain of 12.8% over the trailing twelve months. The best performer is the Brown Advisory Sustainable Growth I Fund, up almost 24.9% versus a gain of 13.8% posted by the S&P 500 Index. At the other end of the range is the only bond fund. Bond funds experienced a difficult year, but the TIAA-CREF Core Impact Bond Fund managed to produce a 1.6% gain versus an increase of 1.2% recorded by the Bloomberg US Aggregate Bond Index.

Expense ratios vary

An important consideration in evaluating a fund is the fund’s expense ratio. These vary considerably across the largest ten funds, ranging from a low of 0.09% applicable to the passively managed Vanguard ESG US Stock ETF to a high of 1.8% covering Pioneer Fund C. Expense ratios applicable to index funds are, on average, much lower.

Sustainable investing approaches of the largest sustainable mutual funds and ETFs

Fund Name | Expense Ratio (%) | Sustainable Investing Approach/Strategy |

Parnassus Core Equity Institutional and Investor share classes | Instl.-0.61 Investor-0.82 | ESG integration. Screening/exclusions. Environmental, social and governance factors are considered in making investment decisions. The fund applies a fossil-fuel free investment strategy. |

0.15 | ESG integration. Screening/exclusions. Emphasis on companies with higher ESG ratings, per MSCI. Exclusions apply to various companies, sectors, and activities. | |

Vanguard FTSE Social Index Fund* Admiral and Investor shares | Admiral-0.14 Investor-0.12 | Screening/exclusions. Companies are screened for certain environmental, social, and corporate governance criteria by the index provider (FTSE Russell) and excluded based on certain activities or business segments. |

Brown Advisory Sustainable Growth Fund Institutional and Investor shares | Instl.-0.64 Investor-0.79 | ESG integration. Strategic engagement with companies The advisor seeks companies that effectively implement what it calls Sustainable Business Advantages, defined as companies that use internal sustainability strategies to improve their financial position. |

0.20 | ESG integration. Screening/exclusions. Emphasis on companies with higher ESG ratings, per MSCI. Exclusions apply to various companies, sectors, and activities. | |

Pioneer Fund A, C, K, R and Y share classes^ | A-1.0 C-1.8 K-0.61 R-1.5 Y-0.61 | ESG integration. Screening/exclusions. Environmental, social and/or corporate governance are considered in selecting securities to buy and sell. Exclusions are based on certain business activities. |

0.09 | Screening/exclusions. Companies are screened for certain environmental, social, and corporate governance (ESG) criteria by the index provider (FTSE Russell) and excluded based on certain activities or business segments. | |

Calvert Equity Fund | A-0.91 Instl.-0.65 C-1.65 R6-0.59 | Sustainable investing. ESG integration. Screening/exclusions. Active engagement with issuers. Pursuant to its Calvert Principles for Sustainable Investing, the advisor seeks to invest in issuers that provide positive leadership in the areas of their operations and overall activities that are material to improving societal outcomes, including those that affect future generation; and seek to balance the needs of financial and nonfinancial stakeholders and demonstrate a commitment to the global commons, as well as the rights of individuals and communities. |

TIAA-CREF Core Impact Bond Fund | Adv.-0.43 Instl.-0.37 Prem.-0.55 Retail-0.63 Ret.-0.62 | ESG integration. Screening/exclusions. Social and environmental outcomes oriented. ESG criteria are used to evaluate corporate issuers, sovereign issuers and asset-backed securities, favoring issuers or securities that exhibit ESG leadership. Through the fund’s impact framework, the fund also provides direct exposure to issuers or projects that have the potential to have social or environmental benefits. Exclusions are based on the involvement of companies in certain business activities. |

TIAA-CREF Social Choice Equity Fund | Adv.-0.27 Instl.-0.18 Prem.-0.37 Retail-0.46 Ret.-0.43 | ESG integration. Screening/exclusions ESG criteria is considered and the advisor favors companies with leadership in ESG performance relative to peers. Exclusions are based on certain business activities. |

Notes of Explanation: Sustainable investment approaches are extracted from each fund’s prospectus and are summarized in the table. For complete fund prospectus disclosures, refer to the fund in the SRI Funds Directory. ^Fund adopted its sustainable investing approach as of May 2019. * Refers to an index fund. #Fund is not considered an anchor equity position in a sustainable portfolio. Sources: Morningstar Direct, Sustainable Research and Analysis LLC.