The Bottom Line: After 133 funds launched last year, 2022 promises growth for sustainable investing. New funds expand investor options, with more innovation to come.

Launches of sustainable funds will record another strong quarter and full calendar year 2021

With 10 fund launches in November, seven ETFs and three mutual funds, it looks like sustainable fund launches will record another strong quarter and full calendar year 2021. The new fund introductions in November expand for investors the menu of available sustainable investing options at varying price points while also continuing to underscore the contrasts between sustainable strategies pursued by actively managed funds, both mutual funds and ETFs, and index tracking funds. In addition to closely examining each fund’s sustainable investing strategy, investors must weigh the trade-offs between active and passive management.

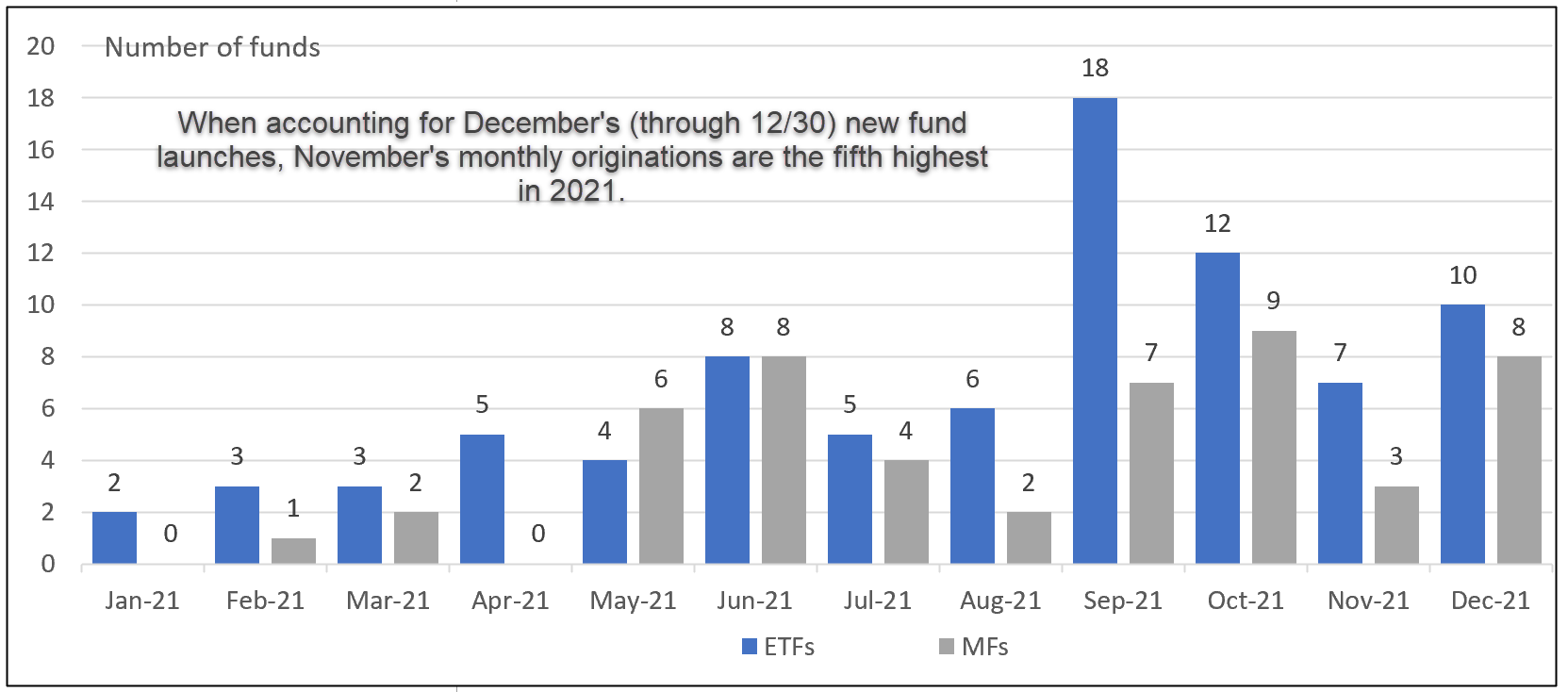

Ten new funds were launched in November; and a total of 133 funds through December 30, 2021

The combined total of 10 new fund originations in November ranks as the fourth highest in 2021, matching May’s number. November’s originations decline to the fifth highest when accounting for December’s fund launches. In the last month of the year, through December 30, 2021, another 18 funds were launched, bringing the total, excluding the addition of new share classes, to 133 funds. These consist of 83 ETFs and 50 mutual funds. Refer to Chart 1.

Chart 1: New launches of mutual funds and ETFs: January to December 30, 2021

Source: Morningstar Direct, Sustainable Research and Analysis.

Expense ratios for actively managed funds are 2.9X higher than index funds

On a combined basis, actively managed funds launched in November are 2.9X more expensive than index tracking funds.

The three newly launched mutual funds are actively managed investment vehicles subject to an average expense ratio of 70 bps. Expense ratios vary by target market and range from a low of 36 bps assessed by the institutionally directed Hartford Schroders Sustainable Core Bond Fund F (HSSFX) to a high of 106 bps charged by a different share class of the same fund, the Hartford Schroders Sustainable Core Bond Fund R3 (HSACX).

In contrast, the newly launched ETFs, which combine both passive and actively managed funds, levy an average expense ratio of 40 bps. These range from a low of 20 bps charged by the passively managed Invesco ESG S&P 500 Equal Weight ETF (RSPE) to a high of 76 bps charged by the actively managed OneAscent Large Cap Core ETF that employs a values-based exclusionary approach. When evaluated further, index tracking ETFs are charging an average of 21 bps versus an average expense ratio of 65 bps by the actively managed ETFs—fees that are in line with actively managed mutual funds.

Some new funds expand the range of sustainable investing options for investors

Three funds in particular expand the range of sustainable investing approaches available to investors. These include:

Invesco ESG S&P 500 Equal Weight ETF (RSPE). There are at least 3 ETFs that offer exposure to the S&P 500 ESG Index, a market-cap weighted benchmark that tracks the performance of large cap companies qualified by S&P Global’s ESG criteria. RSPE, however, is the first ETF to offer exposure to the same large cap companies qualified by S&P Global’s ESG scoring methodology that are equally weighted. The fund levies an attractive 2 bps expense ratio.

VanEck Green Metals ETF (GMET). This is a thematic index tracking fund that invests in companies involved in the production, refining, processing and recycling of green metals, including certain rare earth and strategic metals, used in the applications, products and processes that enable the energy transition from fossil fuels to cleaner energy sources and technologies. That said, the name of the fund may be misconstrued by investors. Companies in the sector carry high credit risks and some are exposed to significant environmental, social and governance risks. This applies to companies within the fund’s top 10 holdings, like China Northern Rare Earth Group and Grupo Mexico SAB, for example, that make up about 10% of portfolio assets as of November 30th.

Schwab Ariel ESG ETF (SAEF). This actively managed fund gives investors exposure to the investment management skills of Ariel Investments. Sub advised by Ariel, the fund invests in small and mid-capitalization companies in the Russell 2,500 Index pursuant to an investment management process that integrates ESG factors and excludes certain companies from the portfolio, such as tobacco, fossil fuels, etc., based on a 50% or greater revenue test.

New funds underscore the difference between ESG Integration and ESG Screening

Broad investment mandates aside, November’s new fund offerings are differentiated based on the pursuit of three distinct sustainable investing approaches.

The first involves index tracking funds based on conventional benchmarks that are further qualified using negative ESG screening and exclusions. Typically, securities are mechanistically excluded based on various criteria such as severe controversies, values-based considerations, alignment with United Nations Global Compact principles in areas such as human rights, labor, the environment and anti-corruption, or the failure to achieve a minimum ESG score as determined by the ESG index and scoring provider.

The second involves actively managed funds that have adopted an ESG Integration approach, defined as the systematic and explicit inclusion of material ESG factors into investment analysis and investment decisions. In this way, ESG factors are used as part of the investment analysis when considering securities to inform the portfolio construction decisions; and they form part of the wider analysis of a stock’s valuation or a bond’s credit analysis. The investment advisor may rely on proprietary in-house ESG research, or this may be supplemented by external third-party ESG information providers to source information for the implementation of its ESG framework. On top of that, some sectors or companies may be excluded. In addition, the fund’s advisor may engage with current or potential investees to gain insight and/or influence (or identify the need to influence) involving ESG practices and/or improve ESG disclosure, to the extent possible.

Lastly, one actively managed fund pursues a values-based screening approach while another fund, an index tracker, pursues a thematic orientation by investing in companies that enable the energy transition from fossil fuels to cleaner energy sources and technologies. That said, the fund does not qualify eligible firms based on ESG considerations.

In addition to closely examining each fund’s sustainable investing strategy, investors must weigh the trade-offs between active and passive management

- Newly launched funds lack an explicit track record and may not come out of the gate with a desirable minimum of $50 million in assets under management. Except for one fund, the RBC BlueBay Core Plus Bond Fund at $50 million, none of the other newly launched funds in November reached this threshold as of November 30th. Another fund, the OneAscent Large Cap Core ETF is just shy of that level at $49.8 million.

- Actively managed funds will appeal to sustainable investors drawn to an ESG integration approach rather than an ESG screening methodology, however, actively managed funds are not only costlier, but they tend to underperform relative to their benchmarks. For example, 93.8% of all domestic U.S. equity funds underperformed their respective benchmarks for the 20-year period ended June 30, 202, according to S&P Global research.

- Passively managed funds are cost effective, but investors are bound by the mechanistic rules based frameworks to portfolio construction based on ESG ratings and scores provided by a single firm. The meaning of ESG ratings and the methodology for arriving at these vary from one rating firm to another. More importantly, the views expressed by these ratings and their resultant impact on portfolios may no align entirely with an investor’s sustainability preferences. A careful review of the construction of sustainable indices should precede any decision to invest.

Table 1: Sustainable funds launched in November and their sustainable investment strategies

Fund Name/Symbol | Investment Adviser | AUM ($M) | ER (%) | Broad Inv. Mandate & Sustainable Investment Strategy |

Hartford Schroders Sustainable Core Bond (HSSFX, HSAEX, HSACX, HSSBX, HSADX) | Hartford Funds Management Company, LLC./Schroder Investment Management North America Inc. | 0.0 | 0.36-1.06 | Actively managed intermediate core bond: ESG Integration-Mixed |

Impact Shares MSCI Global Climate Select ETF (NTZO) | Impact Shares Corp. | 2.0 | 0.30 | Index tracking world large stock blend: ESG screening |

Invesco ESG S&P 500 Equal Weight ETF (RSPE) | Invesco Capital Management LLC | 4.8 | 0.2 | Index tracking large blend equity: ESG Screening |

iShares ESG Advanced Inv Grade Corp Bd ETF (ELQD) | BlackRock Fund Advisors | 19.8 | 0.18 | Index tracking corporate bond: ESG Screening |

iShares ESG MSCI USA Min Vol Factor ETF (ESMV) | BlackRock Fund Advisors | 4.9 | 0.18 | Index tracking large blend: ESG Screening |

OneAscent Large Cap Core ETF (OALC) | OneAscent Investment Solutions | 49.8 | 0.76 | Actively managed large blend: Values based screening |

RBC BlueBay Core Plus Bond Fund (RCPAX, RCPIX, RCPRX) | RBC Global Asset Management (U.S.) Inc./ BlueBay Asset Management LLP | 50 | 0.4 -0.45 | Actively managed intermediate core bond: ESG Integration-Mixed |

RBC BlueBay Strategic Income Fund (RBIAX, RBSIX, RBSRX) | RBC Global Asset Management (U.S.) Inc./ BlueBay Asset Management LLP | 49.7 | 0.58 – 0.63 | Actively managed intermediate investment grade + high yield: ESG Integration-Mixed |

Schwab Ariel ESG ETF (SAEF)^ | Charles Schwab Investment Management/Ariel Investments LLC | 7.7 | 0.59 | Actively managed small and midcap blend: ESG Integration |

VanEck Green Metals ETF (GMET) | Van Eck Associates Corp. | 3.4 | 0.59 | Actively managed natural resources: Thematic |

Notes of Explanation: ER=Expense ratio. For mutual funds, expense ratios for the various share classes displayed as a range. ^AUM is as of December 29, 2021. Data sources: Morningstar Direct and Sustainable Research and Analysis.

Sustainable Investment strategies definitions

Values based screening – A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment. For example, excluding companies involved in abortion, production of addictive products, including adult entertainment, pornography, gambling and tobacco, predatory lending practices, human rights violations, etc.

ESG Integration – The investment adviser assesses a company’s environmental, social and governance profile by conducting ESG research and leveraging engagement when appropriate through dialogue with company management teams as part of its fundamental due diligence process. The adviser views ESG characteristics as material to fundamentals and seeks to understand their impact on companies in which the fund may invest. Proactive proxy voting may also be employed.

ESG Integration-Mixed – The broadest form of ESG Integration. In addition to employing an ESG Integration approach as described above, the fund may also incorporate values-based screening as well as broader-based exclusions. Thematic elements may also apply. The investment adviser may also engage in active dialogues with company management teams to further inform investment decision-making and to foster best corporate governance practices using its fundamental and ESG analysis.

(Note: There is a distinction between engagement when appropriate through dialogue with company management teams as part of an adviser’s fundamental due diligence process and engagement as an active owner on environmental, social and governance issues. Same applies to proxy voting and filing or co-filing shareholder proposals).

ESG Screening – The fund employs a rules based approach by which securities are mechanistically excluded based on various criteria such as severe controversies, values-based considerations, alignment with United Nations Global Compact principles in areas such as human rights, labor, the environment and anti-corruption, or the failure to achieve a minimum ESG score as determined by an ESG rating or scoring provider.

ESG Integration – Consideration – As part of the research process, portfolio management may consider financially material environmental, social and governance factors. Such factors, alongside other relevant factors, may be considered in the fund’s securities selection process.

Thematic – An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.