The Bottom Line: Assets of green bond funds end March 2021 at another high of $1.3 billion; green bonds bounced back to $163.1 in Q1.

Assets of green bond funds gain $47.8 million to end March 2021 at another high of $1.3 billion

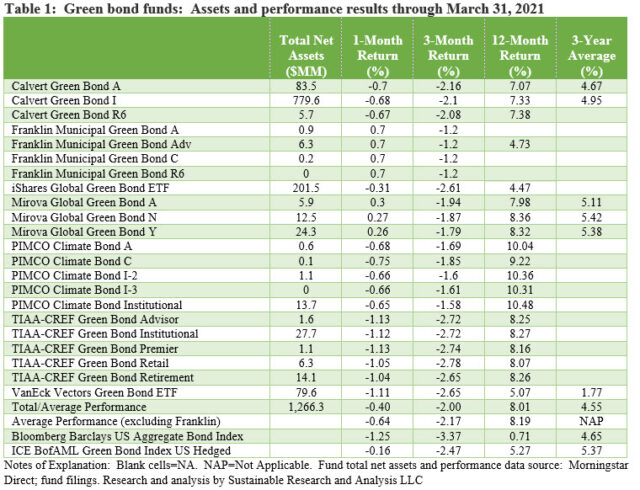

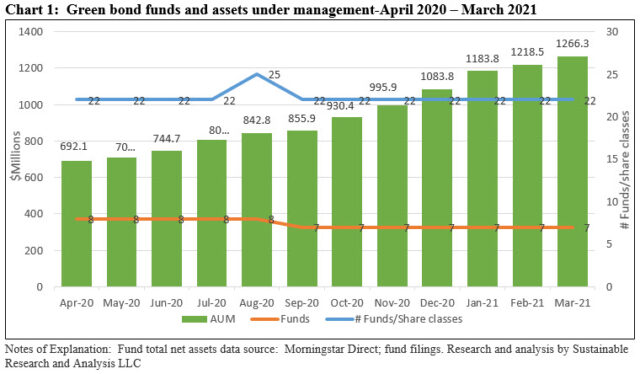

Assets of green bond funds in the US reached $1,266.3 million at the end of March 2021, adding $47.8 million in net assets or a month-over-month increase of 4%. Year-to-date, the seven green bond funds offering 22 share classes were up $182.5 billion, from $1,083.8 at the end of 2020. Refer to Chart 1.

-

-

- The top 3 green bond funds include the oldest and largest Calvert Green Bond Fund, for a total of $1.1 billion, or 91% of the segment’s total net assets.

- The same three funds accounted for 96% of the month-over-month net assets increase with the addition by the Calvert Green Bond Fund of $28.2 million, $13.0 million by iShares Global Green Bond ETF and $4.5 million by the VanEck Vectors Green Bond ETF.

- Fund assets continue to be dominated by institutional investors.

-

Green bond funds, on average, outperformed the Bloomberg Barclays US Aggregate Bond Index but lagged the ICE BofAML Green Bond Index US Hedged

Whereas short-term interest rates declined by one basis point in March, 10-year Treasury yields moved from 1.44% at the end of February to 1.74% at the end of March. For the quarter, 10-year Treasury yields surged by 81 bps from 0.93% as reopening economies and robust fiscal stimulus fueled growth expectations and inflation concerns. Refer to Table 1.

Against this backdrop, green bond funds, on average, outperformed the Bloomberg Barclays US Aggregate Bond Index but lagged the ICE BofAML Green Bond Index US Hedged ICE BofAML). Green bond funds posted an average return of -40 basis points (bps), including the results of the better than average Franklin Municipal Green Bond Fund. Excluding Franklin’s four share classes, green bond funds dropped 64 bps. At the same time, the ICE BofAML posted a decline of -16 bps and exceeded the average performance of green bond funds in March. That said, green bond funds, on average, outperformed both indices for the first quarter and trailing 12-month period.

The average performance of the three funds in operation for the trailing three year interval beat the conventional Bloomberg Barclays US Aggregate Bond Index, but failed to outperform the narrower-based green bond ICE BofAML index.

-

- The Franklin Municipal Green Bond Fund led in March with a total return of 0.7%. The fund invests predominantly in municipal green bonds issued by municipalities that intend to use bond proceeds for projects and programs that promote environmental sustainability. Municipal obligations were up 62 bps in March, based on the Bloomberg Barclays Municipal Total Return Bond Index.

- Excluding Franklin, the leading green fund was Mirova Global Green Bond Fund. Each of the fund’s three share classes also posted positive results ranging from 3 bps to 27 bps.

- The TIAA-CREF Green Bond Fund Advisor and Premier shares brought up the rear in March, recording declines of -1.13%, each.

Sustainable debt market, including green bonds, added $378.2 billion in first quarter

The sustainable debt market, including green bonds, social bonds, sustainability bonds, and sustainability linked bonds, experienced a strong first quarter in 2021 as volumes reached $378.2 billion. Green bonds and loans, combined, accounted for $163.1 billion or 43% of the total. This compares to $269.5 billion issued during the entire 2020 calendar year. After a temporary reversal due to the Covid-19 crisis in 2020, green bond issuance rebounded in the first quarter with sovereign issuers making up a large part of the new issuance.

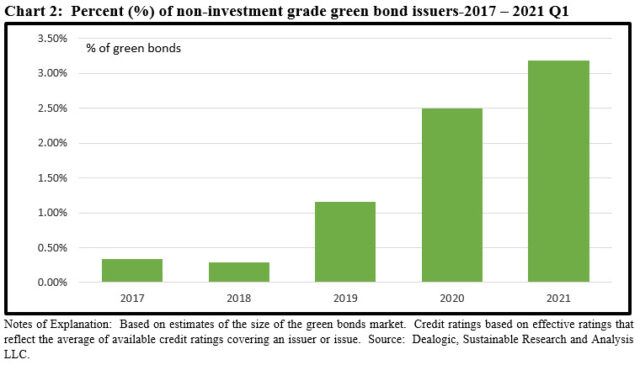

Most green bonds are issued by investment grade issuers or carry investment grade ratings at the time of issue. In recent years, however, there has been an uptick in non-investment grade green bond issuance. In the first quarter, an estimated 3.2% of green bonds by deal value carried non-investment grade ratings. This is up from 1.2% in 2019 and 2.5% in 2020. Refer to Chart 2.

Some of the non-investment grade issuers in Q1 2021 include: Vía Célere, a developer specializing in the development, investment and management of homes in Spain, Public Power Company (PPC), a Greece-based power company funding its energy transition, Faurecia, a global automobile supplier and Luxembourg-based ArdaghGroup S.A., a leading global supplier of sustainable beverage cans that issued a green bond through Ardagh Metal Packaging S.A. and its wholly-owned subsidiaries.

While green bonds have been issued since 2007, the first non-investment grade green bond was issued in 2014 by Abengoa S.A., a Spain-based renewable energy company that was rated B-. The company filed for bankruptcy in 2016. The next high yield green bond was not issued until 2017.

In addition to Abengoa’s default, reasons cited for the muted issuance of high yield green bonds include the difficulty in obtaining information from some high yield issuers regarding their climate risks and climate mitigation activities, incremental costs of issuing green bonds to cover tracking and additional reporting as well as the increment cost of securing on a voluntary basis an independent second party opinion.

That said, the reasons for the uptick in recent years and the likelihood that non-investment grade issuance, including green and sustainable bonds, is likely to gain traction are, as follows:

-

- The imposition of European Union climate disclosure requirements and the possibility that this may also be required in the US via SEC actions.

- Growth in assets under management sourced to sustainable investing strategies.

- Strong demand for ESG oriented bonds generally and green bonds as well as social bonds in particular.

- Appetite for higher yielding securities in a low rate environment and the opportunity to diversify ESG portfolio assets across corporate issuers.