The Bottom Line: Green bond funds added $35.9 million in assets to $1,324.7 million in May 2021 while recording an average return gain of 0.29%.

Summary

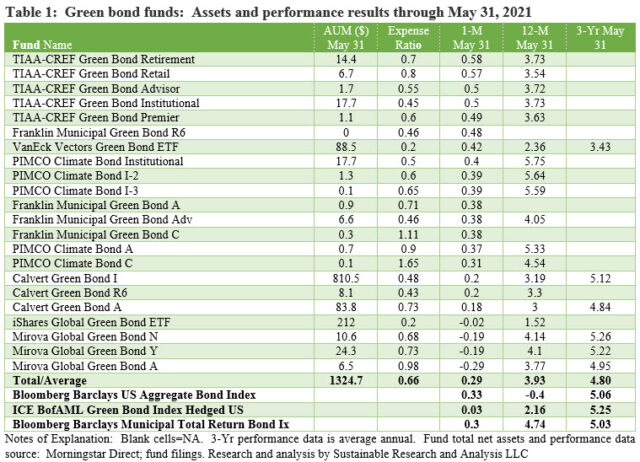

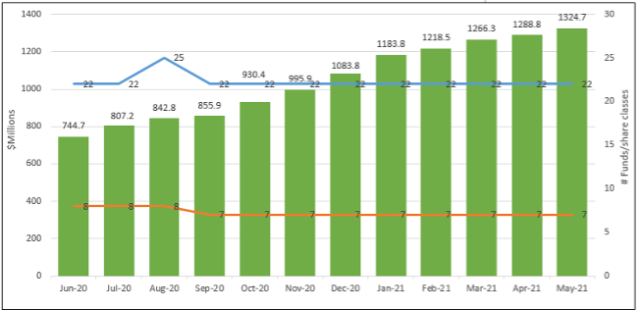

Green bond funds added $35.9 million in assets during the month of May 2021, ending the month at $1,324.7 billion. This represents a gain of 3% relative to last month’s $22.5 million increase or 2%. The seven funds that comprise the green bonds segment recorded an average total return gain of 0.29% in May, lagging the broad intermediate investment-grade market but beating the ICE BofAML Green Bond Index Hedged US by 26 bps. For the trailing twelve months, the segment has registered an average gain of 3.93% versus -0.4% for the Bloomberg Barclays US Aggregate Bond Index and 2.16% for the narrower green bond benchmark.

Net Assets Comment

-

- The $35.9 million gain in May propelled the green bond funds segment to another new month-end high of $1,324.7 million. This represents the 14th consecutive monthly gain in net assets. Refer to Chart 1.

- May’s net gain was almost entirely attributable to net new cash realized by the Calvert Bond Fund ($32.1 million), almost entirely via its institutional share class I, as well as the VanEck Vectors Green Bond ETF that added a net of $4.3 million.

Chart 1: Green bond funds and assets under management-June 30, 2020 – May 31, 2021

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC

Performance Comment

-

- Four funds and 14 share classes outperformed the Bloomberg Barclays US Aggregate Bond Index. These funds included the Franklin Municipal Green Bond Fund R6 that also eclipsed the performance of the Bloomberg Barclays Municipal Total Return Bond Index. Refer to Table 1.

- TIAA-CREF Green Bond Retirement Fund posted the best May return at 0.58% while the four other share classes came in right behind. The fund’s trailing three year results lags behind the conventional intermediate investment-grade benchmark.

- IShares Global Green Bond ETF and each of the three share classes that comprise the Mirova Green Bond Fund generated negative returns in May.

Expense Ratio Comment

-

- The VanEck Vectors Green Bond ETF and iShares Global Green Bond ETF are the lowest cost providers, each charging 2c0 bps. But so far the PIMCO Climate Bond Fund, which imposes an expense ratio ranging between 0.5% and a high 0.9% for class A shares, has outperformed over the trailing 12-months.