The Bottom Line: Article on building sustainable investment products published in connection with webinar conducted on April 14, 2020 by Steve Schoepke and Henry Shilling.

Introduction and summary

As interest in sustainable investing continues to rise, judging by the growth in fund firms, sustainable fund investment products and assets under management that as of March 31, 2020 exceeds $2 trillion, investment managers are examining ways to enter the market with mutual fund and/or ETF product offerings. There are a number of methods for building sustainable investment products, management expertise, research capabilities, and a corporate image and reputation, but each comes with pros and cons. We outline five of the more common methods and their implementation trade-offs, and offer some recent examples that are further described in Appendix 1.

The demand for sustainable investment fund management product and expertise is projected to expand further (currently only 179 of 851 firms or 21% offer sustainable fund products). In the process an increase is anticipated in the number of management companies exploring ways to build out their sustainable capabilities. The increased interest is likely to emerge from both companies with no established sustainable investment capabilities as well as those already in the business. As more managers explore ways to strengthen their sustainable investment management capabilities, most will rely upon the methods or some combination of those outlined in this article, including a “one-off” start up, sub-advisor managed investment product, affinity relationship, mergers and acquisitions and re-branding of existing products.

The method by which individual managers choose to establish their sustainable management qualifications is expected to be highly individualized, reflecting the unique nature of each organization. As such, there is no way to predict which methods will predominate for individual management companies. For those investing in a manager’s sustainable investment products, however, the method used to establish their capabilities can be expected to increasingly be a point of selection and oversight focus. Given this, investment managers utilizing any one of the methods described below, should consider the longer-term due diligence implications.

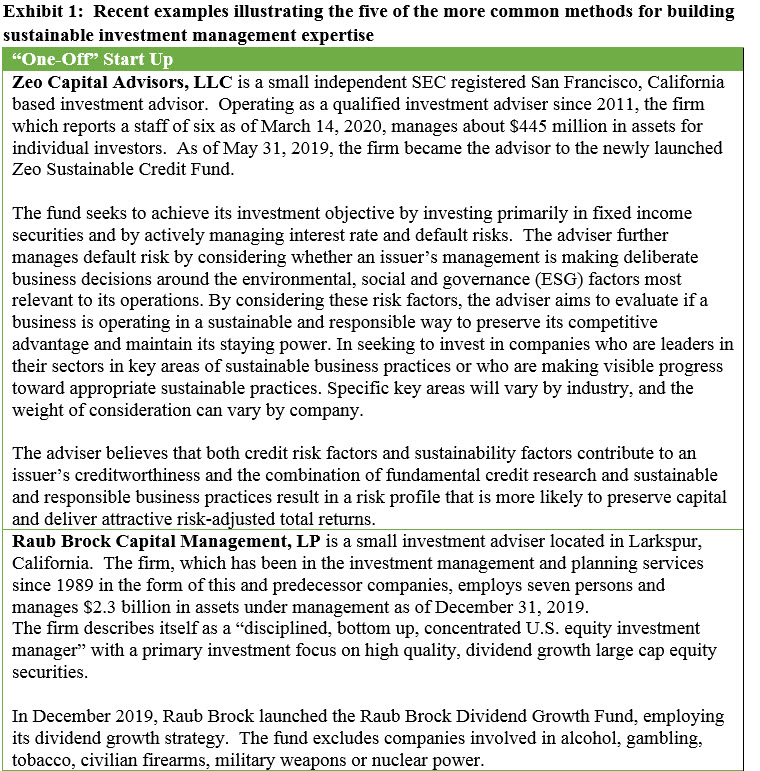

“One-Off” Start Up

This method of developing a fund company’s sustainable investment expertise, management capabilities and fund products is not only relatively costly, but in some respects the most risky. Essentially it involves a company with no prior experience or track record with sustainable investment management or funds, starting from scratch to build their capabilities.

Pros:

• The development of customized and possibly unique sustainable investment processes that more closely reflect existing in-house investment management strengths.

• The implementation of a closer and cleaner fit with the management company’s overall corporate “culture.”

• Greater flexibility to design and implement more specialized sustainability products.

Cons:

• Longer and more uncertain lead-times and associated costs.

• Lack of a performance track record as well as a record of proven sustainable investment experience.

• “New comer” image and experience issues, combined with lack of presence, especially among established sustainable fund competition.

Recent examples:

• Zeo Sustainable Credit Fund

• Raub Brock Dividend Growth Institutional Fund

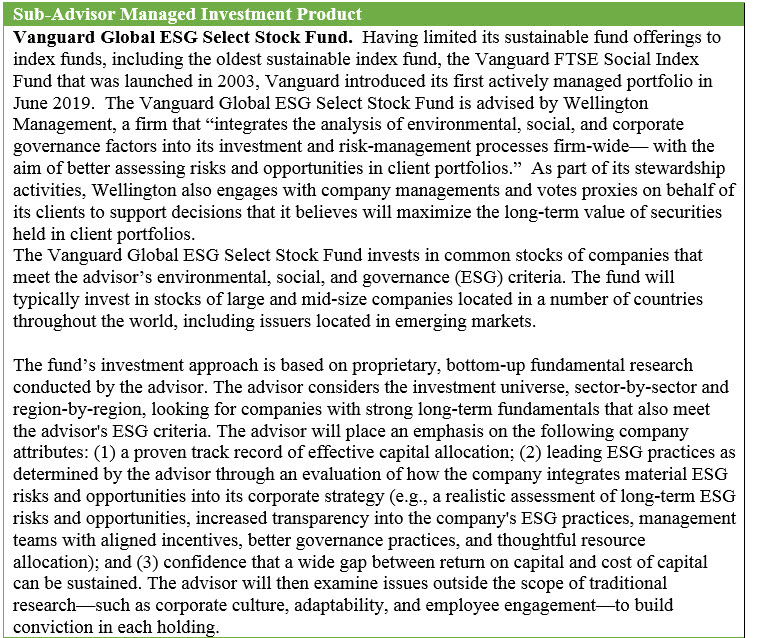

Sub-Advisor Managed Product

In this method, a fund management company, typically but not always acting as the advisor, selects and hires another manager to serve as an advisor or sub-advisor to a fund. The fund firm contracts with the advisor or sub-advisor to manage the fund’s portfolio according to a selected benchmark and investment policy guidelines. In this case, the mandate would be to provide specific sustainable investment expertise. Conversely, a firm may enter the market by offering its services as a sub-advisor.

Pros:

• An experienced and proven management team and process that can be quickly operationalized.

• Minimal development costs and less need for in-house sustainable investment expertise.

• Heightened flexibility when adding or closing selected sustainable investment products, especially in response to quickly changing market demands.

Cons:

• Higher overall fund expense ratios, in many cases, due to added advisor or sub-advisor management fees.

• Less ability to fine-tune the investment management approach than if the fund is internally managed. This can, however, vary by relationship.

• Added difficulties when a sub-advisor must be changed for any reason. A comparable replacement may not be available.

Recent examples:

• Vanguard: Vanguard Global ESG Select

• TrueMark ESG Active Opportunities ETF

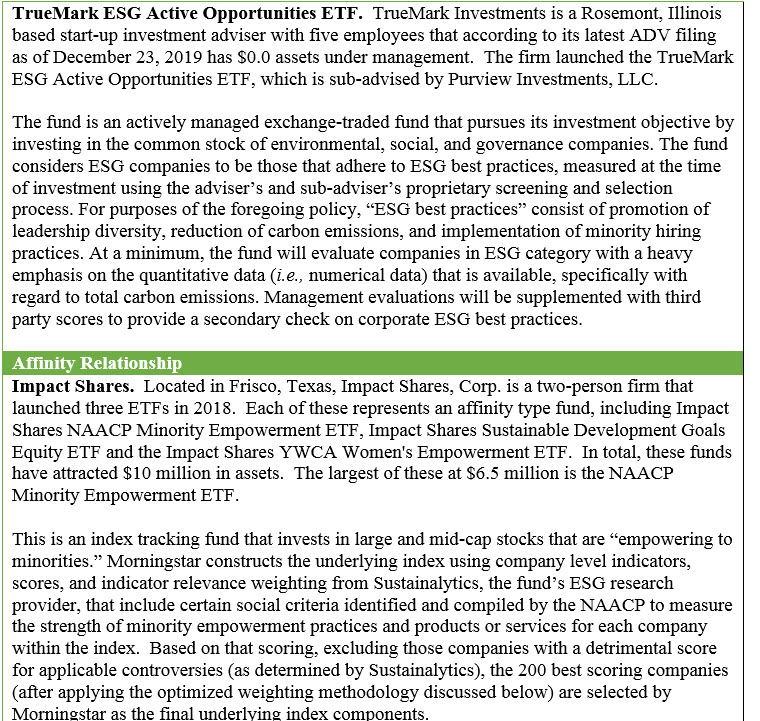

Affinity Relationship

This is similar to entering the market through a sub-advisory relationship in terms of some of the

pros and cons but rather than retaining a sub-adviser, the management firm secures high profile

branding rights to an organization name or theme that is, in turn, transformed into an index-

tracking or actively managed product offering.

Pros:

• Out of the gate name recognition, trust factor and halo effects associated with the adopted

brand name or theme.

• Identifiable base of potential investors and possibly marketing support from branding

organization.

Cons:

• Product success or failure linked to the reputation of branding partner.

• Contract terms and conditions, including licensing fees, may be subject to renegotiation.

• Longer and more uncertain lead-time, lack of performance track record and expertise.

Recent example:

• Impact Shares NAACP Minority Empowerment ETF

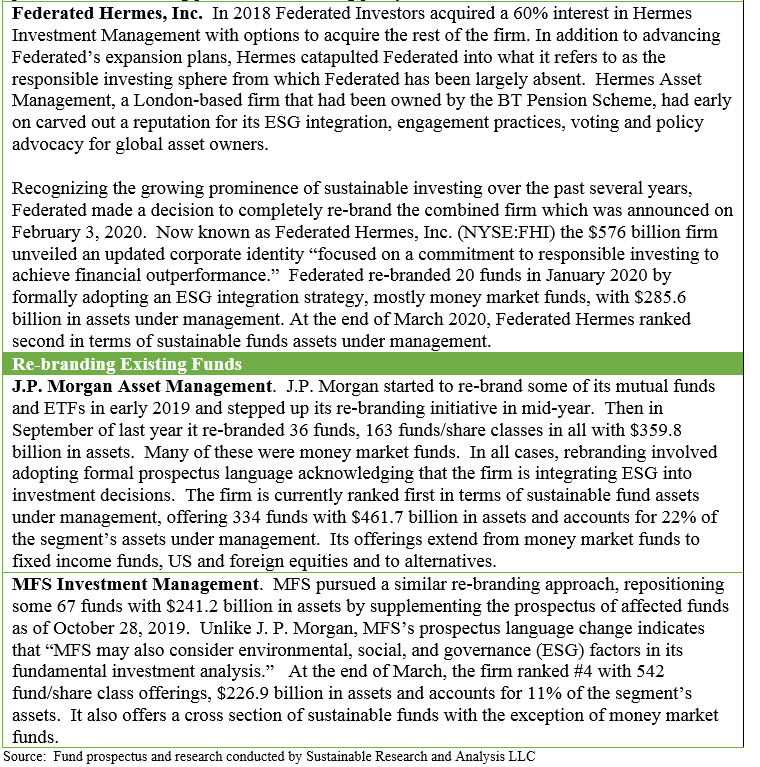

Re-branding Existing Funds

Using this method, an investment management company typically converts the investment process policies for one or more of their existing funds to meet sustainable investment guidelines or restrictions by formally amending the mutual fund or ETF’s prospectus accordingly. Most often to-date such policy changes involved the adoption of an ESG integration approach.

Pros:

• Low or no development costs especially related to re-defining a fund’s investment approach.

• Retention of investment performance track record.

• Quickly attaining product scale, an established shareholder base and market presence with limited barriers to entry.

• Minimal disruptions for the fund’s current shareholders and distribution network. This approach avoids negative tax implications for shareholders and “ease” of transition for distributors.

Cons:

• Limited flexibility when building a unique sustainable market identity and presence.

• Fewer investment process possibilities, especially in the short-term.

• Difficulties when reconciling pre- and post-rebranding performance records.

• Accusations of “green-washing.”

Recent examples:

• J.P. Morgan Asset Management

• MFS Investment Management

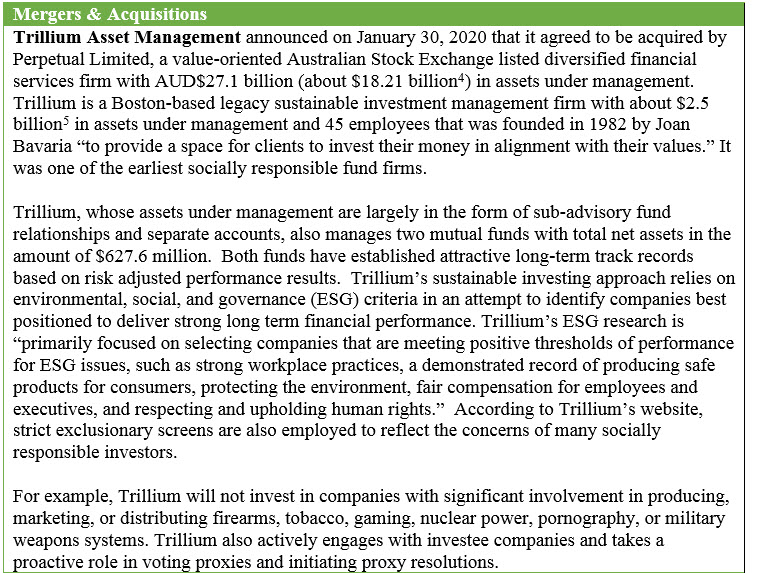

Mergers and Acquisitions

This method is not uncommon in the fund industry. However, at the current stage of the sustainable investment segment’s maturity, it is used to acquire specialized management capabilities and reputational capital. As might be expected, the acquiring firms are often larger fund management companies.

Pros:

• Lower development costs and lead-time to establish sustainable investment capabilities.

• Quickly establishing a proven performance track record, while simultaneously ‘leveling’ the competitive landscape.

• A more precise and tested staffing of the sustainable investment management team, and less trial-time before activating.

Cons:

• High acquisition cost(s) and added uncertainty as to whether a deal will go forward, leading to potential reputational exposure.

• Heightened level of risk when matching corporate cultures of fund management companies – the possibility that the buyer or seller’s management teams will remain intact is a concern.

• High public visibility when negotiating and implementing the deal, possibly exposing more company details to the competitions than may be desired.

Recent examples:

• Trillium Asset Management and Perpetual Limited

• Federated Investors and Hermes Asset Management