Sustainable Funds End June at $285.9 Billion, Adding $1.9 Billion but Experiencing an Estimated $375.2 Million in Net Outflows

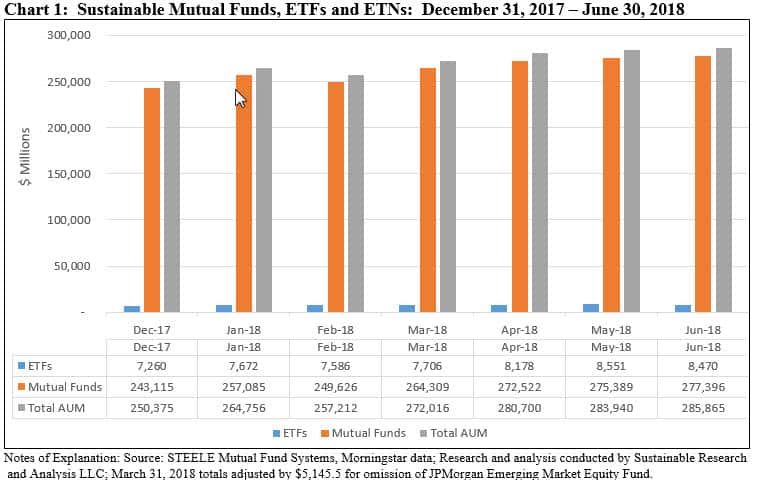

The net assets of 1,025 sustainable funds, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), ended the month of June with $285.9 billion in assets versus $283.9 billion at the end of May. Net assets recorded an increase of $1.9 billion or 0.68%, entirely sourced to repurposed funds. Since the start of the year, sustainable funds have added $35.5 billion in net assets, but much of that sum, a total of $30.9 billion, or 87%, is also attributable to repurposed funds. These are existing funds that have adopted a sustainable strategy or investment approach by formally amending their prospectus. Refer to Chart 1.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”4″ ]

Mutual fund assets stood at $277.4 billion as of June 30, 2018 while ETFs and ETNs closed the month at $8.5 billion. The relative proportion of the two segments remaining unchanged at about 97% and 3%, respectively. Assets sourced to institutional only funds versus all other funds recorded an uptick to $93 billion, or 33% of the segment’s assets, versus $91.0 billion at the end of May.

The 1,025 funds in operation at the end of June were offered by 115 fund groups. This reflects an increase of 60 funds that included repurposed funds, new fund launches as well as the introduction of additional share classes by existing funds. Two new fund groups added to the number of fund firms from last month’s 113 offering sustainable funds.

Sustainable Funds Register Average Total Return Performance Decline of –0.54% in June and Cash Outflows Estimated at -$375.2 Million

The universe of 1,004 sustainable funds in operation for the full month, including share classes, posted a -0.54% total return in June[1]. A total of 420 funds, or 41.8, posted 0.00 to positive results for the month. This compares to the S&P 500 Index which recorded an increase of 0.62%, the Bloomberg Barclays U.S. Aggregate Bond Index, down -0.12% and the MSCI EAFE (Net) Index that recorded a loss of -1.22%. At the same time, the SUSTAIN Equity Fund Index posted an increase of 0.90% in June while the SUSTAIN Bond Fund Indicator closed the month lower at -0.06%. For further information, refer to the latest Monthly Sustainable Portfolios Performance Summary: June 2018.

Against this backdrop, sustainable funds were subject to a market-driven decline in an amount estimated to be $1.6 billion across all funds. Included in this figure is the addition of two new funds, one mutual fund and one ETF, with a combined total of $33.1 million.

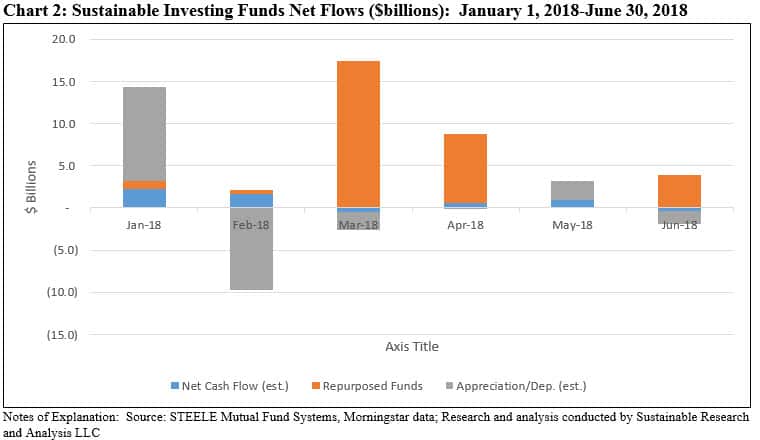

At the same time, repurposed funds added a combined total of almost $3.9 billion in assets. This is attributable 10 Morgan Stanley funds that added $2,810.5 million in new assets, two funds offered by Nationwide that contributed $1,052.9 million in new assets as well as an additional $4.2 million added by the reconstitution of the Tortoise Global Water ESG Fund. Based on this data, it is estimated that sustainable funds experienced net cash outflows in the amount of -$375.2 million during the month of June, a reversal from the prior month’s net positive cash flow that was estimated at $900 million. Refer to Chart 2.

Firms Ranking in Top 20 Remain Unchanged but Four Fund Groups Shift Slightly

A total of 115 fund groups offered sustainable investment products at the end of June. This compares to 113 fund groups at the end of May 2018, a net increase of 2 fund groups. These included Amplify ETFs which launched the Amplify Advanced Battery Metals and Materials ETF as of June 6, 2018 as well as Tortoise Capital Advisors that transformed its existing Tortoise Water Index Fund.

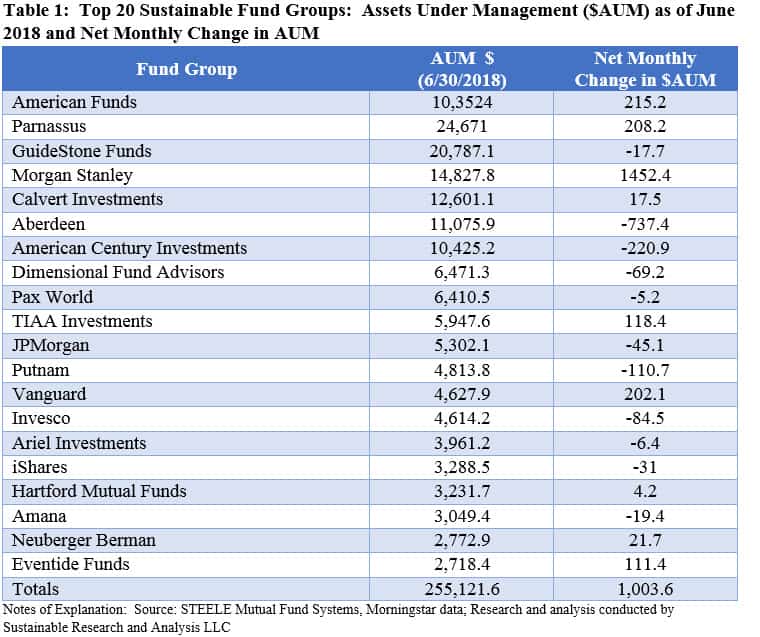

The universe of 115 sustainable fund groups is dominated by the top 20 groups that accounted for $255.1 billion in sustainable assets, or 89.2% of the segment’s total assets. There was limited but still some movement within the ranking of the top 20 fund groups.

Within the ranks of the top 10 fund groups, Dimensional Fund Advisors moved into the 8th ranked spot by eclipsing Pax World which gave up $69.2 million in net assets to end the month of June ranked ninth with $6,410.5 million in total net assets. Pax World, which offers 12 sustainable funds comprised of 28 share classes in total retains its position within the top 10 ranked fund groups and ahead of the 10th ranked TIAA Investments.

There was also a shift in the position of two fund groups within the next tier of sustainable fund firms. The 13th ranked Vanguard with its Vanguard FTSE Social Index Fund, added $202.1 million in net assets to surpass Invesco which recorded a decline in assets to the tune of $84.5 million. Refer to Table 1.

Largest Monthly Gains Recorded by Fund Groups and Funds: Morgan Stanley, American Funds and Parnassus

The following fund firms and funds contributed to the largest gains attributable to market movement, positive flows or repurposed funds, or some combination these factors:

- The largest monthly gain in June was realized by Morgan Stanley which added a net of $1.5 billion in June. That net gain is entirely attributable to the addition of 10 repurposed institutional funds to the firm’s line up of institutional sustainable funds, comprised of 52 share classes in total, with total net assets in the amount of $2.8 billion. A net drop of about $ 1.3 billion is attributable to net cash outflows and market movement in June.

- The second largest monthly gain in June was realized by American Funds’ $103.5 billion Washington Mutual Fund, a fund offered by American Funds that excludes companies deriving a majority of their revenues from alcohol or tobacco products. The fund group’s Washington Mutual Fund is the only fund in the group that is explicitly described as a sustainable fund. It continues to account for 36.2% of the sustainable segment’s assets under management.

- The third largest monthly gain was experienced by Parnassus, which added a net of $208.2 million across the fund group. Within the fund group, the Parnassus Core Equity Fund-Institutional Shares recorded an increase of $466.4 million.

Largest Monthly Declines Recorded by Fund Groups and Funds: Aberdeen, American Century and Putnam

The following fund groups and funds contributed to the largest declines attributable to market movement and/or negative cash flows:

- Once again Aberdeen topped the list, giving up about $737 million as two funds, the Emerging Markets Fund and Small Cap Equity Fund, saw assets decline by $581.3 million and $86.9 million, respectively. Last month Aberdeen’s assets declined by $510.9 million primarily due to a drop of $468 million realized in the Aberdeen Emerging Markets Fund-Institutional Shares.

- American Century’s funds sustained net outflows in the amount of $220.9 million. Net outflows in varying amounts up to $43.2 million sourced to the American Century NT Equity Growth Fund were experienced by all 13 fund offerings, 22 share classes in total, except for the American Century NT Disciplined Growth Fund-Investment Shares which added $0.3 million in assets.

- Putman Funds posted a net outflow in the amount of $111 million, of which $99 million is attributable to the Putnam Sustainable Leaders Fund.

New Funds Launched by Fidelity Investments and Amplify

Adding to its domestic and international ESG index fund offerings, Fidelity Investments launched a new Fidelity Sustainability Bond Index Fund, a fund seeking to achieve the investment results corresponding to the Bloomberg Barclays MSCI U.S. Aggregate ESG Choice Bond Index. The index, which is composed of U.S. dollar denominated, investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, qualifies securities based on MSCI ESG research and ESG criteria for security eligibility. Companies showing involvement above certain thresholds in adult entertainment, alcohol, gambling, tobacco, military weapons, civilian firearms, nuclear power, and genetically modified organisms are excluded from the index.

The fund offers two share classes, an Investor Class at 20 bps and an Institutional Class at 13 bps.

The second new fund is the $7.9 million Amplify Advanced Battery Metals and Materials ETF. The fund is an actively managed ETF that seeks to provide investment exposure to companies principally engaged in the mining, exploration, production, development, processing or recycling of the metals and materials being utilized in advanced battery technologies, currently Lithium, Cobalt, Nickel, Manganese and Graphite. In addition to meeting various financial eligibility standards, securities are also qualified on the basis of a company’s environmental, social and governance (ESG) scores.

While not a new fund, the $4.2 million Tortoise Global Water ESG Index Fund, formerly the Tortoise Water Index Fund, was reconstituted to focus on companies across the globe that manage, treat, and distribute water based on the thesis that water is vital not only for survival, but also the ability to thrive and prosper and significant investment must be made to maintain current water infrastructure and to develop new infrastructure to more sustainably utilize and distribute this vital resource. Further, the index selection methodology now requires candidate companies to achieve a minimum level of ESG score, as determined by Sustainalytics.

[1] This contrast with 1,025 funds in operation at the end of June 30, 2018.