Sustainable funds close November with $312.5 billion in assets under management, adding $8.7 billion due to market movement and repurposed/reclassified funds[1]

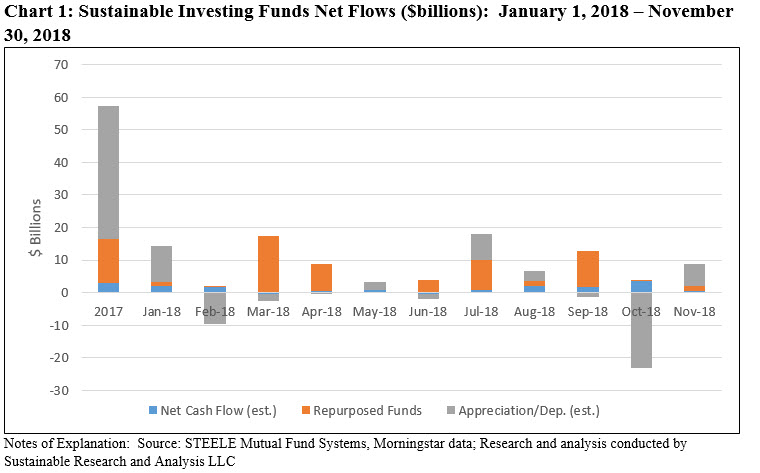

The net assets of the universe of sustainable funds registered a month-over-month increase to offset some of last month’s decline. The 1,130 sustainable funds ended the month of November with $312.5 billion in net assets under management versus an adjusted $303.8 billion at the end of October. The month-over-month increase is attributable to market movement, estimated to account for $6.6 billion, or an increase of 2.2%, and almost 76% of the net increase for the month. Another $1.7 billion, or 19.5% of the increase, is attributable to repurposed funds, including reclassified funds, involving Wells Fargo and Bridgeway. Finally, only an estimated $482.3 million, or 0.16% relative to October and 5.5% of the November increase, is attributable to net new money. Refer to Chart 1.

Mutual fund assets stood at $302.9 billion as of the end of November while ETFs and ETNs closed the month at $9.6 billion. The relative proportion of the two segments remain largely unchanged at 96.9% and 3.1%, respectively. Assets sourced to institutional only mutual funds/share classes, 423 in total, versus all other funds, ended the month at $106.4 billion or 36.6% of sustainable funds.

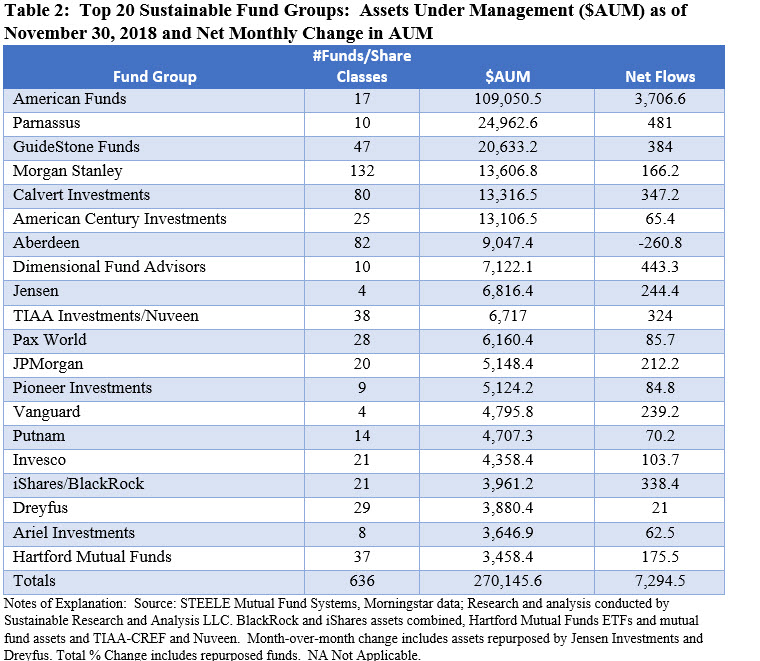

Top 20 sustainable fund firms manage $270.1 billion in combined assets, representing 86.4% of the fund assets linked to the sustainable segment

Including the consolidation of affiliated firms, the universe of explicitly designated mutual funds and ETFs/ETNs were sourced to an adjusted 121[2] fund groups or firms, up three fund groups since the previous month. The three new firms include Wells Fargo, Bridgeway and Federated Investors. The first two firms repurposed existing funds while Federated Investors launched a new fund.

The top 20 firms manage $270.1 billion in combined assets, representing 86.4% of the fund assets linked to the sustainable segment. With the exception of Aberdeen which experienced a net decline of -$260.8 million, all the other 19 fund groups added assets in November due to market gains and/or net flows. The top 20 sustainable fund groups alone gained $7.3 billion, with $3.7 billion, or 47.5%, alone sourced to the Washington Mutual Fund of the American Funds Group that ended November with $109.1 billion. Washington Mutual, a fund that avoids investing in companies that derive a majority of their revenues from alcohol or tobacco products, accounts for about 35% of the segment’s assets. Refer to Table 2. Other highlights include:

- Aberdeen Investments, which manages 19 funds across 82 share classes with $9.0 billion in combined assets, experienced net outflows from institutional share classes of the Aberdeen International Equity (-$202.4 million) and Aberdeen Emerging Markets (-$91.6 million) that largely accounted for the firm’s $260.8 million net decline in November.

- Parnassus Investments, which added $481 million to end the month of November with almost $25 billion in fund assets under management, saw net inflows into its Core Equity Fund in the amount of $312.4 million. The fund performed well in November, posting gains in its institutional and investor share classes of 4.17% and 4.15%, respectively.

- Dimensional Fund Advisors, the 8th ranked firm for offering sustainable funds, with $7.1 billion in net assets offered across 10 funds/10 share classes, gained $443.3 million in assets largely linked to the introduction of a new fund, the $201.2 million DFA Global Sustainability Fixed Income Portfolio. For further details, see below.

Eight new mutual funds and 20 share classes were launched during the month of November along with 3 ETFs, with combined assets of $330.8 million

Eight new mutual funds and 20 share classes were launched during the month of November along with 3 ETFs, with combined assets of $330.8 million. Highlights include:

- Three new green bond funds were launched, thereby doubling the number of green bond funds. Green bond mutual funds and/or exchange traded funds were introduced by Allianz Global Investors, BlackRock and Teachers Advisors. This brings to six the number of green bond funds available to investors, including four mutual funds offering 12 share classes across a range of targeted investors and corresponding expense ratios as well as two ETFs.

- In addition to a green bond fund, TIAA also launched the Short-Duration Impact Bond Fund. This fund brings to market another important shorter-term option for investors and complements the very successful Social Choice Bond Fund by offering to investors the raw ingredients necessary to build a complete investment program around actively managed sustainable fixed income funds.

- DFA introduced a $201.2 million DFA Global Sustainability Fixed Income Portfolio. Managed by Dimensional Fund Advisors LP and DFA Australia Limited which serves as the sub-advisor, the fund discloses that its intends to take into account the impact that companies may have on the environment and other sustainability considerations when making investment decisions. For further guideline details, click on the InvestmenResearch/The Basics/Sustainable Investment Glossary.

- Federated launched the Federated Hermes SDG Engagement Equity Fund. The fund, which has not been funded as of November 30, 2018, will seek to invest in companies that contribute to positive societal impact aligned to the United Nations Sustainable Development Goals (the UN Sustainable Development Goals. In addition to fundamental financial indicator criteria, the fund’s adviser may consider engagement criteria such as assessment of company management competence, integrity, and vision, as well as exposure to one or multiple UN Sustainable Development Goals. Federated has wasted no time to launch a sustainable investing product managed by Hermes, its recently acquired firm. Hermes is now majority owned by Federated Investors since its 60% acquisition from the BT Pension Scheme closed in the third quarter.

Two reclassified/repurposed funds added in November: Wells Fargo and Bridgeway Capital Management add $1,670.3 million

Wells Fargo’s Large Cap Core Equity Fund, consisting of 6 share classes with total net assets in the amount of $1,075.3 million, was reclassified. The fund generally avoids investments in issuers that are deemed to have significant alcohol, gaming or tobacco business.

Also, Bridgeway Capital Management repurposed one fund with $595 million by adopting language in its prospectus to exclude any tobacco companies.

[1] Franklin funds and 3 Hartford ETFs are excluded (TNA=$2,537.0 million) as offering documents do not explicitly reference adoption of sustainable strategies.

[2] BlackRock and iShares, Hartford funds and ETFs and TIAA and Nuveen are each combined into a single fund group; Franklin funds are excluded.