Summary

The performance of model portfolios, which posted positive total returns in November ranging from 0.78% to 1.51%, fell behind their designated conventional indexes as two of three underlying funds underperformed. Bond and equity markets continued on their volatile path into November, but ended on positive notes. The S&P 500 posted a gain of 2.04% while Bloomberg Barclays US Aggregate Index added 0.60%. Against this backdrop, the universe of 1,105 sustainable funds/share classes, exchange traded funds (ETFs)and exchange traded notes (ETNs), registered an average gain of 2.02%. Also, the SUSTAIN Large Cap Equity Fund Index recorded a gain of 3.21% and outperformed the S&P500 by 1.17%. The SUSTAIN Bond Fund Indicator, up 0.426%,lagged behind the Bloomberg Barclays US Aggregate Index that posted a gain of 0.60%. For more details, refer to article entitled Monthly Performance Summary: November 2018. Sustainable funds closed November with $312.5 billion in net assets, up $8.7 billion relative to the prior month, benefiting from market appreciation and repurposed/reclassified funds. The segment expanded by three the number of fund firms offering sustainable funds to 121 groups, and eight new funds as well as 20 share classes with $330.8 million in assets were added.

Performance of model portfolios fell behind their designated conventional indexes as two of three underlying funds underperform

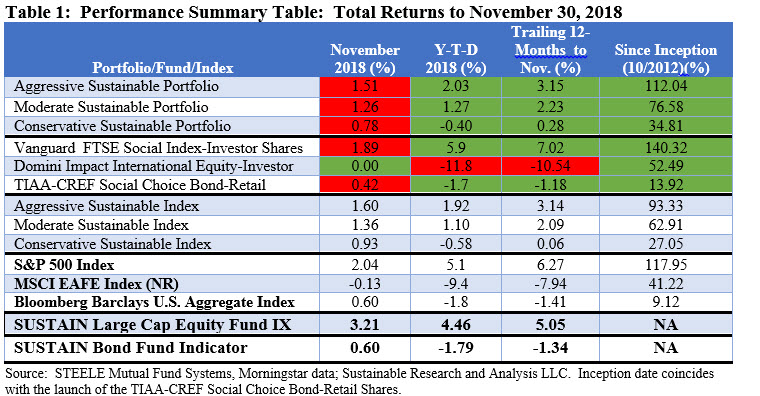

Recovering somewhat from last month’s sharp losses, the Aggressive Sustainable Portfolio (95% stocks/5% bonds), Moderate Sustainable Portfolio (60% stocks/40% bonds) and the Conservative Sustainable Portfolio (20%/80%) produced positive total returns in November that ranged from 0.78% to a high of 1.51%. The results correspond to the model portfolios’ risk profiles and also the performance of their underlying mutual funds. Still, the three model portfolios posted returns that came in behind their designated conventional securities benchmarks as two of the three underlying funds did the same. Only the total return of the Domini Impact International Equity-Investor Shares eclipsed its MSCI EAFE (NR)Index that it outperformed by 0.13% or 13 basis points (bps). On the other hand, the Vanguard FTSE Social Index-Investor Shares and TIAA-CREF Social Choice Bond-Retail Shares missed their conventional benchmarks by 15 bps and 18 bps, respectively. Refer to Table 1.

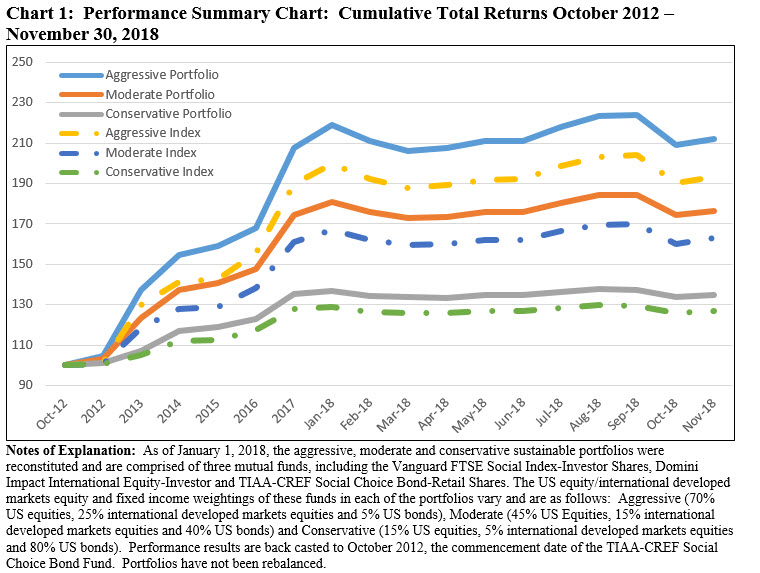

The three model portfolios continue to post since inception results that exceed their conventional indexes by 18.7%, 13.7%and 7.8%, respectively, however, the differential narrowed slightly. For Sustainable Portfolio the differential relative to a conventional index narrowed by 0.4% and it expanded to 1.4% for the Aggressive Sustainable Portfolio. Refer to Chart 1.

Sustainable funds register average gain of 2.02% and performance ranged from a high of 26.38%to a low of -5.78%

Sustainable mutual funds,exchange-traded funds and exchange-traded notes posted an average gain of 2.02%while the median gain stood at 1.89%. This is based on a universe consisting of 1,105 sustainable funds[1] that registered performance results for the entire month of November. Of these, 970 funds posted ≥0.00% results while 135 funds, or 12.2%, recorded negative outcomes. This compares to last month when only 26 funds, or 2.4% of funds, recorded positive results.

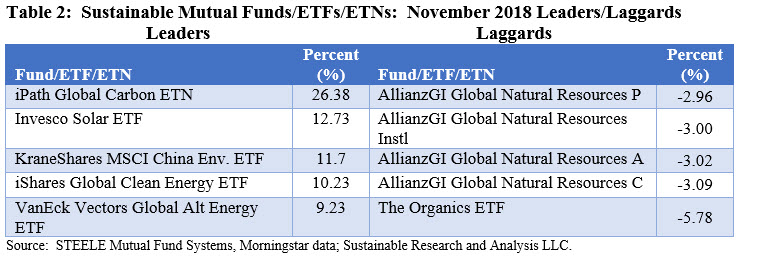

In a dramatic about face, the iPath Global Carbon ETN posted a gain of 26.28% and,in the process, erased last month’s loss of -23.81%. This highly volatile $10.4 million exchange-traded note provides exposure to the global price of carbon by referencing the price of carbon emissions credits from the world’s major emissions related mechanisms. It led other clean or alternative energy funds that may have experienced price run ups linked to heightened concerns over climate change and global warming in light of recently issued reports that the world continues to emit historic levels of carbon dioxide and other greenhouse gas emissions, the recent publication of several authoritative reports updating previous assessments of the impacts resulting from global warming and the intensity as well as speed with which these are accelerating and the convening in Poland of COP 24, or the 24th Conference of the Parties to the United Nations Framework Convention on Climate Change.

At the other end of the range, the $10.9 million Organics ETF gave up 5.78%. The fund seeks exposure to companies globally that can capitalize on our increasing desire for naturally-derived food and personal care items, including companies which service, produce, distribute, market or sell organic food, beverage,cosmetics, supplements, or packaging. Managed by Janus Capital Management, the fund was launched in January 2016 and is down -19.66%since the start of the year. Refer to Table 2.

Sustainable funds close November with $312.5 billion in assets under management, adding $8.7 billion due to market movement and repurposed/reclassified funds.

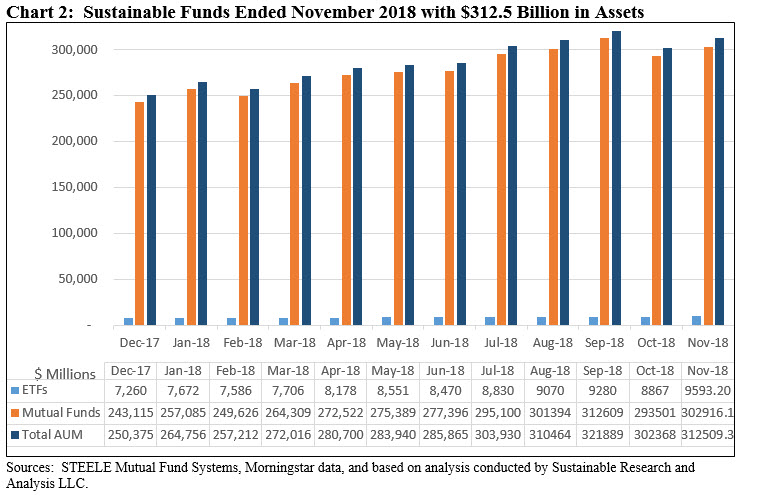

The net assets of the universe of sustainable funds registered a month-over-month increase to offset some of last month’s decline. The 1,130 sustainable funds ended the month of November with$312.5 billion in net assets under management versus an adjusted $303.8 billion at the end of October. Refer to Chart2. The month-over-month increase is attributable to market movement, estimated to account for $6.6 billion, or an increase of 2.2%, and almost 76% of the net increase for the month. Another $1.7 billion, or 19.5% of the increase, is attributable to repurposed funds, including reclassified funds,involving Wells Fargo and Bridgeway. Finally, only an estimated $482.3 million,or 0.16% relative to October and 5.5% of the November increase, is attributable to net new money.

Mutual fund assets stood at $302.9 billion as of the end of November while ETFs and ETNs closed the month at $9.6 billion. The relative proportion of the two segments remain largely unchanged at 96.9% and 3.1%, respectively. Assets sourced to institutional only mutual funds/share classes, 423 in total, versus all other funds, ended the month at$106.4 billion or 36.6% of sustainable funds.

At the end of November, the universe of explicitly designated mutual funds and ETFs/ETNs were sourced to an adjusted 121[2]fund groups or firms, up three fund groups since the previous month. The three new firms include Wells Fargo,Bridgeway and Federated Investors.

Wells Fargo’s Large Cap Core Equity Fund, consisting of 6 share classes, total net assets in the amount of $1,075.3 million, was reclassified. The fund generally avoids investments in issuers that are deemed to have significant alcohol,gaming or tobacco business. Bridgeway repurposed 1 fund with$595 million in that it adopted language in its prospectus to exclude any tobacco companies.

Eight new mutual funds and 20 share classes were launched during the month of November along with 3 ETFs, with combined assets of $330.8 million

Eight new mutual funds and 20 share classes were launched during the month of November along with 3 ETFs, with combined assets of $330.8 million. Highlights include:

- Three new green bond funds were launched, thereby doubling the number of green bond funds. Green bond mutual funds and/or exchange traded funds were introduced by Allianz Global Investors, BlackRock and Teachers Advisors. This brings to six the number of green bond funds available to investors, including four mutual funds offering 12 share classes across a range of targeted investors and corresponding expense ratios as well as two ETFs.

- In addition to a green bond fund, TIAA also launched the Short-Duration Impact Bond Fund. This fund brings to market another important shorter-term option for investors and complements the very successful Social Choice Bond Fund by offering to investors the raw ingredients necessary to build a complete investment program around actively managed sustainable fixed income funds.

- DFA introduced a $201.2 million DFA Global Sustainability Fixed Income Portfolio. Managed by Dimensional Fund Advisors LP and DFA Australia Limited which serves as the sub-advisor, the fund discloses that its intends to take into account the impact that companies may have on the environment and other sustainability considerations when making investment decisions. For further details, click on the Investment Research/TheBasics/Sustainable Investment Glossary.

- Federated launched the Federated Hermes SDG Engagement Equity Fund. The fund,which has not been funded as of November 30, 2018, will seek to invest in companies that contribute to positive societal impact aligned to the United Nations Sustainable Development Goals (the UN Sustainable Development Goals. In addition to fundamental financial indicator criteria, the fund’s adviser may consider engagement criteria such as assessment of company management competence, integrity, and vision, as well as exposure to one or multiple UN Sustainable Development Goals. Federated has wasted no time to launch a sustainable investing product managed by Hermes, its recently acquired firm. Hermes is now majority owned by Federated Investors since its 60%acquisition from the BT Pension Scheme closed in the third quarter.

[1] 1,105 funds reported performance results for the full month of September 2018, including five share classes offered by the Franklin Select US Equity Fund with $103.8 million in assets that are excluded from the October analysis as their most recent prospectus does not reflect the adoption of a sustainable strategy or approach.

[2] BlackRock and iShares, Hartford funds and ETFs and TIAA and Nuveen are each combined into a single fund group; Franklin funds are excluded.