Model portfolios: Strong U.S equity market in November boost sustainable model portfolios to rise above their conventional benchmarks and achieve new highs

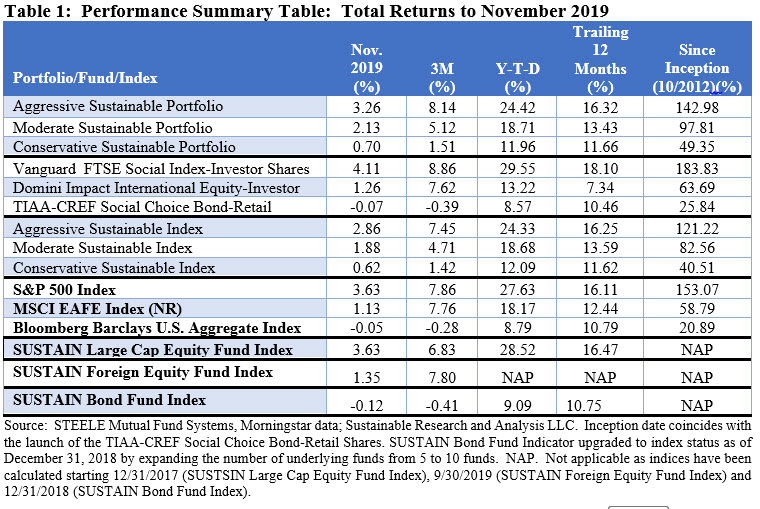

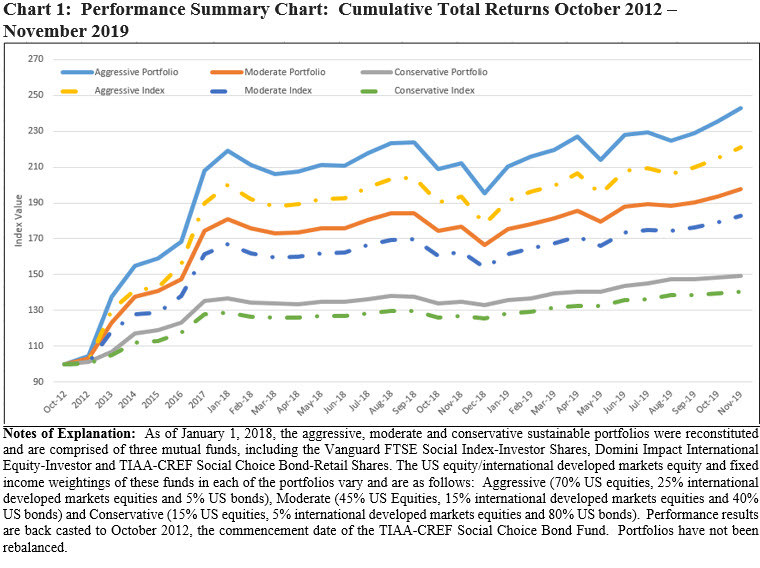

The Aggressive Sustainable Portfolio (95% stocks/5% bonds), the Moderate Sustainable Portfolio (60% stocks/40% bonds) and the Conservative Sustainable Portfolio (20% stocks/80% bonds) outperformed their conventional indices by a range from 8 basis points (bps) to a high of 40 bps. The three model portfolios also registered above benchmark returns for the trialing three month period while delivering mixed results year-to-date and over the latest twelve months. Still, the portfolios remain well ahead since their inception as of October 2012, beating their indices by cumulative margins ranging from a high of 21.76% to 8.84%. Refer to Table 1 and Chart 1.

In an outcome similar to the one observed in October, the three model portfolios benefited from the outperformance delivered by the Vanguard FTSE Social Index Fund Investor Shares relative to the S&P 500 Index. The fund posted a total return of 4.1% relative to a 3.6% gain achieved by the S&P 500, surpassing the conventional benchmark for the second consecutive month. As well, the fund eclipses the index over the previous twelve-months. Also benefiting the model portfolios in November, but to a lesser degree, was the outperformance of the Domini Impact International Equity Fund Investor Shares which gained 1.26% versus the 1.13% gain registered by the MSCI EAFE (Net) Index. Fixed income funds, on the other hand, have lost momentum over the last three months, giving up -0.28%, as long-term interest rates, based on 10-year Treasuries, reversed course starting in early September and rose 31 bps since September 4th to November 30, 2019. In the process, the TIAA-CREF Social Choice Bond Fund Retail Shares has given up -0.39% since the end of August and -0.07% in November. This, in turn, detracted from the performance results achieved by each of the three model portfolios.

U.S. stock indices posted a series of record highs during November

U.S. stock indices posted a series of record highs during November and closed the next to last month of the year with their strongest monthly gains since June. These milestones also pushed the model portfolios to record highs in November.

The Dow Jones Industrial Average, S&P 500 and the Nasdaq Composite each experienced a steady march upward and rose more than 3% for the month as investors reacted favorably to positive US economic news ahead of the Thanksgiving holiday while continuing to shrug off geopolitical and domestic political uncertainties, including US-China trade, Brexit, unrest in Hong-Kong and impeachment proceedings in the US. The S&P 500 Index gained 3.63%, the Dow Jones Industrial Average closed even higher at 4.11% while the NASDAQ Composite added 4.64%. Small stocks performed well, expanding by 4.12% per the Russell 2000 Index, and continuing to outpace the S&P 500 for the third month in a row. Small cap growth stocks recorded even stronger gains, returning 5.89%, however, this relationship did not hold for large cap stocks. Across sectors, Healthcare, Information Technology and Financials led with returns of 8.24%, 6.39% and 5.14%, respectively, while Utilities, Real Estate and Energy were the only sectors to post negative results, giving up -2.05%, -1.96% and -0.70%, in that order.

Stocks in the US eclipsed their counterparts overseas. The MSCI ACWI ex US index gained 2.44% while emerging markets backtracked with regional variations. Latin America dropped -4.13% while Asian emerging markets added 0.53%, boosted by China which was up 1.78%.

US rates rose across the yield curve in November. Three-month Treasuries ticked up 5 basis points, 2-year Treasuries added 9 basis points to end November at 1.61% while 10-year treasuries also gained 9 basis points to end at 1.78%. Intermediate investment-grade bonds, on the other hand, closed the month -0.05% lower on a total return basis while US Treasuries lost -0.3%.