Sustainable funds achieved another new all-time high at the end of February, reaching $485.4 billion in net assets versus $440.2 billion in January with net cash inflows contributing $1.67 billion or 2.8%

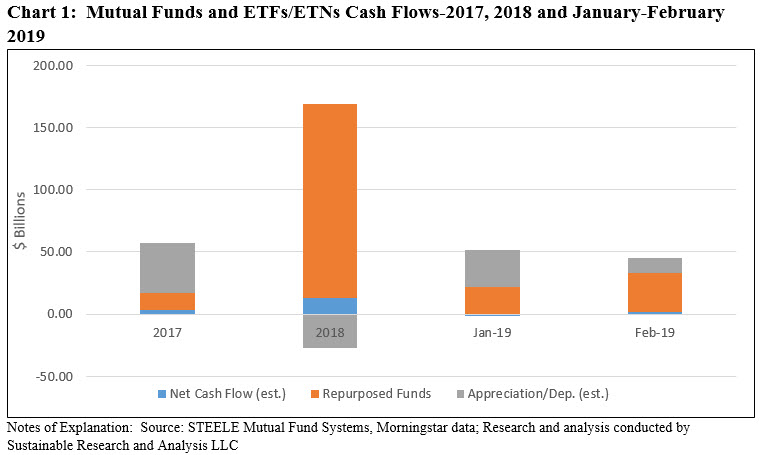

Sustainable funds, including mutual funds, ETFs and ETNs, again registered another monthly all-time high of $485.4 billion in assets as of February 28, 2019, with the net addition of $45.3 billion for the month versus $49.8 billion added in January 2019. Of this sum, $1.7 billion is attributable to net positive inflows, but additions of $31.1 billion due to repurposed or rebranded funds and $12.5 billion attributable to market movement had a more significant impact on the growth of sustainable assets. Refer to Chart 1.

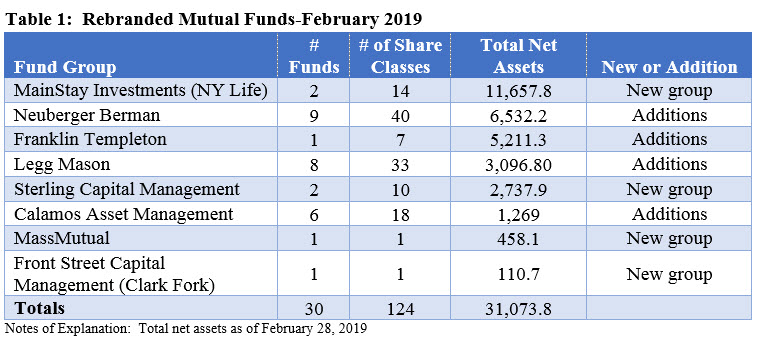

Mutual funds, which account for 97.6% of the segment’s assets under management (AUM), were responsible for 98.4% of the month-over-month gains. The assets were distributed across 1,320 mutual funds/share classes and 129 ETFs/ETNs offered by 127 separate firms. Eight separate fund groups, including four first time firms, either repurposed existing funds for the first time or added to the roster of existing funds by repurposing additional funds and share classes, for a total of 30 funds and 124 share classes. The largest of these was MainStay Investments (NY Life) that repurposed two funds, with 14 share classes, and total net assets in the amount of $11.7 billion. The other three firms include Sterling Capital Management (subsidiary of BB&T), MassMutual and Front Street Capital Management, Inc. (Clark Fork Trust) that on a combined basis added about $3.3 billion. Refer to Table 1.

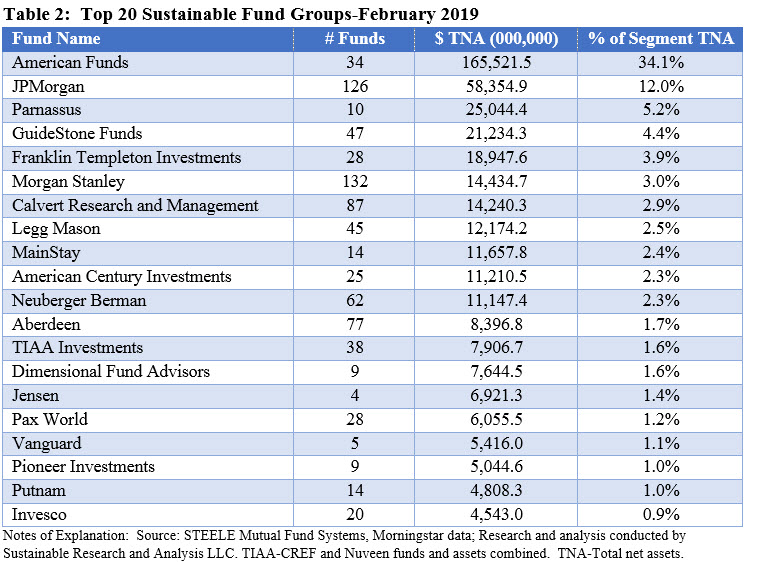

Top 20 sustainable fund groups of 127 firms account for $420.7 billion or 87% of the segment’s assets under management

Four new fund groups joined the universe of firms offering sustainable mutual funds and/or ETFs/ETNs that, when combined with exiting fund groups, brought the total number of sustainable fund groups to 127. As noted above, the new additions repurposed existing funds.

MainStay’s repurposed funds added $11.7 billion in assets across two funds that catapulted the firm into the top 10 sustainable fund group ranks. The top 10 fund groups account for $352.8 billion in assets under management (AUM), or 72.7% of the segment’s total. This level of concentration represents a 2.8% decline from last month’s 75.5%. American Funds Washington Mutual, with its $165.5 billion in net assets, accounts for 34% of the entire segment’s AUM. Because the segment is skewed by this fund, the average assets per fund firm is overstated at $3.7 billion. In fact, the median sustainable assets per fund group is only $268.5 million.

The top 20 fund groups account for $420.7 billion in AUM, and 87% of the segment’s assets which is roughly in line with January’s level of concentration. BlackRock, including its iShares ETFs which consists of 13 funds and $4.4 billion in AUM, dropped out of the top 20 fund groups line up as its ranking fell to 21st.

Existing sustainable fund firms rebranded additional funds with $16.1 billion in assets

In addition to first time fund firms, four fund groups added to existing fund offerings by repurposing a total of 30 funds, 124 share classes and a combined total of $16.1 billion in AUM. The addition of Neuberger Berman’s $6.5 billion to the sustainable funds segment pushed the firm’s ranking to 11th from last month’s rank of 18th. Refer to Table 2, which identifies both the new fund groups as well as those adding to existing funds.

Vanguard added an Admiral share class to the FTSE Social Index Fund

Along with new share classes introduced by a number of firms, Vanguard added an Admiral Share class to the existing Vanguard FTSE Social Index Fund and in the process added $289.7 million. The Admiral Share class is subjects to a 14 basis points fee with a minimum investment of $3,000.

Two sustainable funds announced closings

In a relatively new development for the sustainable funds segment, two sustainable funds are in the process of closing. The $11.8 million Highmore Sustainable All Cap Equity Fund, which was launched in early 2018, closed in February 2019 while the $1.8 million Spouting Rock Small Cap Growth Fund, that had commenced operations in 2014, announced that it was intending to close as of March 20, 2019.

Goldman Sachs redeems its seed capital from the JUST U.S. Large Cap Equity

It was reported by the Wall Street Journal that Goldman Sachs during the week of March 4, 2019 withdrew its seed capital from the Goldman Sachs JUST U.S. Large Cap Equity ETF. The fund, which seeks to provide broad exposure to U.S. large cap equities with a focus on companies that demonstrate just business behavior as measured by JUST Capital, reported net assets in the amount of $214.4 million at the end of February. It experienced an outflow of $101.9 million, thus reducing the ETFs assets by 49% to $109.8M, according to FactSet market data as reported by Seeking Alpha on March 11, 2019. As of March 28, 2019, the ETF’s net assets were $114.5 million.