Sustainable funds pierce through half trillion for the first time and reach new high of $627 billion, benefiting from a large number of fund re-brandings and capital appreciation in March

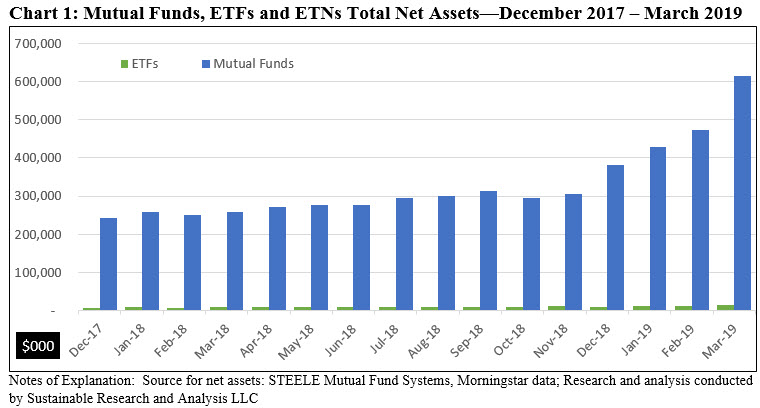

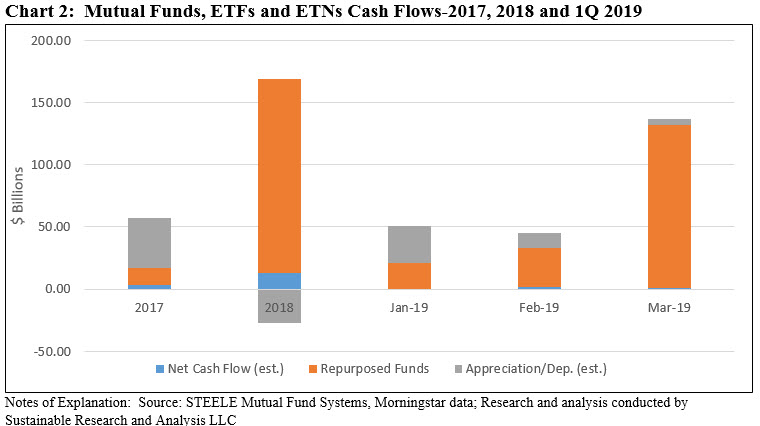

For the sixth consecutive month, sustainable funds, including mutual funds, ETFs and ETNs, registered another monthly all-time high of $627.5 billion in assets under management as of March 29, 2019. Funds added a net of $137.2 billion in assets for the month versus net additions of $45.3 billion and $49.8 billion, respectively, in January and February of the first quarter. Of this sum, $131.4 billion is due to re-branded or repurposed funds, an estimated $4.9 billion is attributable to market movement while an estimated $0.9 billion is due to net new cash flows. Refer to Chart 1.

1Q Observation: sustainable assets expanded from $390.4 billion, adding $237.1 during the first quarter, or an increase of 61%.

Since the start of the year, sustainable assets expanded from $390.4 billion, adding $237.1 during the first quarter, or an increase of 61%. As is the case in March, the net increase is largely attributable to fund re-brandings which added a whopping $183.2 billion in net new assets, or 79% of the total increase while market movement and net cash flows added an estimated $47.4 billion and $1.6 billion, respectively. Refer to Chart 2.

In the aggregate, mutual funds/share classes, ETFs and ETNs jumped from 1,163 funds to 1,923 funds at the end of March, or an increase of 65.3% due to the large number of fund re-brandings. Mutual funds and their corresponding assets under management jumped dramatically, adding $234 billion, or a 61% increase, to end the quarter with $614.6 billion. This also served to lift the proportion of mutual funds to ETFs from 97.6% at the end of February to 97.9% at the end of March. The assets were distributed across 1,833 mutual funds/share classes and 90 ETFs/ETNs offered by 131 separate firms. That said, just 45 mutual funds and share classes accounted for 50.3% of total sustainable mutual fund assets.

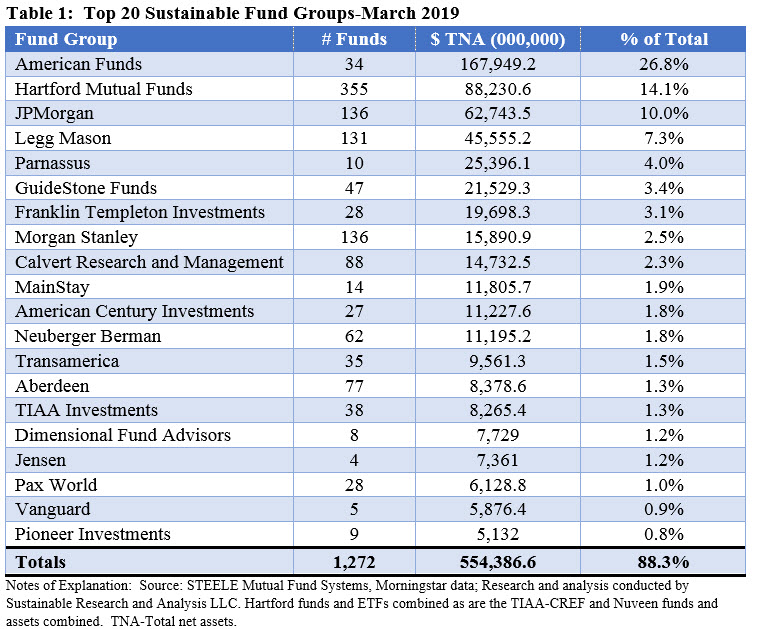

Top 20 sustainable fund groups out of 131 firms account for $554.4 billion or 88.3% of the segment’s assets under management

Five new funds groups joined the universe of firms offering sustainable mutual funds and/or ETFs/ETNs that, when combined with existing fund groups, brought the total number of sustainable fund groups to 131. All but one fund group repurposed existing funds by amending their prospectuses to reflect the adopting of ESG integration practices. One fund group, Spouting Rock, dropped out after announcing the March 20th close of its $1.8 million Spouting Rock Small Cap Growth Fund that had commenced operations in 2014. Refer to Table 1.

Since the start of the year, there has been significant movement in the rankings of the top funds. American Funds Washington Mutual, a fund that excludes tobacco companies, maintains its top ranking in the segment but the firm’s 38% market share at the beginning of the year dropped to 27% due to the entry of additional mainstream firms with their large number of rebranded funds. That said, three new fund groups moved into the top ten rankings after having re-branded their funds to reflect the formal adoption of ESG integration in investment decision making. These include the Hartford Funds, Franklin Templeton and Mainstay. In the process, Calvert Research and Management now ranks 9th, moving down from its rank as the fifth-largest sustainable fund firm with $14.7 billion in assets, up from $12.8 billion at the end of 2018. Now owned by Eaton Vance, Calvert offers 27 funds comprised of 87 share classes along with one exchange traded fund. Some of the firm’s largest gains in the first quarter were realized by its excellent performing Calvert Equity Fund, gaining $432.9 million, Calvert Emerging Markets Equity Fund, adding $427.5 million and Calvert’s US Large Cap Core Responsible Index Fund that saw an increase of $256.8 million.

Also giving up its top 10 ranking is Dimensional Fund Advisors that dropped from 10th place to 16th at the end of March.

Shifts in rankings were not limited to the top 10 firms. Transamerica now ranks 13th, having re-branded 35 funds/share classes with about $9.6 billion in assets. In the process, it pushed Putnam out of its 20th rank and into the 21st spot in terms of assets under management. Dreyfus and Blackrock were also displaced from their top 20 ranks over the course of the first quarter.

Focus on ETFs: 90 sustainable ETFs with $12.9 billion in assets under management

At the end of March there were 90 sustainable ETFs offered, including one ETN, with total net assets in the amount of $12.9 billion, representing a gain of $1.5 billion in March, an increase of 12.8%, and $3.1 billion since the start of the year. These ETFs include 5 investment vehicles re-branded by Hartford ($796.1 million) and two by JP Morgan ($97 million) for a total of $893.1 million that adopted ESG integration language after launch.

Just eight funds account for just slightly over 50% of the segment’s assets with their $6.5 billion in assets under management. 41 funds, or 46% of total funds, manage at least $50 million in assets. These may be marginal and unless they can grow assets are likely to be shuttered as they are operating close to break-even. Three small ETFs actually closed during the quarter, including: Invesco Wilder Hill Progressive Energy ETF that was part of a rationalization of ETFs acquired from Guggenheim and OppenheimerFunds, James Purpose Based Investment ETF that invested in biblically responsible corporations and the $4.3 million SerenityShares Impact ETF that invested in companies that generate revenues from products or services that address a variety of societal, social, and environmental challenges.

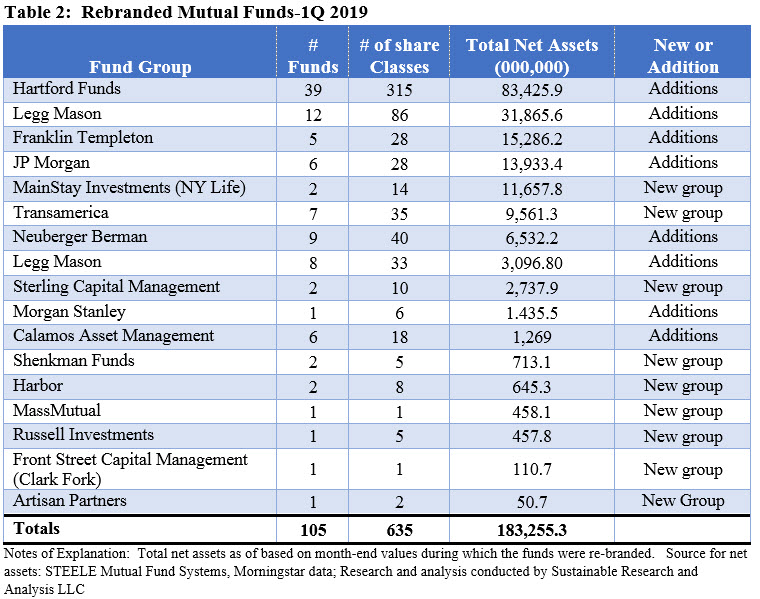

Rebranded Funds: March experienced the highest number of fund re-brandings, adding $131.4 billion in assets under management

The month of March experienced the highest number of fund re-brandings as seven fund groups, including three first time management groups, added 64 funds, a total of 465 share classes, and $131.4 billion in assets under management. This monthly level of rebranded assets eclipsed the previous monthly high of $99.5 billion that occurred in December of 2018.

These seven fund groups included first time entrants Transamerica, Russell Investments and Harbor and the following four groups that re-branded additional funds: JP Morgan, Legg Mason, Hartford Funds and Morgan Stanley. In each instance, the fund groups amended their prospectuses to reflect that their investment strategy takes into account environmental, social and governance (ESG) considerations. By way of illustration, JPMorgan’s amended investment language is typical for funds that adopt ESG integration language when it reflects in its amended prospectus that “As part of its investment process, the adviser considers certain environmental, social and governance factors that it believes could have a material negative or positive impact on the risk profiles of certain securities in which the Fund may invest. These determinations may not be conclusive and securities that may be negatively impacted by such factors may be purchased and retained by the Fund while the Fund may divest or not invest in securities that may be positively impacted by such factors.

When combined with similar actions taken by fund groups in January as well as February of this year, re-branded or repurposed mutual fund assets shot up to about $184 billion, exceeding the $155.9 billion repurposed during the entire 2018 calendar year. Refer to Table 2.

Re-brandings are not limited as to fund types, in terms of assets classes or investment objectives, and while these are still dominated by equity investment vehicles, the re-brandings are applied to equity funds as well as fixed income funds. For the first time in March, re-brandings included a convertible securities fund as well as a fund focused on gold and precious metals.

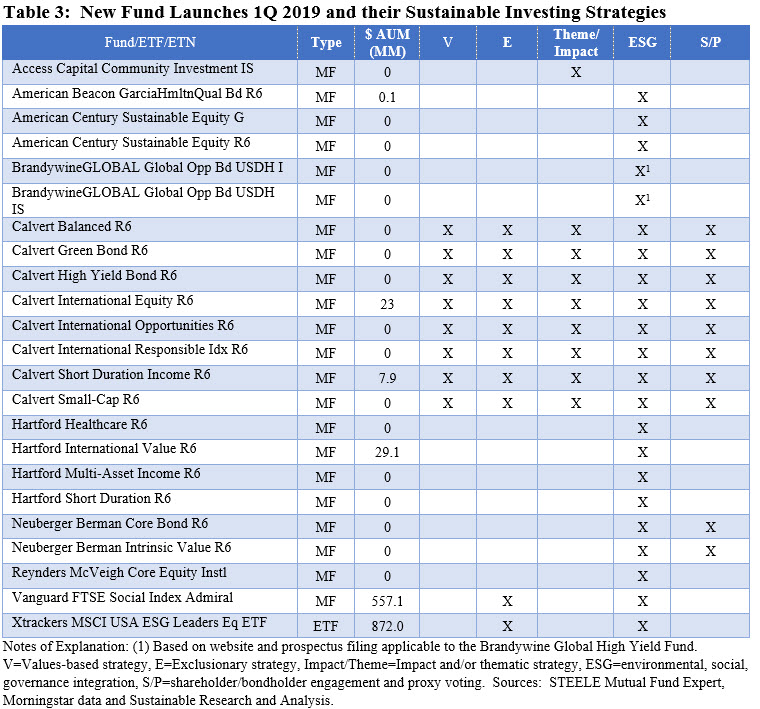

New funds: 23 mutual funds/share classes and ETFs were launched in the first quarter

Re-brandings aside, 23 mutual funds/share classes and ETFs were launched in the first quarter, including one ETF, pursuing a variety of sustainable investing strategies. By far the largest segment of these, 14 funds or 61%, adopted an ESG integration approach exclusively or, as is the case with Vanguard and DWS’s Xtrackers, in combination with limited exclusions involving certain companies that are involved in specific businesses which have high potential for negative social and/or environmental impact, such as companies in the alcohol, tobacco, gambling, nuclear power, conventional and controversial weapons and civilian firearms industries. Also, in the case of Neuberger Berman, ESG integration is combined with shareholder/bond holder engagement. Otherwise, ESG integration is combined with a values-based approach along with exclusions and shareholder/bond holder engagement and proxy voting.Refer to Table 3.

Combined, these funds added about $1.5 billion in assets under management. Of these 21 new mutual fund share classes linked to sustainable funds were launched by eight firms that added a total of $617.2 million in assets, or 41% of the total additions. The most notable of these, was the Vanguard FTSE Social Index Admiral Shares that added $557.1 million in assets.

In addition, the 10-basis point DWS managed Xtrackers MSCI USA ESG Leaders Equity ETF ended the quarter with $872.0 million in assets, largely seeded by Ilmarinne, Finland’s largest pension insurance company.