The Bottom Line: Smallest number of funds launched in Q3 2022, but new launches include two sustainable infrastructure funds using different approaches to qualifying companies.

0:00

/

0:00

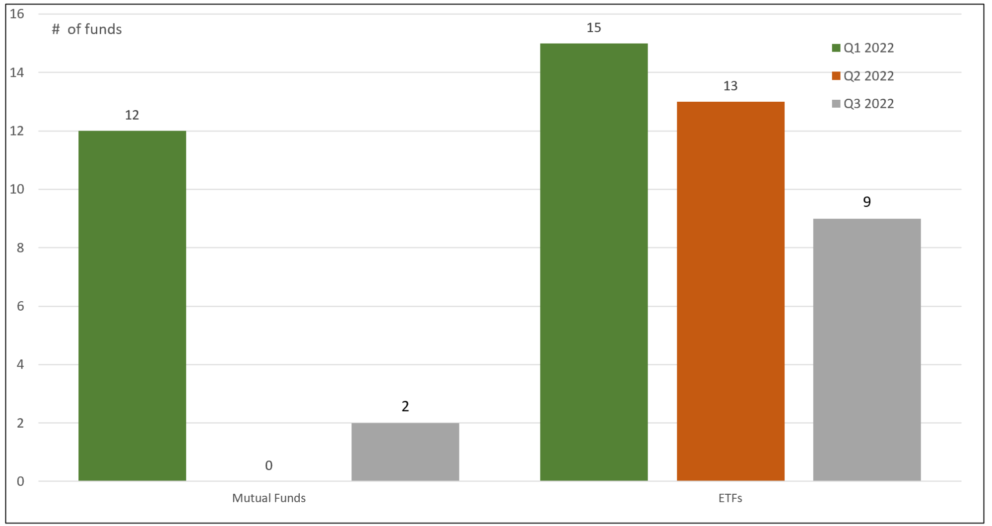

Quarterly # of mutual funds and ETFs launched between Jan. 1, 2022 – Sept. 30, 2022 Notes of Explanation: New mutual funds data excludes the addition of share classes on top of existing mutual funds. Sources: Morningstar Direct, Sustainable Research and Analysis LLC

Notes of Explanation: New mutual funds data excludes the addition of share classes on top of existing mutual funds. Sources: Morningstar Direct, Sustainable Research and Analysis LLC

Observations:

- 11 sustainable funds were launched during the third quarter 2022, including two mutual funds and nine ETFs. This was the smallest number of funds launches so far this year. The largest number of funds came to market in the first quarter of the year, and the number of new fund introductions has been declining since then.

- That said, eight new ETFs were listed in September, the largest number of ETFs in a single month so far in 2022.

- Of note are two sustainable infrastructure funds listed in September: An ETF advised by J.P. Investment Management Inc. and a mutual fund advised by Principal Global Investors/Principal Real Estate Investors Global. The funds are positioned to take advantage of the growing demand for sustainable infrastructure and these funds, especially at scale, can serve as intermediaries to mobilize much needed capital for sustainable infrastructure investments, particularly in emerging markets.

- The two funds are the JPMorgan Sustainable Infrastructure ETF (BLLD) that came to market with $9.2 million in net assets and carries an expense ratio of 49 basis points (bps), and the Principal Global Sustainable Listed Infrastructure Institutional Shares (PGSLX) with $9.0 million at the time of launch, is subject to an expense ratio of 88 bps, and is available for purchase without a minimum investment through financial professionals. Both funds are actively managed, non-diversified funds, that intend to invest in large, medium and small cap US and foreign stocks, including stocks in emerging markets.

- BLLD focuses on infrastructure companies that facilitate accessibility to public goods and services such as electricity, renewable energy, clean water, digital access, transportation, medical facilities, affordable housing and education. Before employing a bottom-up investment approach, companies are qualified for consideration after screening them based on an exclusionary framework that includes controversial weapons, conventional weapons or thermal coal. Thereafter, eligible companies are identified using natural language processing to isolate companies that facilitate sustainable infrastructure through their products and services. They are, in turn, evaluated using J. P. Morgan Investment Management’s proprietary sustainable investment inclusion process.

- PGSLX is focused on companies engaged in the development, operation, and management of infrastructure assets. Infrastructure assets include but are not limited to utilities (electric, gas, water), transportation infrastructure (airports, highways, railways, marine ports), energy infrastructure (renewable energy generation, oil and gas pipeline operators), and communications infrastructure (cell phone tower operators, data centers, other providers of telecommunication services). Companies are evaluated based on their overall quality, valuation and market perception, including their ESG practices using a proprietary Principal Global Investors/Principal Real Estate Investors ESG-ratings framework. Companies are also assessed against their alignment with the United Nations Sustainable Development Goals (SDGs) with special emphasis on clean water and sanitation, affordable and clean energy, decent work and economic growth, industry innovation, and infrastructure, sustainable cities and infrastructure, and climate action.