The Bottom Line: Markets rallied in November across the board; actively managed sustainable mutual funds outperformed their conventional benchmarks while ESG securities market indices lagged.

November market commentary

The broad stock market as measured by the S&P 500 rallied strongly in November, gaining 10.95%. The index recorded the best monthly gain since April of the same year and in doing so recovered from the back-to-back declines registered over the prior two months. Fueled by the outcome of the U.S. presidential election and optimism over a COVID-19 vaccine, investors overcame pandemic-driven economic concerns. The Dow Jones Industrial Average (DJIA) and the NASDAQ Composite registered gains of 12.1% and 11.9%, respectively. Participation in the rally was not limited to technology and large-cap stocks. Small company stocks, especially value-oriented stocks, as well as microcap stocks have now recorded two consecutive monthly increases, including an 18.4% surge in November per the Russell 2000 Index, and an even better 19.3% increase registered by the Russell 2000 Value Index that was, in turn, topped by a gain of 21.6% achieved by the Russell Microcap Growth Index. Still, the top of the charts performance was recorded by energy stocks that eclipsed all other industry sectors across the market capitalization range with gains from 21.2% for mid-caps to 30.7% for small cap energy stocks.

Global and international markets across the board also turned in outstanding results. The MSCI ACWI, ex US Index posted a gain of 13.5% while MSCI EAFE logged an increase of 15.5%. The MSCI Emerging Markets Index was up 9.3% while some emerging market regions and a number of individual countries delivered even higher returns. Latin America and Eastern Europe, for example, were up 21.9% and 22.4%, respectively, while Korea, Mexico, Russia and Brazil posted gains of 17.9%, 20.3%, 20.8% and 23.7%, in that order.

Investment-grade intermediate fixed income securities as measured by the Bloomberg Barclays US Aggregate Bond Index added 0.98% but longer dated instruments, corporate bonds as well as high yield securities registered gains ranging from 1.3% for 20+ year US Treasury securities, 2.6% for corporates and 6.3% for Caa rated bonds.

ESG Indices: Actively managed funds outperform while ESG securities market indices lagged

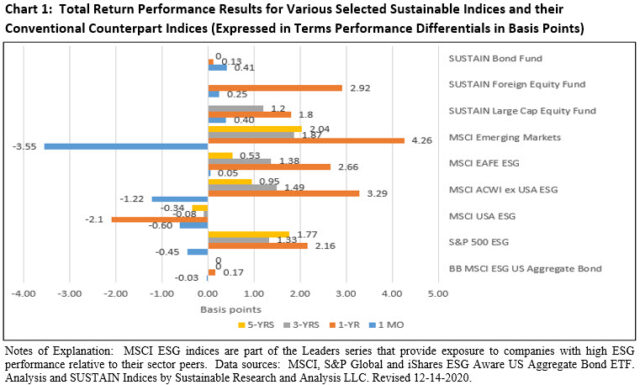

Actively managed sustainable equity, foreign and bond fund indices outperformed their conventional counterpart benchmarks while at the same time, with one exception, selected ESG securities market indices underperformed their corresponding non-ESG benchmarks in November.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index, the SUSTAIN Foreign Fund Index and SUSTAIN Bond Fund Index outperformed by 40, 41 and 25 bps. As for ESG-oriented securities market indices, both equity and fixed income, the S&P 500 ESG Index, the MSCI USA ESG Leaders Index, the MSCI ACWI, ex USA ESG Leaders Index, the MSCI Emerging Markets ESG Leaders Index and the Bloomberg Barclays MSCI US Aggregate ESG Focus Index each posted returns the fell short of their non-ESG counterparts by a range from 0.01% to a high of 3.55%. The only exception was the MSCI EAFE ESG Leaders Index that gained 15.55% versus 15.50% for its non-ESG counterpart, or a positive differential of 0.05%. In part, the performance lag may be attributable to lower than market energy sector weightings in light of the sector’s strong across the board performance in November. That said, this is not the only factor. For example, an underweight exposure to Brazil in the MSCI Emerging Markets ESG Leaders Index detracted from performance given Brazil’s 23.7% return in November. Also, it should be noted that in each instance month-to-month relative performance results are expected to vary, however, except for the MSCI USA ESG Leaders Index ESG benchmark results achieved by the above mentioned indices for periods of one-year, three-years and five-years through the end of November remain solidly ahead of their non-ESG counterparts. Refer to Chart 1.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index (11.34%)

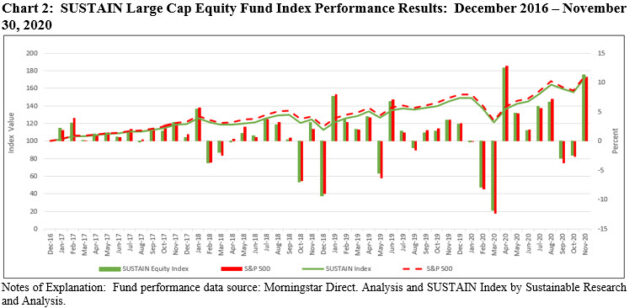

Coming in with a return of 11.34%, the SUSTAIN Larger Cap Fund Index beat the S&P 500 and the S&P 500 ESG Index by 40 bps and an even wider 84 bps, respectively. Seven of the ten funds in the index beat both benchmarks, led by the Hartford Capital Appreciation A shares that posted a 12.74% return versus the three laggards, including the Schroder North American Equity Inv shares (10.41%), Parnassus Core Equity Investor (10.36%) and Pioneer A (10.26%).

The SUSTAIN Large Cap Equity Fund Index has eclipsed the S&P 500 for three consecutive months and leads the conventional benchmark over the latest three months, year-to-date and trialing 12-months. Refer to Chart 2.

Sustainable (SUSTAIN) Bond Fund Index (1.38%)

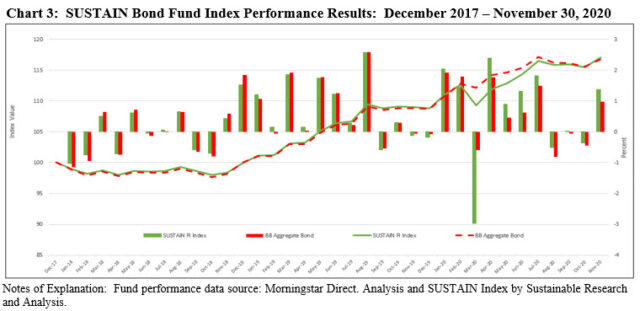

The Sustainable (SUSTAIN) Bond Fund Index recorded a gain of 1.38%, outperforming both the Bloomberg Barclays US Aggregate Bond Index (0.98%) and the Bloomberg Barclays MSCI US Aggregate ESG Focus Index (0.95%) by 40 bps and 43 bps. The index was powered higher by eight of the ten funds that comprise the index that posted excess returns ranging from 1.26% to a high of 1.90%. The Calvert Bond Fund I led the pack with a return of 1.9%, benefiting from lower rated bonds while the PAX Core Bond Fund Institutional shares brought up the rear with its 0.80% return.

The SUSTAIN Bond Fund Index, which has now exceeded the performance of the conventional benchmark during each of the last eight months, is also ahead over the latest three-months, year-to-date and trailing 12-month periods. Refer to Chart 3.

Sustainable (SUSTAIN) Foreign Fund Index (13.7%)

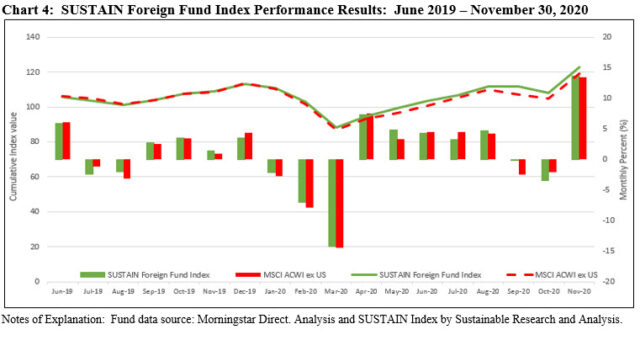

The SUSTAIN Foreign Fund Index registered a 13.7% increase, adding the best monthly gain since the commencement of the index as of June 2019. This was enough to exceed by 25 bps the performance of the MSCI ACWI, ex US, which gained 13.45%. The index is ahead of the conventional benchmark over the past three-months, year-to-date and trailing 12-month intervals.

Seven of the ten constituent funds beat the conventional index, led by TIAA-CREF Social Choice International Equity Institutional shares that delivered a 15.38% return. Closely behind was the JPMorgan International Research Enhanced Equity R6, up 15.19%. BMO Pyrford International Stock I brought up the rear with its 11.35% return. Refer to Chart 3.

November 2020 market update: Markets rally and ESG indices diverge

The Bottom Line: Markets rallied in November across the board; actively managed sustainable mutual funds outperformed their conventional benchmarks while ESG securities market indices lagged.

Share This Article:

The Bottom Line: Markets rallied in November across the board; actively managed sustainable mutual funds outperformed their conventional benchmarks while ESG securities market indices lagged.

November market commentary

The broad stock market as measured by the S&P 500 rallied strongly in November, gaining 10.95%. The index recorded the best monthly gain since April of the same year and in doing so recovered from the back-to-back declines registered over the prior two months. Fueled by the outcome of the U.S. presidential election and optimism over a COVID-19 vaccine, investors overcame pandemic-driven economic concerns. The Dow Jones Industrial Average (DJIA) and the NASDAQ Composite registered gains of 12.1% and 11.9%, respectively. Participation in the rally was not limited to technology and large-cap stocks. Small company stocks, especially value-oriented stocks, as well as microcap stocks have now recorded two consecutive monthly increases, including an 18.4% surge in November per the Russell 2000 Index, and an even better 19.3% increase registered by the Russell 2000 Value Index that was, in turn, topped by a gain of 21.6% achieved by the Russell Microcap Growth Index. Still, the top of the charts performance was recorded by energy stocks that eclipsed all other industry sectors across the market capitalization range with gains from 21.2% for mid-caps to 30.7% for small cap energy stocks.

Global and international markets across the board also turned in outstanding results. The MSCI ACWI, ex US Index posted a gain of 13.5% while MSCI EAFE logged an increase of 15.5%. The MSCI Emerging Markets Index was up 9.3% while some emerging market regions and a number of individual countries delivered even higher returns. Latin America and Eastern Europe, for example, were up 21.9% and 22.4%, respectively, while Korea, Mexico, Russia and Brazil posted gains of 17.9%, 20.3%, 20.8% and 23.7%, in that order.

Investment-grade intermediate fixed income securities as measured by the Bloomberg Barclays US Aggregate Bond Index added 0.98% but longer dated instruments, corporate bonds as well as high yield securities registered gains ranging from 1.3% for 20+ year US Treasury securities, 2.6% for corporates and 6.3% for Caa rated bonds.

ESG Indices: Actively managed funds outperform while ESG securities market indices lagged

Actively managed sustainable equity, foreign and bond fund indices outperformed their conventional counterpart benchmarks while at the same time, with one exception, selected ESG securities market indices underperformed their corresponding non-ESG benchmarks in November.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index, the SUSTAIN Foreign Fund Index and SUSTAIN Bond Fund Index outperformed by 40, 41 and 25 bps. As for ESG-oriented securities market indices, both equity and fixed income, the S&P 500 ESG Index, the MSCI USA ESG Leaders Index, the MSCI ACWI, ex USA ESG Leaders Index, the MSCI Emerging Markets ESG Leaders Index and the Bloomberg Barclays MSCI US Aggregate ESG Focus Index each posted returns the fell short of their non-ESG counterparts by a range from 0.01% to a high of 3.55%. The only exception was the MSCI EAFE ESG Leaders Index that gained 15.55% versus 15.50% for its non-ESG counterpart, or a positive differential of 0.05%. In part, the performance lag may be attributable to lower than market energy sector weightings in light of the sector’s strong across the board performance in November. That said, this is not the only factor. For example, an underweight exposure to Brazil in the MSCI Emerging Markets ESG Leaders Index detracted from performance given Brazil’s 23.7% return in November. Also, it should be noted that in each instance month-to-month relative performance results are expected to vary, however, except for the MSCI USA ESG Leaders Index ESG benchmark results achieved by the above mentioned indices for periods of one-year, three-years and five-years through the end of November remain solidly ahead of their non-ESG counterparts. Refer to Chart 1.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index (11.34%)

Coming in with a return of 11.34%, the SUSTAIN Larger Cap Fund Index beat the S&P 500 and the S&P 500 ESG Index by 40 bps and an even wider 84 bps, respectively. Seven of the ten funds in the index beat both benchmarks, led by the Hartford Capital Appreciation A shares that posted a 12.74% return versus the three laggards, including the Schroder North American Equity Inv shares (10.41%), Parnassus Core Equity Investor (10.36%) and Pioneer A (10.26%).

The SUSTAIN Large Cap Equity Fund Index has eclipsed the S&P 500 for three consecutive months and leads the conventional benchmark over the latest three months, year-to-date and trialing 12-months. Refer to Chart 2.

Sustainable (SUSTAIN) Bond Fund Index (1.38%)

The Sustainable (SUSTAIN) Bond Fund Index recorded a gain of 1.38%, outperforming both the Bloomberg Barclays US Aggregate Bond Index (0.98%) and the Bloomberg Barclays MSCI US Aggregate ESG Focus Index (0.95%) by 40 bps and 43 bps. The index was powered higher by eight of the ten funds that comprise the index that posted excess returns ranging from 1.26% to a high of 1.90%. The Calvert Bond Fund I led the pack with a return of 1.9%, benefiting from lower rated bonds while the PAX Core Bond Fund Institutional shares brought up the rear with its 0.80% return.

The SUSTAIN Bond Fund Index, which has now exceeded the performance of the conventional benchmark during each of the last eight months, is also ahead over the latest three-months, year-to-date and trailing 12-month periods. Refer to Chart 3.

Sustainable (SUSTAIN) Foreign Fund Index (13.7%)

The SUSTAIN Foreign Fund Index registered a 13.7% increase, adding the best monthly gain since the commencement of the index as of June 2019. This was enough to exceed by 25 bps the performance of the MSCI ACWI, ex US, which gained 13.45%. The index is ahead of the conventional benchmark over the past three-months, year-to-date and trailing 12-month intervals.

Seven of the ten constituent funds beat the conventional index, led by TIAA-CREF Social Choice International Equity Institutional shares that delivered a 15.38% return. Closely behind was the JPMorgan International Research Enhanced Equity R6, up 15.19%. BMO Pyrford International Stock I brought up the rear with its 11.35% return. Refer to Chart 3.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainableinvest.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact