The Bottom Line: Green bond funds added $60.7 million in November while green bond issuance flagged as COP 26 concluded and Y-T-D volume reached record.

Summary

Green bond funds added $60.7 million in November, recovering from sluggish gains over the last two months, and ending the last month of the year at almost $1.5 billion in net assets. At the same time, volume of green bonds flagged again in November but reached a new 11-month high at $429.8 billion. November’s performance of funds versus relevant benchmarks was mixed, however, effective active management combined with lower expense ratios and exposure to dollar as well as non-dollar denominated green bonds have offered investors the best green bond fund risk adjusted performance results over the three-year interval.

Green bond funds added $60.7 million in November, recovering from sluggish gains over the last two months

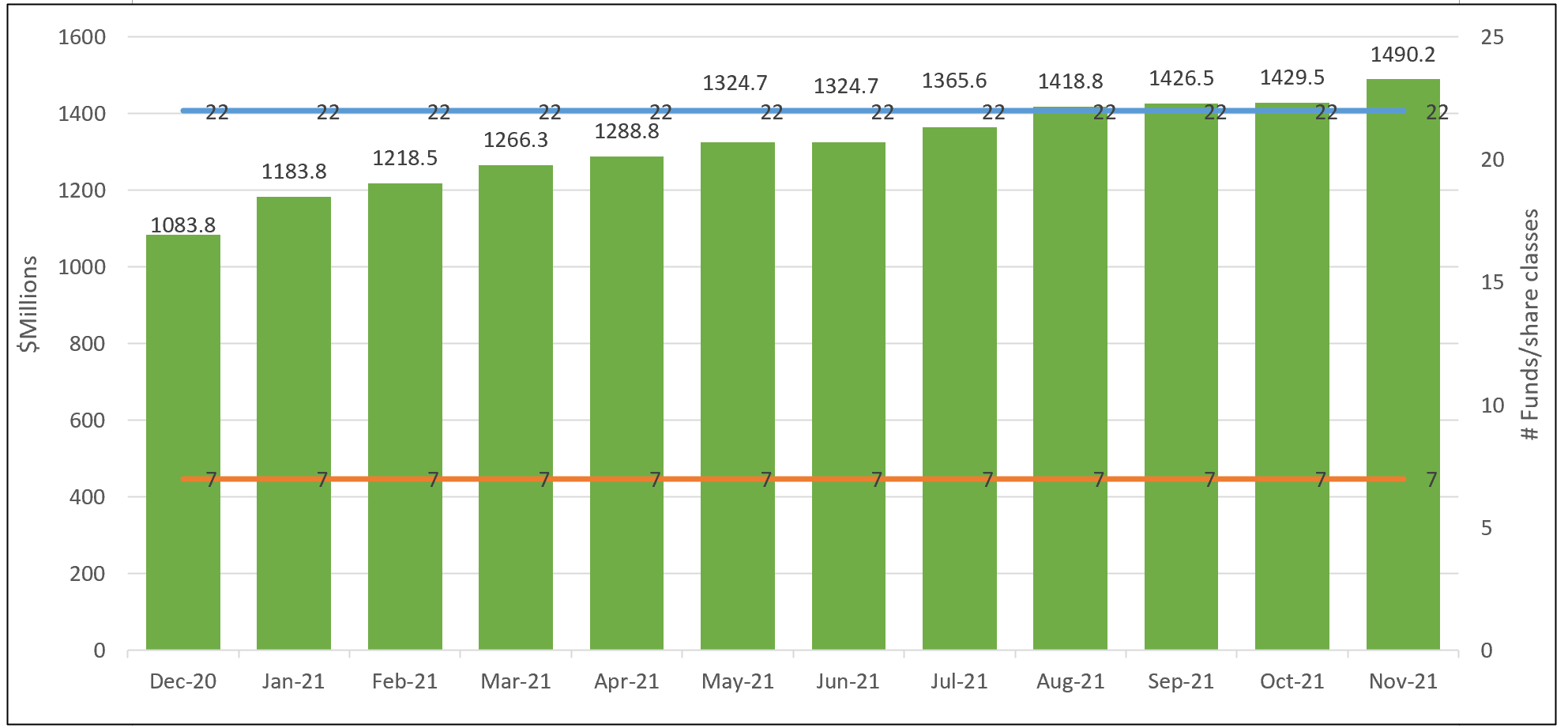

Green bond funds, consisting of five mutual funds offering 20 share classes in total and two ETFs, came back strongly in November after a sluggish two-month interval to add $60.7 million and end the month with $1,490.2 million in net assets. The 4.2% month-over-month increase was the best monthly gain since January 2021 when green bond funds added $100 million. Attention focused on the climate debate and negotiations taking place in Glasgow, Scotland, over a two-week period that ended November 13th might have been a contributing factor. On a year-to-date basis, green investment funds added $406.4 million, or a 37.5% gain in net assets, up from $1,083.8 million at year-end 2020. Refer to Chart 1.

The Calvert Green Bond Fund I (CGBIX) experienced net institutional inflows in the amount of $34.1 million (of $35.2 million across the fund’s three share classes) and at the same time the iShares World Green Bond ETF (BGRN) accumulated a net of $19.1 million. The two funds accounted for 87.6% of the month’s net gain. Also during November, the VanEck Green Bond ETF (GRNB) succeeded in piercing through the $100 million in net assets level with its net addition of $2.5 million. The three funds combined account for $1,353.5 million or 91% of the segment’s total assets.

Two recently registered green bond ETFs, both to be managed by Tuttle Capital Management LLC, including the Green Bond ETF and Green Bond Short-Term ETF appear to have again deferred their effective date again, this time pushing off the proposed public offering beyond November 30th.

Chart 1: Green bond mutual funds and ETFs and assets under management – December 2020 – November 30, 2021

Notes of Explanation: Fund total net assets data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and analysis LLC

November’s performance of funds versus relevant benchmarks was mixed

Green bond funds in November produced an average return of 0.31% as compared to a 0.30% gain recorded by the Bloomberg US Aggregate Bond Index, 1.05% increase posted by the ICE BofAML Green Bond Index Hedged US Index, and -0.10% return posted by the S&P Green Bond US Dollar Select Index¹. The average results for the group were lifted by the Franklin Municipal Green Bond Fund with its four share classes that were up at the higher end of the performance range with total returns between 0.95% and 1.02%. Excluding the Franklin funds, the average performance of green bond funds dropped to 0.16%. Considering the investment mandates of the various funds, only three funds outperformed their relevant benchmark. These are the iShares Global Green Bond ETF, the Franklin Municipal Green Bond Fund and the VanEck Green Bond ETF. Refer to Table 1.

The iShares Global Green Bond ETF was November’s best performing fund, adding 1.12%. At $256 million, the fund eclipsed the performance of the broader ICE BofAML Green Bond Index Hedged US Index that reflects the global eligible universe of bonds that the fund may invest in. At the other end of the range, the PIMCO Climate Bond Fund C (PCECX) recorded a decline of -0.35%.

Over the trailing 12-month interval, with and without the impact of the Franklin Municipal Green Bond Fund, the average performance of the segment eclipsed both the the Bloomberg US Aggregate Bond Index and the ICE BofAML Green Bond Index Hedged US Index.

Green bond funds in operation for three years or more posted an average return of 5.4% for the three-year interval through the end of November. Of these funds, the TIAA-CREF Green Bond Fund and its five share classes was the only fund to beat the Bloomberg US Aggregate Bond Index and the ICE BofAML Green Bond Index Hedged US Index. Effective active management combined with lower expense ratios and exposure to dollar as well as non-dollar denominated green bonds have offered investors the best green bond fund risk adjusted performance results during the trailing three-year interval.

¹The ICE BofAML Green Bond Index Hedged US Dollar Index is more relevant benchmarks for funds also investing in non-US dollar denominated green bonds while the S&P Green Bond US Dollar Select Index is more relevant to funds restricting their investment universe to US dollar denominated green bonds.

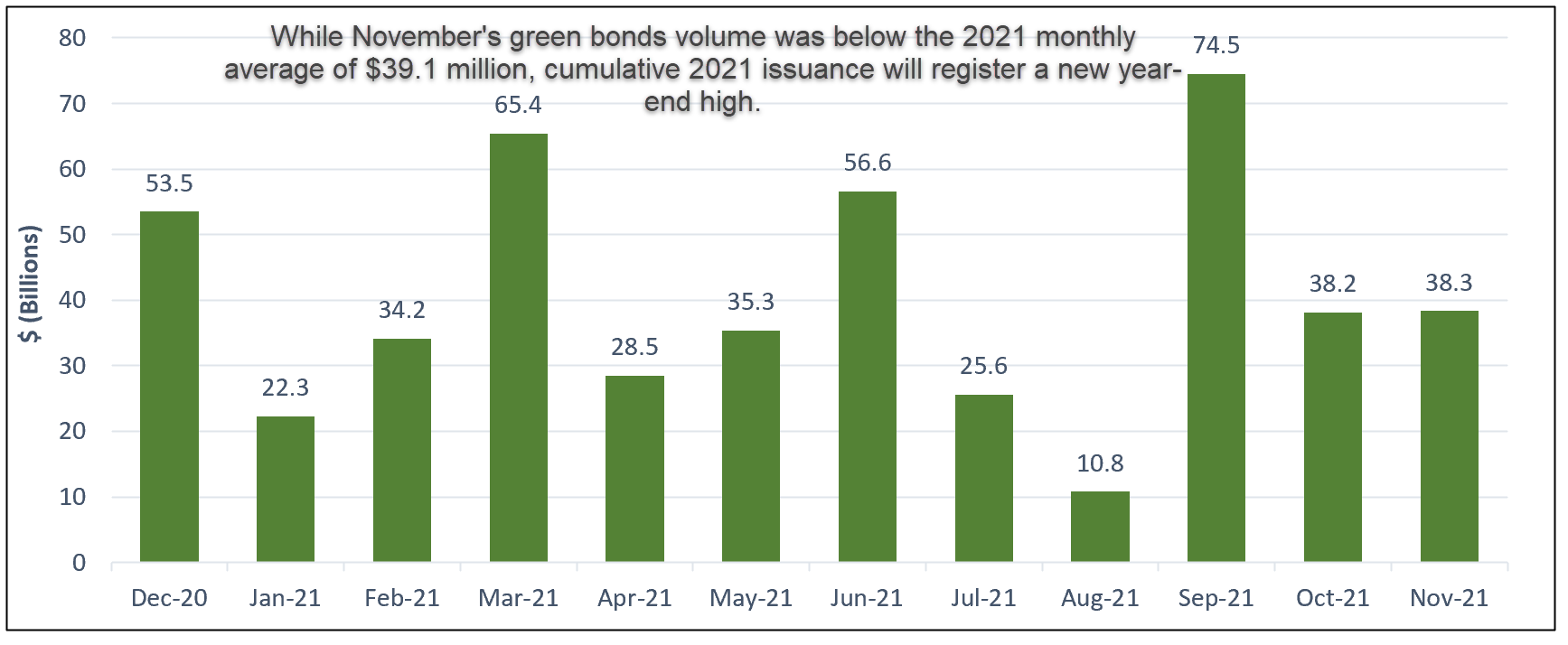

Volume of green bonds flagged again in November but reached a new 11-month high

Monthly green bond issuance flagged again even as volume in November, which came in at $38.3 billion, exceeded October’s level of $38.2 billion. This compares to the average monthly volume over 11-months of $39.1 billion. Year-to-date green bond issuance has already achieved an all-time eleven-month high of $429.8 billion and is expected to translate into a new annual all-time high record at the end of December 2021. Volumes in 2022 are likely to reach even higher levels. Refer to Chart 2.

Chart 2: Monthly green bonds issuance: December 2020– November 30, 2021

In part, this development can be explained by the growing number of first time sovereign green bond issuances, including Italy, Spain, the United Kingdom and the European Union. Also contributing to the rise this year is the acceleration in issuances by energy generation companies, real estate firms and industrial manufacturers, most notably in the automotive sector.

While it may have been surprising that volumes did not tick up during and following the conclusion of the COP 26 climate negotiations in Glasgow, at least three new sovereign issuers announced in November their intent to issue green bonds in 2022. These include the Kingdom of Denmark, the Philippines as well as the government of Ghana.

The two-week COP 26 climate summit deliberations concluded with 200 countries agreeing to the Glasgow Climate Pact that sets out a consensus on accelerating climate action. Either in the form of negotiations among the participating countries, a series of voluntary side deals or complementary announcements, the summit produced a number of important breakthrough outcomes. These included: pledges to “phase down” coal power, a joint US and China declaration to engage in expanded individual and combined efforts to accelerate the transition to a global net zero economy, the adoption of carbon trading rules, pledges on the part of more than 100 countries to reduce methane emissions, a commitment to return next year to Cop 27 with better climate plans along with new rules that will allow for greater scrutiny on emissions reporting, an agreement to properly set up a mechanism for providing financial help to countries struck by catastrophic climate events, a pact on deforestation, as well as a commitment on the part of banks, investors and insurers representing $130 trillion in assets to decarbonize their businesses by mid-century. In addition, there was a major announcement made by the International Financial Reporting Standards Board (IFRS) to provide the global financial markets with high-quality disclosures on climate and other sustainability issues.

Taken together, an IEA analysis shows that fully achieving all net-zero pledges to date along with pledges made by more than 100-countries to reduce methane could limit global warming to 1.8℃; and the Glasgow Climate Pact is expected to stimulate sustainable bond issuances going forward, including green bonds.

Table 1: Green bond funds: Assets and performance through November 30, 2021

Fund Name | 1-Month Return (%) | 3-Month Return (%) | Y-T-D Return (%) | 12-Month Return (%) | 3-Yesar Return (%) | AUM ($M) | Expense Ratio (%) |

Calvert Green Bond A* | 0.04 | -1.18 | -1.71 | -1.33 | 4.79 | 89.6 | 0.73 |

Calvert Green Bond I* | 0.07 | -1.11 | -1.48 | -1.08 | 5.04 | 896.2 | 0.48 |

Calvert Green Bond R6* | 0.07 | -1.1 | -1.43 | -1.03 | 9.7 | 0.43 | |

Franklin Municipal Green Bond A | 0.95 | -0.25 | 0.8 | 1.59 | 1.2 | 0.71 | |

Franklin Municipal Green Bond Adv | 0.98 | -0.19 | 0.91 | 1.69 | 8.7 | 0.46 | |

Franklin Municipal Green Bond C | 1.02 | -0.26 | 0.73 | 1.51 | 0.2 | 1.11 | |

Franklin Municipal Green Bond R6 | 0.98 | -0.19 | 0.96 | 1.75 | 0 | 0.44 | |

iShares Global Green Bond ETF* | 1.12 | -0.56 | -1.52 | -1.29 | 5.12 | 256 | 0.2 |

Mirova Global Green Bond A* | 0.77 | -0.56 | -2.07 | -1.6 | 5.01 | 6.8 | 0.93 |

Mirova Global Green Bond N* | 0.77 | -0.49 | -1.76 | -1.22 | 5.35 | 8 | 0.63 |

Mirova Global Green Bond Y* | 0.87 | -0.5 | -1.71 | -1.27 | 5.31 | 31.3 | 0.68 |

PIMCO Climate Bond A* | -0.29 | -1.6 | -0.83 | -0.22 | 0.8 | 0.94 | |

PIMCO Climate Bond C* | -0.35 | -1.79 | -1.49 | -0.97 | 0 | 1.69 | |

PIMCO Climate Bond I-2* | -0.26 | -1.53 | -0.53 | 0.08 | 1.9 | 0.64 | |

PIMCO Climate Bond I-3* | -0.27 | -1.54 | -0.59 | 0.03 | 0.1 | 0.69 | |

PIMCO Climate Bond Institutional* | -0.25 | -1.5 | -0.45 | 0.18 | 19.6 | 0.54 | |

TIAA-CREF Green Bond Advisor* | 0.11 | -0.82 | -0.47 | 0.13 | 6.09 | 3.2 | 0.55 |

TIAA-CREF Green Bond Institutional* | 0.11 | -0.81 | -0.46 | 0.14 | 6.12 | 30 | 0.45 |

TIAA-CREF Green Bond Premier* | 0.1 | -0.85 | -0.57 | 0.02 | 5.99 | 1.1 | 0.6 |

TIAA-CREF Green Bond Retail* | 0.09 | -0.88 | -0.8 | -0.14 | 5.84 | 7.6 | 0.78 |

TIAA-CREF Green Bond Retirement* | 0.1 | -0.85 | -0.56 | 0.02 | 5.98 | 16.2 | 0.7 |

-0.01 | -1.92 | -1.89 | -1.58 | 4.13 | 102 | 0.2 | |

Average/Total | 0.31 | -0.93 | -0.77 | -0.21 | 1,490.2 | 0.66 | |

Bloomberg US Aggregate Bond Index | 0.30 | -0.6 | -1.29 | -1.15 | 5.52 | ||

Bloomberg Municipal Total Return Index | 0.85 | -0.17 | 1.35 | 1.97 | 5.09 | ||

S&P Green Bond US Dollar Select Index | -0.10 | -0.03 | -1.58 | -1.13 | 4.66 | ||

ICE BofAML Green Bond Index Hedged US | 1.05 | -0.66 | -1.36 | -1.04 | 4.17 |

Notes of Explanation: Blank cells=NA. *Fund invests in foreign currency bonds and performance should also be compared to a more narrowly based relevant index such as the ICE BofAML Green Blond Index Hedged US or equivalent. ** Fund invests in US dollar denominated green bonds only and performance should also be compared to a more narrowly based relevant index such as the S&P Green Bond US Dollar Select Index or equivalent. Fund total net assets and performance data source: Morningstar Direct; fund filings. Research and analysis by Sustainable Research and Analysis LLC