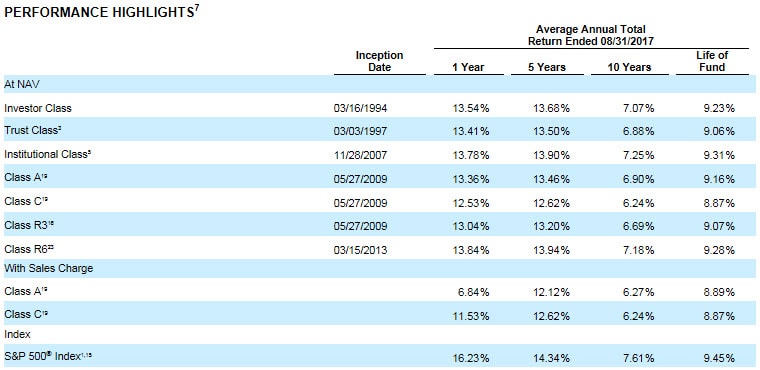

Neuberger Berman Socially Responsive Fund

11/1 Semi-Annual Report as of 9/30/2017

Observations

- This large cap growth fund continues to lag the fund’s prospectus benchmark, the S&P 500 Index, over the 1-year, 5-year, 10-year and since inception intervals, across all share classes.

- The report does not make any industry or company specific references to the impacts that its sustainable strategy might have had on fund performance; nor is there any mention of societal outcomes although these are to be found in other reports and research published by the management firm. Refer to previously published article.

Sustainable Investing Strategy

The fund seeks long-term growth of capital by investing primarily in securities of companies that meet the fund’s financial criteria and social policy. To pursue its goal, the fund invests primarily in common stocks of mid- to large-capitalization companies that meet the fund’s social policy. In addition to financial considerations and selection criteria, companies are selected on the basis of their leadership with regard to environmental concerns, and progressive workplace practices including diversity and community relations. In addition, a company’s record in public health and the nature of its products are evaluated. Firms are judged on their corporate citizenship overall, considering their accomplishments as well as their goals. It is noted by Neuberger Berman that while these judgments are inevitably subjective, the fund endeavors to avoid companies that derive revenue from gambling or the production of alcohol, tobacco, weapons, or nuclear power. The fund also does not invest in any company that derives its total revenue primarily from non-consumer sales to the military. Also, the fund is active in shareholder engagement and proxy voting.

Report Commentary

Top individual detractors this period included W.W. Grainger, Kroger, and Advance Auto Parts. All three businesses saw stock valuations impacted on rising worries about Amazon’s competitive threat. The Fund continues to own these names, as we believe these businesses will benefit as markets begin to shift towards a focus on fundamentals, including the opportunity of operating in a fragmented industry, as well as the benefits and competitive advantages of incumbent business models.

Top contributors included Progressive Corp., Ryanair, and Novozymes. Long-term holding Progressive Corp. continuing to demonstrate profitable growth in the auto insurance industry. Ryanair benefited as the company continued to report strong operating performance and investor fears around Brexit started to dissipate. Novozymes, an addition during the fiscal year, produces, distributes and sells enzymes to a broad range of end users globally. We believe the long-term opportunity to replace petro-chemicals via enzymes is a secular opportunity, as typically enzymes are a more cost-efficient and sustainable solution.

Consistent with our investment process, we took advantage of transitory market concerns to opportunistically buy well-positioned businesses while we exited positions based on valuation or where we found replacements that in our view offered a superior risk return profile.

Performance Results

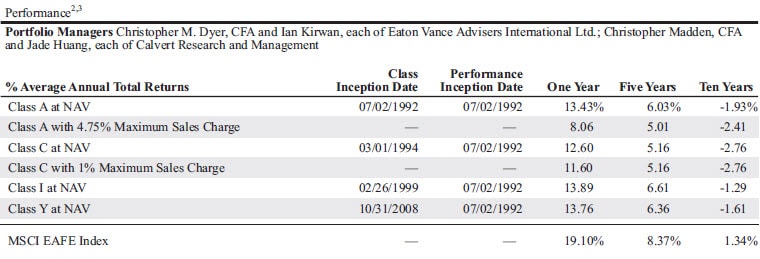

Calvert International Equity Fund

11/28 Annual Report as of 9/30/2017

Observations

- This international fund lagged the performance of its prospectus benchmark, the MSCI EAFE Index, over the 1-year, 5-year and 10-year intervals, across all share classes.

- The fund’s annual report makes reference to the impact that energy, oil and mining stocks that the fund has avoided due to environmental and other sustainability considerations was detrimental to fund performance. Also, relevant information regarding societal impacts may be found in other reports and research published by the management firm.

Sustainable Investing Strategy

Calvert Research and Management seeks to invest in issuers that provide positive leadership in the areas of their operations and overall activities that are material to improving societal outcomes, including those that will affect future generations.

Calvert seeks to invest in issuers that balance the needs of financial and nonfinancial stakeholders and demonstrate a commitment to the global commons, as well as to the rights of individuals and communities.

The Calvert Principles for Responsible Investment (Calvert Principles) provide a framework for Calvert’s evaluation of investments and guide Calvert’s stewardship on behalf of clients through active engagement with issuers. The Calvert Principles seek to identify companies and other issuers that operate in a manner that is consistent with or promote:

Environmental Sustainability and Resource Efficiency

- Reduce the negative impact of operations and practices on the environment

- Manage water scarcity and ensure efficient and equitable access to clean sources

- Mitigate impact on all types of natural capital

- Diminish climate-related risks and reduce carbon emissions

- Drive sustainability innovation and resource efficiency through business operations or other activities, products and services

Equitable Societies and Respect for Human Rights

- Respect consumers by marketing products and services in a fair and ethical manner, maintaining integrity in customer relations and ensuring the security of sensitive consumer data

- Respect human rights, respect culture and tradition in local communities and economies and respect Indigenous Peoples’ Rights

- Promote diversity and gender equity across workplaces, marketplaces and communities

- Demonstrate a commitment to employees by promoting development, communication, appropriate economic opportunity and decent workplace standards

- Respect the health and well-being of consumers and other users of products and services by promoting product safety

Accountable Governance and Transparency

- Provide responsible stewardship of capital in the best interests of shareholders and debtholders

- Exhibit accountable governance and develop effective boards or other governing bodies that reflect expertise and diversity of perspective and provide oversight of sustainability risk and opportunity

- Include environmental and social risks, impacts and performance in material financial disclosures to inform shareholders and debtholders, benefit stakeholders and contribute to strategy

- Lift ethical standards in all operations, including in dealings with customers, regulators and business partners

- Demonstrate transparency and accountability in addressing adverse events and controversies while minimizing risks and building trust.

Calvert’s commitment to these Principles signifies continuing focus on investing in issuers with superior responsibility and sustainability characteristics. The application of the Calvert Principles generally precludes investments in issuers that:

- Demonstrate poor environmental performance or compliance records, contribute significantly to local or global environmental problems, or include risks related to the operation of nuclear power facilities.

- Are the subject of serious labor-related actions or penalties by regulatory agencies or demonstrate a pattern of employing forced, compulsory or child labor.

- Exhibit a pattern and practice of human rights violations or are directly complicit in human rights violations committed by governments or security forces, including those that are under U.S. or international sanction for grave human rights abuses, such as genocide and forced labor.

- Exhibit a pattern and practice of violating the rights and protections of Indigenous Peoples.

- Demonstrate poor governance or engage in harmful or unethical practices.

- Manufacture tobacco products.

- Have significant and direct involvement in the manufacture of alcoholic beverages or gambling operations.

- Manufacture or significant and direct involvement in the sale of firearms and/or ammunition.

- Manufacture, design or sell weapons, or the critical components of weapons that violate international humanitarian law; or manufacture, design or sell inherently offensive weapons, as defined by the Treaty on Conventional Armed Forces in Europe and the U.N. Register on Conventional Arms, or the munitions designed for use in such inherently offensive weapons.

- Abuse animals, cause unnecessary suffering and death of animals, or whose operations involve the exploitation or mistreatment of animals.

- Develop genetically-modified organisms for environmental release without countervailing social benefits such as demonstrating leadership in promoting safety, protection of Indigenous Peoples’ rights, the interests of organic farmers and the interests of developing countries generally.

Report Commentary

Stock selection was the largest contributor to underperformance during the period. For the most part, sector allocations did not have a significant impact on the Fund’s performance relative to the Index. Overall, holdings in the health care, consumer discretionary and industrials sectors were the weakest performers. Holdings in the consumer staples and information technology sectors performed best.

In the energy sector, a combination of allocation and security selection effects resulting from the portfolio’s environmental, social and governance (ESG) guidelines detracted from performance. Many energy, oil and mining companies do not meet Calvert’s ESG criteria due to environmental or other sustainability concerns. Early in the period, when the energy sector overall performed well, the Fund’s underweight to the sector weakened performance. Later in the period, the lack of exposure to major oil companies, and poor performance among some Fund holdings in the sector, detracted. An underweight to the mining sector was also detrimental. Kering, a French consumer discretionary company that owns numerous luxury brands, was the strongest individual contributor during the period. Its strength largely stemmed from a successful reinvigoration of its Gucci brand.

ASML Holding NV, a Dutch information technology company, was the next largest contributor as adoption of extreme ultraviolet (EUV) technology, for which ASML is a market leader, took off considerably earlier than had been anticipated. EUV is a cutting-edge technology used in the semiconductor industry, including by industry leaders. Unilever plc, a consumer staples holding based in London, was also a leading individual contributor. It benefited from a takeover bid from 3G Capital. Although Unilever fended off the offer, the takeover attempt prompted significant cost cutting at the company.

Brambles Ltd., the leading global manufacturer of wooden pallets used for shipping in fast-moving consumer goods industries, was the largest individual detractor during the period. Performance of the Australian company, in the industrials sector, was hurt by turnover in corporate leadership and challenging conditions in the North American market.

WPP plc, a U.K. company in consumer discretionary, was also one of the largest detractors. The company, the largest media advertising agency worldwide, was hurt by both cyclical and secular trends during the period. Foremost among these were cost cutting by major clients, including that of Unilever in response to the takeover bid, and growing concerns about the challenges traditional advertising agencies face as Google, Inc., Facebook, Inc., and other social media disrupt the market and assume greater market share.

Fund Performance Results

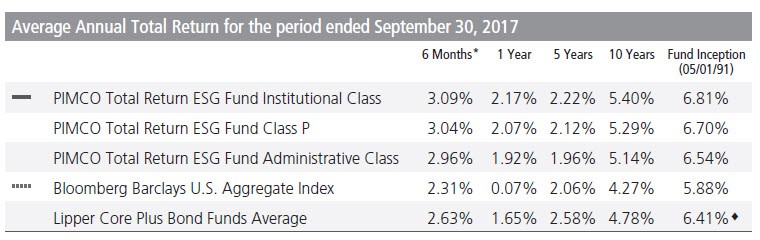

PIMCO Total Return ESG Fund

11/28 Semi-Annual Report as of 9/30/2017

Observations

- The fund’s performance for the 6-month interval ending September 30, 2017, during which its newly adopted sustainable investing strategy was in place having been adopted as of January 7, 2017, exceeded the results achieved by the fund’s prospectus benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. Excess returns ranged from 65 bps to 78 bps.

- The report does not make any industry or company specific references to the impacts that its sustainable strategy might have had on fund performance.

Sustainable Investing Strategy

Effective 6 January 2017 the fund adopted a set of exclusionary practices, an ESG integration strategy and issuer engagement approach to improve ESG practices.

Exclusionary practices: The fund will not invest in the securities of any issuer determined to be engaged principally in the manufacture of alcoholic beverages, tobacco products or military equipment, the operation of gambling casinos, the production of coal, or in the production or trade of pornographic materials. In addition, the fund will not invest in the securities of any issuer determined to be engaged principally in the provision of healthcare services or the manufacture of pharmaceuticals, unless the issuer derives 100% of its gross revenues from products or services designed to protect and improve the quality of human life, as determined on the basis of available information. To the extent possible on the basis of available information, an issuer will be deemed to be principally engaged in an activity if it derives more than 10% of its gross revenues from such activities. In addition, the Fund will not invest directly in securities of issuers that are engaged in certain business activities in or with the Republic of the Sudan.

Shareholder/Bond holder engagement: PIMCO may engage proactively with issuers to encourage them to improve their ESG practices. PIMCO’s activities in this respect may include, but are not limited to, direct dialogue with company management, such as through in-person meetings, phone calls, electronic communications, and letters. Through these engagement activities, PIMCO seeks to identify opportunities for a company to improve its ESG practices, and will endeavor to work collaboratively with company management to establish concrete objectives and to develop a plan for meeting these objectives. The Fund may invest in securities of issuers whose ESG practices are currently suboptimal, with the expectation that these practices may improve over time either as a result of PIMCO’s engagement efforts or through the company’s own initiatives. It may also exclude those issuers that are not receptive to PIMCO’s engagement efforts, as determined in PIMCO’s sole discretion.

ESG Integration: The fund may avoid investment in the securities of issuers whose business practices with respect to the environment, social responsibility, and governance (ESG) are not to PIMCO’s satisfaction. In determining the efficacy of an issuer’s ESG practices, PIMCO will use its own proprietary assessments of material ESG issues and may also reference standards as set forth by recognized global organizations such as entities sponsored by the United Nations.

Report Commentary

The following affected performance during the reporting period:

» Positions in non-agency mortgage-backed securities contributed to relative performance, as total returns in these securities were positive.

» U.S. interest rate strategies contributed to relative performance, particularly due to overweight exposure to U.S. duration.

» Long exposure to the euro during the latter half of the reporting period contributed to relative performance, as the euro appreciated against the U.S. dollar.

» Short exposure to the French OAT-German Bund spread detracted from relative performance, as the spread tightened.

» Underweight exposure to investment-grade corporate spread duration detracted from relative performance, as investment corporate spreads tightened.

» Positions in U.S. Treasury Inflation-Protected Securities detracted from relative performance, as breakeven inflation rates fell.

Fund Performance Results

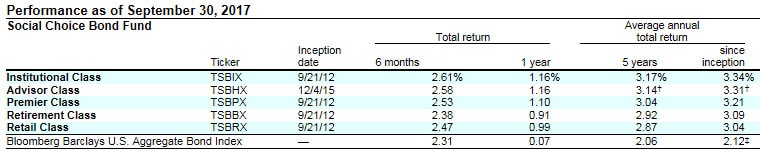

TIAA Social Choice Bond Fund

11/28 Semi-Annual Report as of 9/30/2017

Observations

- The fund continues to deliver strong performance results relative to its prospectus index, the Bloomberg Barclays U.S. Aggregate Bond Index. For the 6-month interval ending September 30, 2017, the fund, including its five share classes, exceeded the performance of its benchmark by a low of 7 bps and a high of 30 bps achieved by the Institutional Class subject to the lowest expense ratio.

- The report does not make any industry or company specific references to the impacts that its sustainable strategy might have had on fund performance. That said, relevant information regarding societal impacts may be found in other reports and research published by the management firm.

Sustainable Investing Strategy

The fund pursues a unique sustainable investing mandate, through a combination of strategies that relies on external ESG research as well as a proprietary approach. The strategies are, as follows:

Exclusion: The fund will not generally invest in companies significantly involved in certain business activities, including but not limited to, the production of alcohol, tobacco, military weapons, firearms, nuclear power and gambling.

ESG Integration: The fund’s investments are subject to ESG criteria. The ESG criteria are implemented based on data provided by independent research firms. All corporate issuers must meet or exceed minimum ESG performance standards to be eligible for investment by the fund. The evaluation process favors companies with leadership in ESG performance relative to their peers. Typically, environmental assessment categories include climate change, natural resource use, waste management and environmental opportunities. Social evaluation categories include human capital, product safety and social opportunities. Governance assessment categories include corporate governance, business ethics and government & public policy. How well companies adhere to international norms and principles and involvement in major ESG controversies (examples of which may relate to the environment, customers, human rights & community, labor rights & supply chain, and governance) are other considerations.

The ESG evaluation process is conducted on an industry-specific basis and involves the identification of key performance indicators, which are given more or less relative weight compared to the broader range of potential assessment categories. Concerns in one area do not automatically eliminate an issuer from being an eligible fund investment. When ESG concerns exist, the evaluation process gives careful consideration to how companies address the risks and opportunities they face in the context of their sector or industry and relative to their peers.

The fund invests in certain asset-backed securities, mortgage-backed securities and other securities that represent interests in assets such as pools of mortgage loans, automobile loans or credit card receivables. These securities are evaluated on the basis of the underlying interests in pools of loans rather than the ESG sponsor of the asset-backed security.

Impact Investing: A portion of the fund’s assets is invested in fixed income instruments in accordance with TIAA’s proprietary Proactive Social Investments (PSI) framework. These investments, which as of March 31, 2016 accounted for 39.8% of the portfolio, provide direct exposure to issuers and/or individual projects with social or environmental benefits that are classified based on the issuer’s mission, ESG performance quality and/or the project to be funded. Within this PSI allocation, the fund seeks opportunities to invest in publicly traded fixed-income securities that finance initiatives in areas including affordable housing, community and economic development, renewable energy and climate change, and natural resources. These investments will be selected based on the same financial criteria used in selecting the fund’s other fixed-income investments.

The four thematic areas are further described, as follows: 1. Affordable housing: investments that support the financing of low- and moderate-income housing loans, transit-oriented development, walkable communities or mixed-use development projects. 2. Community and economic development: investments that support financial services, hospital/medical services, educational services, community centers, urban revitalization, humanitarian, disaster and international aid services, inclusive of underserved and/or economically disadvantaged communities. 3. Renewable energy and climate change: securities that finance new or expand existing renewable energy projects (including hydroelectric, solar and wind, geothermal, and energy from waste, etc.), smart grid and related projects designed to make power generation and transmission systems more efficient, and other energy efficiency projects that result in a reduction of greenhouse gas emissions. 4. Natural resources: investments that support land conservation, sustainable forestry and agriculture, remediation and redevelopment of polluted or contaminated sites, sustainable waste management projects, water infrastructure (including improvement of clean drinking water supplies and/or sewer systems) and sustainable building projects.

The fund also invests in green bonds. These are equivalent to other fixed income securities, both taxable and tax-exempt, except that green bonds raise funds specifically to finance new and existing projects with environmental benefits.

Report Commentary

The fund outpaced its benchmark, primarily as a result of an overweight position in the municipal bond sector. An overweight position in the strong-performing corporate bond sector made it the second-largest contributor to fund performance versus the benchmark. Offsetting these positive factors, the fund’s yield curve positioning generally held back its results relative to the benchmark.

Fund Performance Results