The bottom line: July’s sustainable fixed income fund performance results were largely aligned with year-to-date 2023 returns in that riskier assets continued their strong performance.

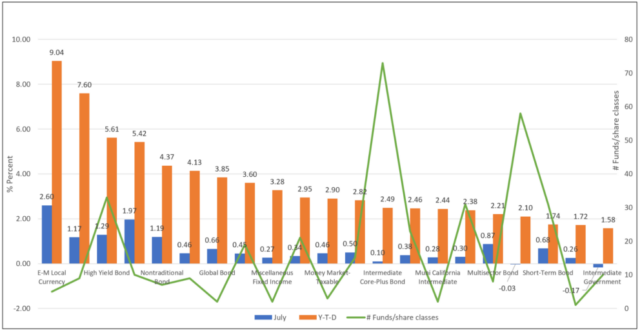

Average performance of sustainable fixed income mutual funds and ETFs, by categories: July 2023 and Y-T-D to July 2023  Notes of Explanation: Number of funds/share classes includes ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis

Notes of Explanation: Number of funds/share classes includes ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis

Notes of Explanation: Number of funds/share classes includes ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis

Notes of Explanation: Number of funds/share classes includes ETFs. Sources: Morningstar Direct and Sustainable Research and Analysis

Leading performance results in July and Y-T-D largely aligned with the riskier assets

July’s sustainable fixed income fund performance results were largely aligned with year-to-date 2023 returns in that riskier assets continued their strong performance while funds with stronger credit profiles and better liquidity recorded lower but positive average returns. Lower-than-expected inflation figures from the US raised optimism that the US economy could avoid a more serious downturn. The narrative of a soft landing gained traction. Both the US Federal Reserve (Fed) and the European Central Bank (ECB) raised rates by 0.25% in line with expectations, but pledged data dependency in terms of forward guidance. Against this backdrop, the Bloomberg US Aggregate Bond Index posted a decline of 0.07%, the Bloomberg Global Aggregate Bond Index added 0.69% while corporate high yield bonds gained 1.38% per the Bloomberg high yield index.

Leading sustainable funds investing in riskier assets, five categories posting average returns in excess of 1% in July, included funds investing in emerging-markets local currency bonds, emerging markets bonds, high yield bonds, nontraditional bonds and bank loans. The same funds, but not in that order, also led on a year-to-date basis.

At the other end of the range were sustainable intermediate government funds, intermediate core bond funds and intermediate core-plus bond funds. Average returns were negative 0.17%, negative 0.03% and 0.10%, respectively.

Some sustainable fixed income categories offer limited investment company options

While the sustainable fixed income segment now includes 332 mutual funds/share classes and 40 ETFs with a combined total of almost $55 billion in assets under management, some of the segments consist of limited offerings and, even more so, offerings with limited long-term track records for now. This introduces challenges for sustainable investors seeking exposures to some of the sustainable fixed income segments that include limited offerings and even when this is not the case, limited track records due to recent fund re-brandings. For example, the best performing sustainable fixed income fund category in July and year-to-date, the emerging markets local currency bond fund category, consists of only a single fund, the Templeton Sustainable Emerging Markets Bond Fund. The fund was launched in 2013 as the Templeton Emerging Markets Fund but adopted an ESG integration approach as of December 15, 2021. Therefore, the fund’s intermediate and long-term performance is not reflective of its current strategy.