The Bottom Line: ESG investing has morphed from ESG integration to encapsulate socially responsible investing considerations. Lack of standards has led to widespread misunderstanding and confusion.

Introduction

ESG investing is a term that morphed over the last several years from ESG integration, a particular form of sustainable investing strategy, to encapsulate various approaches making up sustainable investing. An overarching designation, sustainable investing refers to at least five, some argue six, key strategies that range from values-based investing or socially responsible investing (SRI), negative/exclusionary screening, thematic investing, impact investing, ESG integration and issuer engagement. In the process of evolving, ESG integration, with its core emphasis on properly evaluating investment risks as well as opportunities, has become conflated with socially responsible investing practices. The morphing of terminology and the lack of standards and definitions has led to confusion in the US around sustainable investing, ESG investing and ESG integration. The following 10 questions and answers attempt to define these various terms for investors, asset managers, financial intermediaries, politicians and various other stakeholders.

Q1. What does ESG mean?

ESG refers to environmental, social and governance factors. ESG factors are numerous and subject to change. While there are no universal definitions for these terms, the following are some of the factors that constitute ESG:

Environmental: Climate change, energy, waste, water scarcity, pollution, deforestation and biodiversity.

Social: Human rights, child labor, working conditions, safety, employee relations, gender equality, employee treatment, fair and living wage.

Governance: Bribery and corruption, rule of law, executive pay, board diversity and structure, political lobbying and donations, reporting and disclosure and tax strategy.

Q2. What is ESG investing?

ESG investing is a term that seems to have morphed over the last several years from ESG integration, to encapsulate various approaches making up sustainable investing. Whereas ESG integration defines a particular form of sustainable investing strategy, sustainable investing, and now ESG investing, refers to at least five key strategies that range from values-based investing or socially responsible investing, negative/exclusionary screening, thematic investing, impact investing, ESG integration and issuer engagement. The morphing of terminology and the lack of standards and definitions has led to confusion in the US around sustainable investing, ESG investing and ESG integration.

Q3. What is ESG integration?

ESG integration is an investing approach that considers relevant and material ESG factors in investment analysis and decision-making using a consistent and systematic approach and methodology. The consideration of ESG issues in investment analysis is intended to complement and not substitute for traditional fundamental analysis that might otherwise ignore or overlook relevant factors. As for passive investing, ESG factors are typically considered in the construction of indices via negative/exclusionary screening, best in class and norms-based screening as well as weighting variations, either up or down.

ESG integration is one of at least five, some argue six, key strategies that make up a sustainable investing. Here too, a universally accepted definition for sustainable investing does not exist yet, but practitioners agree that this overarching term refers to values-based investing or socially responsible investing, negative/exclusionary screening, thematic investing, impact investing and ESG integration. In addition, proxy voting and engagement practices may be employed on their own or in combination with one or more of the previously mentioned approaches[1]. Refer to Appendix 1 for definitions.

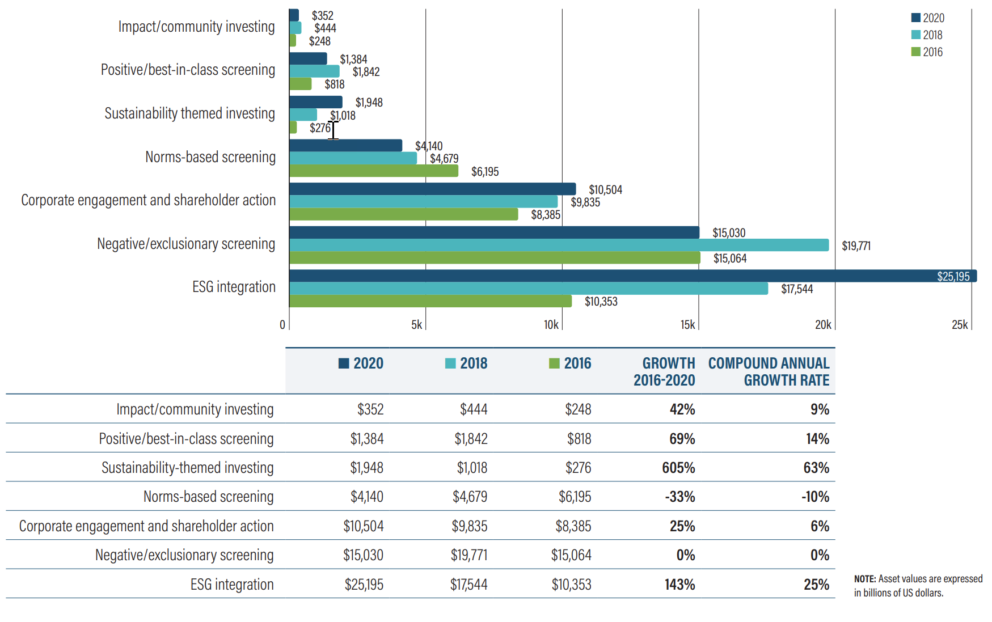

According to data published by Global Sustainable Investment Review 2020, worldwide sustainable assets under management reached about $35 trillion or so at the start of 2020 across varying strategies. Refer to Appendix 2. The number may be inflated due to definitional uncertainties and subject to double counting, but what is clear is that ESG integration and related strategies, such as negative/exclusionary screening, are by far the largest component of sustainable investing assets worldwide, making up some 90% or more while impact investing, as a strategy, accounts for about 1% of world-wide assets.

[1] Proxy voting and engagement practices are usually but not always employed in combination with one or more of the five above mentioned approaches. For this reason, these practices are not identified as a separate sustainable investing approach.

Q4. What is an example of how ESG integration is implemented?

By way of illustration, if a company is believed not to be paying its employees a fair and living wage and this is figured to impact employee morale and productivity, employee turnover, unionization efforts, or the company’s ability to hire new workers, this can bear down on the company’s profitability and, in turn, its valuation. All other considerations aside, if this factor is viewed as relevant and material to the company’s valuation, it should be taken into consideration when a portfolio analyst or manager evaluates the company relative to its share price, current and projected.

Various methods can be employed by fundamental investment analysts to apply ESG factors in company valuations and the analysis of individual instruments and issuers. These include discounted cash flow models (DCF) or multiple analysis, to mention just two. None of the methods are without their challenges but adjusting the company’s future cash flows in a DCF model to reflect the potential impacts of the above noted ESG factors on future wages at least forces analysts to focus on relevant and material issues.

That said, it should be noted that ESG factors may not be deemed or considered central in the evaluation of a company and ESG considerations have not typically in the past been the main driver of valuation or credit outcomes. Rather, broader factors may form a more important part of a company’s assessment. For example, even when environmental risks may have material implications, the impacts on valuations may be mitigated by other considerations.

Q5. Is there a difference between ESG integration and socially responsible investing?

ESG integration should not be confused with socially responsible investing, or related approaches, such as socially conscious investing, green investing, ethical investing, faith-based investing or values-based investing which are investment approaches based on a set of beliefs with a view toward achieving positive societal outcomes.

Typically, these approaches are implemented via negative/exclusionary screening involving individual companies or sectors fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. In recent years, high greenhouse gas emitting sectors or companies that have not adopted carbon transition plans, may also be screened out. Such approaches may be combined with proxy voting and/or active engagement involving equity as well as bond issuers.

At the same time, ESG integration approaches have been magnified in recent years to encapsulate negative/exclusionary screening, proxy voting and engagement practices that attempt to modify investee behavior. In that case, the overall investing approach nudges up against socially responsible investing principles and this has been a factor likely contributing to the confusion that exists regarding sustainable investing, ESG investing and ESG integration.

Q6. Does ESG integration produce better performance results?

There is no reliable evidence yet to indicate that ESG integration produces higher or lower investment returns over the intermediate-to-long-term time horizons.

In large part, the lack of reliable evidence has to do with the fact that ESG has a definition problem and a coherent understanding of what is meant by ESG integration is lacking among investing practitioners. Because of this, but also due to the large number of fund conversions or re-brandings to sustainable investing strategies and the limited track record associated with ESG integration, identifying cohorts of like funds over a sufficiently reasonable time interval to effectively evaluate performance results is challenged.

At the same time, returns based on short time intervals can be skewed by shifting market dynamics to produce positive or negative performance differentials, as was the case in 2021-2022 when overweighting growth-oriented technology companies due to their generally higher ESG scoring and underweighting fossil fuel companies in ESG equity portfolios led to periods of outperformance by some funds pursuing a sustainable investing strategy or approach. Since the start of 2022, however, the performance advantage has been narrowing.

On the other hand, there is a somewhat stronger body of evidence in support of the view that socially responsible investing, because this form of investing has been around for many more years, produce below market-based rates of return. Even here, the conclusions may be attributable to the limited number of socially responsible funds, their varying approaches to socially responsible investing and the smaller size and less proficient investment management expertise exhibited by the management firms serving as advisers to these funds.

Q7. Is ESG integration a more costly investing approach?

There is no formal evidence to indicate that ESG integration, either through separately managed portfolios, mutual funds or ETFs, costs any more than conventional investing.

Expense ratios levied by active and passively managed sustainable diversified US equity funds are competitive, but size matters for index tracking funds and conventional index tracking funds have an advantage in that they are larger than their sustainable counterparts, they have been around longer, and they benefit from scale economies that allows sponsors to charge lower fees. That said, discerning sustainable investors can find investing options charging even lower fees.

Q8. Is ESG integration aligned with fiduciary responsibilities?

Fiduciaries must exercise the care, skill, prudence, and the diligence of a prudent person who is acting in a like capacity and is familiar with such matters. To the extent that E, S and G factors can impact valuations and risk adjusted returns due to risk exposures or investment opportunities, investment fiduciaries would not be carrying out their responsibilities as fiduciaries if they ignored such factors.

ESG integration is consistent with the principals of fiduciary responsibility pursuant to which fiduciaries are required to perform their duties solely in the interest of the plan participants and their beneficiaries.

Q9. Is ESG integration new?

ESG integration is not a new concept. Active investment managers, equity and credit analysts engaged in the evaluation and/or selection of individual securities using fundamental analysis have always integrated relevant and material ESG factors to assess exposures to risks and investment opportunities. This has certainly always been the case regarding governance considerations and relevant and material E and S factors, even as these may not have been singled out as such. What has changed, however, is the focus on such factors and, in some cases, the shifting risk profiles of certain environmental and, to a lesser extent, social issues.

Socially responsible investing is also not a new concept and has been around in the US for at least a full century if not longer. Its origins in the US can be traced to religious considerations practiced by the Methodist movement in the 18th century. Historically, the Methodist church opposed investments in companies involved with liquor or tobacco products or promoting gambling, which was expressed in the form of positive and negative screening. As for investment products, the first public offering of a screened investment fund is reported to have occurred in 1928 when an ecclesiastical group in Boston established the Pioneer Fund. The simple screening approach has been expanded to include divestiture, social impact analysis well as shareholder activism, practices that were encapsulated under the label of sustainable and responsible investing or SRI.

Q10. What is the relationship between ESG investing and PRI?

PRI, or the Principles for Responsible Investment, bills itself as the world’s leading proponent of responsible investment and it likely is given the number of signatories that have adopted the PRI’s six Principles. In 2021/2022, the number of signatories reached 4,902 with an estimated $121.3 trillion in assets under management. The PRI has grown consistently since it was launched in 2006.

In early 2005, the then UN Secretary-General, Kofi Annan, invited a group of the world’s largest institutional investors to join a process to develop the Principles for Responsible Investment. A 20-person investor group drawn from institutions in 12 countries was supported by a 70-person group of experts from the investment industry, intergovernmental organizations and civil society. The Principles were launched in April 2006 at the New York Stock Exchange and the PRI was created alongside the Principles to help put the framework into practice.

Asset owners and investment advisers that sign on to the PRI Principles agree to commit themselves to the six principles listed below which in early years were viewed as aspirational. In recent years signing on to the PRI Principles has become a signaling mechanism and a basis for qualifying to compete for asset management mandates worldwide, especially asset owner-initiated mandates. This is one factor that has contributed meaningfully to the growth of ESG in recent years.

Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

Principle 6: We will each report on our activities and progress towards implementing the Principles.

Appendix 1. The overarching sustainable investing strategies/approaches are²:

- Values-based Investing. A strategy based on the guiding principle of investments that are based on a set of beliefs that contain a view toward achieving a positive societal outcome. Typically, this approach is executed via negative screening, divestiture or divestment.

- Negative/exclusionary Screening. Involves the exclusions of companies or certain sectors from portfolios based on specific ethical, religious, social or environmental guidelines. Traditional examples of exclusionary strategies cover the avoidance of any investments in companies that are fully or partially engaged in gambling, sex related activities, the production of alcohol, tobacco, firearms, fossil fuels or even atomic energy. These exclusionary categories have been extended, in recent years, to incorporate serious labor-related actions or penalties, compulsory or child labor, human rights violations and genocide.

- Impact Investing. A relatively small but growing slice of the sustainable investing segment, impact investments are investments directed to companies, organizations, and funds with the intention to achieve measurable social and environmental impacts alongside a financial return. The direct capital in this strategy addresses challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, affordable and accessible basic services, including housing, healthcare, and education.

- Thematic Investing. An investment approach with a focus on a particular idea or unifying concept. Clean energy, clean tech and gender diversity are a few of the leading sustainable investing fund themes. Investing in green bonds or low carbon emitting stocks, bonds and funds also fall into the thematic investing category.

- ESG Integration. Strictly defined, ESG investing, or ESG integration, is an investing approach that considers relevant and material ESG factors in investment analysis and decision-making using a consistent and systematic approach and methodology. The consideration of ESG issues in investment analysis is intended to complement and not substitute for traditional fundamental analysis that might otherwise ignore or overlook relevant factors. As is the case with other sustainable investing strategies, ESG integration can be employed in active and passive investing approaches. Positive/best in class screening (in which investment in sectors, companies or projects selected for positive ESG performance relative to industry peers, and that achieve a rating above a defined threshold) and norms-based screening (which refer to screening of investments against minimum standards of business or issuer practice based on international norms such as the Sustainable Development Goals (SDGs) issued by the UN) are considered varying approaches to ESG integration.

- Engagement/Proxy Voting. Leverages the power of stock ownership in publicly listed companies using action-oriented approaches that rely on influencing corporate behavior through direct corporate engagement, filing shareholder proposals and proxy voting. To a more limited extent, bond investors can also participate in engagement activities with issuers. These activities are usually combined with one or more of sustainable investing approaches listed above, but they can also be employed independently.

Appendix 2: Global Growth of sustainable investing strategies: 2016-2020

Notes of Explanation: ESG investing or ESG integration for purposes of Q2 includes positive/best in class screening and Normes-based screening approaches as these represent variations in the implementation of ESG investing. Data source: Golbal Sustainable Investment Review 2020