The Bottom Line: Acquisitions like fund re-brandings allow acquiring firms to rapidly enter a market segment deemed attractive with an established brand and track record.

Introduction and Summary: Sustainable asset management firm acquisitions like fund re-brandings offer acquiring firms various advantages

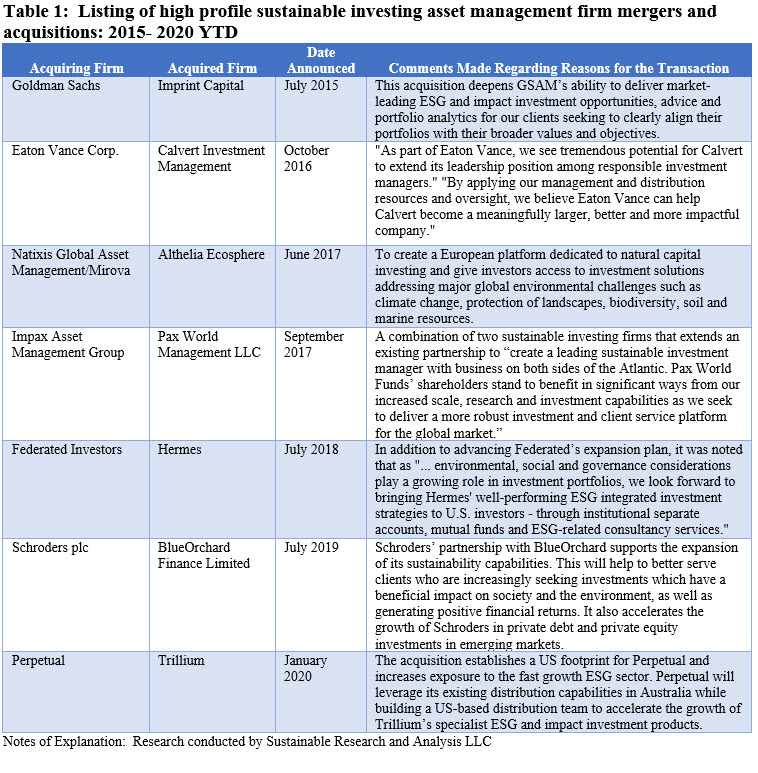

Trillium Asset Management announced on January 30, 2020 that it agreed to be acquired by Perpetual Limited, a value-oriented Australian Stock Exchange listed diversified financial services firm with AUD$27.1 billion (about $18.21 billion[1]) in assets under management. Trillium is a Boston-based legacy sustainable investment management firm with about $2.5 billion[2] in assets under management and 45 employees that was founded in 1982 by Joan Bavaria “to provide a space for clients to invest their money in alignment with their values.” It was one of the earliest socially responsible fund firms[3]. According to Barron’s in an article posted on January 31st, it was noted that this acquisition is the latest in a string of transactions in the popular ESG investing space that is attracting assets and recording record flows. Firms in the ESG space, per the Barron’s article, are more likely to be acquired. We note that the Trillium transaction is taking place following a year in 2019 during which asset management deal volumes generally hit record levels as firms in the space face increasing competition, a continuing shift to passive investing, fee pressure and declining AUM. While motivations for acquisitions vary, there is, to some degree, a parallel between the significant volume in fund re-brandings observed in 2019 and potential mergers and acquisition activity in the sustainable investing space. As is the case with fund re-brandings, acquiring firms can rapidly enter a market segment deemed attractive with an established brand and proven sustainable investing approaches and methodologies. While our research indicates that net cash flows into the long-term sustainable funds segment are still modest, an acquisition is also identified as a way to quickly achieve a thought leadership position and evidence a commitment to long-term value creation through sustainable investing that will serve as a magnet to attract assets in the intermediate to long-term time frame. Other benefits include the adoption of an existing performance track record and reaching scale quickly. These benefits were anticipated in at least three of the seven firms involved in transactions identified in the last five years or so, whereas the other four transactions involved firms already engaged in sustainable investing for which acquisitions deepened and or expanded the franchise geographically or along product lines. Refer to Table 1.

$2.5 billion Trillium Asset Management acquisition gives Perpetual Limited quick entry into the sustainable investing sphere

Trillium, whose assets under management are largely in the form of sub-advisory fund relationships and separate accounts, also manages two mutual funds with total net assets in the amount of $627.6 million. These include the $20.8 million Trillium Small/Mid Cap Fund and the since inception in 1999 the fossil fuel free $606.8 million Trillium P21 Global Equity Fund, itself a product of an acquisition that was completed in late 2014. Both funds have established attractive long-term track records based on risk adjusted performance results. Trillium’s sustainable investing approach relies on environmental, social, and governance (ESG) criteria in an attempt to identify companies best positioned to deliver strong long term financial performance. Trillium’s ESG research is “primarily focused on selecting companies that are meeting positive thresholds of performance for ESG issues, such as strong workplace practices, a demonstrated record of producing safe products for consumers, protecting the environment, fair compensation for employees and executives, and respecting and upholding human rights.” According to Trillium’s website, strict exclusionary screens are also employed to reflect the concerns of many socially responsible investors. For example, Trillium will not invest in companies with significant involvement in producing, marketing, or distributing firearms, tobacco, gaming, nuclear power, pornography, or military weapons systems. Trillium also actively engages with investee companies and takes a proactive role in voting proxies and initiating proxy resolutions.

Last year re-brandings reached a record high as did asset management M&A activities

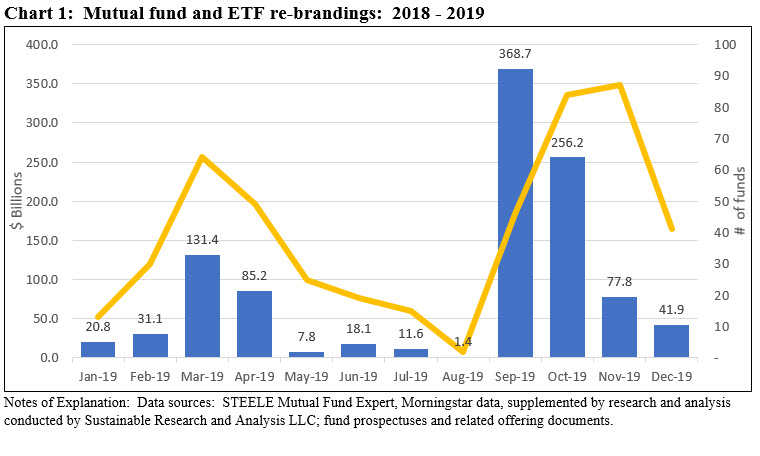

Last year, sustainable mutual funds and ETFs[4] experienced significant growth in the number of fund offerings and assets under management which expanded from $390 billion at the end of 2018 to reach $1.6 trillion by the end of 2019, for an increase of $1.2 trillion or 313%. Refer to Chart 1. This was the largest ever year-over-year increase for sustainable funds. Fund re-brandings represents the most significant contributor to the 2019 increase in sustainable investment fund assets in the United States. Referring to the formal adoption of a sustainable investing strategy or approach by an existing mutual fund or ETF in the form of an amendment to the fund’s offering document (i.e. prospectus), this activity involved 47 separate firms and 460 funds or 2083 funds/share classes that added $1.05 trillion in assets under management, or 86% of the increase recorded in 2019.[5] At the same time, net cash flows added $33.88 billion in new investment dollars, including money market funds, but a more modest flow of $7.97 billion if flows are limited to long-term assets.

Turning to asset management firms, according to PwC, asset and wealth management deal volume reached a record level in 2019, with 212 transactions recorded last year with a disclosed transaction value of $41.6 billion. In its report, PwC expects that momentum to continue and make 2020 another blockbuster year “in response to pressure to scale and improve margins.” At least one notable sustainable fund manager transaction occurred in 2019, this one involving the acquisition of a majority stake by Schroders in $3.5 billion Switzerland-based BlueOrchard Finance Limited as a way of expanding into the impact investment business on the part of a firm that was already deeply engaged in sustainable investing. This contrasts with Federated’s 60% acquisition of Hermes Investment Management in 2018, with options to acquire the rest of the firm. In addition to advancing Federated’s expansion plans, Hermes catapulted Federated into what it refers to as the responsible investing sphere from which Federated has been largely absent. The growing prominence of sustainable investing over the past several years, however, has led to a complete re-branding of the combined firm that was announced on February 3, 2020. Now known as Federated Hermes, Inc. (NYSE:FHI) the $576 billion firm unveiled an updated corporate identity “focused on a commitment to responsible investing to achieve financial outperformance.”

[1] Using 1/30/2020 exchange rate $0.672008.

[2] Per Trillium’s ADV dated 1/16/2020.

[3] The Calvert Social Investment Fund was created in 1982.

[4] While the definition continues to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration, company engagement and proxy voting. These are not mutually exclusive.

[5] Based on total net assets as of month-end during which re-brandings occurred.