Summary

- California Senate passes bill last week requiring California firms to have a minimum of one female director on its board of directors by the end of the 2019 calendar year.

- Rather than anchoring the bill on the rights of women to achieve gender equality, the bill emphasizes independent studies that have concluded that publicly held companies perform better when women serve on their boards of directors.

- SB 826 fails to mention any academic studies suggesting contradictory findings or research that the presence of more female board members does not much improve a firm’s performance.

- While performance results vary, several investment options are available to investors specifically interested in investing in mutual funds and exchange-traded funds or notes (ETFs/ETNs) that focus on companies that promote gender diversity and the advancement of women.

California Senate passes state sponsored bill that requires California firms to have a minimum of one female director on its board by the end of 2019

Last week, the California Senate passed a first of its kind state-sponsored bill in the US, SB 826, that requires publicly held corporations located in California to have a minimum of one female director on its board of directors by the end of the 2019 calendar year. Otherwise, the Secretary of State is authorized to impose fines for violation of the bill, ranging from $100,000 for board member reporting violations and first time compliance violators and $300,000 for second time violations. In addition, the bill would increase by no later than the close of calendar year 2021 the mandatory female board requirement to 2 female directors if the corporation has 5 directors and to 3 female directors if the corporation has 6 or more directors. To take effect, SB 826 has to be signed into law by California Governor Jerry Brown.

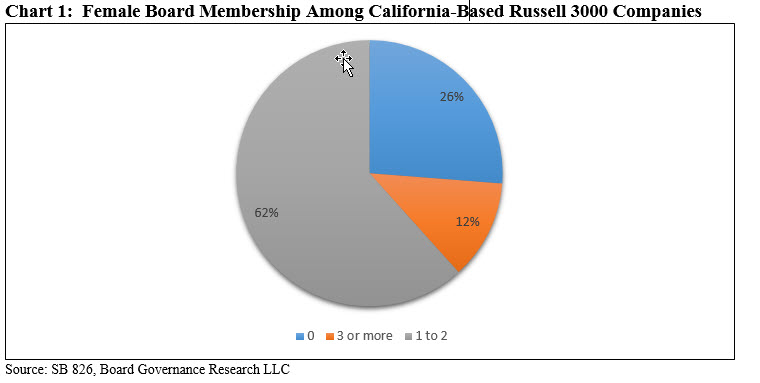

This mandatory bill follows an attempt by the state to encourage companies in California to take these actions by December 31, 2016. Apparently the effort to achieve a voluntary response proved unsuccessful. According to the text of the bill, 117 companies, or 26%, of California public companies that make up the Russell 3000 Index have no women on their board of directors. 275 companies, or 62%, have at least 1 to 2 women board members while 54 companies or 12% have 3 or more female board members. Refer to Chart 1.

Rather than anchoring the bill on the rights of women to achieve gender equality, SB 826 emphasizes studies that publicly-held companies perform better when women serve on boards

The bill makes the case that “more women directors serving on boards of directors of publicly held corporations will boost the California economy, improve opportunities for women in the workplace, and protect California taxpayers, shareholders, and retirees, including retired California state employees and teachers whose pensions are managed by CalPERS and CalSTRS. Yet studies predict that it will take 40 or 50 years to achieve gender parity, if something is not done proactively.”

The bill itself further makes references to numerous independent studies and cites references to various studies that have concluded that publicly held companies perform better when women serve on their boards of directors. These include a 2017 study by MSCI, a 2014 study published by Credit Suisse, a 2012 University of California, Berkley study, a six-year Credit Suisse global research study conducted between 2006 and 2012 with more than 2,000 companies worldwide. Also, the bill cites other countries that have addressed the lack of gender diversity by mandating quotas on public companies boards, including Germany, Norway, France, Spain, Iceland and the Netherlands.

At the same time, SB 826 fails to mention any academic studies suggesting contradictory findings or research that the presence of more female board members does not much improve a firm’s performance

On the other hand, the senate bill fails to mention any academic studies suggesting contradictory findings or research that the presence of more female board members does not much improve a firm’s performance. According to an Opinion research report published by Katherine Klein of Wharton School of the University of Pennsylvania, there have been many rigorous, peer-reviewed studies of board gender diversity and these suggest that companies do not perform better when they have women on the board. The research article refers to over 100 studies of firms in 35 countries and five continents concluding that there is no evidence available to suggest that the addition or presence of women on the board actually causes a change in company performance. “In sum, the research results suggest that there is no business case for-or against-appointing women to corporate boards. Women should be appointed to boards for reasons of gender equality, but not because gender diversity on boards leads to improvements in company performance[1].”

Several investment options available to investors specifically interested in investing in mutual funds and exchange-traded funds or notes (ETFs/ETNs) that focus on companies that promote gender diversity and the advancement of women

That said, investors specifically interested in investing in mutual funds and exchange-traded funds or notes (ETFs/ETNs) that focus on companies that promote gender diversity and the advancement of women, have several options from which to choose. These options include two ETFs, one ETN and two mutual funds that have to-date attracted $650.1 million. These funds were cited in an earlier article published by sustainableinvest.com in December 2017. Refer to Gender Diversity Thematic Investment Opportunities, December 21, 2017. Since then, a sixth option has been added to the mix with the launch in August of this year of Impact Shares YWCA Women’s Empowerment ETF. The fund, which charges 0.75%, seeks to track the performance of the Morningstar Women’s Empowerment Index that selects companies that have strong women’s empowerment practices but also excludes companies involved in weapons, gambling, or tobacco, or appear on the Norwegian Ethics Council List[2], including, for example, fossil fuel firms, or firms that have experienced an applicable legal controversy. Such exclusions can potentially negatively impact performance results over time.

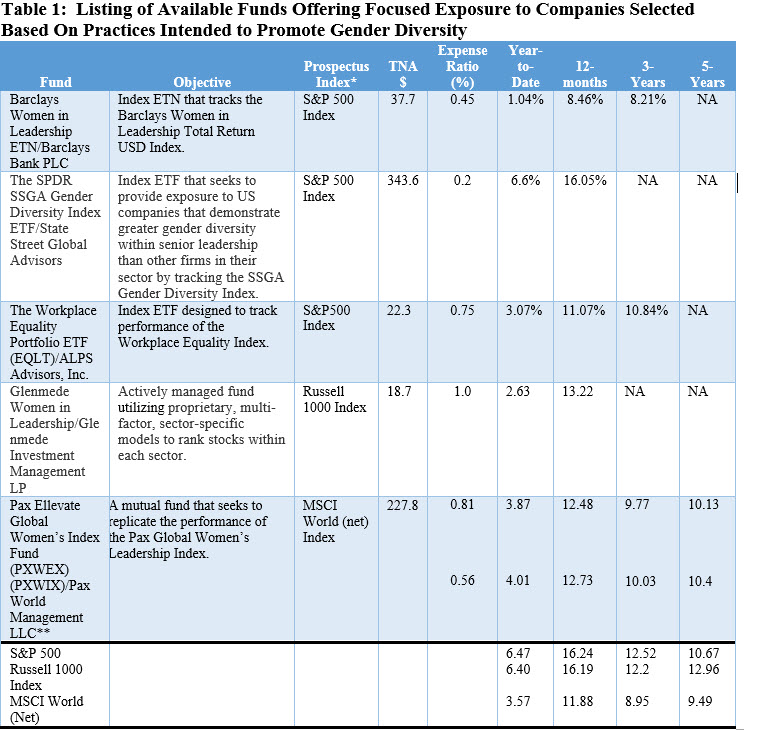

Some of the fund details, such as investment objectives, gender diversity criteria and expense ratios don’t need repeating, however, the table below updates the performance results achieved by these funds through the end of July 2018.

Based on updated performance results through the end of July when compared against each fund’s prospectus index, the longest available of the five funds is also the only fund to consistently outperform its benchmark over the four time intervals displayed below is the Pax Ellevate Global Women’s Leadership Fund. The only fund of the five investing in US and foreign stocks of companies in developed markets, both share classes have outperformed their prospectus designated non-ESG benchmark form a low of 0.3% to a high of 1.08%, and the results have been achieved with lower volatility relative to the benchmark. Refer to Table 1.

Notes of Explanation: TNA or total net assets as well as performance results as of July 31, 2018. NA Not applicable. *Primary prospectus benchmark, except for SPDR SSgA Gender Diversity Index ETF. The ETF compares itself to the SSgA Gender Diversity Index. For purposes of this analysis, the S&P 500 Index, which aligns with the portfolio, is used to evaluate the fund’s relative performance results. **On June 4, 2014, the Pax World Global Women’s Equality Fund merged into the Pax Ellevate Global Women’s Index Fund. The fund’s performance data for periods prior to June 4, 2014 is attributable to the Pax World Global Women’s Equality Fund.

[1] Source: Does Gender Diversity on Boards Really Boost Company Performance, May 18, 2017.

[2] Apparently this list is now maintained by Norges Bank. The list of companies that the Council of Ethics for the Norwegian Government Pension Fund Global has recommended excluding from the Pension Fund’s portfolio of investments on the grounds that investment in such companies would be inconsistent with the Pension Fund’s Ethical Guidelines.