The Bottom Line: The S&P 500 posted a -4.7% decline in September and selected sustainable securities market indices disappoint but maintain intermediate to long-term outperformance.

Summary

- The S&P 500 posted a decline of -4.7% in September, after recording seven successive monthly gains.

- Selected sustainable securities market indices disappoint in September while intermediate to long-term results maintain their track record of outperformance.

- Sustainable equity fund indices lagged in September while bond funds outperformed.

The S&P 500 posted a decline of -4.7% in September, after recording seven successive monthly gains

The S&P 500 posted a decline of -4.7% in September, after recording seven successive monthly gains. Still, the drop left the broad-based stock index just barely in positive territory for the third quarter, up 0.6%, but considerably ahead on a year-to-date basis, up 15.92%, and over the trailing twelve months during which time the index gained 30%. About two-thirds of the September decline took place in the last three days ahead of the 11th hour congressional passage of a temporary stop-gap budget measure to keep the government funded and avoid a shut down until December 3rd. Refer to Chart 1. As if this was not enough, other uncertainties eroded confidence and contributed to a drop off from an all-time closing high achieved by the S&P 500 on September 2nd, including COVID, the Federal Reserve Bank’s plans to start slowing its purchases of government-backed bonds, supply chain bottlenecks, constrained economic growth and the impact on third-quarter corporate earnings, rising inflation as well as a possible default by China Evergrande Group and its rippling effect through global markets. These unresolved concerns not only sank stocks in September but they have the potential to affect markets and prices going forward.

None of the broad-based indices achieved positive results for the month. The Dow Jones Industrial Average (DJIA) dropped -4.2% while the NASDAQ Composite gave up -5.3%. Smaller cap stocks, however, outperformed their large and mid-cap counterparts while value stocks eclipsed growth stocks across the market capitalization range. At the same time, 10 of 11 sectors across the market capitalization range recorded negative results. The energy sector was the stand out exception, up between 9.4% in the case of large caps and 17.3% for the small cap segment as oil, natural gas and even coal prices shifted higher due, in part, to short term demand-supply imbalances. In addition, energy led on a year-to-date basis with returns ranging from 73.8% for small cap energy stocks to 43.2% for large caps. Stock prices also declined outside the U.S. The MSCI ACWI ex USA Index registered a decrease of -3.1% while emerging markets fell even further to post a -3.9% drop.

Treasury yields moved higher during the month as 10-year Treasury Notes ended September at 1.52%, or an increase of 22 basis points (bps) from 1.30% registered at the end of August. In turn, investment-grade intermediate bonds, as measured by the Bloomberg US Aggregate Bond Index, posted a drop of -0.87%.

Chart 1: S&P 500 cumulative price performance-September 2021

[ihc-hide-content ihc_mb_type=”block” ihc_mb_who=”unreg” ihc_mb_template=”4″ ]

Contact Us for this chart.

[/ihc-hide-content]

Source: Yahoo finance/S&P Global

Selected sustainable securities market indices disappoint in September while intermediate to long-term results maintain their track record of outperformance

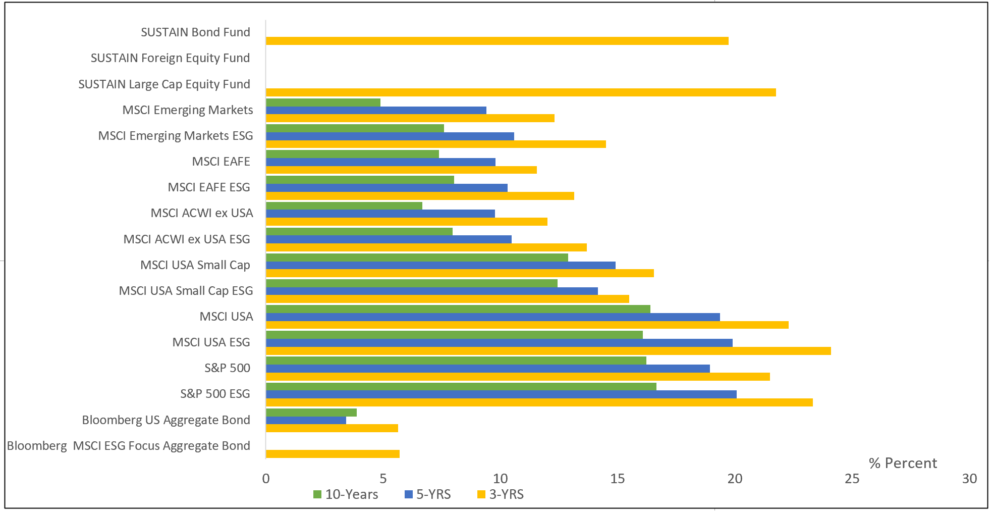

Selected sustainable bond and equity securities market indices across the board underperformed their conventional index counterparts in September. Negative return differentials ranged from a low of 1 basis point registered by the Bloomberg MSCI Aggregate Bond ESG Focus Index to a high of 45 bps sourced to the MSCI USA Small Cap ESG Leaders Index. The outperformance of energy during the month of September, that in some but not all cases is underweighted in the sustainable indices, was a contributing factor but not necessarily the only one. This circumstance also contributed to the lagging trailing twelve month results across domestic and foreign sustainable equity indices while bonds seemed to be unaffected.

Except for the MSCI’s USA Small Cap ESG Leaders index, sustainable equity indices continue to outperform conventional benchmarks on a consistent basis over intermediate and long-term time intervals. These results should continue to boost the confidence of investors attracted to long-term sustainable investing but they also reaffirm the fact that index selection matters. Refer to Chart 2.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to September 30, 2021

Notes of Explanation: Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. Sources: MSCI, S&P Global, Sustainable Research and Analysis

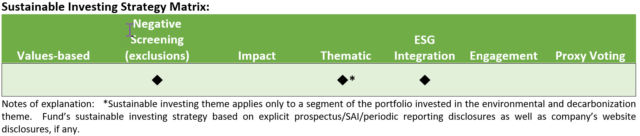

Sustainable equity fund indices lagged in September while bond funds outperformed

On a combined basis, 1,126 sustainable investment funds classified as such by Morningstar, including mutual funds and ETFs, were up 4.41% in September. Results on an asset class basis ranged from an average of -4.77% recorded by equity funds and -0.63% generated by fixed income funds.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index dropped -4.98% in September and lagged the S&P 500 by 33 bps. The index has now fallen behind the conventional benchmark for three successive months. Seven of ten funds comprising the SUSTAIN index failed to beat the S&P 500 Index but leading the pack in September was the TIAA-CREF Social Choice Equity Fund Institutional, down -4.4%. At the other end of the range, the T. Rowe Price Blue Chip Growth Fund declined -5.7%.

The SUSTAIN Large Cap Equity Fund Index now extends the intervals of its underperformance up to the trailing 12-months (lagged by 1.67%) while continuing to outperform over the latest three-year period. For the three years ending in September, the SUSTAIN Index was up an average annual 16.4% while the S&P 500 was up 16%, or a cumulative positive differential of 1.4%. Refer to Chart 3.

Also underperforming in September is the Sustainable (SUSTAIN) Foreign Equity Fund Index. At -3.39%, it lagged by 19 bps the MSCI ACWI ex USA Index that recorded a -3.2% total return. Only four of the ten constituent funds managed to outperform, led by the value-oriented Templeton Foreign Fund A that ended the month with a -1.4% decline. This was 3.04% ahead of the Morgan Stanley Institutional International Equity Fund I that brough up the rear with its return of -4.5%.

The index has not as yet registered a three-year track record as it was first calculated starting as of June 2019. With its gain of 24.3% the SUSTAIN Foreign Fund Index remains 41 bps ahead of the MSCI ACWI ex USA over the twelve months ended September 2021. Refer to Chart 4.

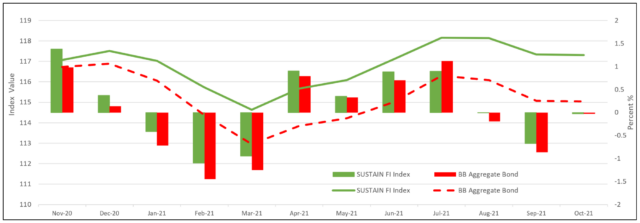

On the other hand, the Sustainable (SUSTAIN) Bond Fund Index outperformed by 19 bps in September, posting a -0.68% return versus –0.87% recorded by the Bloomberg US Aggregate Bond Index. This represents the second successive month of excess return for the index after its fifteen successive months of outperformance that was interrupted in July. Eight of the ten funds that comprise the sustainable benchmark excelled, led by the Neuberger Berman Strategic Income Fund I that registered a -0.07% total return. Lagging in the month was the Goldman Sachs Core Fixed Income Fund P that gave up -0.92%.

Having recorded a three-year average annual return of 5.9%, the SUSTAIN Bond Fund Index remains well ahead of its conventional counterpart that’s up 5.4%, or a cumulative differential of 1.97%. The index is also ahead on a 1-year basis, leading by 2.15%. Refer to Chart 5.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.  Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.