Sustainable Bottom Line: Expanding programs like the Exxon Mobil Corporation’s Retail Voting Program and Voting Choice Programs invite stepped up retail investor education and engagement.

Summary/Conclusion

On September 15, 2025, the U.S. Securities and Exchange Commission granted Exxon Mobil Corporation (Exxon) permission in the form of a no-action letter to roll out a voluntary, auto voting program enabling retail shareholders to cast votes in line with management’s recommendations. The SEC’s no-action position covering the “Retail Voting Program” allows Exxon to seek standing voting instructions at annual general or special shareholder meetings from individual shareholders, provided certain protections are in place (such as annual reminders, opt out rights, and the ability to override votes on specific items). With approximately 40% of Exxon’s shares held by retail investors, many of whom historically abstain from voting (1), the company stands to benefit from the implementation of its program which comes at a time when some of the world’s largest investment management firms have either launched or may be considering the introduction of Voting Choice initiatives, or programs that allow certain fund investors to influence how the shares held on their behalf are voted at shareholder meetings. In each case, the changing shareholder voting programs playing field means that with respect to environmental and social oriented proposals, in particular, greater efforts should be directed at stepping up retail shareholder education and engagement to help investors understand these programs, their features and conditions as well as advance their understanding of individual upcoming shareholder proposals and their implications.

Exxon’s program seems to be designed to shift the power dynamics in corporate governance

Traditionally, shareholder proposals, and particularly those tied to environmental, social, and governance (ESG) issues, leverage the abstention or passivity of retail shareholders. Institutional investors, influenced by proxy advisory firms and ESG activists, can sometimes carry votes in favor of proposals because the margin is narrow and affected by how many small investors participate. With auto voting aligning non voting retail shareholders with management by default, that margin shrinks, tilting outcomes toward the board’s position in many cases.

From a sustainable investing perspective, Exxon’s retail voting approach isn’t simply about boosting shareholder meeting vote totals. It seems designed to shift the power dynamics in corporate governance. If companies with large retail ownership follow Exxon’s lead, they may find themselves better insulated against ESG driven proposals they oppose. Boards may feel less pressure to negotiate or compromise with activists if they can reliably count on activated retail votes supporting management.

More generally, however, companies with large retail bases and a relatively small actively managed institutional base may find that auto voting meaningfully tilts the outcome of a proxy contest in favor of the company. By locking in retail votes aligned with the board, a company can potentially reduce the risk that an activist seeking to change a company’s governance or strategy can mobilize retail votes (or surprises) to tip a close contest.

Beyond Exxon, other companies with large retail shareholder bases might also consider auto-voting

Exxon isn’t the only company with a substantial retail base. Other companies reported to have a substantial retail base include Tesla, Apple, Amazon and Nvidia, to mention just a few. In the right circumstances, these companies could also consider seeking similar no action relief or introducing their own auto voting programs to mobilize passive retail holders. For ESG activists, this means more contests won or lost not only in boardrooms and court filings, but in the realm of mobilizing the small investor.

Potential Risks and Counterarguments

Critics warn that auto voting could dampen shareholder democracy by creating a default that favors management — even when many retail shareholders, if properly informed and motivated, might oppose certain proposals. There is also the risk of information asymmetry: retail investors may lack the resources to vet complex ESG proposals, leading them to rely too heavily on management’s framing or proxy

advice.

Another risk is that this development might deepen polarization, with companies pursuing dual track strategies: public disclosure emphasizing ESG alignment, while using auto voting to resist binding proposals. Regulators may also scrutinize whether these programs are transparent enough, whether opt-out and override rights are meaningful, and whether the SEC will in the future adjust its rules in light of such programs.

Pass-through voting offers a potential antidote, even if it’s applied for the time being to broad policy directives

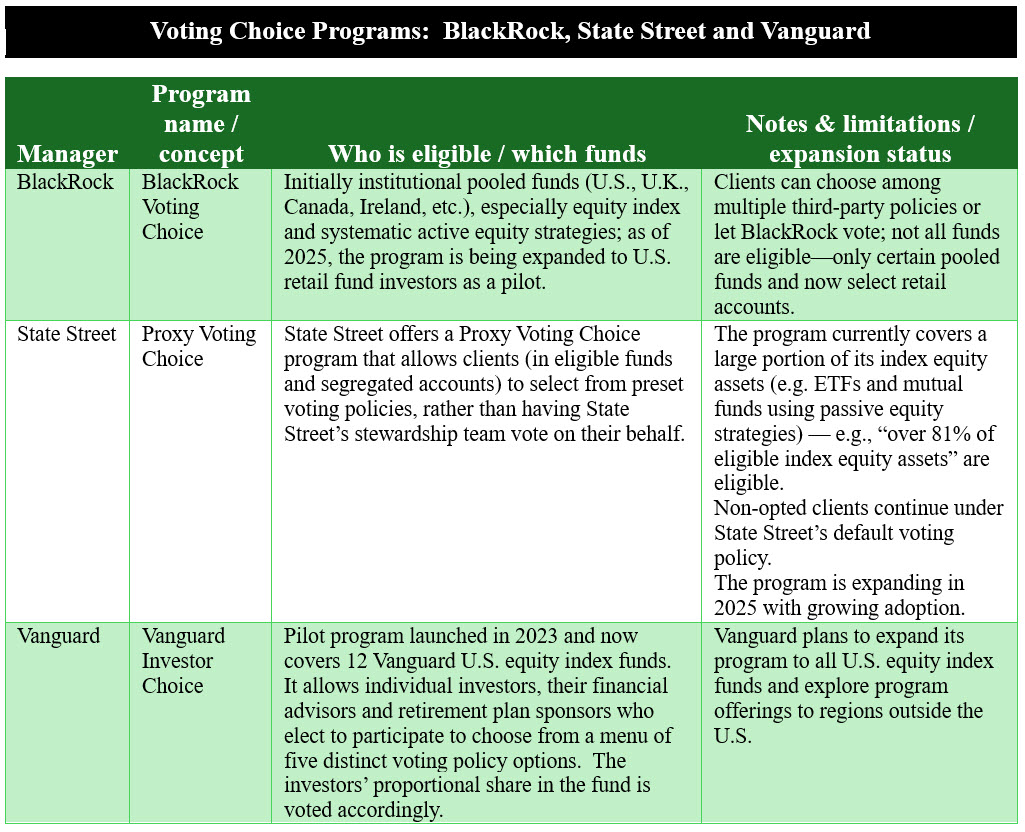

Paradoxically, Exxon’s Retail Voting Program is being introduced at a time when the volume of environmental and social-oriented (less so governance) shareholder proposals along with support levels are on the decline relative to 2024 and when a number the world’s largest asset managers, including BlackRock, State Street and Vanguard, are testing and implementing pass-through voting or investor choice voting programs that allows certain fund investors to influence how the shares held on their behalf are voted at shareholder meetings. At this stage, however, these programs apply broadly to policy directives and stop short of being applied to individual securities. With technological innovations, this approach is likely to evolve in time to apply to individual securities.

Traditionally, fund managers cast proxy votes for all shares in a fund according to the firm’s own stewardship policies. Under Voting Choice, investors can instead select from a set of pre-defined voting policies (for example, a management-aligned policy, an ESG-oriented policy, or a governance-focused policy). The manager then casts votes in proportion to investor preferences across the fund’s total holdings.

This framework aims to (a) Enhance investor participation in corporate governance decisions, (b) increase transparency and accountability in proxy voting and (c) Reflect diverse investor values—especially on environmental, social, and governance (ESG) issues—without requiring each investor to vote on every ballot item.

At present, Voting Choice programs are limited in scope, but they are likely to evolve over time

At present, Voting Choice programs are limited in scope (mainly covering certain index funds and institutional accounts), but they represent a significant shift toward democratizing proxy voting within pooled investment vehicles. While these are still early days, Vanguard in the 2025 proxy season update report released on September 10, 2025, expressed enthusiasm for the level of interest from investors. It reported that thorough July 2025 across eight participating funds and nearly $9 billion of eligible fund AUM ($264 billion) more than 82,000 fund shareholders selected a voting policy that directed how their proportionate shares of mutual funds and ETFs voted on thousands of company ballot items. This, according to Vanguard, is more than double the 2024 total.

These results are encouraging, and programs are expected to evolve over time, including a transition to casting votes on relating to individual stock holdings. In the meantime, the changing shareholder voting programs playing field means that with respect to environmental and social oriented proposals, in particular, greater efforts should be directed at stepping up retail investor education and engagement to not only help retail shareholders understand these programs, their features and conditions but also to advance their understanding of individual upcoming shareholder proposals and their implications.

Sources: Company disclosures and Sustainable Research and Analysis LLC

(1) This is according to Exxon. It noted that at its most recent annual meeting, nearly 40% of its outstanding shares were held by retail investors. Yet only a quarter of these retail shares were voted.