Receive a free compilation highlighting and summarizing each month’s key research articles published by Sustainable Research and Analysis.

Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

S&P 500 and selected sustainable indices recover in October

Gaining confidence from strong earnings reports, investors drove stock prices higher in October and the S&P 500 gained 7.0%, erasing last month’s -4.7% decline. Selected sustainable securities market indices also bounced back in October, beating out conventional benchmarks by a range extending from 0.01% to 2.41%. Sustainable investment funds, limited to mutual funds, registered an…

Share This Article:

The Bottom Line: The S&P 500 gained 7.0% and erased September’s -4.7% decline; selected sustainable indices also bounced back with beats from 0.01% to 2.41%.

October summary

Gaining confidence from strong earnings reports, investors drove stock prices higher in October and the S&P 500 gained 7.0%, erasing last month’s -4.7% decline. Selected sustainable securities market indices also bounced back in October, beating out conventional benchmarks by a range extending from 0.01% to 2.41%. Sustainable investment funds, limited to mutual funds, registered an average gain of 3.71%, led by the performance of alternative energy and environmental funds that achieved gains as high as 16.67%. Sustainable ETFs with a renewable energy thematic focus recorded even higher returns. At the same time, two of three sustainable fund indices tracked by Sustainable Research and Analysis outperformed their conventional securities market index counterparts, including the SUSTAIN Bond Fund and SUSTAIN Foreign Equity Fund indices.

The S&P 500 gained 7.0% in October, erasing the previous month’s -4.7% decline

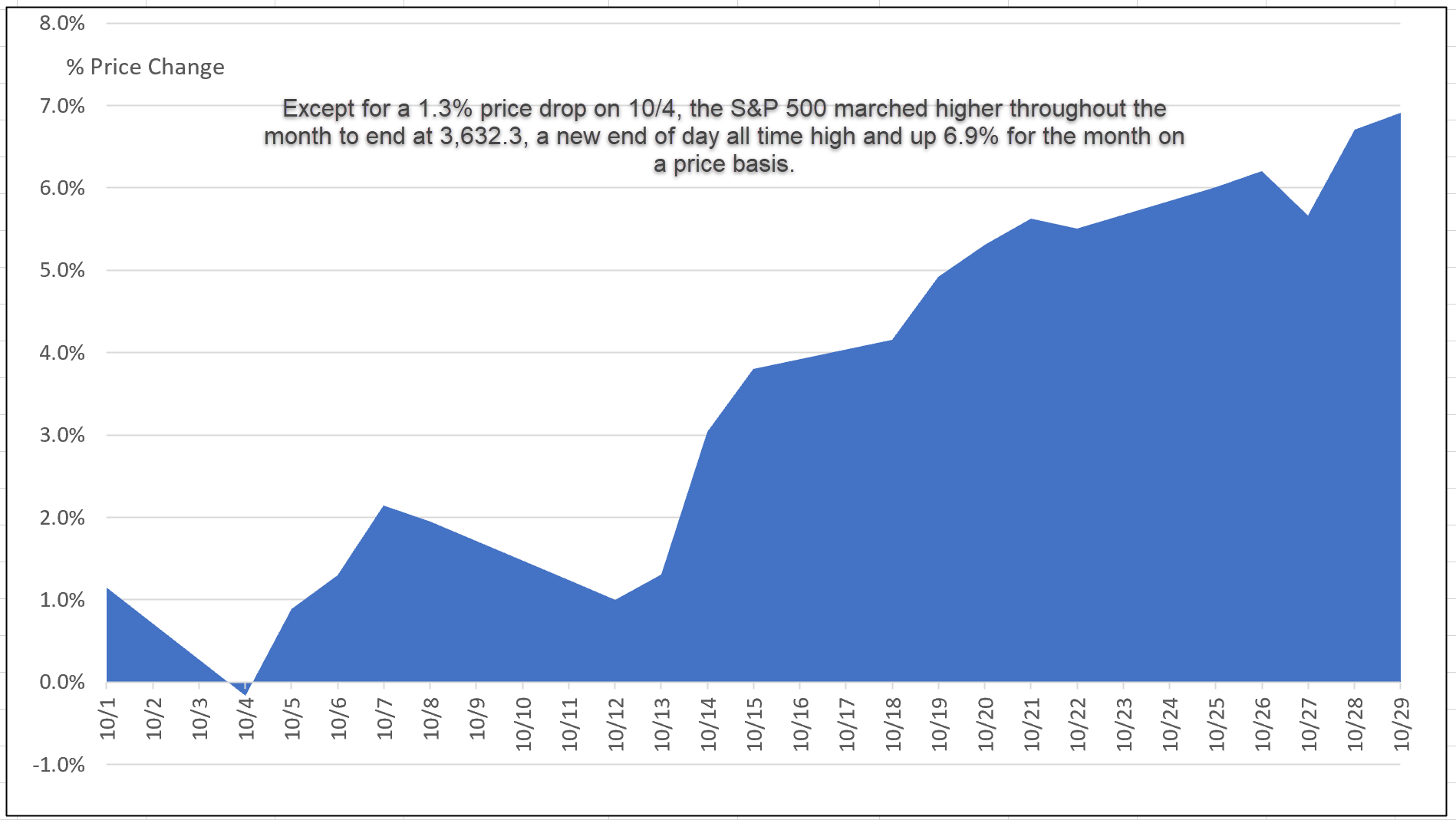

Except for a 1.3% price drop on October 4, the S&P 500 moved successively higher throughout the month to end at 3,632.3, a new end of day all time high and up 7.0% on a total return basis. The gain erased the previous month’s -4.7% decline as investors seemed to gain confidence by the strong start of the third quarter’s earnings season results. By month-end, more than 80% of companies beat earnings expectations. The Dow Jones Industrial Average trailed the broader S&P 500 Index, adding 5.9% while the NASDAQ Composite posted a 7.3% gain. Large cap stocks outperformed midcap and small cap stocks while growth outperformed value stocks across the market capitalization range. The S&P 500 Growth Index registered a gain of 9.1% whereas small caps were up 3.4%. Top S&P 500 sectors included Consumer Discretionary, Energy and Information Technology, up 10.9%, 10.4% and 8.2%, in that order. Except for the best performing Energy sector that was up 7.0%, corresponding sectors across small cap stocks delivered lower returns.

Outside the US, stocks didn’t perform as well. The MSCI ACWI ex USA Index (Net) registered a gain of 2.4% while the MSCI EAFE Index (Net) added 2.5% and MSCI Emerging Markets gained 1.0%. Emerging markets Russia and China led with gains of 3.2% and 4.4%, respectively.

Bonds ended lower in October. The yield on 10-year Treasury securities barely budged month-over-month, starting at 1.52% and rising just 3 bps by the end of the month. That said, yields rose to 1.68% on October 21st on inflation concerns but then settled back to close the month at 1.55%. Against this backdrop, the Bloomberg US Aggregate Bond Index posted a decline of -0.03%.

Chart 1: S&P 500 cumulative price performance-October 2021 Source: Yahoo finance/S&P Global

Source: Yahoo finance/S&P Global

Selected sustainable securities market indices bounced back in October, beating out conventional benchmarks

Seven selected sustainable bond and equity securities market indices bounced back in October, with six of the indices outperforming within a range extending from a low of 0.01% to a high of 2.41%. Only one index, the MSCI USA Small Cap ESG Leaders Index lagged its conventional counterpart by a narrow 4 bps. The overall results in October contrasted with September’s outcomes when sustainable indices underperformed in some instances but not all due to the performance of the energy sector. The energy sector was still a strong performer across small cap stocks in October but less so for large caps.

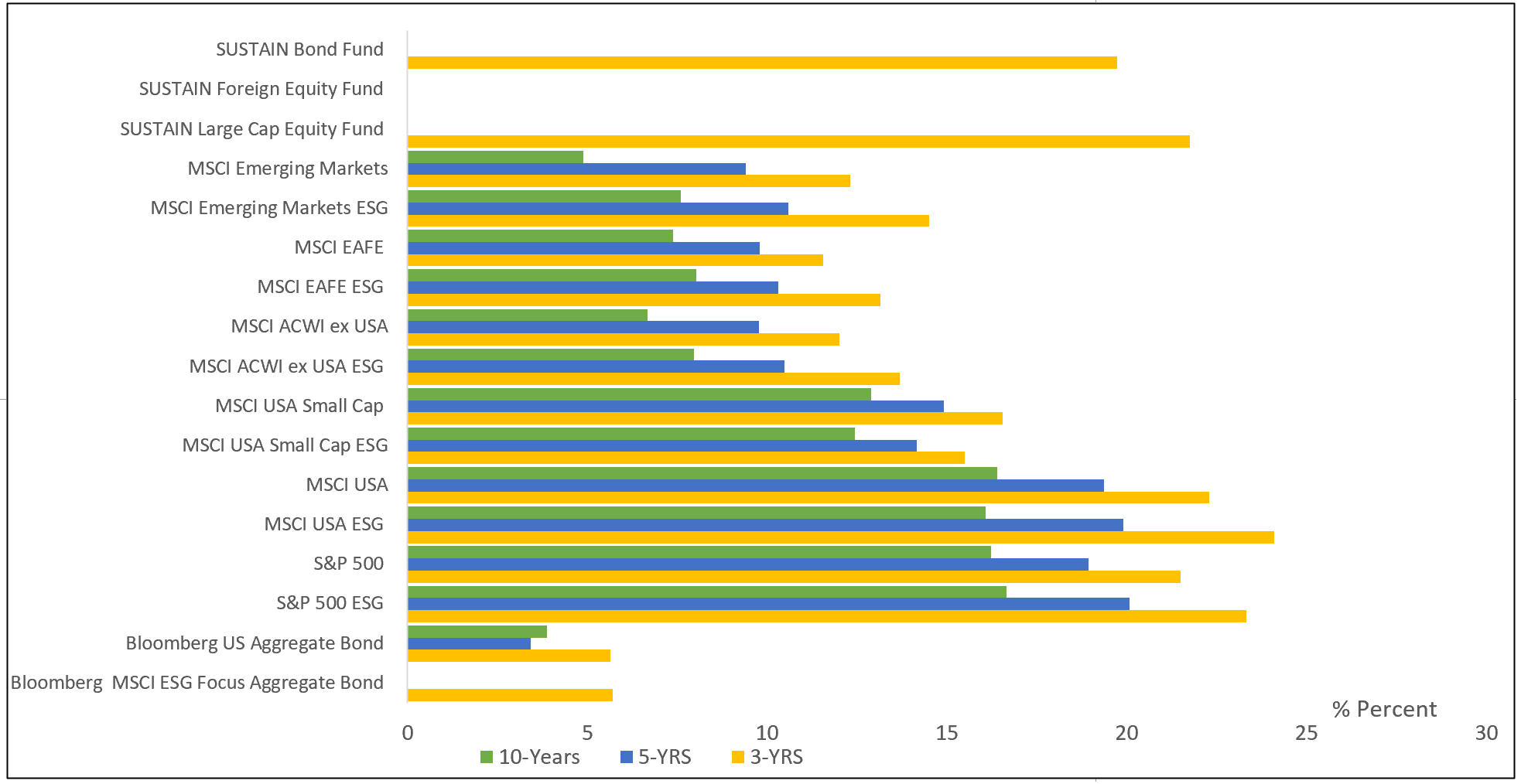

While comparative performance results covering both bonds and equities over the trailing one-year time interval were mixed, this is not the case over the intermediate-to-long-term outcomes apart from small cap stocks. Both the S&P 500 ESG Index (based on back casting) and the MSC ESG Leaders indices referenced in Chart 2 continue to lead their conventional counterparts by margins ranging from a low of 0.52% annualized attributable to the MSCI EAFE ESG Leaders Index over the latest five-year interval to a high of 2.72% annualized return attributable to the MSCI Emerging Markets ESG Leaders Index.

Chart 2: Selected sustainable indices intermediate and long-term total return performance results to October 30, 2021

Notes of Explanation: Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

SUSTAIN Bond Fund and SUSTAIN Foreign Equity Fund indices outperformed in October while the SUSTAIN Large Cap Equity Fund Index lagged

Sustainable mutual funds, a total of 1,011 funds/share classes across all asset classes (excluding ETFs), posted an average return of 3.71% in October. Returns ranged from a low of -3.79% recorded by the Ashmore Emerging Markets Corporate Income Fund C (ECCEX) to a high of 16.67% recorded by the Cushing Global Clean Equity Fund A (CGCAX). In fact, a number of alternative energy and environmental funds produced returns in excess of 10%. Against this backdrop, the Sustainable (SUSTAIN) Large Cap Equity Fund Index added 6.52%, the Sustainable Foreign Fund Index generated a gain of 2.48% while the Sustainable (SUSTAIN) Bond Fund Index dropped -0.02%.

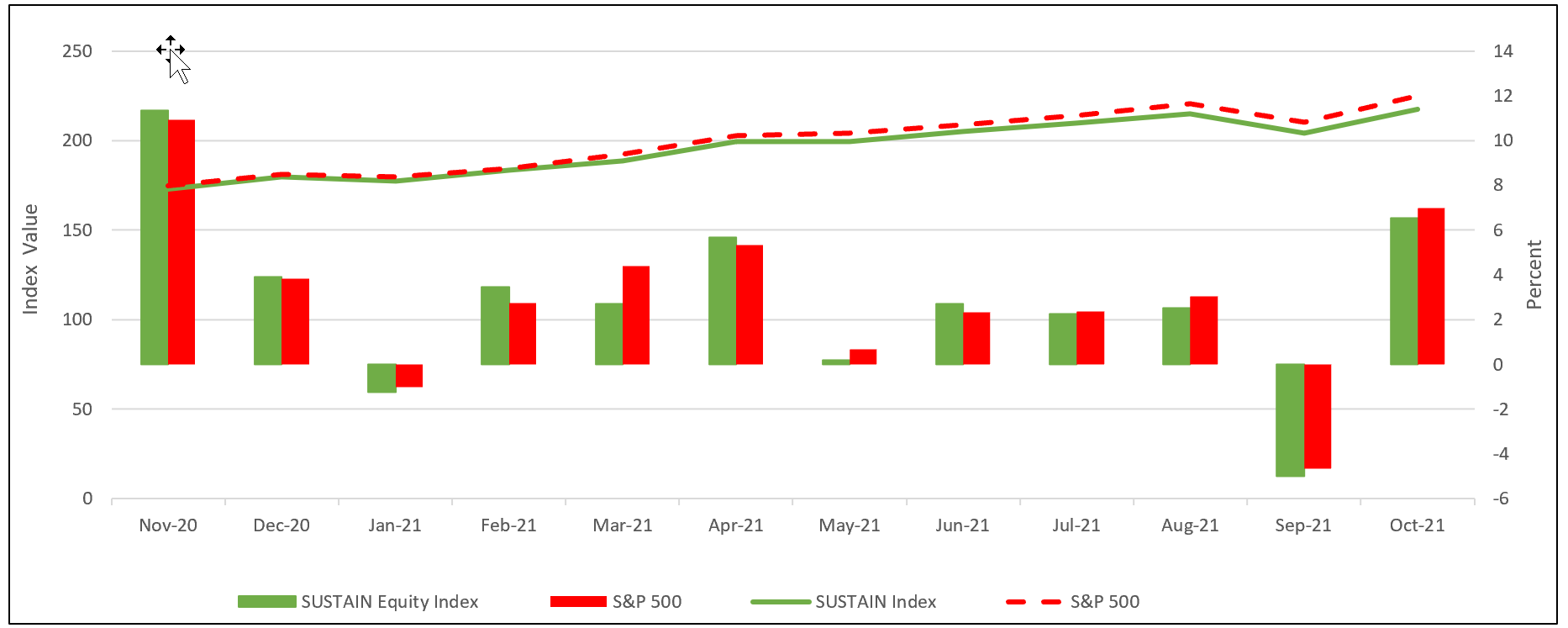

Sustainable (SUSTAIN) Large Cap Equity Fund Index added 6.52% in October, trailing the S&P 500 by 49 bps

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 6.52%, trailing the S&P 500 that added 7.0%, for a negative differential of 49 bps. Only four of ten constituent funds beat the S&P 500, rising between 7.07% and 8.56% on a total return basis. JPMorgan US Equity R6 (JUEMX) posted the best gain at 8.56% while Hartford Capital Appreciation Fund A (ITHAX) brough up the rear with its 4.67% increase.

The SUSTAIN Large Cap Equity Fund Index also trailed the S&P 500 over the previous 3-month and 12-month intervals but lead the conventional benchmark for the 3-year period to the end of October. During that interval, the SUSTAIN Index was up 21.7% versus 21.5% registered by the S&P 500.

Chart 3: SUSTAIN Large Cap Equity Fund Index Performance Results: November 2020 – October 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

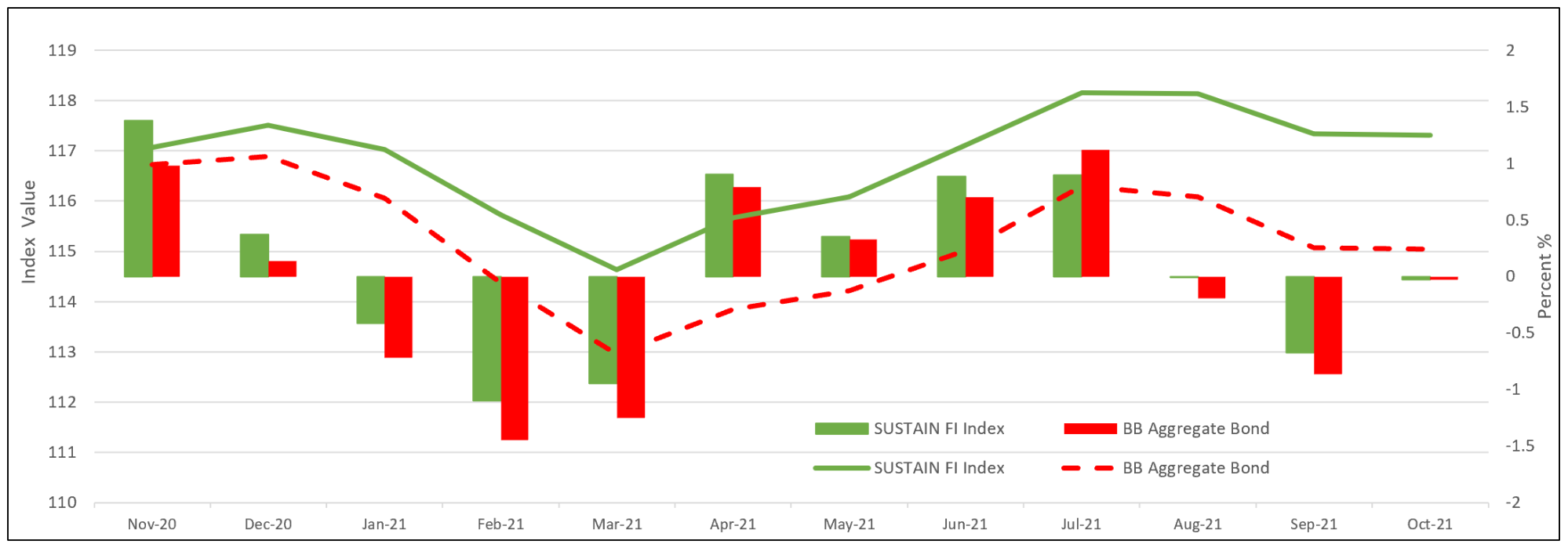

Sustainable (SUSTAIN) Bond Fund Index resumed its record of monthly outperformance, eking out a differential of .01%

Having interrupted its 15-month streak of monthly outperformance in July of this year, the Sustainable (SUSTAIN) Bond Fund Index resumed its record of monthly outperformance in August and eked out a .01% positive differential in October. Outperforming the Bloomberg US Aggregate Bond Index were six constituent funds with returns that ranged from -0.01% to 0.15% attributable to the ESG integrator Neuberger Berman Strategic Income Fund Institutional (NSTLX). The laggard fund with a return of -0.30% was the Goldman Sachs Core Fixed Income Fund P (GAKPX).

The Sustainable (SUSTAIN) Bond Fund Index led the conventional comparison benchmark over the past three-months, twelve-months and three-years with a cumulative differential of 1.88%.

Chart 4: SUSTAIN Bond Fund Index Performance Results: November 2020 – October 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

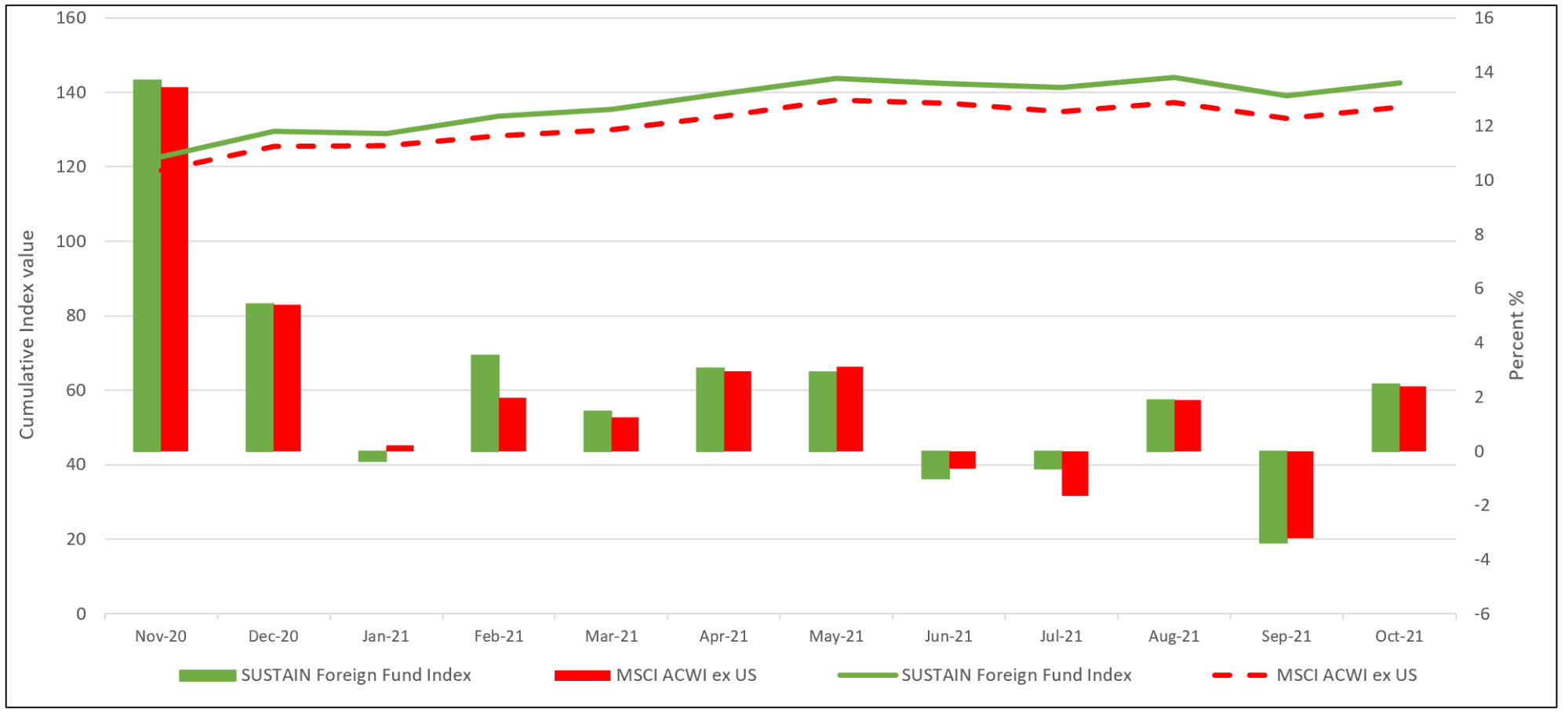

Sustainable (SUSTAIN) Foreign Fund Index with its gain of 2.48% also outperformed in October

Also outperforming its comparison conventional benchmark in October is the Sustainable (SUSTAIN) Foreign Fund Index with its gain of 2.48% versus 2.39% posted by the MSCI ACWI, ex USA Index. Six constituent funds outperformed, led by the Hartford International Opportunities Fund Y (HAOYX), up 3.76%, while the Templeton Foreign Fund A (TEMFX) trailed the group with its return of 1.31%.

While the Sustainable Foreign Fund Index fell behind the MSCI ACWI ex USA Index by 72 bps the last three months, it continues to lead by a strong margin of 4.28% over the last twelve months.

Chart 5: SUSTAIN Foreign Fund Index Performance Results: November 2020 – October 30, 2021

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Premium Articles Access Priority Support 1 Fixed Price

Access to All Data No Credit Card Required Cancel Any Time

Access to Premium Articles Priority Support Save 25%

$99

PER YEAR

Access to exclusive content

Premium Articles

Access 1 Fixed Price

Free Trial

30-Day

Access to exclusive content

Access to All Data No Credit card Required Cancel Any Time

$9.99

MONTHLY

Access to premium content

Access to premium Articles Save 25%

Sustainable Funds Monitor

Funds Glossary

Quarterly On-Line Briefings

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact